Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the information below to answer questions 1 to 5 : On January 1,2023 , Pride, Inc. acquired 80% of the outstanding voting common

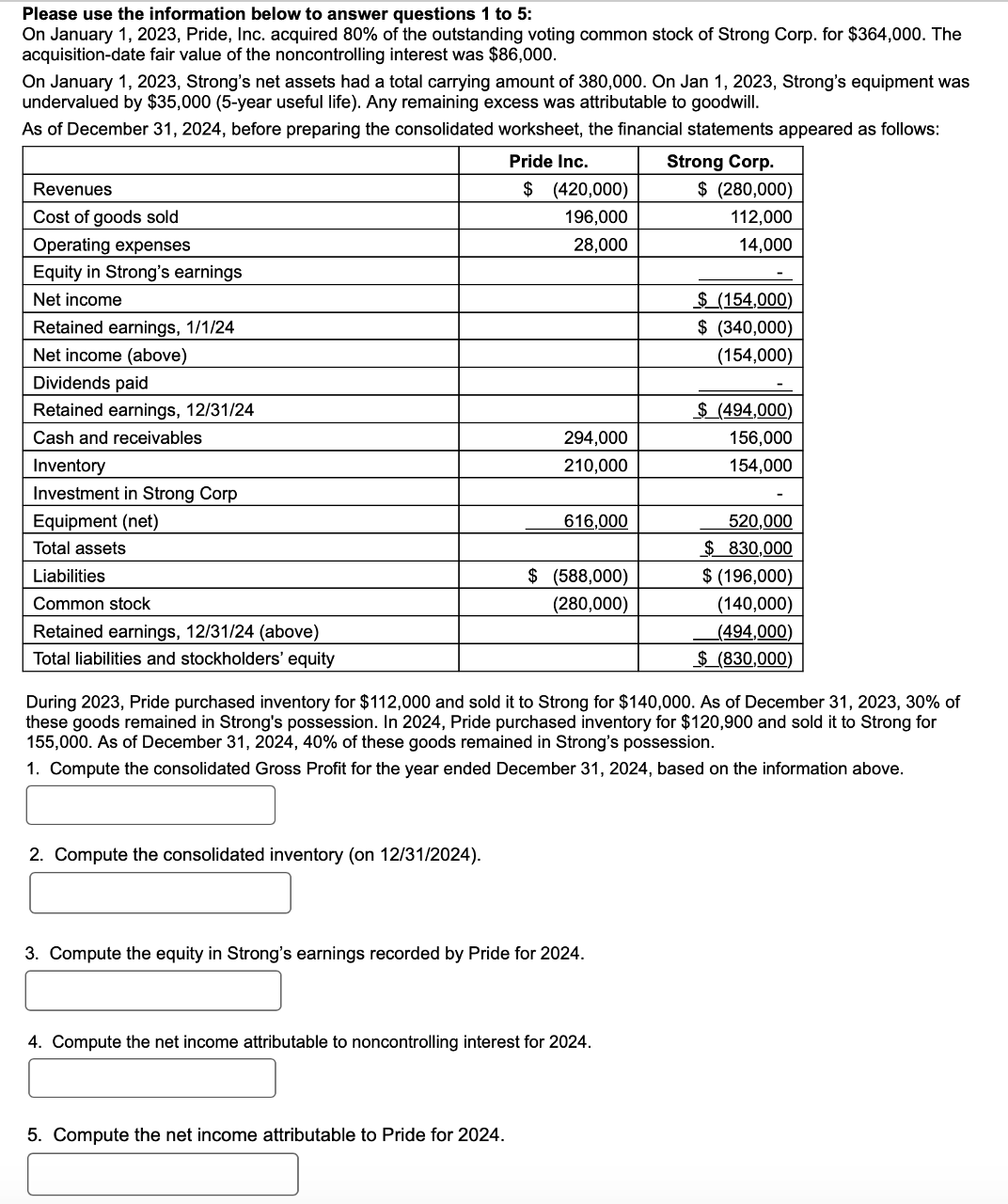

Please use the information below to answer questions 1 to 5 : On January 1,2023 , Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. The acquisition-date fair value of the noncontrolling interest was $86,000. On January 1, 2023, Strong's net assets had a total carrying amount of 380,000. On Jan 1, 2023, Strong's equipment was undervalued by $35,000 (5-year useful life). Any remaining excess was attributable to goodwill. As of December 31, 2024, before preparing the consolidated worksheet, the financial statements appeared as follows: During 2023, Pride purchased inventory for $112,000 and sold it to Strong for $140,000. As of December 31,2023,30% of these goods remained in Strong's possession. In 2024, Pride purchased inventory for $120,900 and sold it to Strong for 155,000 . As of December 31, 2024, 40\% of these goods remained in Strong's possession. 1. Compute the consolidated Gross Profit for the year ended December 31, 2024, based on the information above. 2. Compute the consolidated inventory (on 12/31/2024). 3. Compute the equity in Strong's earnings recorded by Pride for 2024. 4. Compute the net income attributable to noncontrolling interest for 2024 . 5. Compute the net income attributable to Pride for 2024

Please use the information below to answer questions 1 to 5 : On January 1,2023 , Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. The acquisition-date fair value of the noncontrolling interest was $86,000. On January 1, 2023, Strong's net assets had a total carrying amount of 380,000. On Jan 1, 2023, Strong's equipment was undervalued by $35,000 (5-year useful life). Any remaining excess was attributable to goodwill. As of December 31, 2024, before preparing the consolidated worksheet, the financial statements appeared as follows: During 2023, Pride purchased inventory for $112,000 and sold it to Strong for $140,000. As of December 31,2023,30% of these goods remained in Strong's possession. In 2024, Pride purchased inventory for $120,900 and sold it to Strong for 155,000 . As of December 31, 2024, 40\% of these goods remained in Strong's possession. 1. Compute the consolidated Gross Profit for the year ended December 31, 2024, based on the information above. 2. Compute the consolidated inventory (on 12/31/2024). 3. Compute the equity in Strong's earnings recorded by Pride for 2024. 4. Compute the net income attributable to noncontrolling interest for 2024 . 5. Compute the net income attributable to Pride for 2024 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started