Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE USE THE INFORMATION FROM 1 to 3 PICTURE AND WRITE DOWN THE QUESTION ANSWER ON LAST PICTURE PLEASE THANK YOU The following information is

PLEASE USE THE INFORMATION FROM 1 to 3 PICTURE AND WRITE DOWN THE QUESTION ANSWER ON LAST PICTURE PLEASE THANK YOU

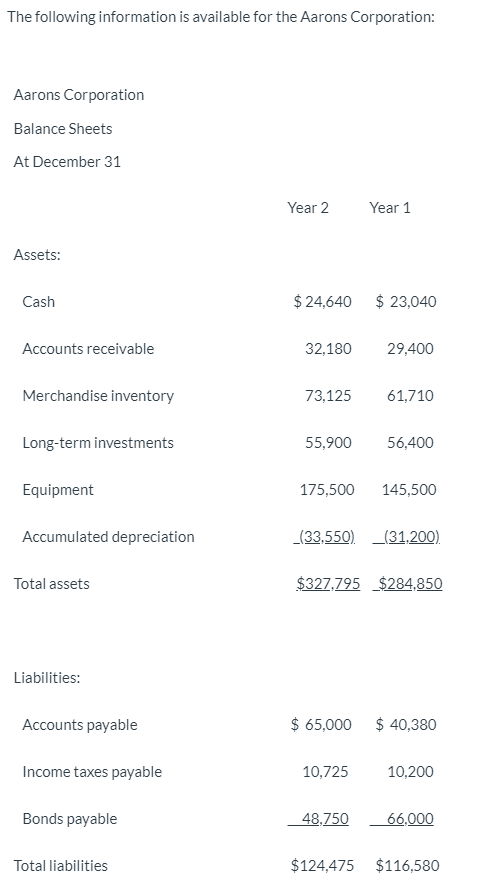

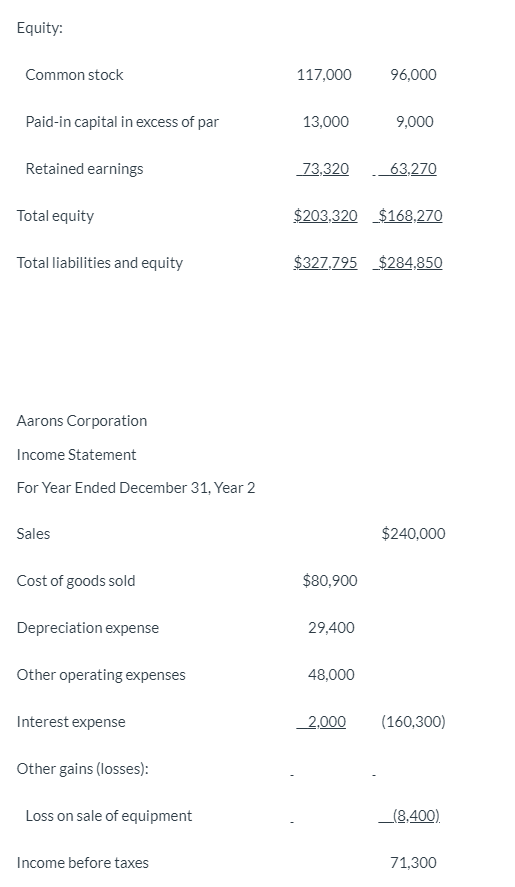

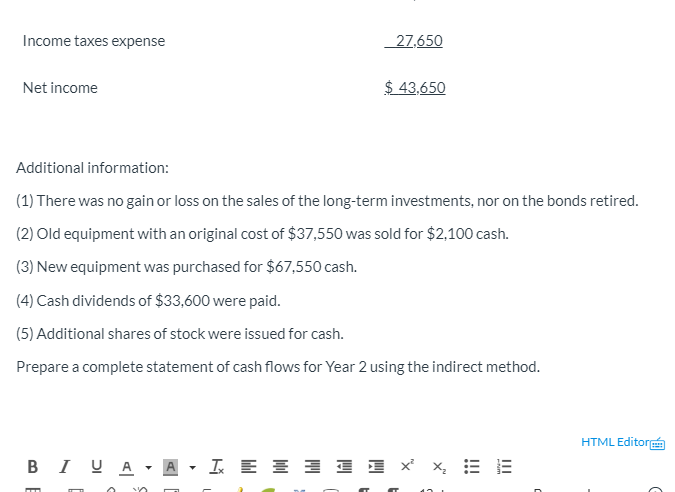

The following information is available for the Aarons Corporation: Aarons Corporation Balance Sheets At December 31 Year 2 Year 1 Assets: Cash $ 24,640 $ 23,040 Accounts receivable 32,180 29,400 Merchandise inventory 73,125 61,710 Long-term investments 55,900 56,400 Equipment 175,500 145,500 Accumulated depreciation _(33,550). _(31.200). Total assets $327,795 $284,850 Liabilities: Accounts payable $ 65,000 $ 40,380 Income taxes payable 10,725 10,200 Bonds payable 48,750 66.000 Total liabilities $ 124,475 $116,580 Equity: Common stock 117,000 96,000 Paid-in capital in excess of par 13,000 9,000 Retained earnings 73,320 63,270 Total equity $203.320 $168.270 Total liabilities and equity $327,795 $284,850 Aarons Corporation Income Statement For Year Ended December 31, Year 2 Sales $240,000 Cost of goods sold $80,900 Depreciation expense 29,400 Other operating expenses 48,000 Interest expense 2.000 (160,300) Other gains (losses): Loss on sale of equipment _(8.400) Income before taxes 71,300 Income taxes expense 27,650 Net income $ 43,650 Additional information: (1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired. (2) Old equipment with an original cost of $37,550 was sold for $2,100 cash. (3) New equipment was purchased for $67,550 cash. (4) Cash dividends of $33,600 were paid. (5) Additional shares of stock were issued for cash. Prepare a complete statement of cash flows for Year 2 using the indirect method. HTML Editora B 1 0 A A A = = = % = x x = = Question 2 25 pts Explain the value of separating cash flows into operating activities, investing activities, and financing activities to financial statement users in analyzing cash flows and the company's financial performance and condition. HTML Editora BIU A 1x E333 X TTK 12pt ParagraphStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started