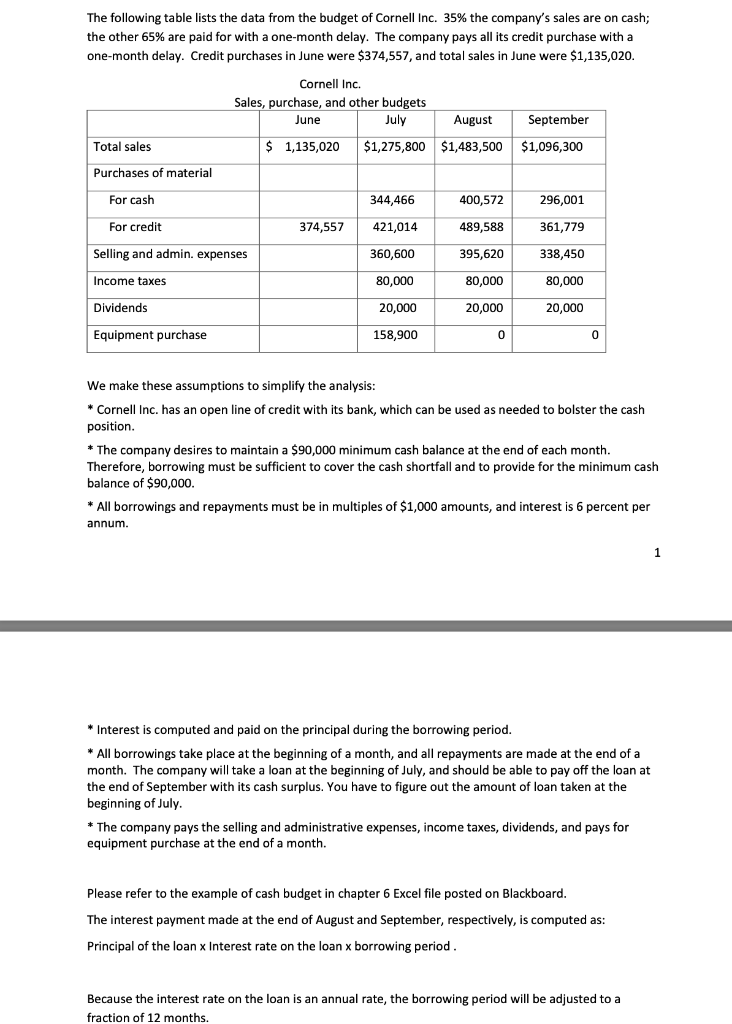

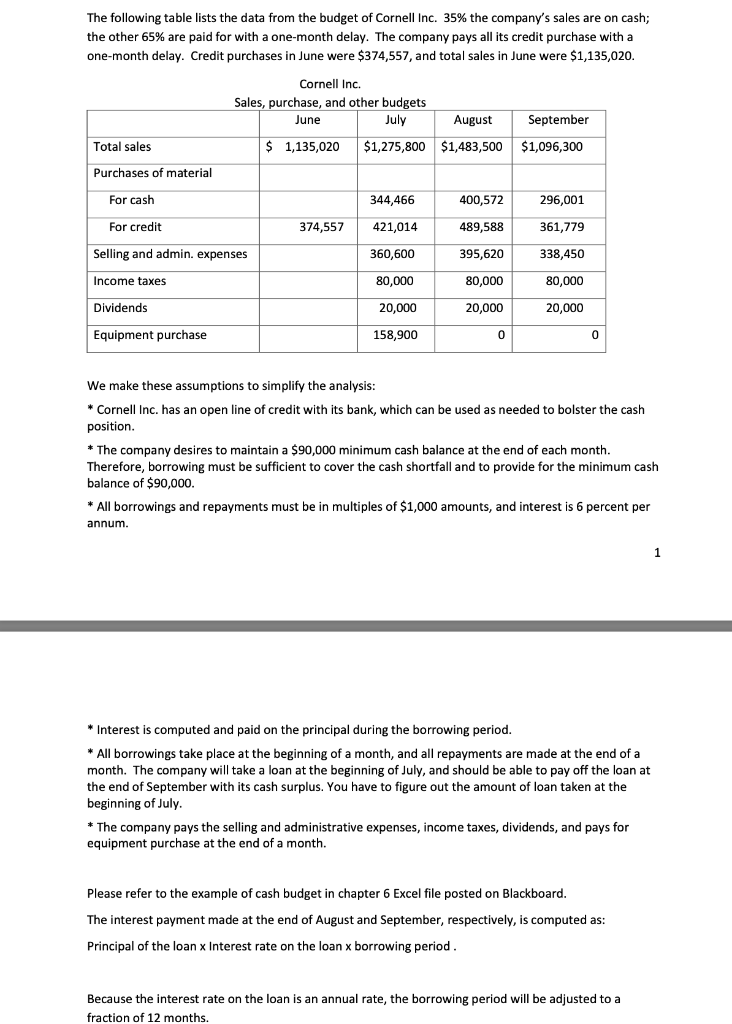

Please use the data from the following table to complete the cash budget in Excel spreadsheets.

The following table lists the data from the budget of Cornell Inc. 35% the company's sales are on cash; the other 65% are paid for with a one-month delay. The company pays all its credit purchase with a one-month delay. Credit purchases in June were $374,557, and total sales in June were $1,135,020. Cornell Inc. Sales, purchase, and other budgets June July $ 1,135,020 $1,275,800 August September Total sales $1,483,500 $1,096,300 Purchases of material For cash 344,466 400,572 296,001 For credit 374,557 421,014 489,588 361,779 Selling and admin. expenses 360,600 395,620 338,450 Income taxes 80,000 80,000 80,000 Dividends 20,000 20,000 20,000 158,900 Equipment purchase We make these assumptions to simplify the analysis: * Cornell Inc. has an open line of credit with its bank, which can be used as needed to bolster the cash position. * The company desires to maintain a $90,000 minimum cash balance at the end of each month. Therefore, borrowing must be sufficient to cover the cash shortfall and to provide for the minimum cash balance of $90,000. * All borrowings and repayments must be in multiples of $1,000 amounts, and interest is 6 percent per annum. * Interest is computed and paid on the principal during the borrowing period. * All borrowings take place at the beginning of a month, and all repayments are made at the end of a month. The company will take a loan at the beginning of July, and should be able to pay off the loan at the end of September with its cash surplus. You have to figure out the amount of loan taken at the beginning of July. * The company pays the selling and administrative expenses, income taxes, dividends, and pays for equipment purchase at the end of a month. Please refer to the example of cash budget in chapter 6 Excel file posted on Blackboard. The interest payment made at the end of August and September, respectively, is computed as: Principal of the loan x Interest rate on the loan x borrowing period. Because the interest rate on the loan is an annual rate, the borrowing period will be adjusted to a fraction of 12 months