Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the given information to complete steps 8, 9, and 10 Do not used data already found on Chegg/ the internet as those answers

Please use the given information to complete steps 8, 9, and 10

Do not used data already found on Chegg/ the internet as those answers are not correct for this problem.

Please use the given information to complete steps 8, 9, and 10

Do not used data already found on Chegg/ the internet as those answers are not correct for this problem.

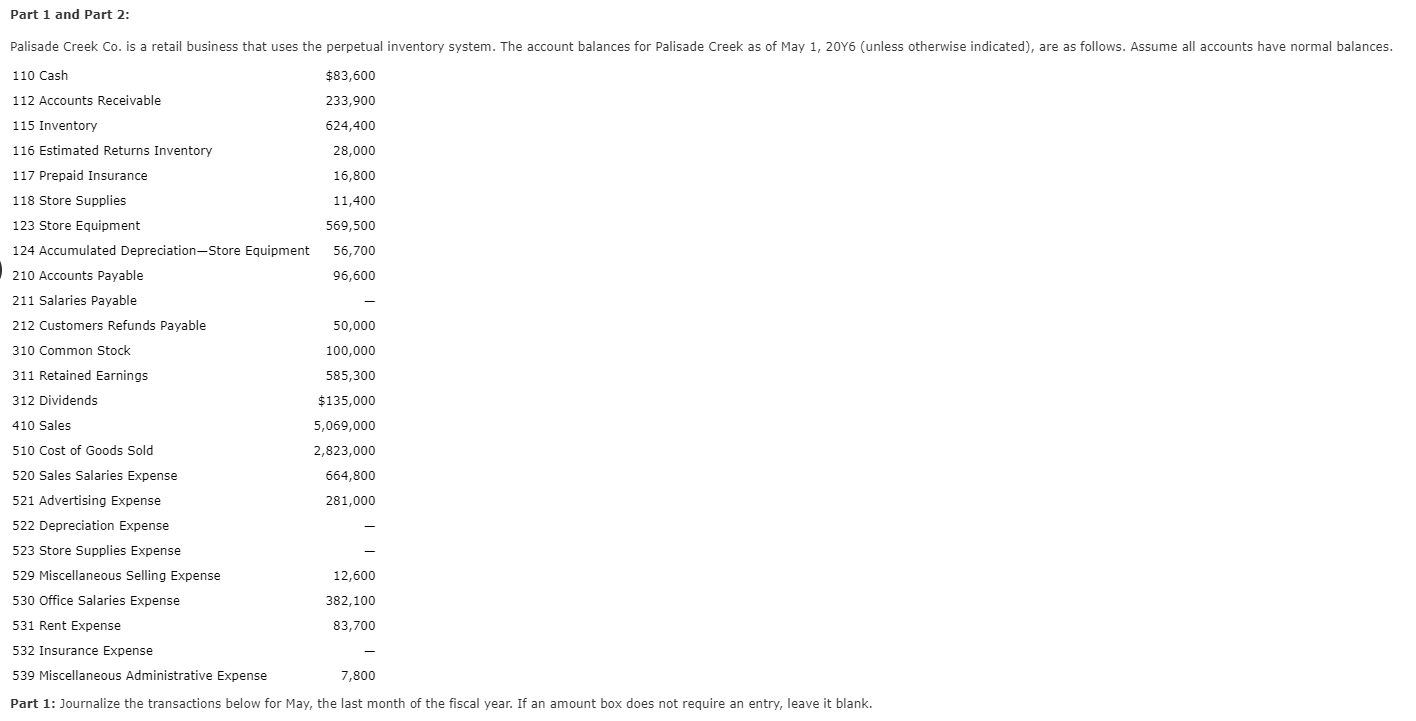

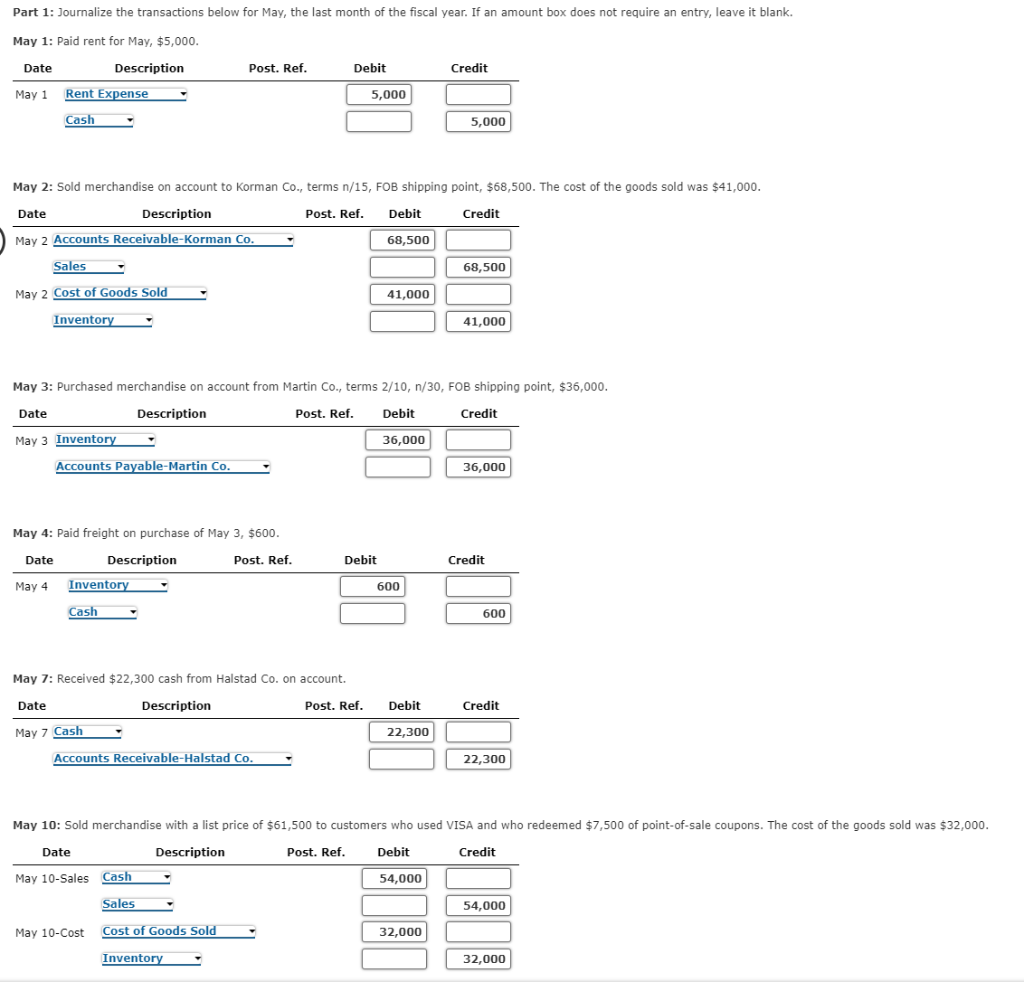

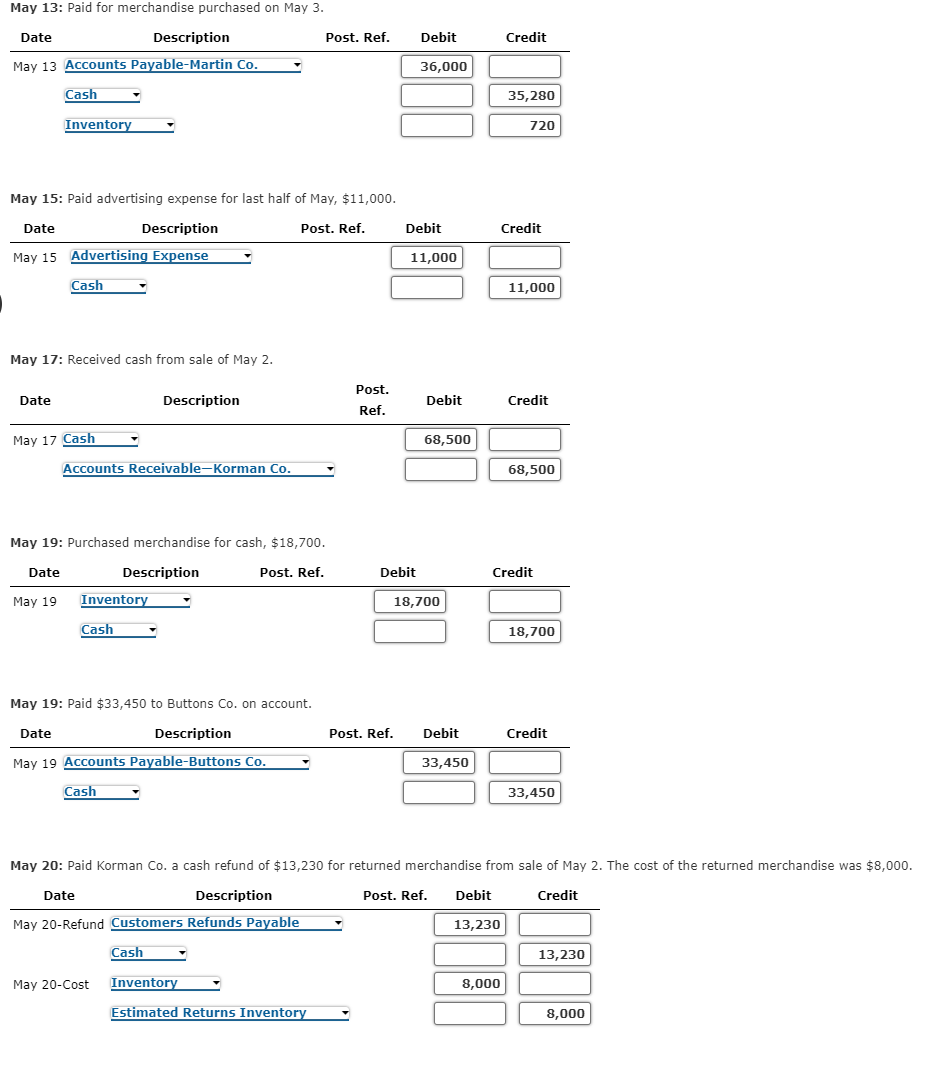

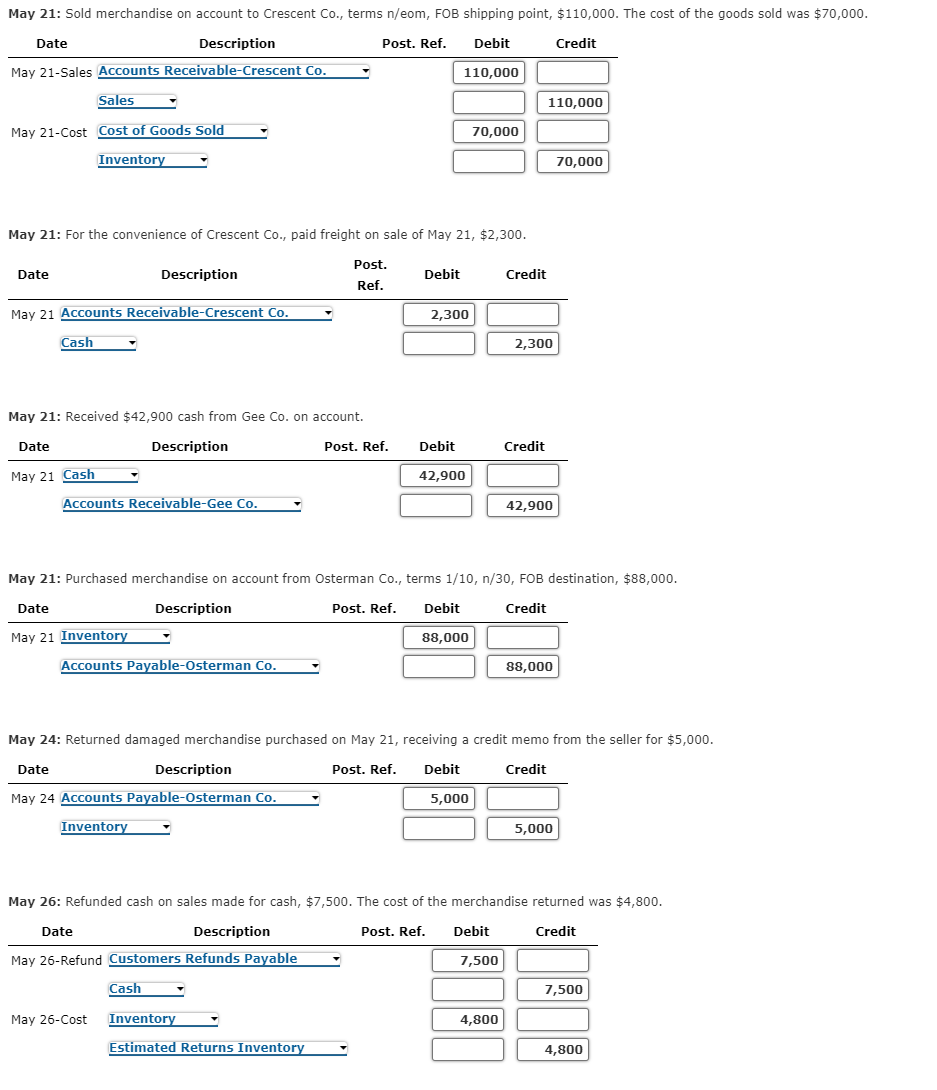

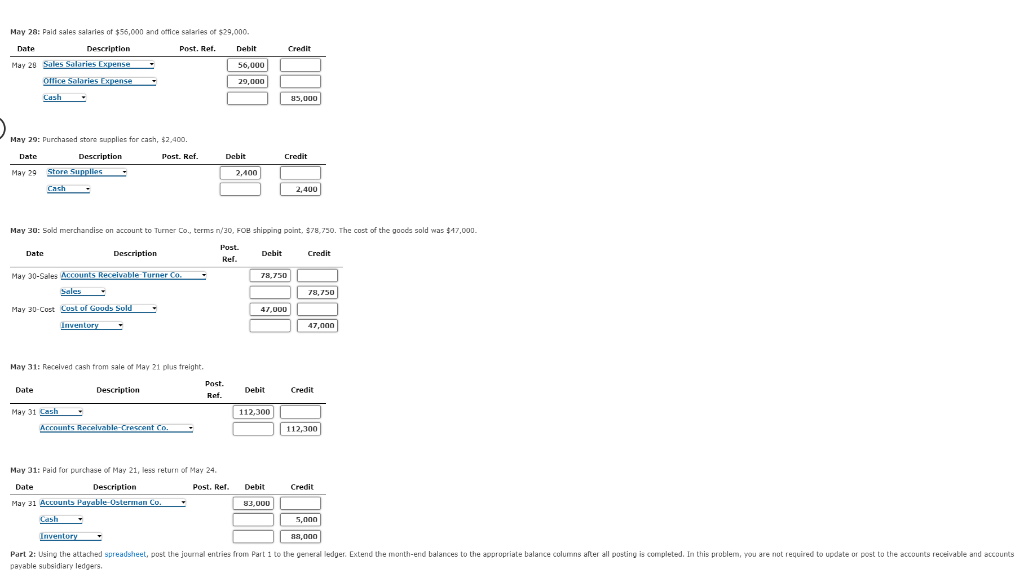

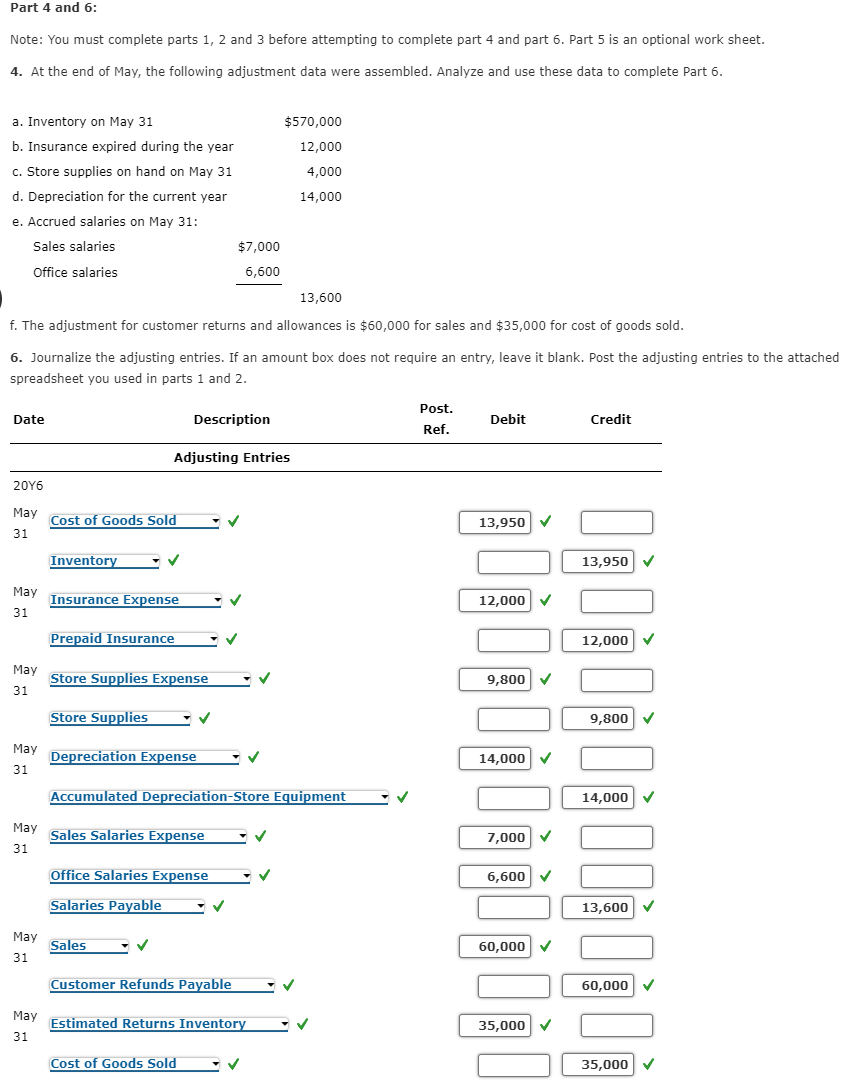

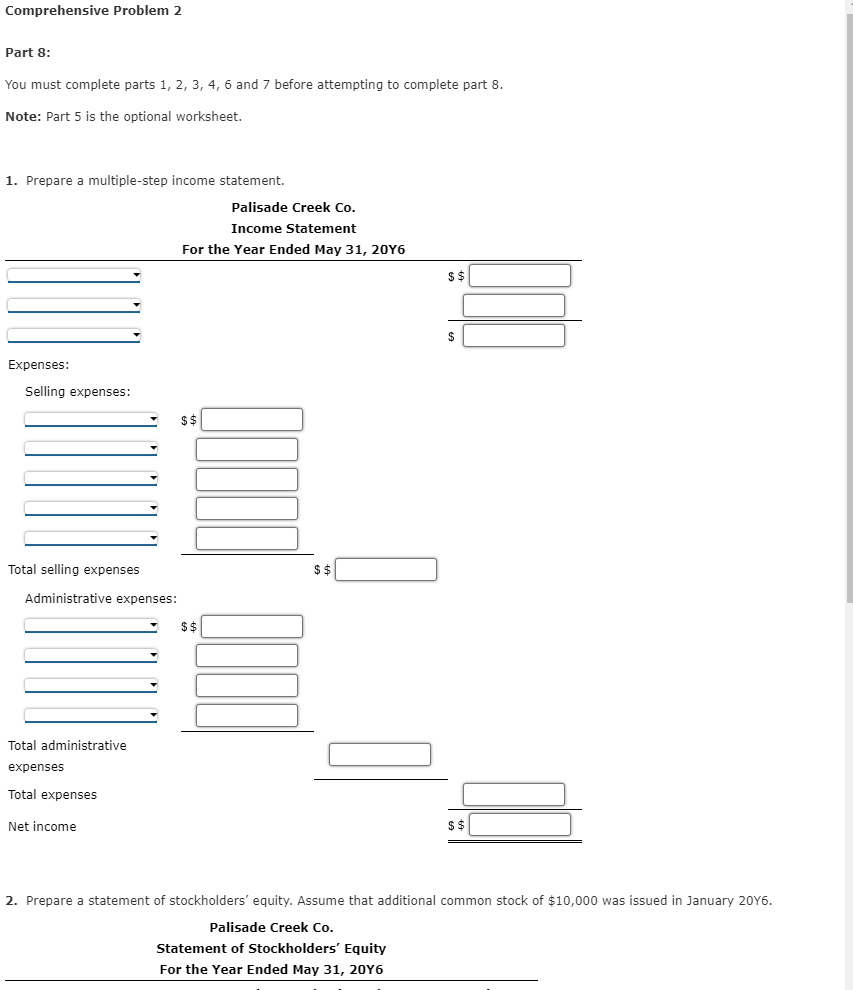

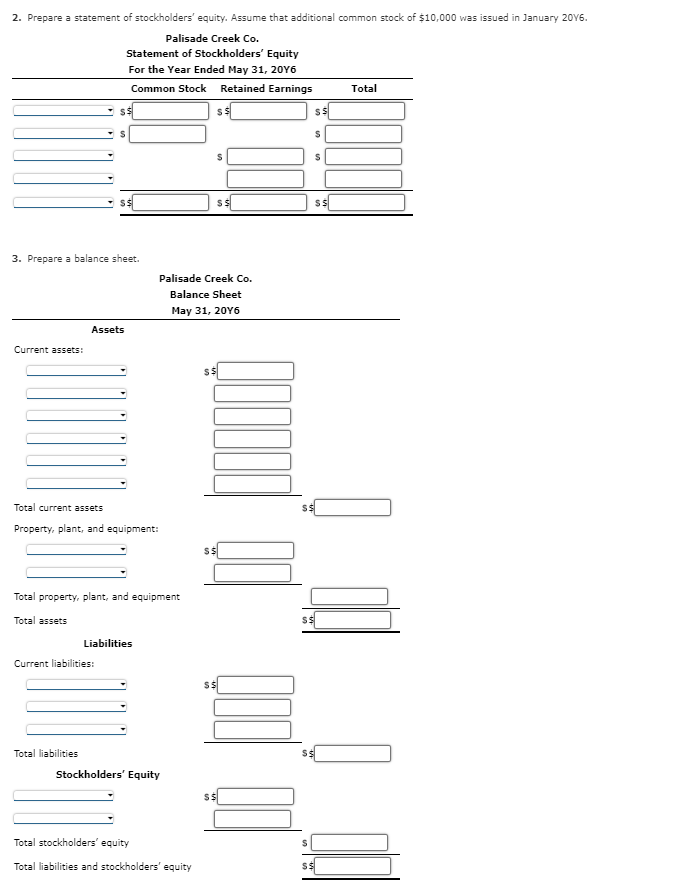

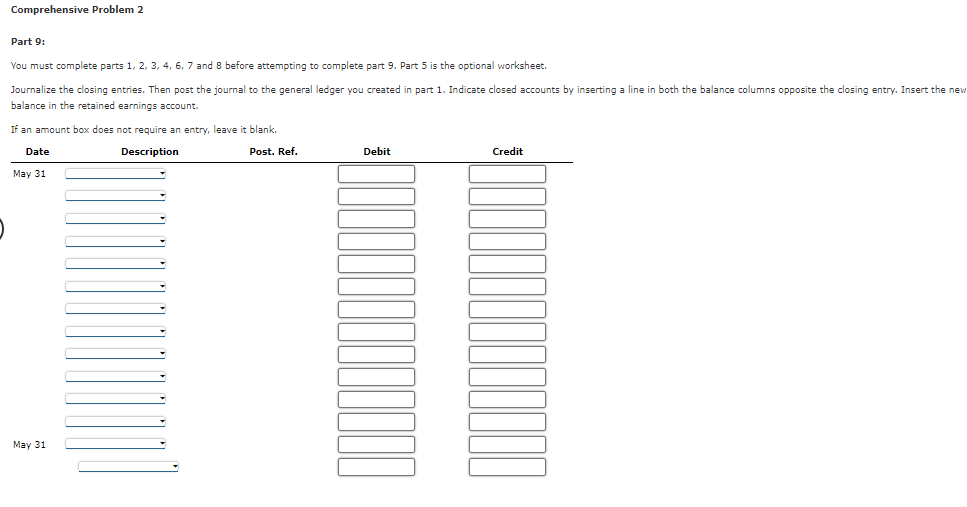

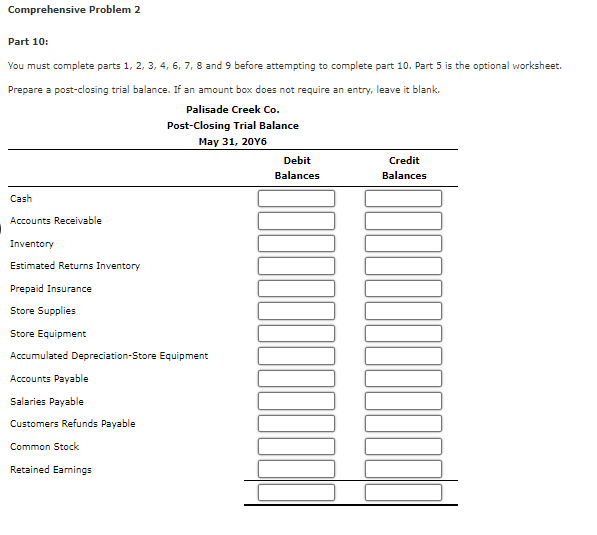

Part 1 and Part 2: Part 1: Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require an entry, leave it blank. Part 1: Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require an entry, leave it blank. May 1: Paid rent for May, $5,000. May 2: Sold merchandise on account to Korman Co., terms n/15, FOB shipping point, $68,500. The cost of the goods sold was $41,000. May 3: Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, $36,000. May 4: Paid freight on purchase of May 3, $600. May 7: Received $22,300 cash from Halstad Co. on account. May 15: Paid advertising expense for last half of May, $11,000. May 17: Received cash from sale of May 2. May 19: Purchased merchandise for cash, $18,700. May 19: Paid $33,450 to Buttons Co. on account. May 21: For the convenience of Crescent Co., paid freight on sale of May 21, $2,300. May 21: Received $42,900 cash from Gee Co. on account. May 21: Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination, $88,000. May 24: Returned damaged merchandise purchased on May 21 , receiving a credit memo from the seller for $5,000. May 26: Refunded cash on sales made for cash, $7,500. The cost of the merchandise returned was $4,800. May 2s: Paid sales salaries of $55,000 and ottice salaries of $29,000. May 29: Purchased store supplies for cash, $2,400. May 30: 5old merchandise on sccount to Turner Co., terms n/30, FOe = May 31: Peceived cash tram sale of May 21 plus treight. May 31: Paid for purchase of May 21, less return of May 24. Part 4 and 6: Note: You must complete parts 1,2 and 3 before attempting to complete part 4 and part 6 . Part 5 is an optional work sheet. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete Part 6. f. The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of goods sold. 6. Journalize the adjusting entries. If an amount box does not require an entry, leave it blank. Post the adjusting entries to the attached spreadsheet you used in parts 1 and 2 . Part 8: You must complete parts 1,2,3,4,6 and 7 before attempting to complete part 8 . Note: Part 5 is the optional worksheet. Nas issued in January 20Y6. 2. Prepare a statement of stockholders' equity. Assume that additional common stock of $10,000 was issued in January 20Y6. Palisade Creek Co. Statement of Stockholders' Equity For the Year Ended May 31, 20Y6 3. Prepare a balance sheet. PalisadeCreekCo.BalanceSheetMay31,20Y6 Assets Current assets: Total current assets 5$ Property, plant, and equipment: Total property, plant, and equipment Total assets Liabilities Current liabilities: 55 Total liabilities StockholdersrEquity $ Total stockholders' equity Total liabilities and stockholders' equity Part 9: You must complete parts 1,2,3,4,6,7 and 8 before attempting to complete part 9 . Part 5 is the optional worksheet. balance in the retained earnings account. Part 10: You must complete parts 1,2,3,4,6,7,8 and 9 before attempting to complete part 10 . Part 5 is the optional worksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started