Answered step by step

Verified Expert Solution

Question

1 Approved Answer

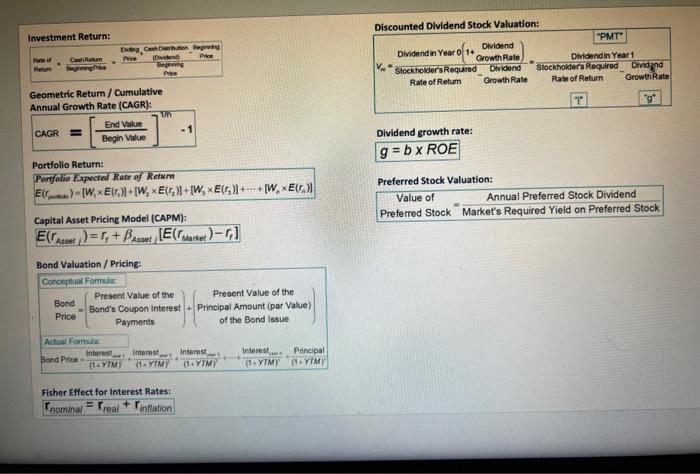

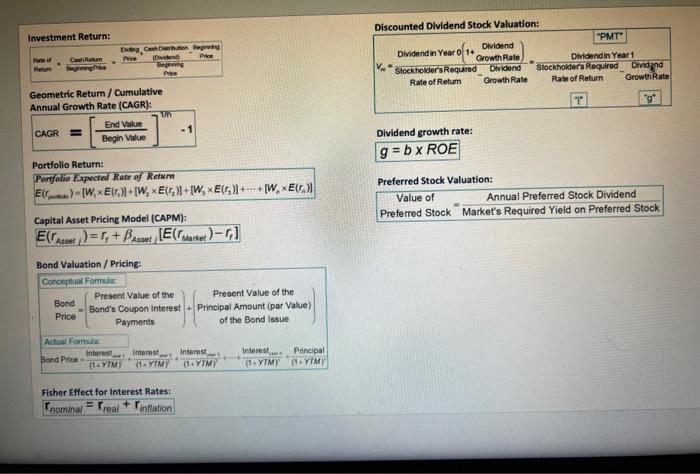

please use the formulas from the formula sheet Imvestment Return: Discounted Dividend Stock Valuation: Geometric Retum / Cumulative Annual Growth Rate (CAGR): Portfolio Return: Portjolio

please use the formulas from the formula sheet

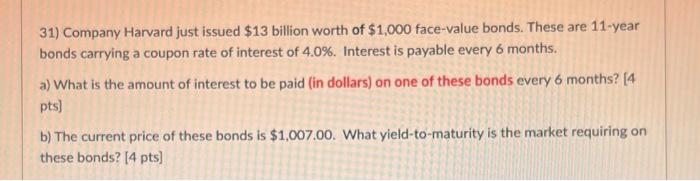

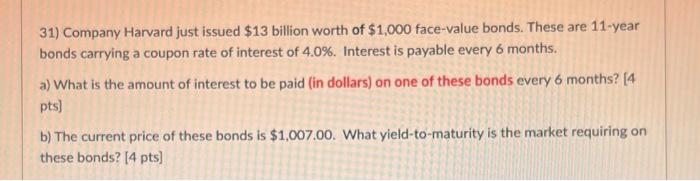

Imvestment Return: Discounted Dividend Stock Valuation: Geometric Retum / Cumulative Annual Growth Rate (CAGR): Portfolio Return: Portjolio Expected Rate of Returm E(rmite)=[W1E(r1)]+[W2E(r2)]+[W3E(r2)]++[WnE(rn)] Capital Asset Pricing Model (CAPM): E(rAstet))=rf+Asset/[E(rMarket)rf] Bond Valuation / Pricing: Fisher Effect for Interest Rates: rnominal=rreal+rinfiation Dividend growth rate: g=bROE Preferred Stock Valuation: Value of Annual Preferred Stock Dividend Preferred Stock "Market's Required Yield on Preferred Stock 31) Company Harvard just issued $13 billion worth of $1,000 face-value bonds. These are 11 -year bonds carrying a coupon rate of interest of 4.0%. Interest is payable every 6 months. a) What is the amount of interest to be paid (in dollars) on one of these bonds every 6 months? [4 pts] b) The current price of these bonds is $1,007.00. What yield-to-maturity is the market requiring on these bonds? [ 4pts ]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started