Answered step by step

Verified Expert Solution

Question

1 Approved Answer

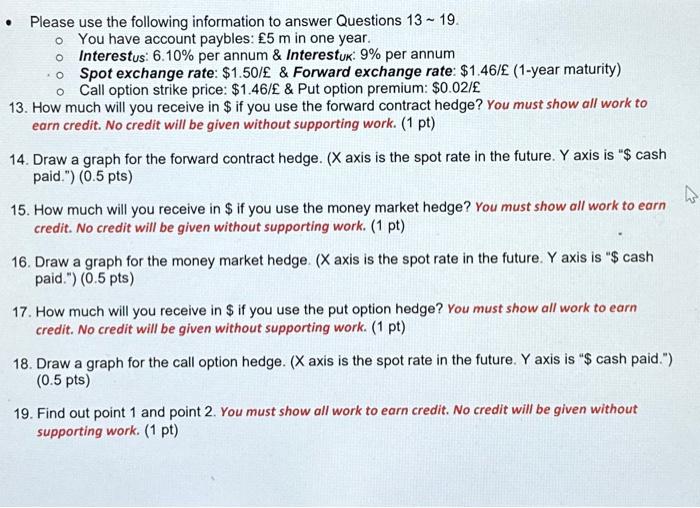

Please use the following information to answer Questions 13 19. O You have account paybles: 5 m in one year. O Interestus: 6.10% per annum

Please use the following information to answer Questions 13 19. O You have account paybles: 5 m in one year. O Interestus: 6.10% per annum & Interestuk: 9% per annum Spot exchange rate: $1.50/ & Forward exchange rate: $1.46/ (1-year maturity) Call option strike price: $1.46/ & Put option premium: $0.02/ O 13. How much will you receive in $ if you use the forward contract hedge? You must show all work to earn credit. No credit will be given without supporting work. (1 pt) 14. Draw a graph for the forward contract hedge. (X axis is the spot rate in the future. Y axis is "$ cash paid.") (0.5 pts) 15. How much will you receive in $ if you use the money market hedge? You must show all work to earn credit. No credit will be given without supporting work. (1 pt) 16. Draw a graph for the money market hedge. (X axis is the spot rate in the future. Y axis is "$ cash paid.") (0.5 pts) 17. How much will you receive in $ if you use the put option hedge? You must show all work to earn credit. No credit will be given without supporting work. (1 pt) 18. Draw a graph for the call option hedge. (X axis is the spot rate in the future. Y axis is "$ cash paid.") (0.5 pts) 19. Find out point 1 and point 2. You must show all work to earn credit. No credit will be given without supporting work. (1 pt)

***Please draw the graphs!***

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started