Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please use the following information to help answer Exercise3-1,3-2,3-3,3-4,3-5 C. The Assets-to-Equity Ratio is a(n); (click the drop-down button and select from the I D.

please use the following information to help answer Exercise3-1,3-2,3-3,3-4,3-5

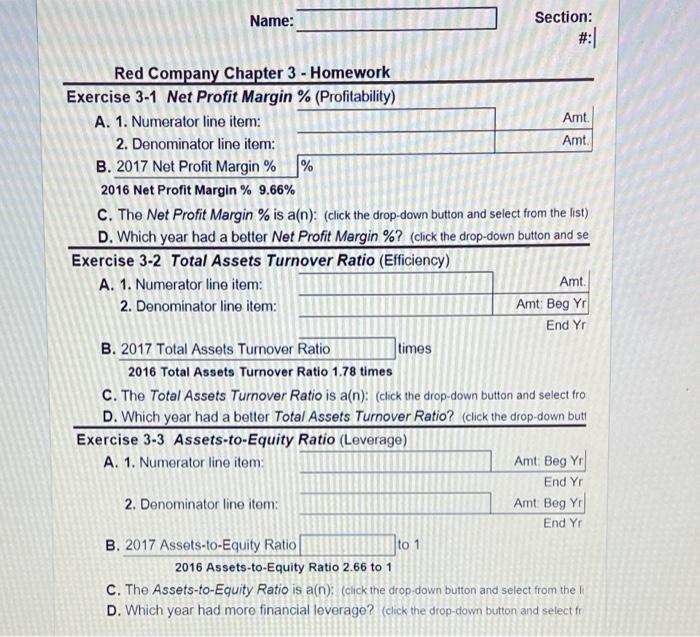

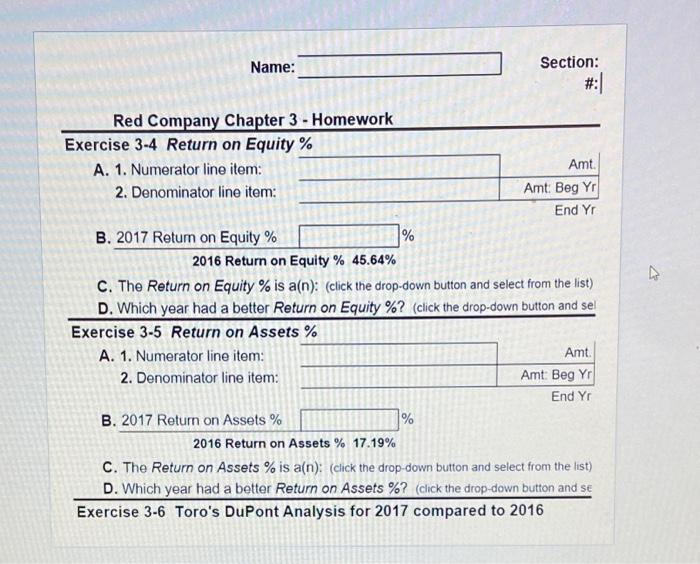

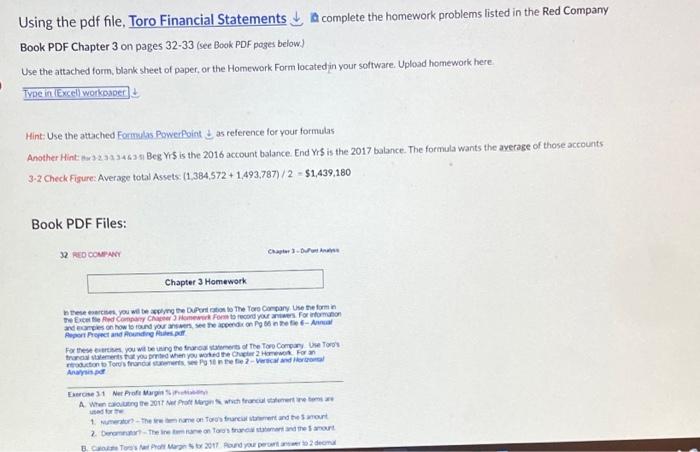

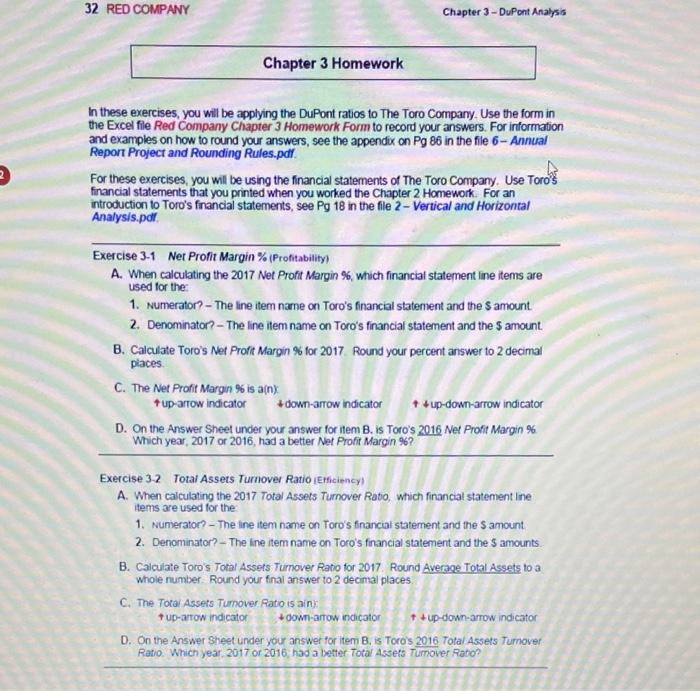

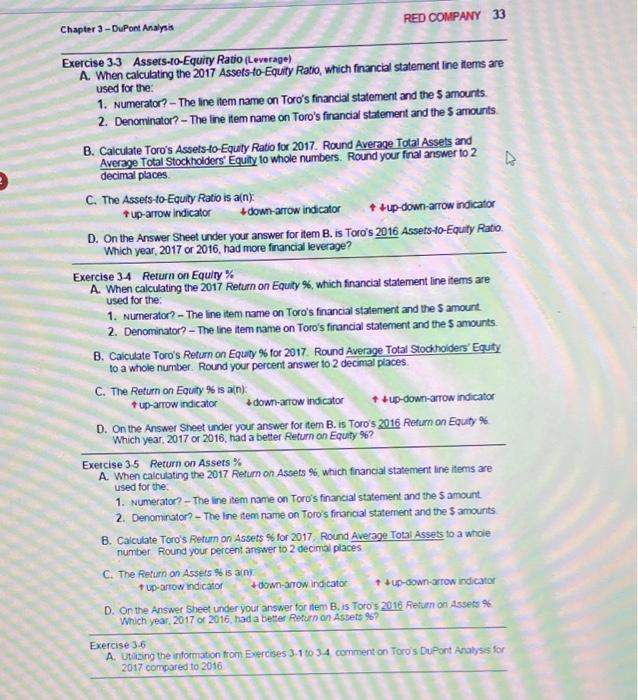

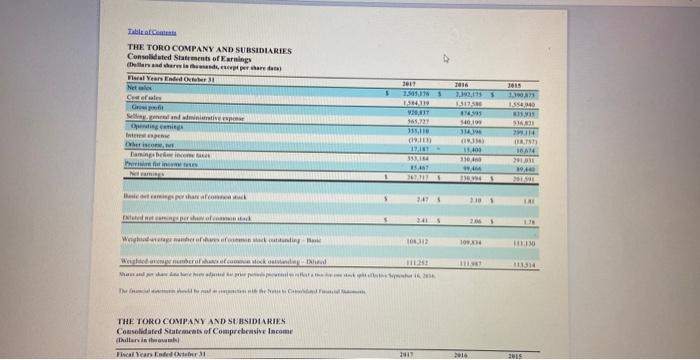

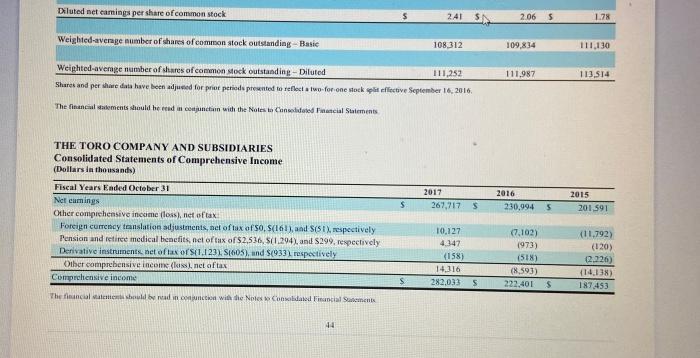

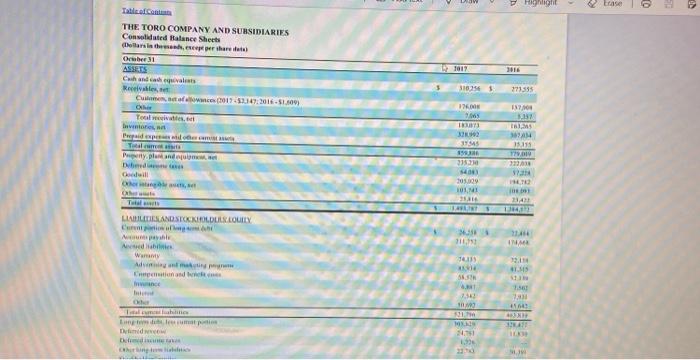

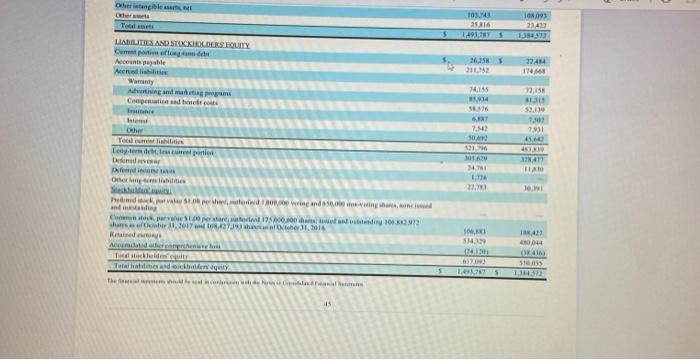

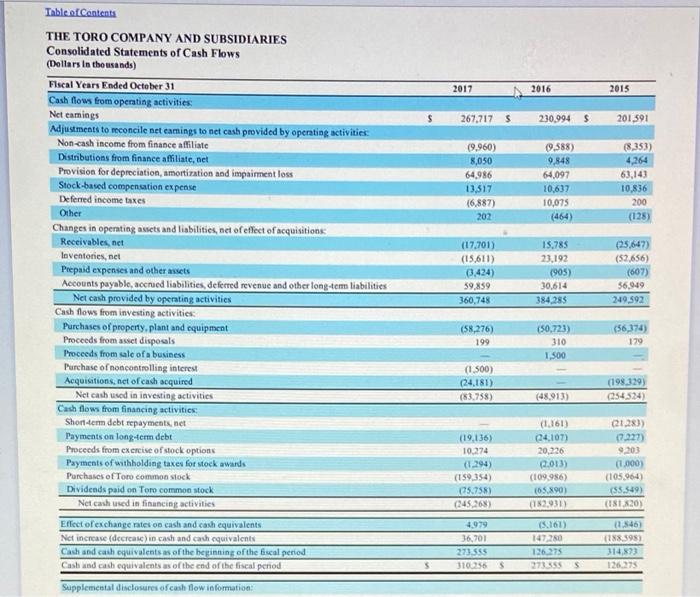

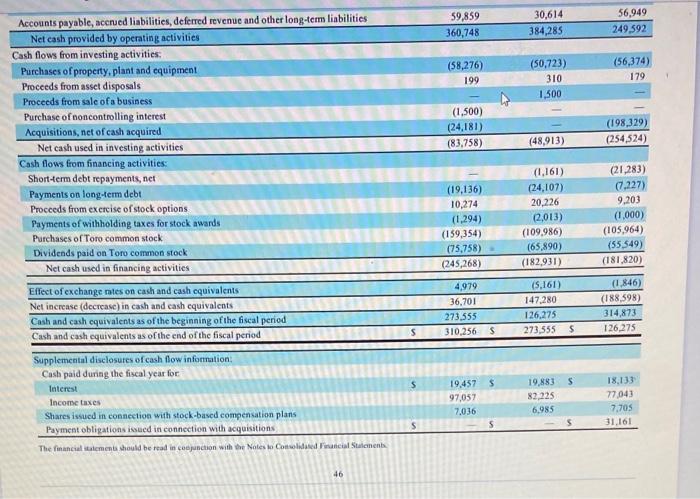

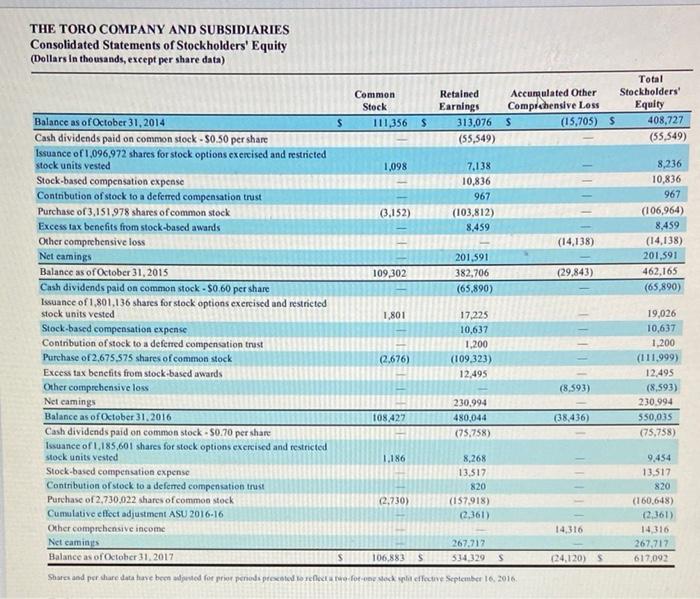

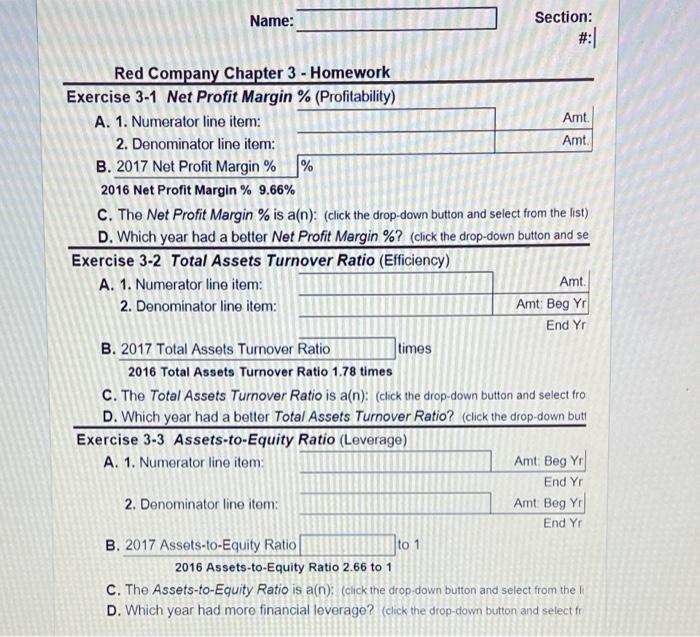

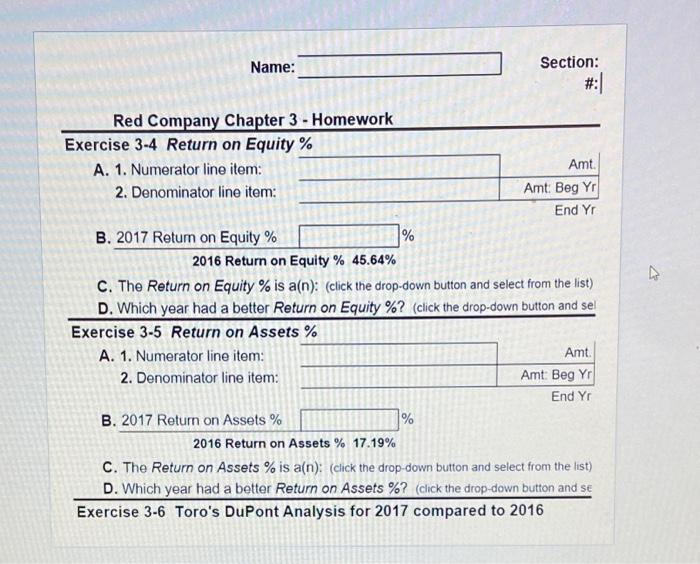

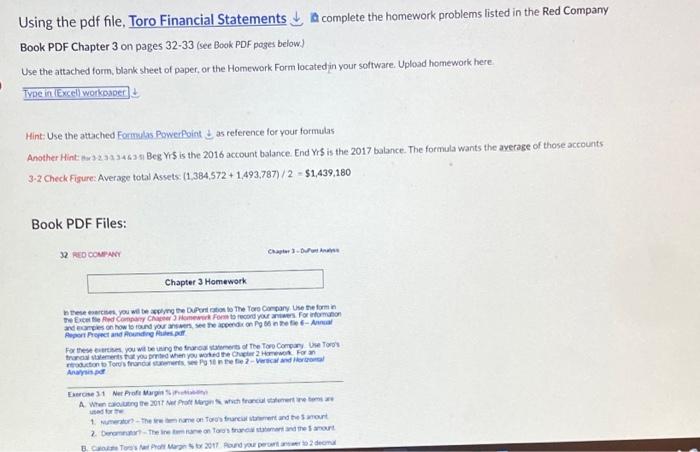

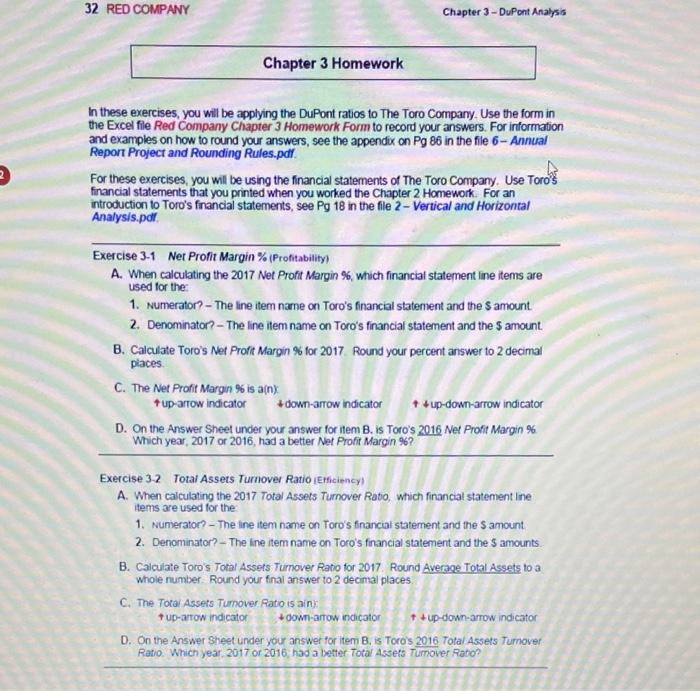

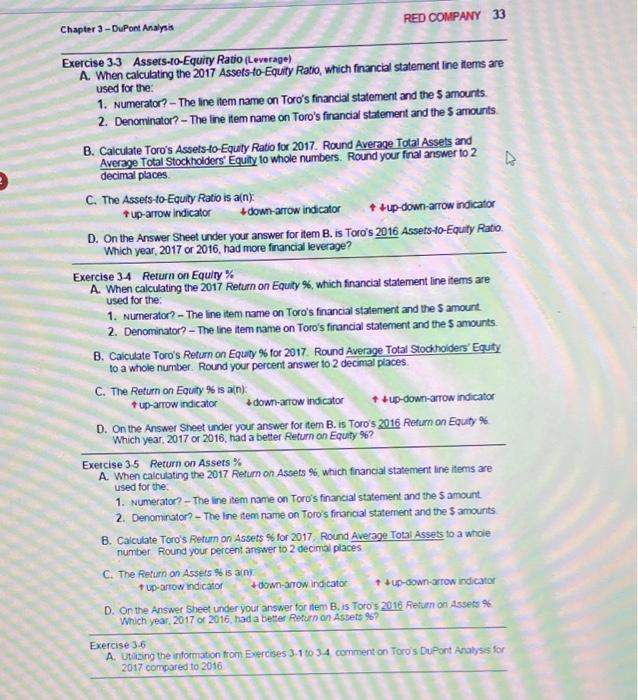

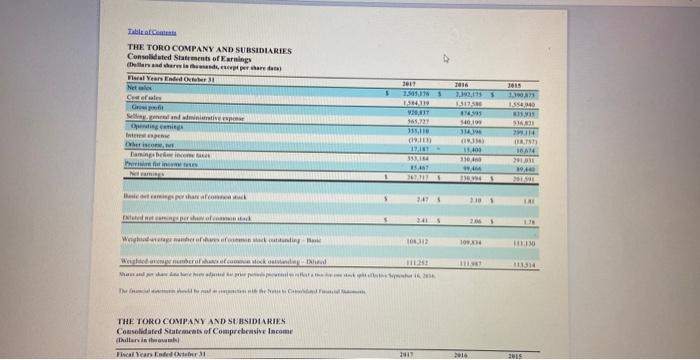

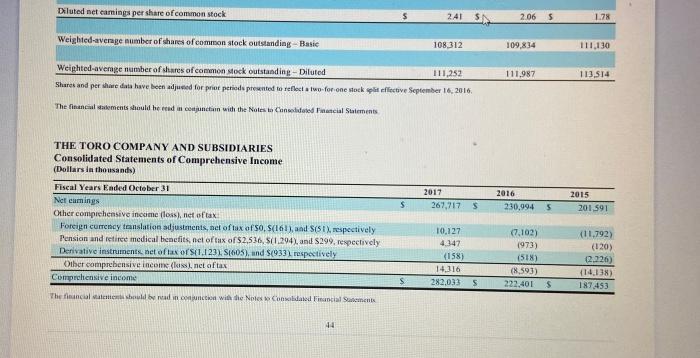

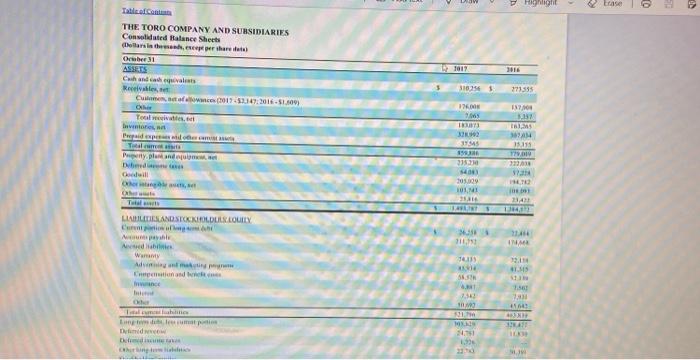

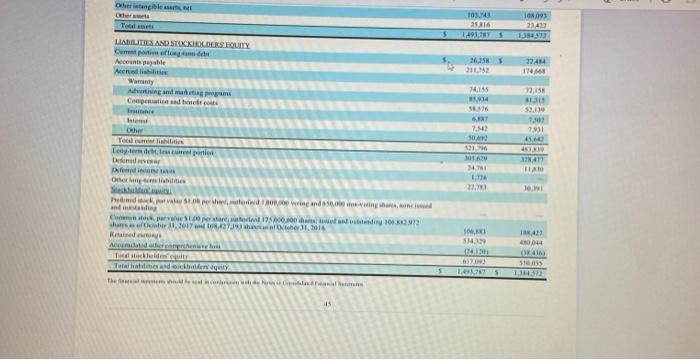

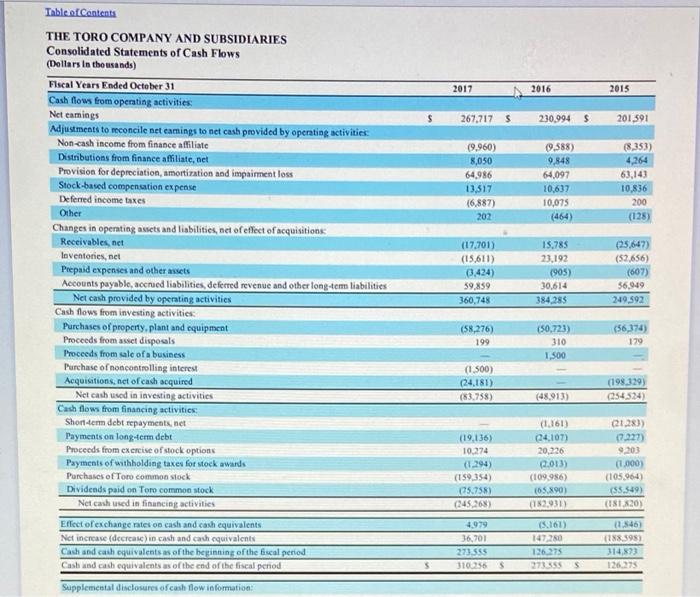

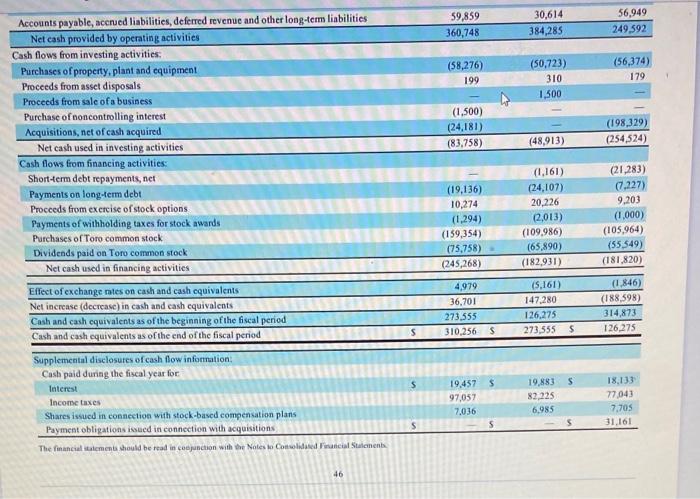

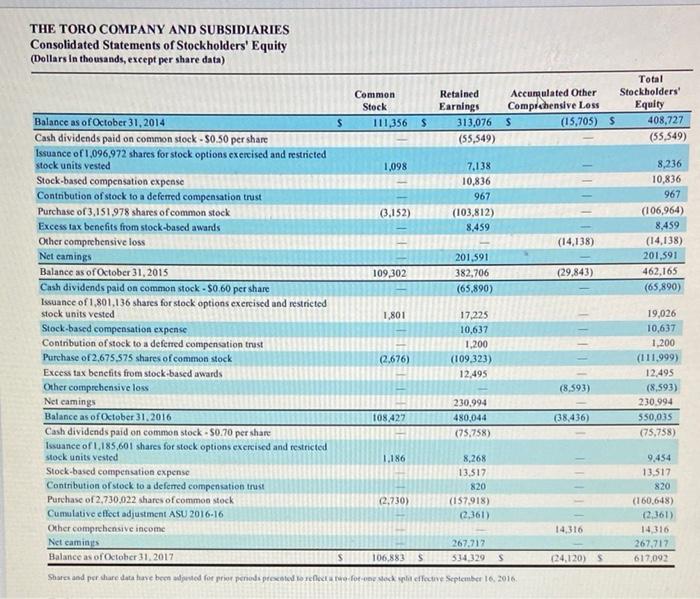

C. The Assets-to-Equity Ratio is a(n); (click the drop-down button and select from the I D. Which year had more financial leverage? (click the drop-down button and select fr Exercise 3-6 Toro's DuPont Analysis for 2017 compared to 2016 Using the pdf file, Toro Financial Statements a complete the homework problems listed in the Red Company Book PDF Chapter 3 on pages 32-33 (see Book PDF poges below) Use the attached form, blank sheet of paper, or the Homework Form located in your soltware. Upload homewotk here Hint Use the atached Formulas PowerPoint J as reference for your formulas Another Hint ter323434629 Beg YrS is the 2016 actount balance. End YrS is the 2017 balance. The formula wants the average of those accounts 3.2 Check Figure: Average total Assets (1,384,572+1,493,787)/2=$1,439,180 Book PDF Files: 32Rerocourntr Anawivit firf Fuercite 11 Ner frofi ilypie " Fretixewth uteed tor the In these exercises, you will be applying the DuPont ratios to The Toro Company. Use the form in the Excel file Red Company Chapter 3 Homework Form to record your answers. For information and examples on how to round your answers, see the appendix on Pg86 in the file 6 - Annual Report Project and Rounding Rules.pdr. For these exercises, you will be using the financial statements of The Toro Company. Use Toros financial statements that you printed when you worked the Chapter 2 Homework. For an introduction to Toro's financial statements, see Pg 18 in the flle 2 - Vertical and Horizontal Analysis.por. Exercise 3-1 Net Profit Margin \% (Profitability) A. When calculating the 2017 Net Proft Margin %, which financial statement line items are used for the: 1. Numerator? - The line item name on Toro's financial statement and the $ amount. 2. Denominator? - The line item name on Toro's financial statement and the $ amount. B. Calculate Toro's Net Proft Margin \% for 2017 . Round your percent answer to 2 decimal places. C. The Net Profit Margin 9 is a(n) t up-arrow indicator tdown-arrow indicator t tup-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Net Profit Margin \% Which year, 2017 or 2016 , had a better Net Profit Margin 96 ? Exercise 3.2 Total Assets Tumover Ratio (Eticiency) A. When calculating the 2017 Total Assets Turnover Rato, which financaa statement ine items are used for the 1. Numerator? - The ine item name on Toro's financial statement and the S amount. 2. Denominator? - The ine item name on Toro's financial statement and the S amounts. B. Calculate Toro's Total Assets Tumover Ratio for 2017. Round Average Total Assets to a whole number. Round your final answer to 2 decimal places. C. The Total Assets Tumover Rato is ain: tup-arow indicator toom-arrow naicator tup-domn-arrow indicator D. On the Answer Sheet under you answer for itemi B, is Toro's 2016 Total Assets Turnover Ratho. Which year. 2017 or 2016 , had a better Total Assets Tumover Rato? Chapter 3 - DuPont Analysis Exercise 3.3 Assets-to-Equiry Ratio (Leverage) A. When calculating the 2017 Assets-to-Equity Ratio, which financial statement ine items are used for the: 1. Numerator? - The line item name on Toro's financial statement and the 5 amourts. 2. Denominator? - The line item name on Toro's firancial statement and the 5 amourts. B. Calculate Toro's Assetsto-Equity Ratio for 2017. Round Average Total Assets and Average Total Stockholders' Equity to whole numbers. Round your final answer to 2 decimal places. C. The Assets-to-Equity Ratio is a(n): T up-arrow indicator toown-arTow indicator tup-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Assets-1o-Equity Ratio. Which year, 2017 or 2016 , had more financial leverage? Exercise 3-4 Return on Equiry \% A. When calculating the 2017 Refurn on Equity %, which financial statement line items are used for the: 1. Numerator? - The ine item name on Toro's financial stalement and the 5 amourt. 2. Denominator? - The line item name on Toro's financial statement and the 5 amounts. B. Caiculate Toro's Retum on Equity \%t for 2017. Round Average Total Stockhoiders' Equty. to a whole number. Round your percent answer to 2 decimal places. C. The Return on Equity 95 is a(n): t up-arrow indicator ddowT-arrow indicator $+4p-down-arrow indicator D. On the Answer Sheet under your answer for item B. is Toro's 2016 Retum an Equity 96 Which year, 2017 or 2016 , had a better Return on Equty o6? Exercise 3.5 Return on Assets \% A. When calculating the 2017 Refurn on Assets %, which financial statement line items are used for the: 1. Numerator? - The line item name on Toro's financial statement and the 5 amount. 2. Denominator? - The Ine ftem name on Toro's financial staternent and the 5 amourts B. Calculate Toro's Retum on Assets % for 2017 . Round Average Total Assets to a whole number. Round your percent answer to 2 decimal places C. The Relurn on Assers $6 is a (n): t up-arrow indicator + dosn-arrow indicator i tup-oown-arrowindicator D. On the Answer Sheet underyour answer for item B, is Toro's 2016 Return on Assets Ab. Which year, 2017 or 2016 . had a better Recurn on Assets 9 ?? Exercise 3.6 A. Utilizing the intormation from Exerciges 3.1 to 3.4 comment on Toros DuPont Analyss for 2017 compared to 2016 Tatele oforentrate THE TORO COMRANY ANI) SUISGIDIARIE Consenlialefed Statreacnts of Yarnings. Coasolidafed Safraucats ef Coapercheasive Incoeac (Thullarein theresaralu) THE TORO COMPANY AND SUBSIDIARIES Consolidated Statements of Comprehensive Income (Dollars in thousands) Fotleof contran THE TORO COMPANY AND SUBSIDIARIES Consolidated Hatance Shects Covilaralia the esenfy, eacege ger thare ifate) Aisuberiptrinis Wested liabilater. Wartifyly THE TORO COMPANY AND SUBSIDIARIES Consolidated Statements of Cash Flows Accounts payable, acerued liabilities, deferred revenue and other long-term liabilities Net eash provided by operating activities Cash flows from investing activities: Purchases of property, plant and equipment Proceeds from asset disposals Proceeds from sale of a business Purchase of noncontrolling interest Acquisitions, net of cash acquired Net cash used in investing activities Cash flows from financing activities: Short-term debt repayments, net Payments on long-term debt Procceds from excrcise of stock options Payments of withholding taxes for stock awands \begin{tabular}{rrr} 59,859 & 30,614 & 56,949 \\ \hline 360,748 & 384,285 & 249,592 \\ \hline \end{tabular} Purchases of Toro common stock (58,276)199(50,723)3101,500(56,374)179 Dividends paid on Toro common stock Net cash used in financing activities \begin{tabular}{rrr} (1,500) & & \\ (24,181) & & (198,329) \\ \hline(83,758) & (48,913) & (254,524) \\ \hline \end{tabular} Effect of exchange mtes on cash and cash cquivalents Net increase (decrease) in cash and eash equivalents Cash and cash equivalents as of the beginning of the fiscal period Cash and cash cquivalents as of the end of the fiscal neriod $ 310,256$ (21,283) Supplemental disclosures of cash flow information: Cash paid during the fiscal year for: Intertst Incorre taxes Shares issucd in connection with stock-based compensation plans Payment obligations issaed in connection with acquisitions: The financial itatemenb should be read in coejenction with the Notes lo Cotwolidasal Firuncial Stalcenenb. 46 THE TORO COMPANY AND SUBSIDIARIES Consolidated Statements of Stockholders' Equity e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started