Answered step by step

Verified Expert Solution

Question

1 Approved Answer

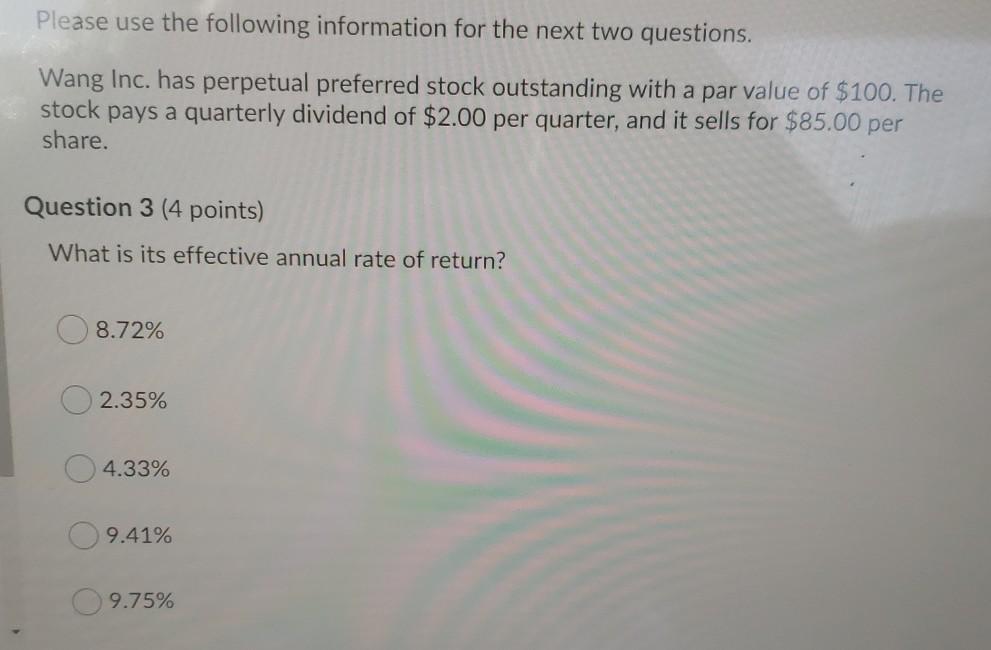

Please use the following information for the next two questions. Wang Inc. has perpetual preferred stock outstanding with a par value of $100. The stock

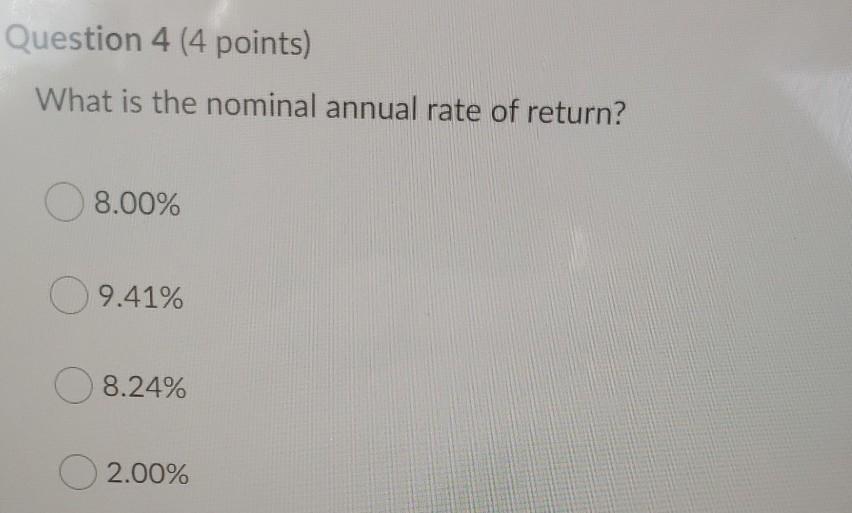

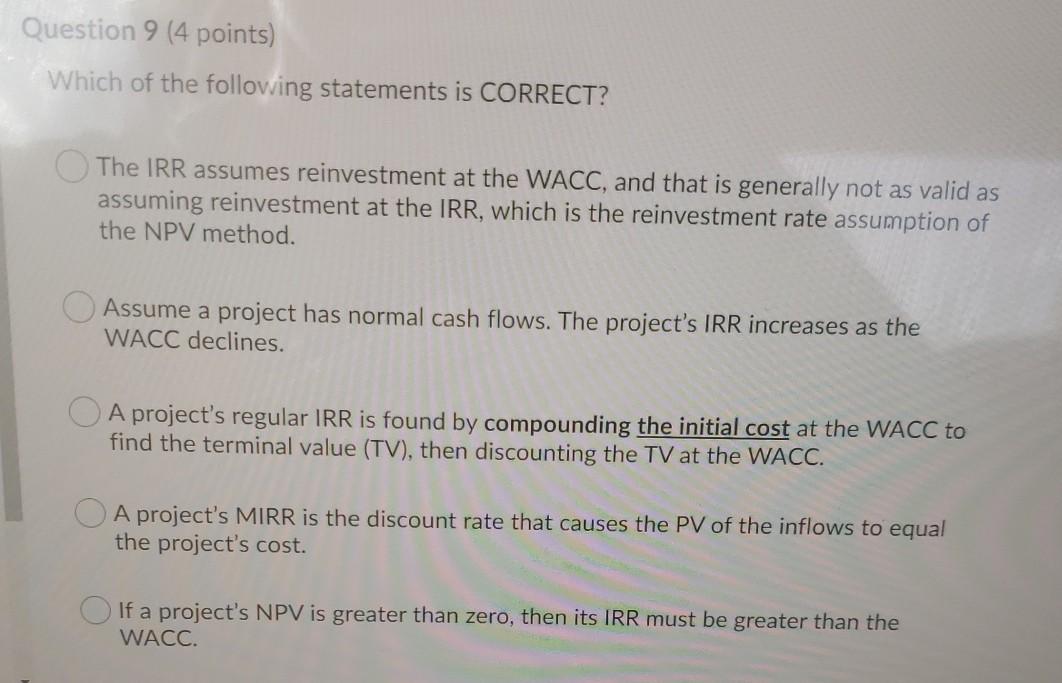

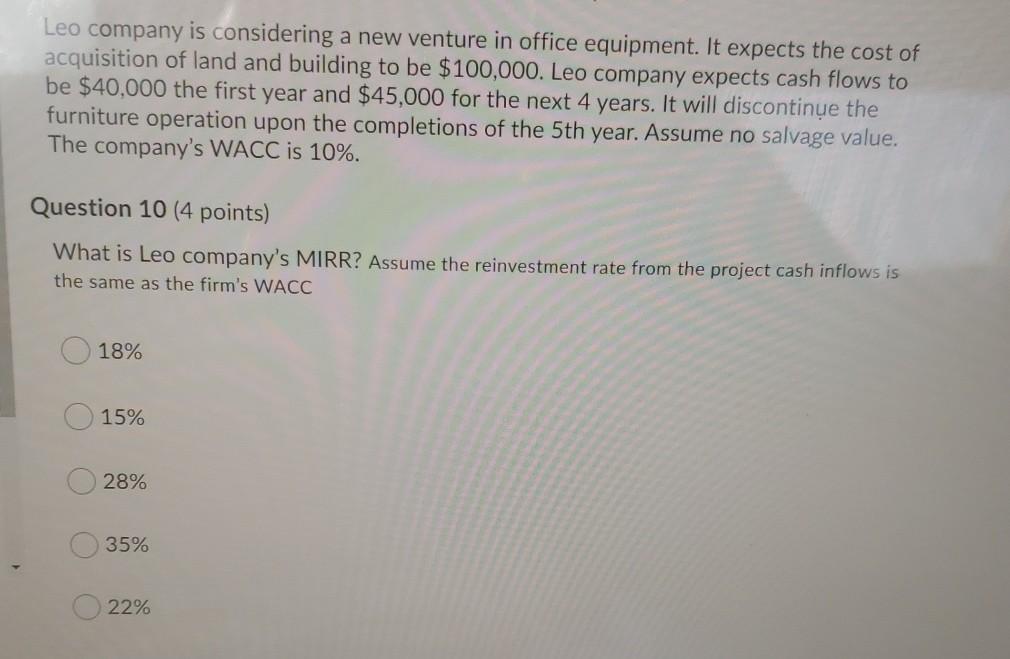

Please use the following information for the next two questions. Wang Inc. has perpetual preferred stock outstanding with a par value of $100. The stock pays a quarterly dividend of $2.00 per quarter, and it sells for $85.00 per share. Question 3 (4 points) What is its effective annual rate of return? 8.72% 2.35% 4.33% 9.41% 9.75% Question 4 (4 points) What is the nominal annual rate of return? 8.00% 9.41% 8.24% 2.00% % Question 9 (4 points) Which of the following statements is CORRECT? The IRR assumes reinvestment at the WACC, and that is generally not as valid as assuming reinvestment at the IRR, which is the reinvestment rate assumption of the NPV method. Assume a project has normal cash flows. The project's IRR increases as the WACC declines. A project's regular IRR is found by compounding the initial cost at the WACC to find the terminal value (TV), then discounting the TV at the WACC. A project's MIRR is the discount rate that causes the PV of the inflows to equal the project's cost. If a project's NPV is greater than zero, then its IRR must be greater than the WACC. Leo company is considering a new venture in office equipment. It expects the cost of acquisition of land and building to be $100,000. Leo company expects cash flows to be $40,000 the first year and $45,000 for the next 4 years. It will discontinue the furniture operation upon the completions of the 5th year. Assume no salvage value. The company's WACC is 10%. Question 10 (4 points) What is Leo company's MIRR? Assume the reinvestment rate from the project cash inflows is the same as the firm's WACC 18% 15% 28% 35% 22%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started