Answered step by step

Verified Expert Solution

Question

1 Approved Answer

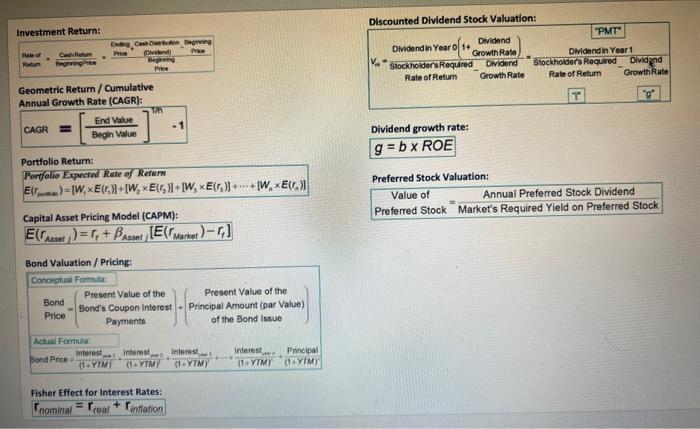

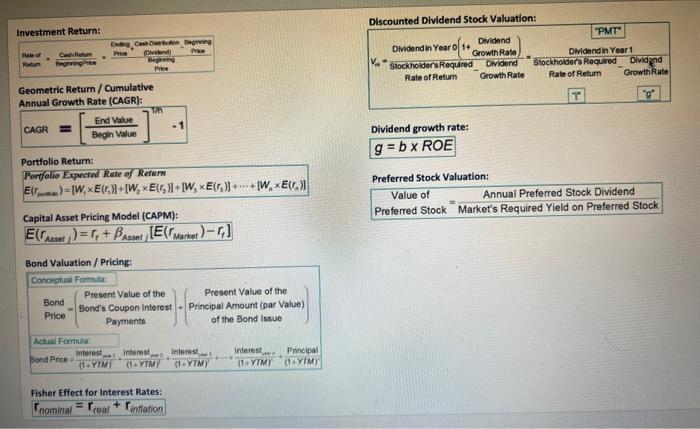

please use the formulas from the formula sheet Investment Return: Geometric Return / Cumulative Annual Growth Rate (CAGR): Portfolio Return: Portflie Expected Rate of Retwrm

please use the formulas from the formula sheet

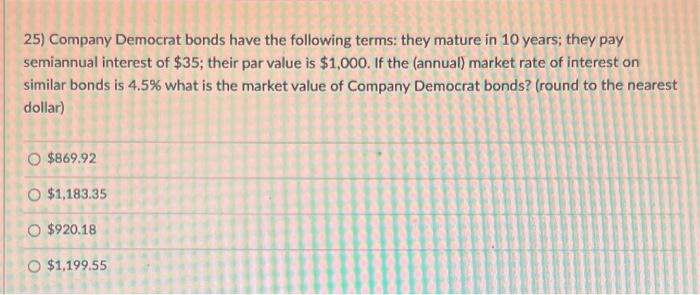

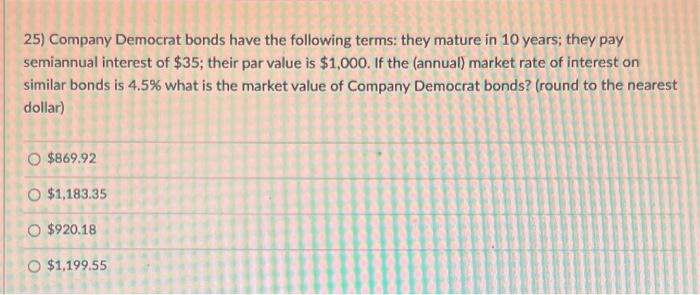

Investment Return: Geometric Return / Cumulative Annual Growth Rate (CAGR): Portfolio Return: Portflie Expected Rate of Retwrm E(rman)=[W1E(r1)]+[W2E(r2)]+[W3E(r3)]++[WnE(rn)] Capital Asset Pricing Model (CAPM): E(rAsset/)=rt+Assetj[E(rManket)rt] Bond Valuation / Pricing: \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Conceptuai Formular } \\ \hlinePriceBond= & \( \left(\begin{tabular}{c} ight. \) Present Value of the \\ Bond's Coupon interest \\ Payments \end{tabular}) & -( \( \begin{tabular}{c} \) Present Value of the \\ of the Bond Issue \end{tabular}) \\ \hline \multicolumn{3}{|c|}{ Actual Formuar } \\ \hline Bend Price & (1+YTM)interest+(1+YTM)interest+(1+YT)in & (1+YTM)Interest,we+(1+YTM)Principal \\ \hline \end{tabular} Fisher Effect for Interest Rates: rnominal=rceal+rinfiation Discounted Dividend Stock Valuation: Dividend growth rate: g=bROE Preferred Stock Valuation: ValueofPreferredStock=MarketsRequiredYieldonPreferredStockAnnualPreferredStockDividend 25) Company Democrat bonds have the following terms: they mature in 10 years; they pay semiannual interest of $35; their par value is $1,000. If the (annual) market rate of interest on similar bonds is 4.5% what is the market value of Company Democrat bonds? (round to the nearest dollar) $869.92 $1,183.35 $920.18 $1,199,55

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started