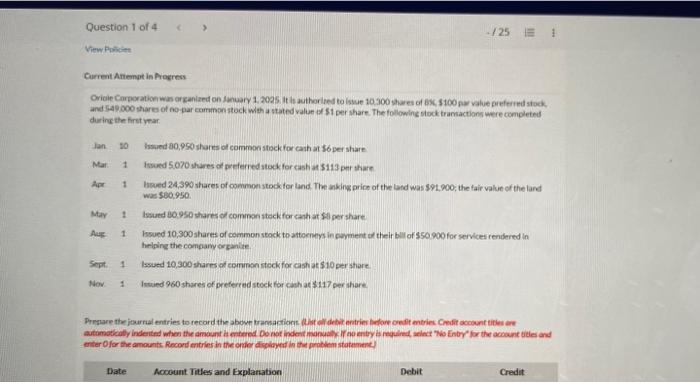

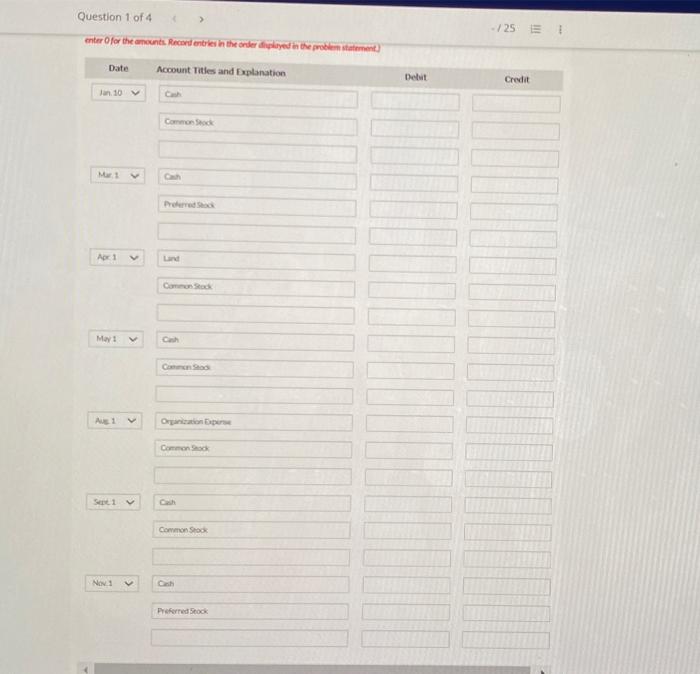

please use the list of account provided and show calculations thanks.

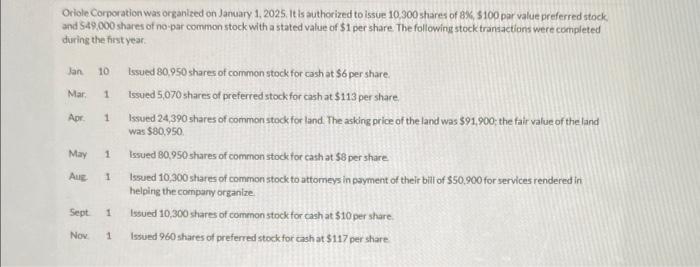

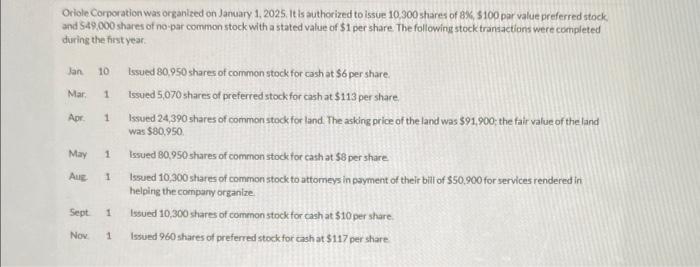

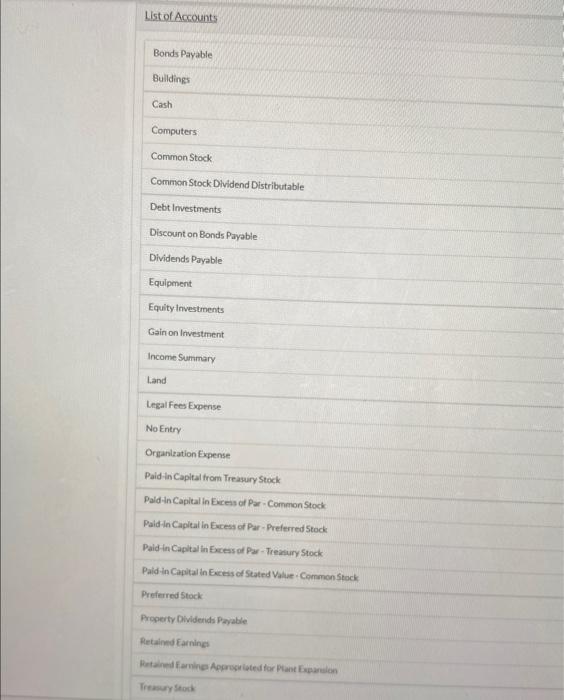

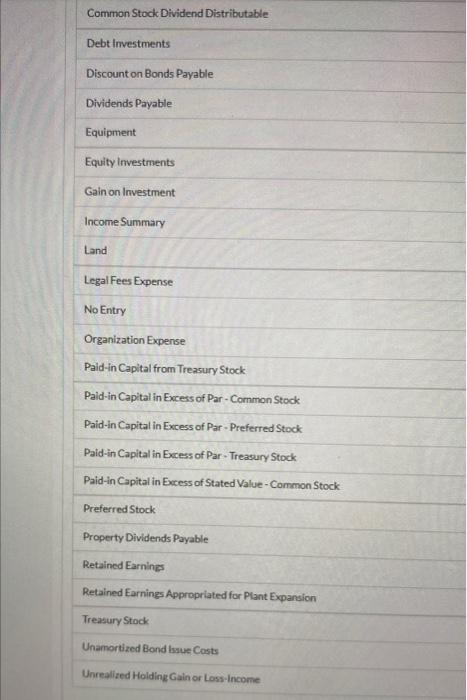

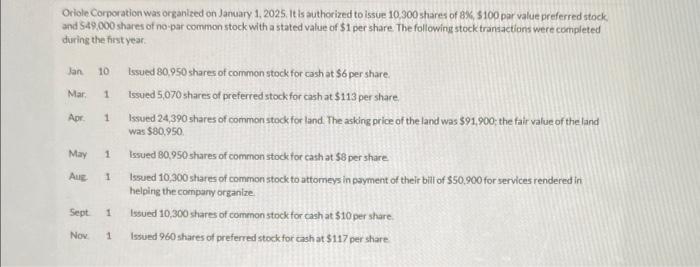

Oriole Cornoration was organized on January 1,2025. It is authorized to issue 10,300 shares of 86,5100 par value preferred stock. and 549000 shares of no-par common stock with a stated value of $1 per share The following stock transactions were completed diring the firstyear. Jan 10 Issued 80,950 shares of common stock for cash at $6 per share. Mar: 1. Issued 5,070 shares of preferred stock for cash at $113 per share. Apr. 1 Issued 24,390 shares of commonstock for land The asking price of the land was $91,900; the fair value of the land was $80,950. May 1 issued 80.950 shares of common stock for cash at $8 per share: Aue. I Issued 10,300 shares of common stock to attomeys in payment of their bili of $50,900 for services rendered in helping the compary organize. Sept 1 Issued 10,300 shares of comenon stock for cash at $10 per share. Nov. 1 Issued 960 shares of preferred stock for cash at $117 per share Current Attempt in Arosress Oricie Carporationwan or canized on Aanuary 1, 2025 it is author ited to iswe 10,100 shares of 8x,3100 na value preferied stock. and 549000 shares of no-par commonstock weh a stated value if 51 per share. The following stock transactions were completed. durinc the firstyear. Jan 10 hsored 80,990 shares of common atpektor cash at S6 per share Mar: 1 isued 5070 shares of preferied stock for cash at $113 per thare May 1 lesuad eo.9so shares of common stock for canh at Si per share Ale 1 bsued 10,300 ahares of common seock th attoeneys in cament of their blill of $50900 for services renidered in helping the compary ow canize. Sepr. 1 Issued 10,300 shares of common stock for caph at $10 per share: Now. 1 levied 960 shares of preferred steck for cashat $117 per thare. enter Ofor the anounts. Recoril entriei in the orifer diplined hi the motien statrment! List of Accounts Bonds Payable Buldings Cash Computers: Common Stock Common Stock Dividend Distributable Debt livestments Discount on Bonds Payable Dividends Payable Equipment Equity investments Gain on lnvestment Income Summary Land Legalfees Expense No Entry Organlzation Expense Paid in Capital from Treasury Stock Pald in Capital in Excess of Par-Common Stock Paid in Capital in Eacess of Par - Preferred Stock Paid in Capital in Excess of Par - Treisiury Stock Paid in Capital in Exceis of Stated Value - Common Stock Preferred Stock Property Dividends Peyable Retained Earning Firtained farning Approsu Leted for Plant Eapareion Treasury Stonk Common Stock Dividend Distributable Debt Investments Discount on Bonds Payable Dividends Payable Equipment Equity Investments Gain on lnvestment Income Summary Land Legal Fees Expense No Entry Organization Expense Paid-in Capital from Treasury Stock Paid-in Capital in Excess of Par - Common Stock Paid-in Capital in Excess of Par - Preferred Stock Paid-in Capital in Excess of Par - Treasury Stock Paid-in Capital in Excess of Stated Value - Common Stock Preferred Stock Property Dividends Payable Retained Earnines Retained Earnings Appropriated for Plant Expansion Treasury Stock Unamortized Bond lssue Costs Unrealized Holding Gain or Loss-Incone