Question

Please use the data in the Data-Part5 tab of homework data file for this exercise. Read the following background information first. Background: The most important

Please use the data in the "Data-Part5" tab of homework data file for this exercise. Read the following background

information first.

Background: The most important economic release in the US is the job report. At 8:30 pm of every first Friday

of every month, the US Labor Department reports the previous month's unemployment rate and number of jobs

(payroll) gained or lost. About one week before the release, economists from dozens of big financial institutions

submitted their forecasts to the media (i.e., Bloomberg). The median of these forecast payroll numbers form the

so called market consensus. In the Friday morning, if actual payroll number released is significantly different

from the consensus, the stock market, bond market, and foreign exchange market could move significantly. In

this exercise we are going to see how this payroll surprise may impact the bond market through 10 year treasury

rate. We will organize data to run the following regression:

Delta (10 year treasury rate) = alpha + beta*payroll surprise + error term

where

Delta (10 year treasury rate)= 10 year treasury rate of the release date - 10 year treasury rate of the date prior the

release date;

Payroll surprise = actual payroll release - consensus

Intuitively, payroll surprise > 0 implies that job market and the general economy is stronger than economists have

expected, and so market would expect the Fed to have more reasons to raise interest rate forward, this implies

that beta>0.

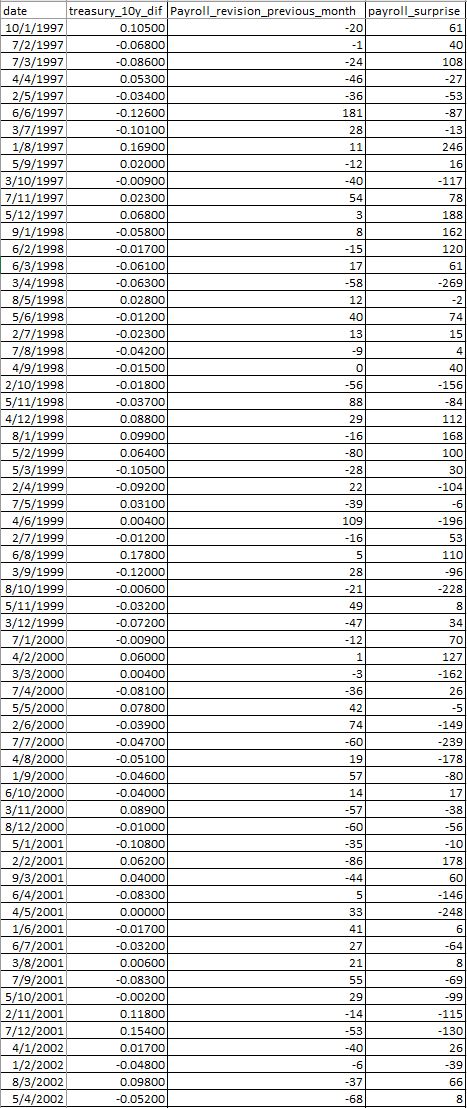

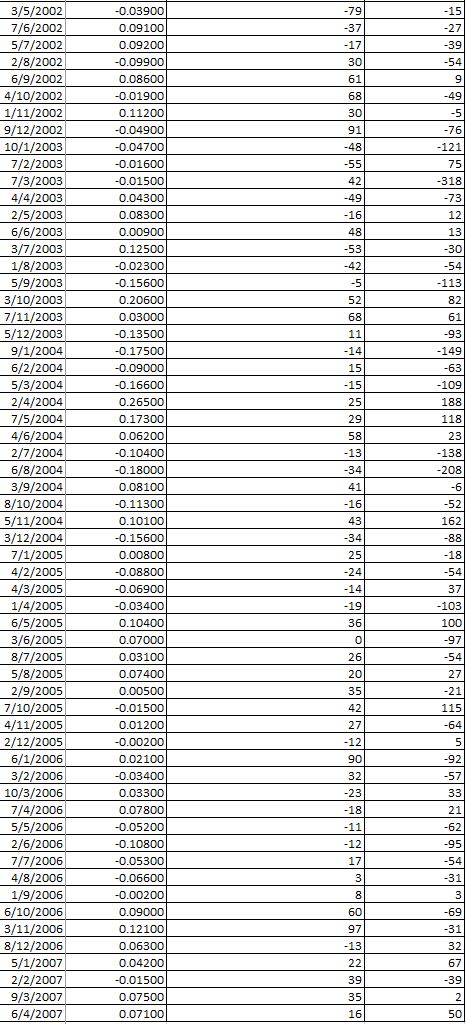

The excel file "part3_data.xls" includes four variables: "date", "treasury_10y_dif", "payroll_surprise", and

"payroll_revision_previous_month". "treasury_10y_dif" represents delta (10 year treasury rate) which is

Delta_treasury_10y below.

Now please work out the following questions (please use 1% level of significance as reference):

1. Run the regression model and discuss briefly your results based on the above background information:

Delta_treasury_10y = b0 + b1*payroll_surprise + error term.

2. Run another regression by adding payroll_revision_previous_month as an independent variable and discuss

briefly your result:

Delta_treasury_10y = b0 + b1*payroll_surprise + b2*payroll_revision_previous_month + error term.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started