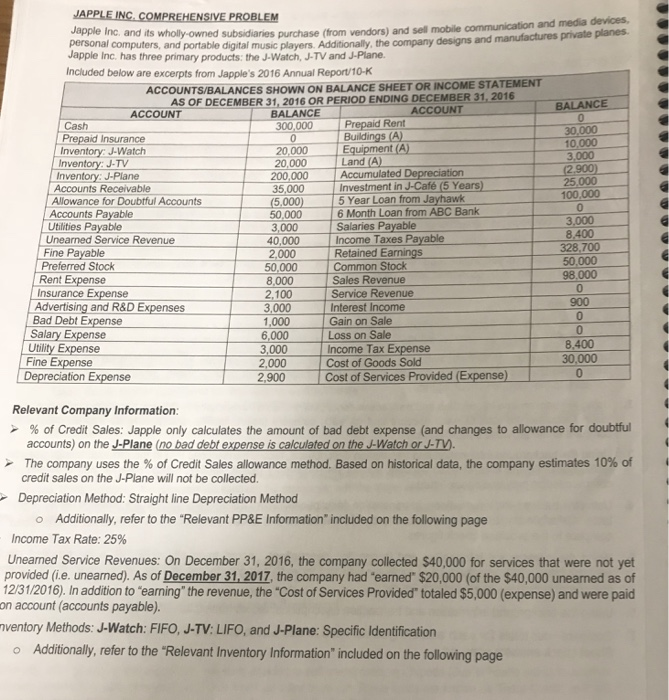

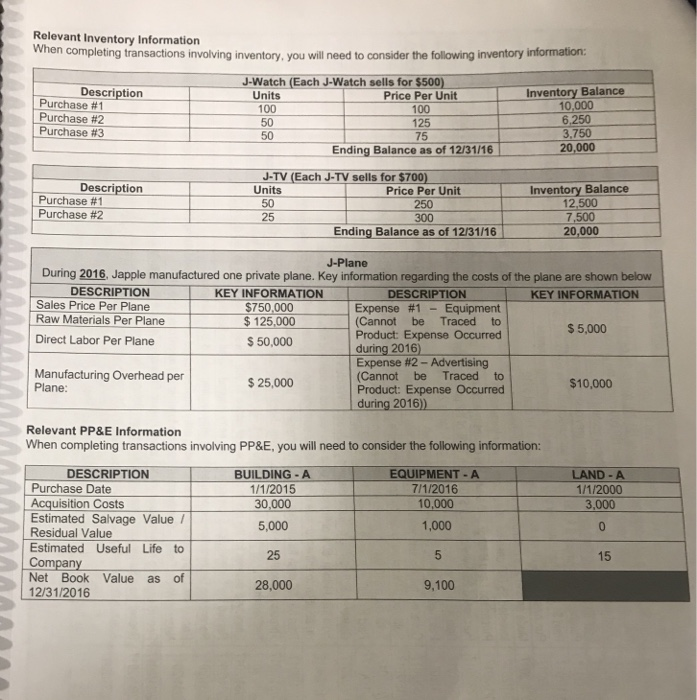

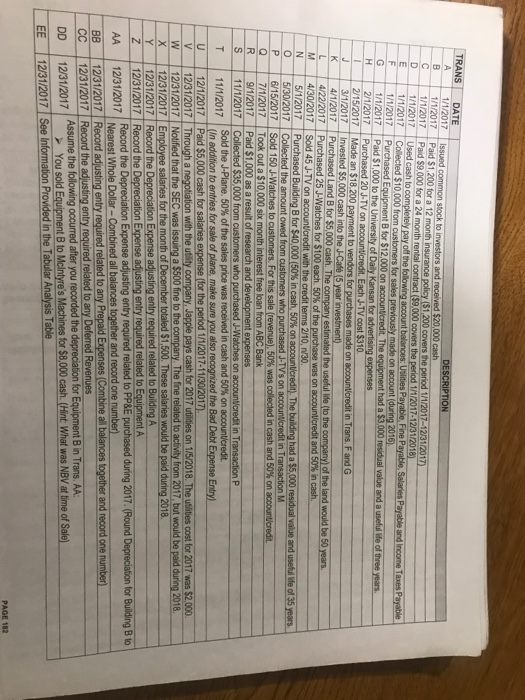

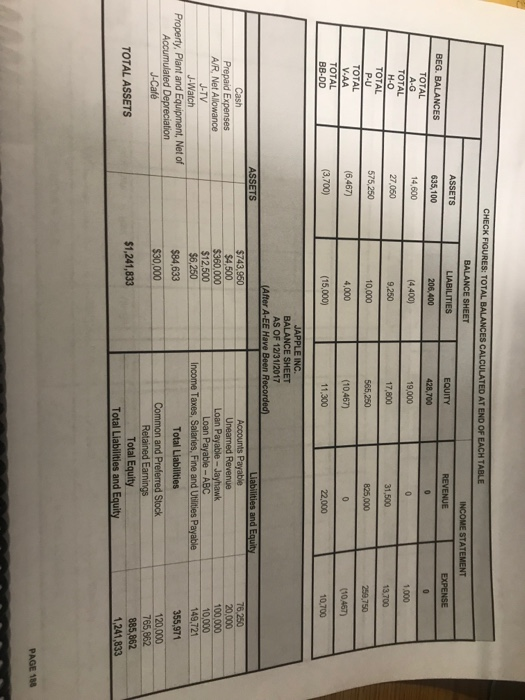

Please use the following information to fill out the tabular analysis. Please show work on the last 2 pages that I provided. And please answer in the same format that this is posted in.

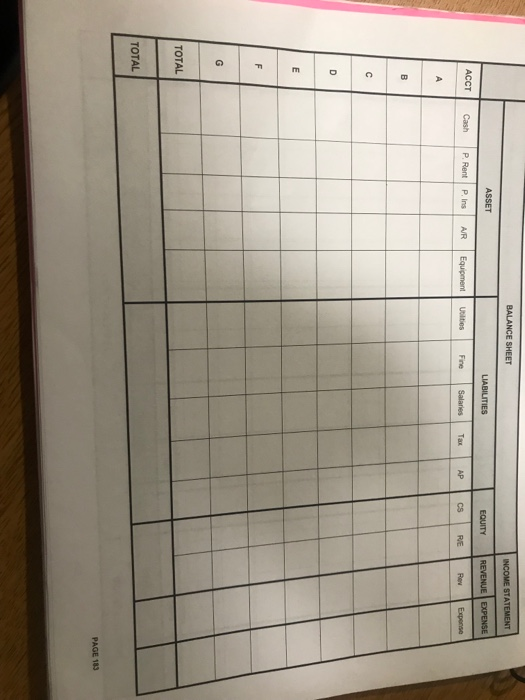

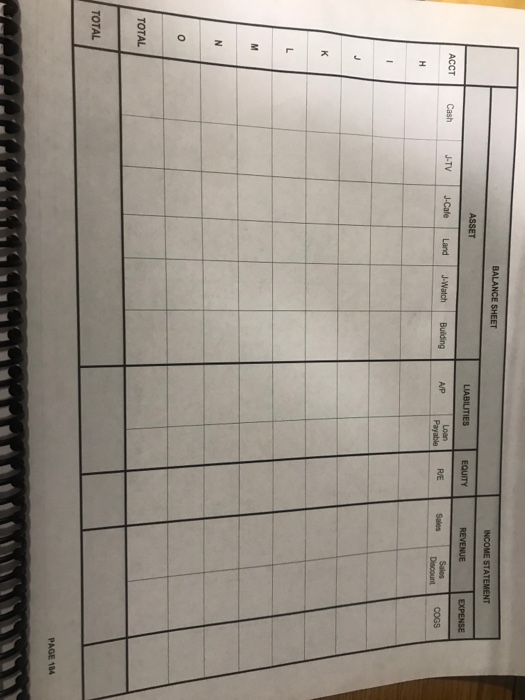

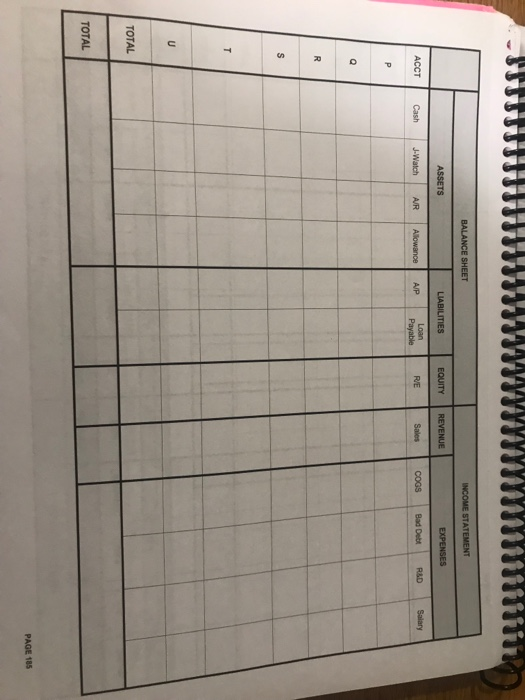

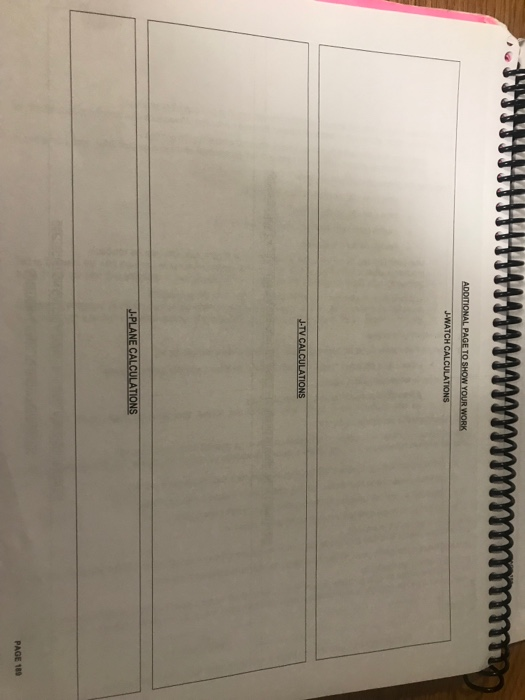

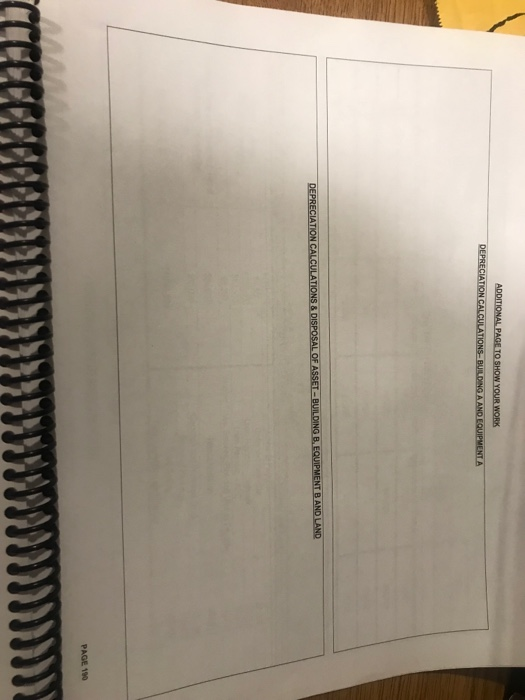

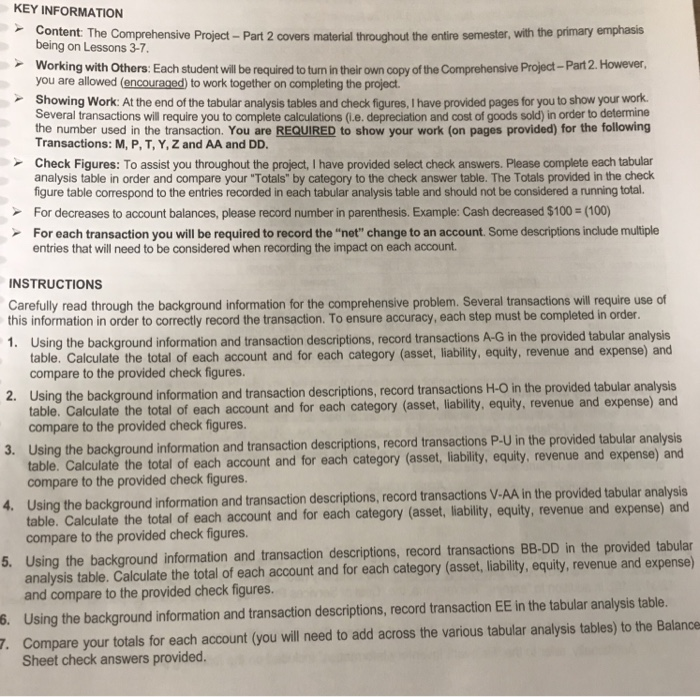

KEY INFORMATION Content: The Comprehensive Project-Part 2 covers material throughout the entire semester, with the primary emphasis being on Lessons 3-7 Working with Others: Each student will be required to turn in their own copy of the Comprehensive Project-Part 2. However you are allowed (encouraged) to work together on completing the project Showing Work: At the end of the tabular analysis tables and check figures, I have provided pages for you to show your work. Several transactions will require you to complete calculations (.e. depreciation and cost of goods sold) in order to determin the number used in the transaction. You are REQUIRED to show your work (on pages provided) for the following Transactions: M, P, T, Y, Z and AA and DD. Check Figures: To assist you throughout the project, I have provided select check answers. Please complete each tabular analysis table in order and compare your "Totals" by category to the check answer table. The Totals provided in the check figure table correspond to the entries recorded in each tabular analysis table and should not be considered a running total. For decreases to account balances, please record number in parenthesis. Example: Cash decreased $100 (100) For each transaction you will be required to record the "net" change to an account. Some descriptions include multiple entries that will need to be considered when recording the impact on each account. INSTRUCTIONS Carefully read through the background information for the comprehensive problem. Several transactions will require use of this information in order to correctly record the transaction. To ensure accuracy, each step must be completed in order 1. Using the background information and transaction descriptions, record transactions A-G in the provided tabular analysi table. Calculate the total of each account and for each category (asset, liability, equity, revenue and expense) and compare to the provided check figures Using the background information and transaction descriptions, record transactions H-0 in table. Calculate the total of each account and for each category (asset, liability, equity, revenue and expense) and compare to the provided check figures. the provided tabular analysis 2. ing the background information and transaction descriptions, record transactions P-U in the provided tabular analysis table. Calculate the total of each account and for each compare to the provided check figures. category (asset, liability, equity, revenue and expense) and analysis each account and for each category (asset, liability, equity, revenue and expense) and Using the background information and transaction descriptions, record transactions V-AA in the provided tabular table. Calculate the total of compare to the provided check figures. analysis table. Calculate the total of each account and for each category (asset, liability, equity, revenue and and compare to the provided check figures. 5. Using the background information and transaction descriptions, record transactions BB-DD in the provided tabular Using the background information and transaction descriptions, record transaction EE in the tabular analysis tabl Compare your totals for each account (you will need to add across the various tabular analysis tables) to the Balance Sheet check answers provided 7