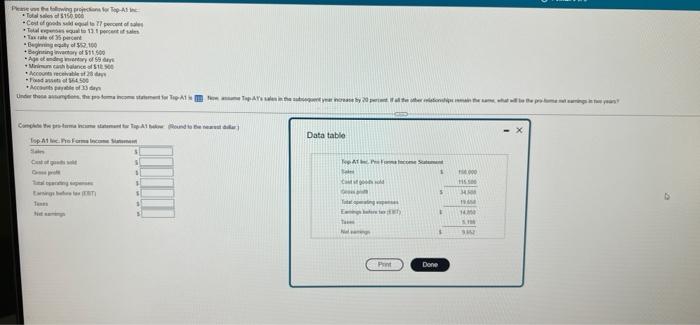

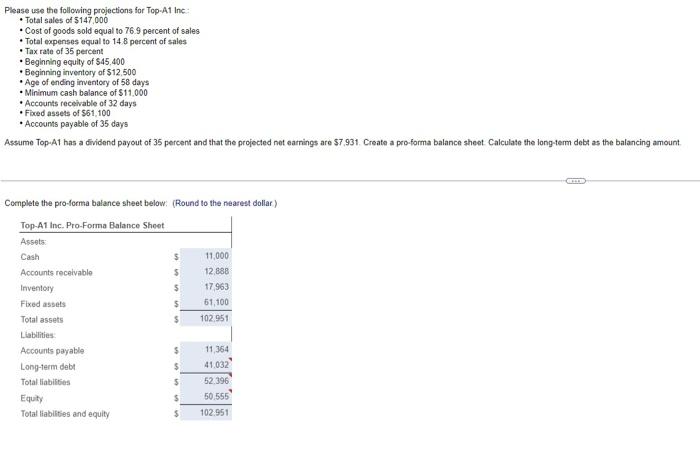

Please use the following projections for Top-An Total sales of $150.000 Cost of goods seld equal to 77 percent of sales Total expenses equal to 13.1 percent of sales *Tax rate of 35 percent Beginning egy of $52.100 *Beginning inventory of $11,500 Age of enginventary of 59 days Minimum cash balance of $1.500 Accounts receivable of day Food assets of $64.500 Accounts payable of 33 Under the assumptions, the profoma income statement for Top-A1 Name Top-AY's sales i Complete prema in statement for Tap A1 below Round to the nearest d Top-A1 Pro Form Salm Cof 1 Tal operating perse Earnings T Tes $ S $ boquent year increase by 20 percentat Data table Top Pa Income Statement Bake S Casti gold S Total Eb Ta Print viationships remain T F Done 000 H5500 JUM 196 14.30 5. 3362 Please use the following projections for Top-A1 Inc: Total sales of $147,000 * Cost of goods sold equal to 76.9 percent of sales Total expenses equal to 14.8 percent of sales Tax rate of 35 percent Beginning equity of $45,400 Beginning inventory of $12.500 Age of ending inventory of 58 days Minimum cash balance of $11,000 Accounts receivable of 32 days Fixed assets of $61,100 Accounts payable of 35 days Assume Top-A1 has a dividend payout of 35 percent and that the projected net earnings are $7.931. Create a pro-forma balance sheet Calculate the long-term debt as the balancing amount T Complete the pro-forma balance sheet below: (Round to the nearest dollar) Top-A1 Inc. Pro-Forma Balance Sheet Assets Cash 11,000 Accounts receivable 12,888 Inventory 17,963 Fixed assets 61,100 Total assets 102.951 Liabilities Accounts payable 11,364 Long-term debt 41.032 Total liabilities 52.396 Equity 50.555 Total liabilities and equity 102.951 $ Please use the following projections for Top-An Total sales of $150.000 Cost of goods seld equal to 77 percent of sales Total expenses equal to 13.1 percent of sales *Tax rate of 35 percent Beginning egy of $52.100 *Beginning inventory of $11,500 Age of enginventary of 59 days Minimum cash balance of $1.500 Accounts receivable of day Food assets of $64.500 Accounts payable of 33 Under the assumptions, the profoma income statement for Top-A1 Name Top-AY's sales i Complete prema in statement for Tap A1 below Round to the nearest d Top-A1 Pro Form Salm Cof 1 Tal operating perse Earnings T Tes $ S $ boquent year increase by 20 percentat Data table Top Pa Income Statement Bake S Casti gold S Total Eb Ta Print viationships remain T F Done 000 H5500 JUM 196 14.30 5. 3362 Please use the following projections for Top-A1 Inc: Total sales of $147,000 * Cost of goods sold equal to 76.9 percent of sales Total expenses equal to 14.8 percent of sales Tax rate of 35 percent Beginning equity of $45,400 Beginning inventory of $12.500 Age of ending inventory of 58 days Minimum cash balance of $11,000 Accounts receivable of 32 days Fixed assets of $61,100 Accounts payable of 35 days Assume Top-A1 has a dividend payout of 35 percent and that the projected net earnings are $7.931. Create a pro-forma balance sheet Calculate the long-term debt as the balancing amount T Complete the pro-forma balance sheet below: (Round to the nearest dollar) Top-A1 Inc. Pro-Forma Balance Sheet Assets Cash 11,000 Accounts receivable 12,888 Inventory 17,963 Fixed assets 61,100 Total assets 102.951 Liabilities Accounts payable 11,364 Long-term debt 41.032 Total liabilities 52.396 Equity 50.555 Total liabilities and equity 102.951 $