Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the following information for the next five questions. Reeve Company is a privately held company in a growing industry. The company is expected

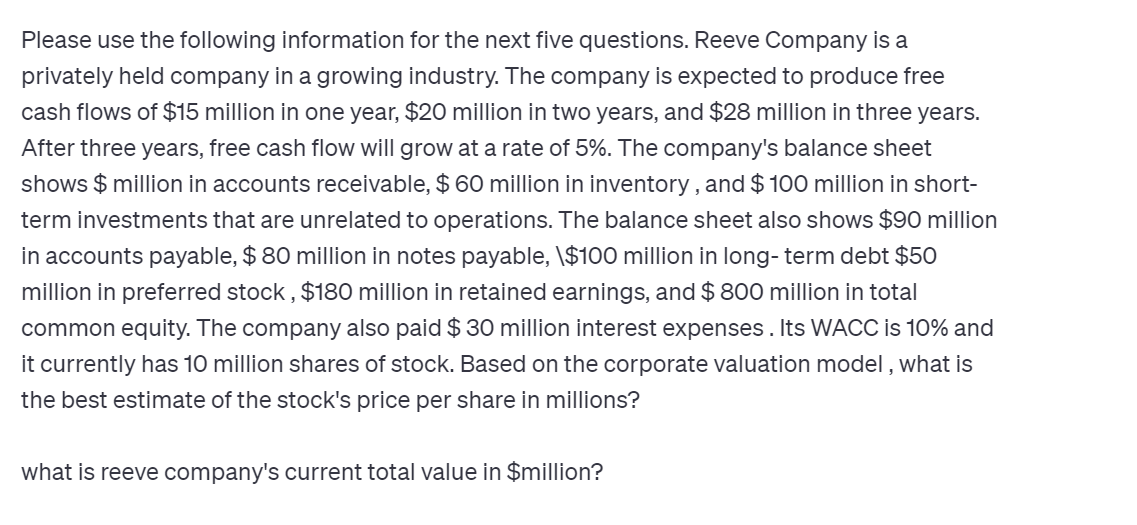

Please use the following information for the next five questions. Reeve Company is a privately held company in a growing industry. The company is expected to produce free cash flows of \$15 million in one year, \$20 million in two years, and \$28 million in three years. After three years, free cash flow will grow at a rate of 5%. The company's balance sheet shows $ million in accounts receivable, $60 million in inventory, and $100 million in shortterm investments that are unrelated to operations. The balance sheet also shows $90 million in accounts payable, $80 million in notes payable, 1$100 million in long-term debt $50 million in preferred stock, $180 million in retained earnings, and $800 million in total common equity. The company also paid \$ 30 million interest expenses . Its WACC is 10% and it currently has 10 million shares of stock. Based on the corporate valuation model, what is the best estimate of the stock's price per share in millions? what is reeve company's current total value in \$million

Please use the following information for the next five questions. Reeve Company is a privately held company in a growing industry. The company is expected to produce free cash flows of \$15 million in one year, \$20 million in two years, and \$28 million in three years. After three years, free cash flow will grow at a rate of 5%. The company's balance sheet shows $ million in accounts receivable, $60 million in inventory, and $100 million in shortterm investments that are unrelated to operations. The balance sheet also shows $90 million in accounts payable, $80 million in notes payable, 1$100 million in long-term debt $50 million in preferred stock, $180 million in retained earnings, and $800 million in total common equity. The company also paid \$ 30 million interest expenses . Its WACC is 10% and it currently has 10 million shares of stock. Based on the corporate valuation model, what is the best estimate of the stock's price per share in millions? what is reeve company's current total value in \$million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started