Answered step by step

Verified Expert Solution

Question

1 Approved Answer

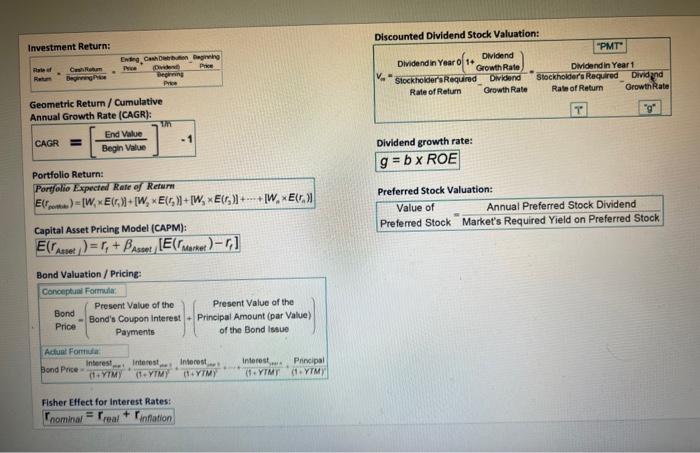

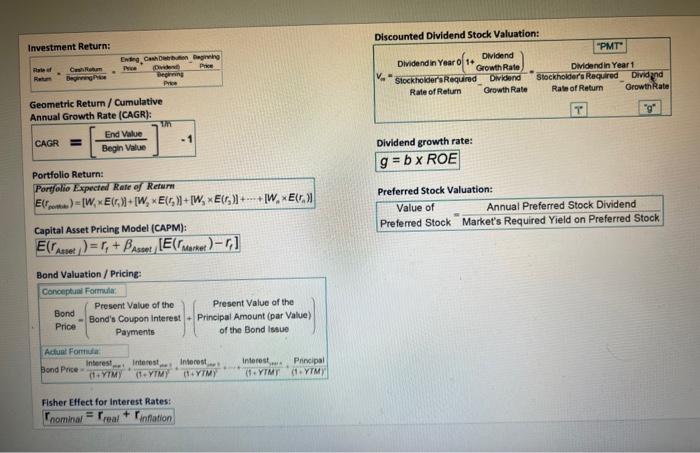

please use the formulas from the formual sheet Investment Return: Geometric Retum / Cumulative Annual Growth Rate (CAGR): Portfolio Return: Portflio Expectel Rate of Returm

please use the formulas from the formual sheet

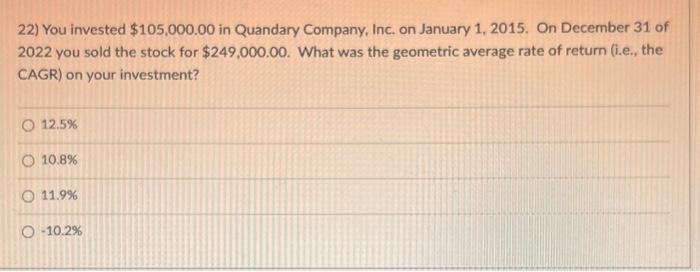

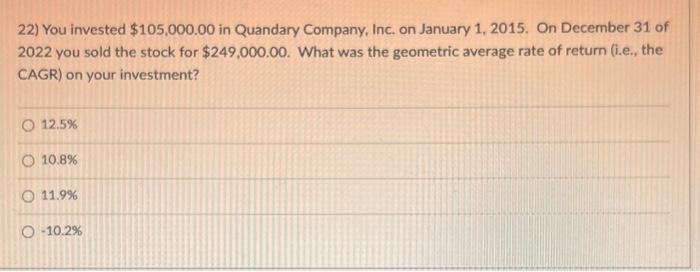

Investment Return: Geometric Retum / Cumulative Annual Growth Rate (CAGR): Portfolio Return: Portflio Expectel Rate of Returm E(rpont)=[W1E(r1)]+[W2E(rn)]+[W3E(r2)]++[WnE(rn)] Capital Asset Pricing Model (CAPM): E(rAtsex1)=rf+Assatj[E(rMarket)r1] Bond Valuation / Pricing: \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Conceptual Formular. } & \\ \hline \begin{tabular}{l} Bond \\ Price = \end{tabular} & \( \left(\begin{tabular}{r} ight. \) Present \\ Bond's Co \\ Pa \end{tabular} & \begin{tabular}{l} Value of the \\ oupon interest \\ ayments \end{tabular} & )\( +\left(\begin{tabular}{r} ight. \) Pre \\ Princip \\ 0 \end{tabular} & \begin{tabular}{l} sent Value of the \\ Amount (par Value) \\ the Bond lssue \end{tabular} \\ \hline \multicolumn{2}{|c|}{ Actuar Fomina: } & & & \\ \hline Pond Prise & =(1+rmi)Interest & (1+VTM)2Interest+1in & (t+rTM)3Interest & +(1+YTMinterest+(1+YTMPnncipal \\ \hline \end{tabular} Fisher Effect for interest Rates: rnominat=rreat+rinfiation Discounted Dividend Stock Valuation: Dividend growth rate: g=bROE Preferred Stock Valuation: Value of Annual Preferred Stock Dividend Preferred Stock " Market's Required Yield on Preferred Stock 22) You invested $105,000.00 in Quandary Company, Inc. on January 1, 2015. On December 31 of 2022 you sold the stock for $249,000.00. What was the geometric average rate of return (i.e., the CAGR) on your investment? 12.5% 10.8% 11.9% 10.2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started