Question

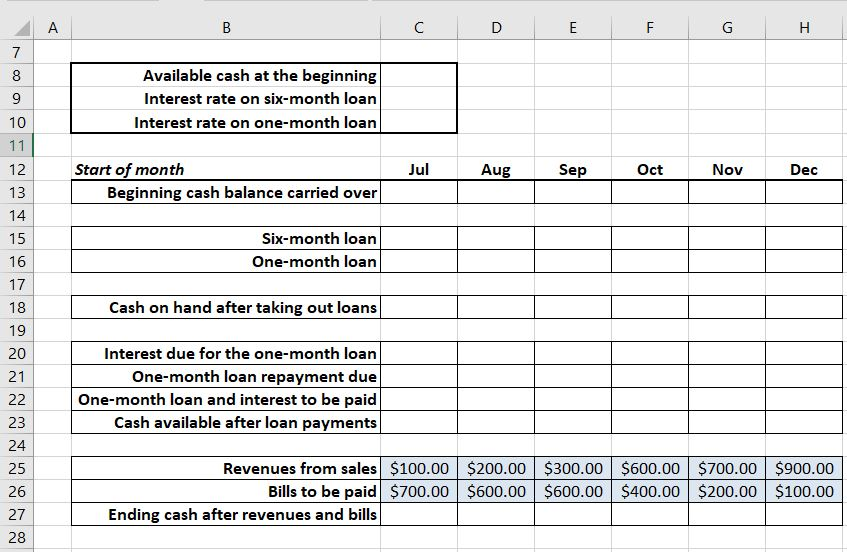

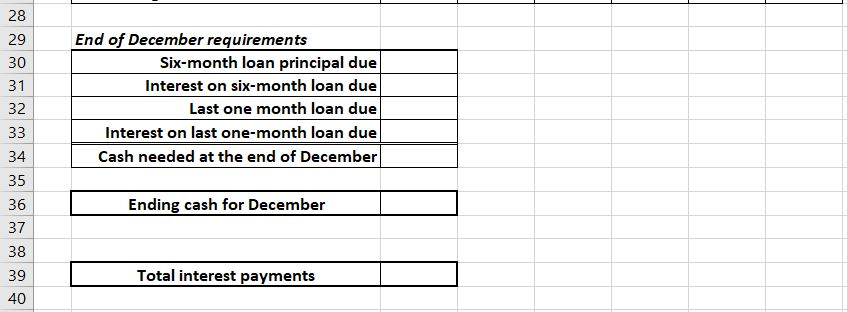

Please use the excel format in the pictures below to answer. Based on Robichek et al. (1965). The Korvair Department Store has $100,000 in available

Please use the excel format in the pictures below to answer.

Based on Robichek et al. (1965). The Korvair Department Store has $100,000 in available cash. At the beginning of each of the next six months, Korvair will receive revenues and pay bills as listed in the file P04_112.xlsx. It is clear that Korvair will have a short-term cash flow problem until the store receives revenues from the Christmas shopping season. To solve this problem, Korvair must borrow money. At the beginning of July, the company takes out a six-month loan. Any money borrowed for a six-month period must be paid back at the end of December along with 9% interest (early payback does not reduce the total interest of the loan). Korvair can also meet cash needs through month-to-month borrowing. Any money borrowed for a one-month period incurs an interest cost of 2.5% per month. Determine how Korvair can minimize the cost of paying its bills on time.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started