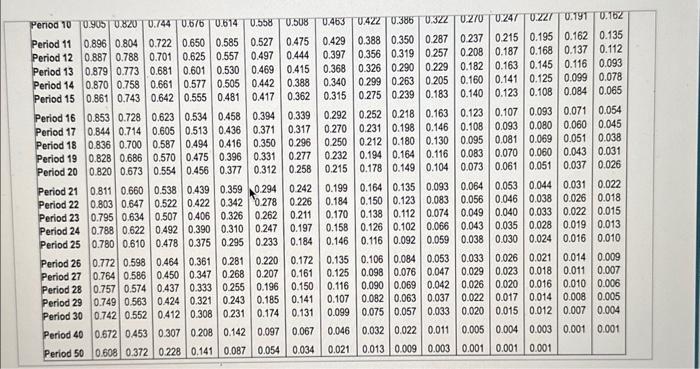

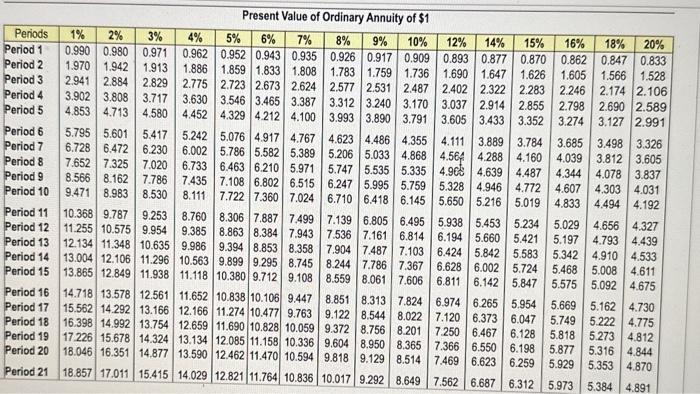

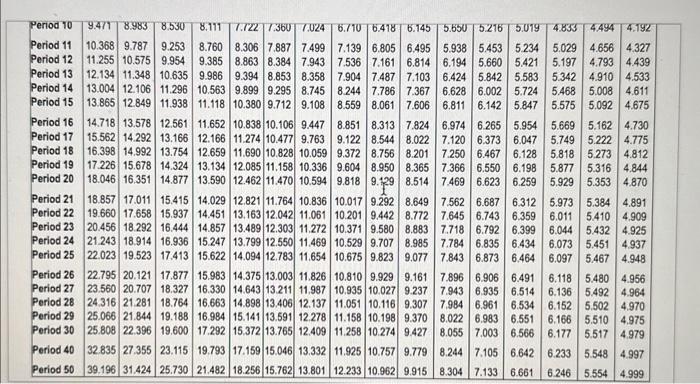

Please use the data found in the question to answer both requirements. Both the present value of $1 table and present value of ordinary annuity are proved in the last four photos. Thank you.

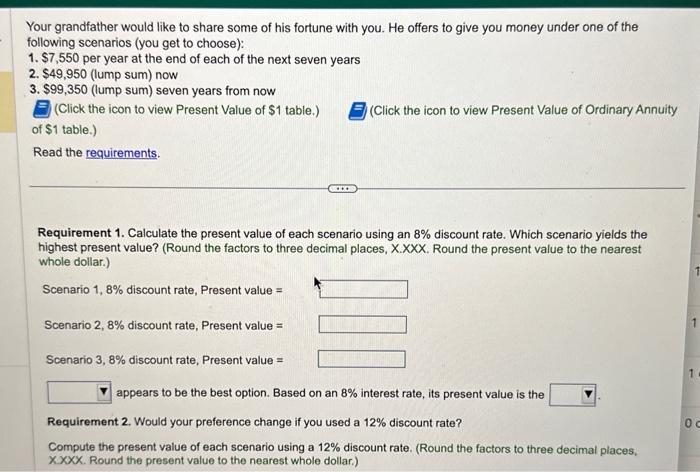

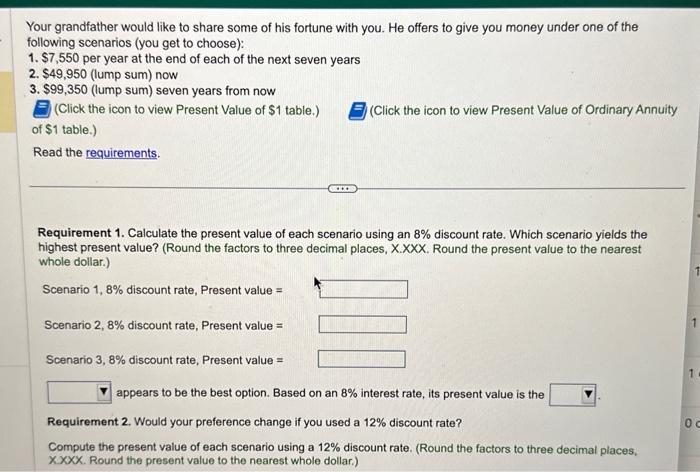

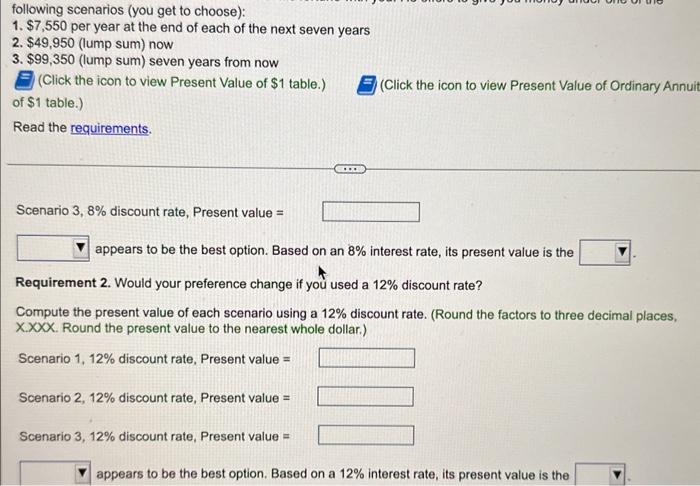

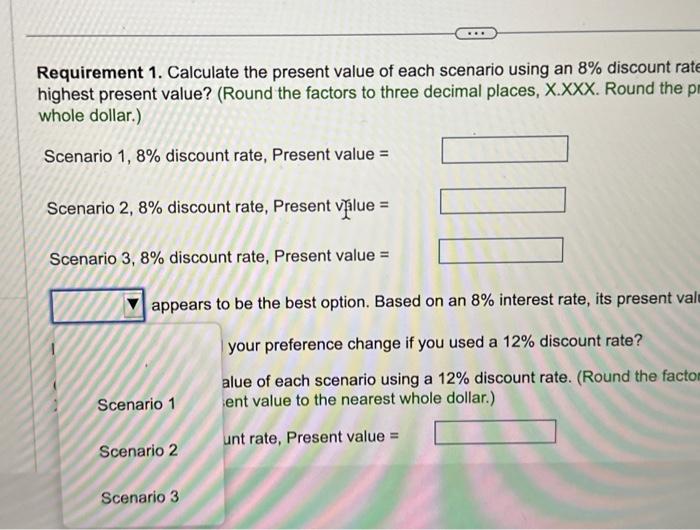

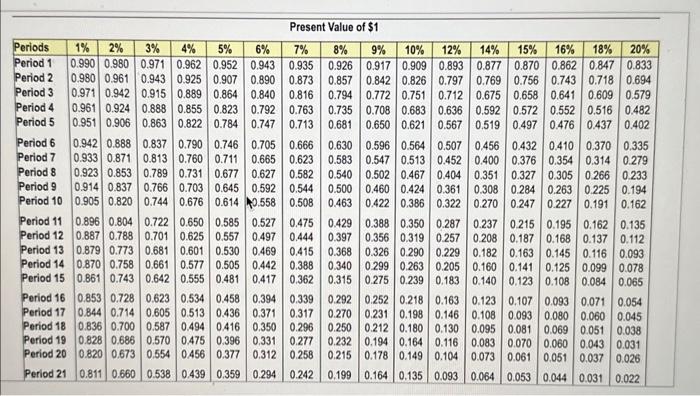

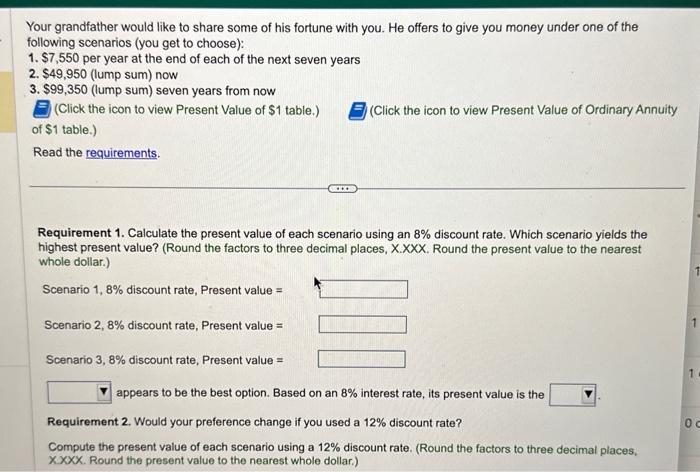

Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios (you get to choose): 1. $7,550 per year at the end of each of the next seven years 2. $49,950 (lump sum) now 3. $99,350 (lump sum) seven years from now (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. Calculate the present value of each scenario using an 8% discount rate. Which scenario yields the highest present value? (Round the factors to three decimal places, X.XXX. Round the present value to the nearest whole dollar.) Scenario 1,8% discount rate, Present value = Scenario 2,8% discount rate, Present value = Scenario 3,8% discount rate, Present value = appears to be the best option. Based on an 8% interest rate, its present value is the Requirement 2. Would your preference change if you used a 12% discount rate? Compute the present value of each scenario using a 12% discount rate. (Round the factors to three decimal places, X. Round the present value to the nearest whole dollar.) following scenarios (you get to choose): 1. $7,550 per year at the end of each of the next seven years 2. $49,950 (lump sum) now 3. $99,350 (lump sum) seven years from now (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annui of $1 table.) Read the requirements. Scenario 3,8% discount rate, Present value = appears to be the best option. Based on an 8% interest rate, its present value is the Requirement 2. Would your preference change if you used a 12% discount rate? Compute the present value of each scenario using a 12% discount rate. (Round the factors to three decimal places, X.XXX. Round the present value to the nearest whole dollar.) Scenario 1, 12\% discount rate, Present value = Scenario 2,12% discount rate, Present value = Scenario 3,12% discount rate, Present value = appears to be the best option. Based on a 12% interest rate, its present value is the Requirement 1. Calculate the present value of each scenario using an 8% discount rate highest present value? (Round the factors to three decimal places, X.XXX. Round the p whole dollar.) Scenario 1,8% discount rate, Present value = Scenario 2,8% discount rate, Present vijlue = Scenario 3,8% discount rate, Present value = appears to be the best option. Based on an 8% interest rate, its present val your preference change if you used a 12% discount rate? alue of each scenario using a 12% discount rate. (Round the factor Scenario 1 ent value to the nearest whole dollar.) Scenario 2 unt rate, Present value = Scenario 1,8% discount rate, Present value = Scenario 2,8% discount rate, Present value = Scenario 3,8% discount rate, Present value = appears to be the best option. Based on an 8% interest rate, its present value is the Requirement 2. Would your preference change if you used a 12% discount rate? Compute the present value of each scenario using a 12% discount rate. (Round the factors to thre XXXX. Round the present value to the nearest whole dollar.) Scenario 1, 12\% discount rate, Present value = Scenario 3,8% discount rate, Present value = appears to be the best option. Based on an 8% interest rate, Requirement 2. Would your preference change if you used a 12% discount alue of each scenario using a 12% discount rate. (Rol ent value to the nearest whole dollar.) Scenario 1 unt rate, Present value = Scenario 2 unt rate, Present value = Scenario 3 unt rate, Present value = appears to be the best option. Based on a 12% interest rate, its Compute the present value of each scenario using a 12% discount rate. (Round the factors to three decimal places, XX. Round the present value to the nearest whole dollar.) Scenario 1,12% discount rate, Present value = Scenario 2,12% discount rate, Present value = highest Scenario 3,12% discount rate, Present value = lowest appears to be the best option. Based on a 12% interest rate, its present value is the Present Value of $1 Present Value of Ordinarv Annulitu af \$1