Please use the excel formulas. See my instructor's email for information.

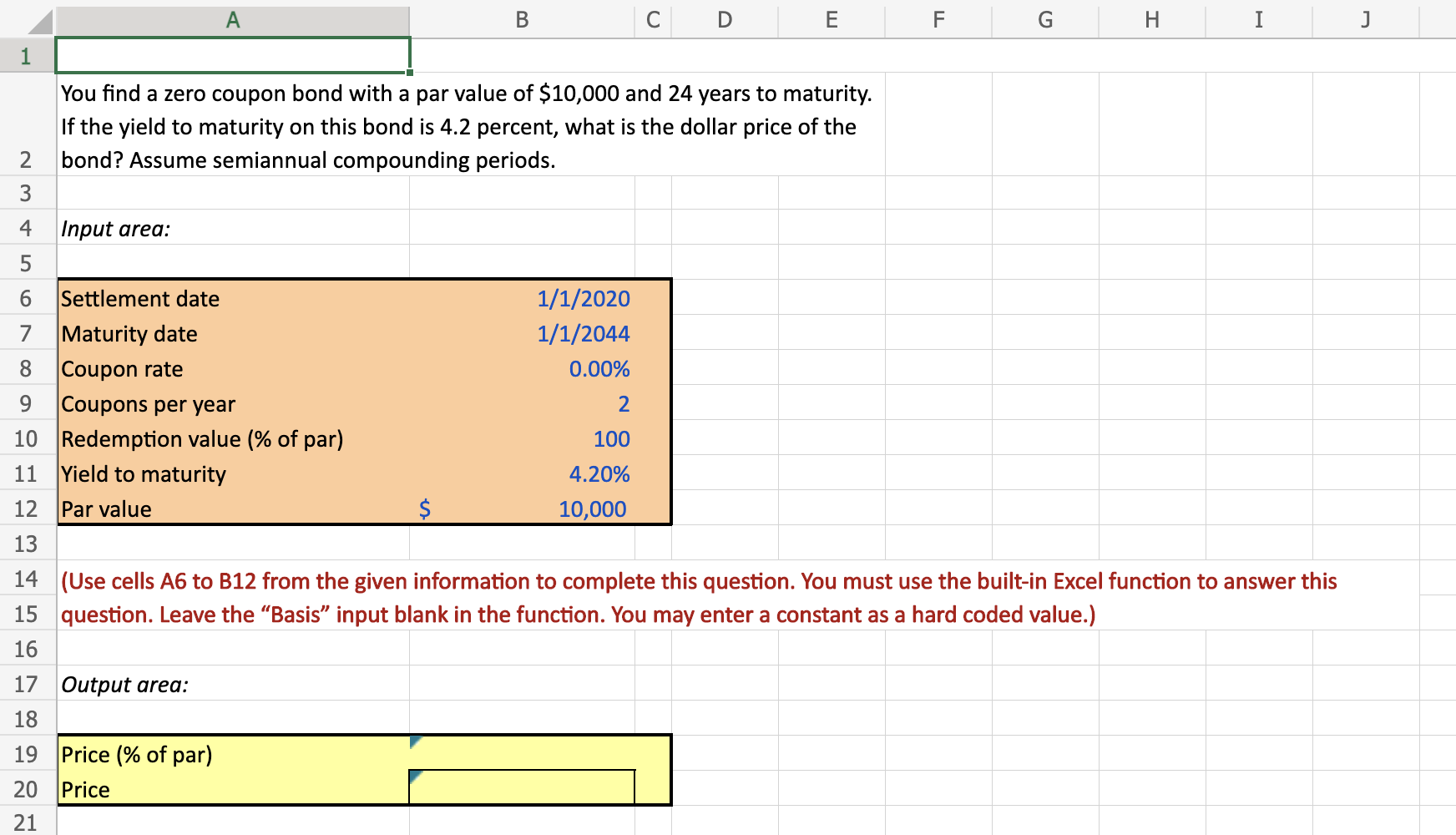

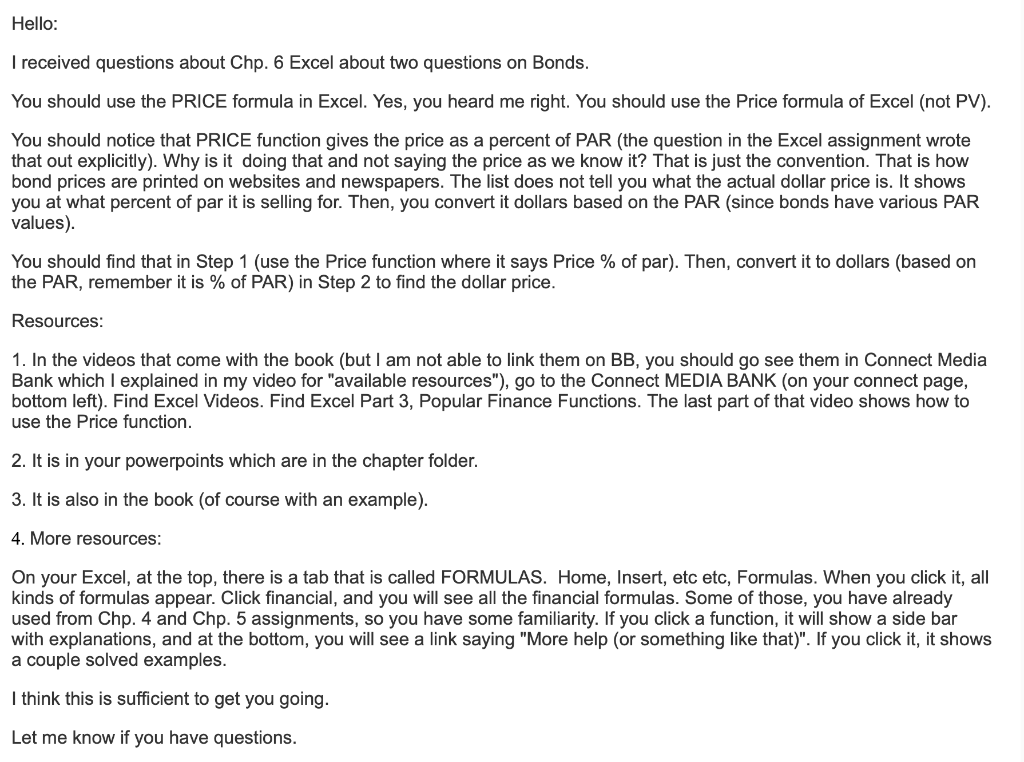

You find a zero coupon bond with a par value of $10,000 and 24 years to maturity. If the yield to maturity on this bond is 4.2 percent, what is the dollar price of the bond? Assume semiannual compounding periods. Input area: (Use cells A6 to B12 from the given information to complete this question. You must use the built-in Excel function to answer this question. Leave the "Basis" input blank in the function. You may enter a constant as a hard coded value.) Hello: I received questions about Chp. 6 Excel about two questions on Bonds. You should use the PRICE formula in Excel. Yes, you heard me right. You should use the Price formula of Excel (not PV). You should notice that PRICE function gives the price as a percent of PAR (the question in the Excel assignment wrote that out explicitly). Why is it doing that and not saying the price as we know it? That is just the convention. That is how bond prices are printed on websites and newspapers. The list does not tell you what the actual dollar price is. It shows you at what percent of par it is selling for. Then, you convert it dollars based on the PAR (since bonds have various PAR values). You should find that in Step 1 (use the Price function where it says Price \% of par). Then, convert it to dollars (based on the PAR, remember it is \% of PAR) in Step 2 to find the dollar price. Resources: 1. In the videos that come with the book (but I am not able to link them on BB, you should go see them in Connect Media Bank which I explained in my video for "available resources"), go to the Connect MEDIA BANK (on your connect page, bottom left). Find Excel Videos. Find Excel Part 3, Popular Finance Functions. The last part of that video shows how to use the Price function. 2. It is in your powerpoints which are in the chapter folder. 3. It is also in the book (of course with an example). 4. More resources: On your Excel, at the top, there is a tab that is called FORMULAS. Home, Insert, etc etc, Formulas. When you click it, all kinds of formulas appear. Click financial, and you will see all the financial formulas. Some of those, you have already used from Chp. 4 and Chp. 5 assignments, so you have some familiarity. If you click a function, it will show a side bar with explanations, and at the bottom, you will see a link saying "More help (or something like that)". If you click it, it shows a couple solved examples. I think this is sufficient to get you going. Let me know if you have questions