Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the list account! The following is a summary of all relevant transactions of Cheyenne Corporation since it was organized in 2022. In 2022,

Please use the list account!

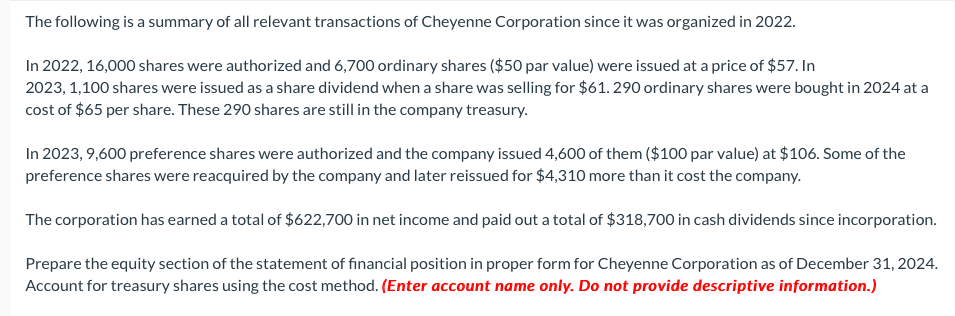

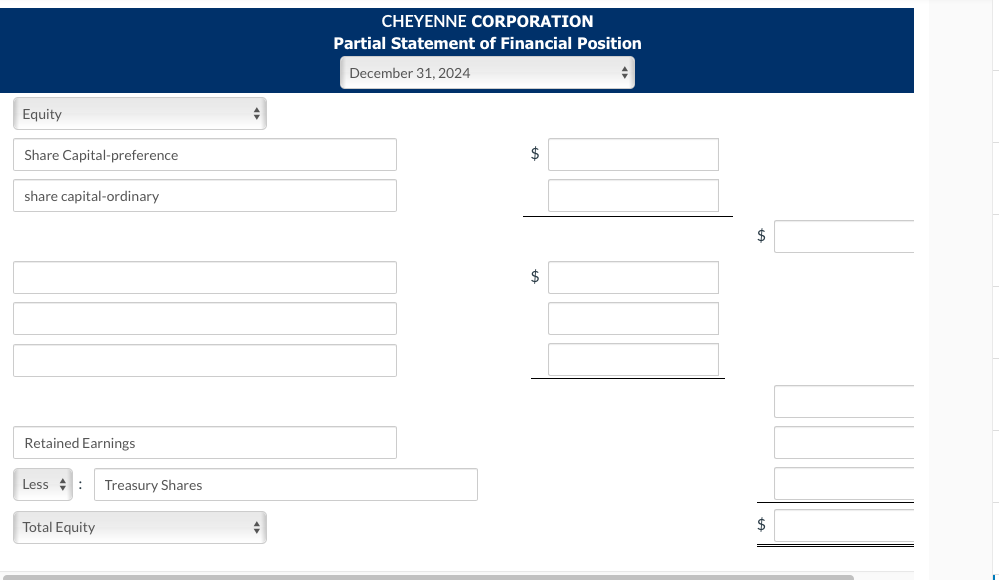

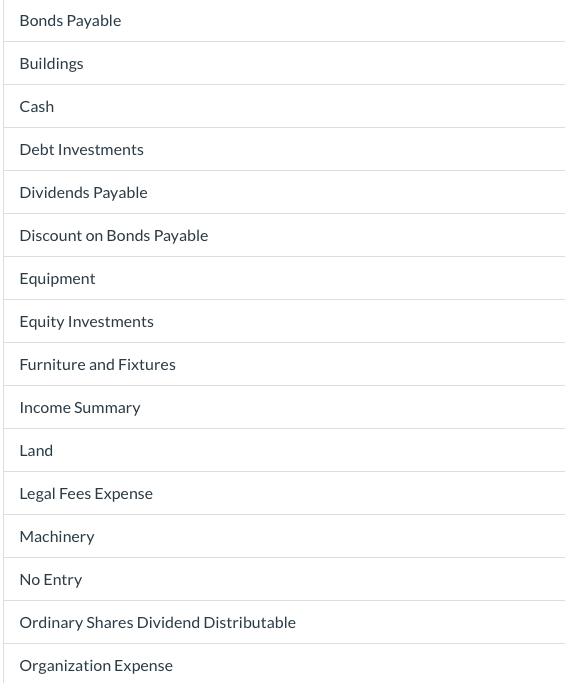

The following is a summary of all relevant transactions of Cheyenne Corporation since it was organized in 2022. In 2022, 16,000 shares were authorized and 6,700 ordinary shares ($50 par value) were issued at a price of $57. In 2023, 1,100 shares were issued as a share dividend when a share was selling for $61.290 ordinary shares were bought in 2024 at a cost of $65 per share. These 290 shares are still in the company treasury. In 2023,9,600 preference shares were authorized and the company issued 4,600 of them ($100 par value) at $106. Some of the preference shares were reacquired by the company and later reissued for $4,310 more than it cost the company. The corporation has earned a total of $622,700 in net income and paid out a total of $318,700 in cash dividends since incorporation. Prepare the equity section of the statement of financial position in proper form for Cheyenne Corporation as of December 31, 2024. Account for treasury shares using the cost method. (Enter account name only. Do not provide descriptive information.) CHEYENNE CORPORATION Partial Statement of Financial Position December 31, 2024 . Equity Share Capital-preference $ share capital-ordinary $ $ Retained Earnings Less : Treasury Shares Total Equity $ Bonds Payable Buildings Cash Debt Investments Dividends Payable Discount on Bonds Payable Equipment Equity Investments Furniture and Fixtures Income Summary Land Legal Fees Expense Machinery No Entry Ordinary Shares Dividend Distributable Organization Expense Organization Expense Property Dividends Payable Retained Earnings Retained Earnings Appropriated for Plant Expansion Share Capital-Ordinary Share Capital-Preference Share Premium-Ordinary Share Premium-Preference Share Premium-Treasury Treasury Shares Unamortized Bond Issue Costs Unrealized Holding Gain or Loss -IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started