Question

please use the information provided above and below. round 2 decimal places. CASE: CASH FLOW PROBLEM? A recent graduate from ACCT 1510 has given you

please use the information provided above and below. round 2 decimal places.

CASE: CASH FLOW PROBLEM?

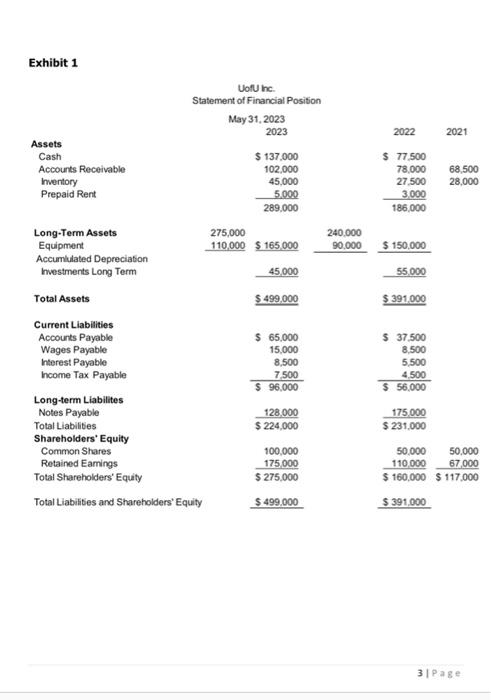

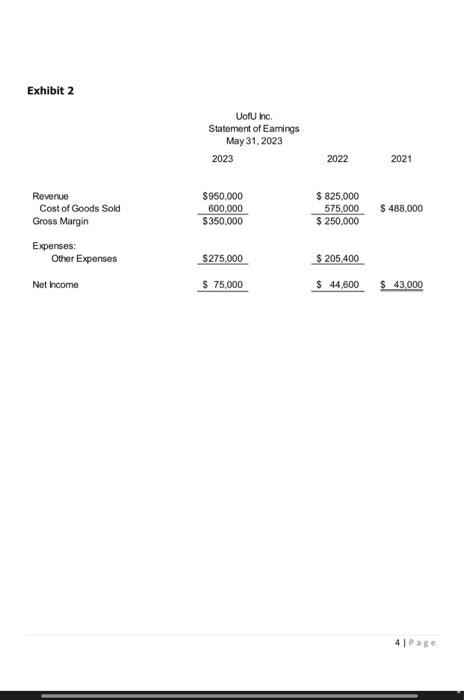

A recent graduate from ACCT 1510 has given you an opportunity to determine what the changes were from 2022 to 2023 for UofU Inc. Provided is the statement of financial position and Statement of Earning as of May 31, 2023, with a comparative of 2022 (Exhibit 1 and 2). and prepare a Statement of Cash Flows using the indirect method. The company is a private enterprise and chooses to follow ASPE.

You will also need to evaluate the results from the Statement of Cash Flows, and summarize the changes that occurred. In addition, you will need to calculate the following ratios:

Current Ratio Debt to Equity Ratio Accounts Receivable Turnover Ratio Inventory Turnover Ratio ROE

Additional Data:

- Cash Dividends of $10,000 were declared and paid.

- Net Income for 2023 was $75,000.

- Depreciation expense of $25,000

- Long-term investments had a value of $ 45,000 and were sold for cash for a gainof $10,000. Additional long-term investments of $35,000 were purchased for cash.

- Principal payment of $47,000 on long term debt

- Shares sold for $50,000 cash.

- Equipment with a cost of $25,000 and accumulated depreciation of $23,000 was sold for $14,000 cash. New Equipment was purchased for $35,000 cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started