Please use the provided excel to work on the problem and show work/formula in a working cell for a thumb up. Please don't forget the forumula !!! Thank you

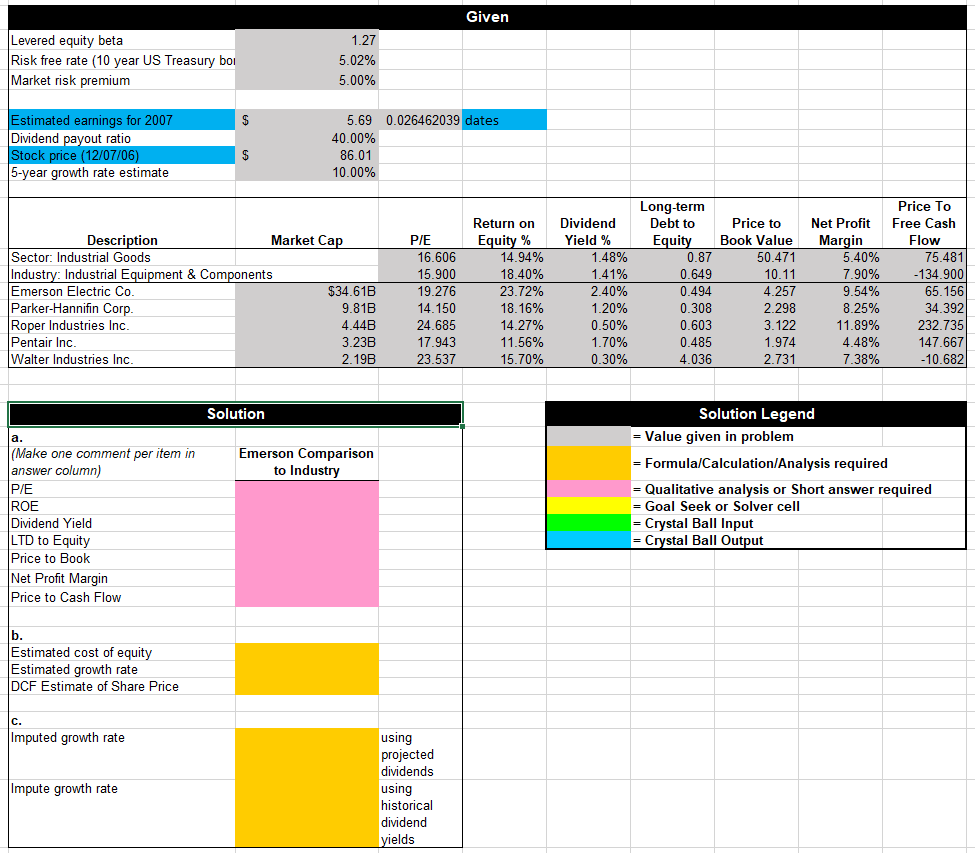

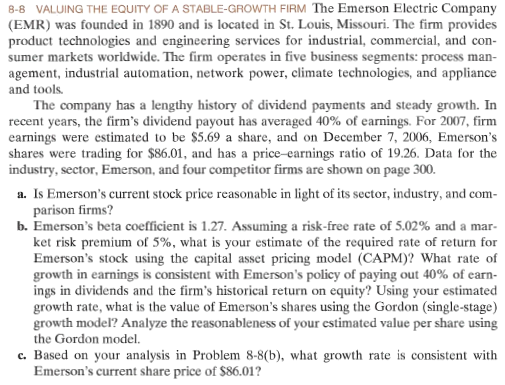

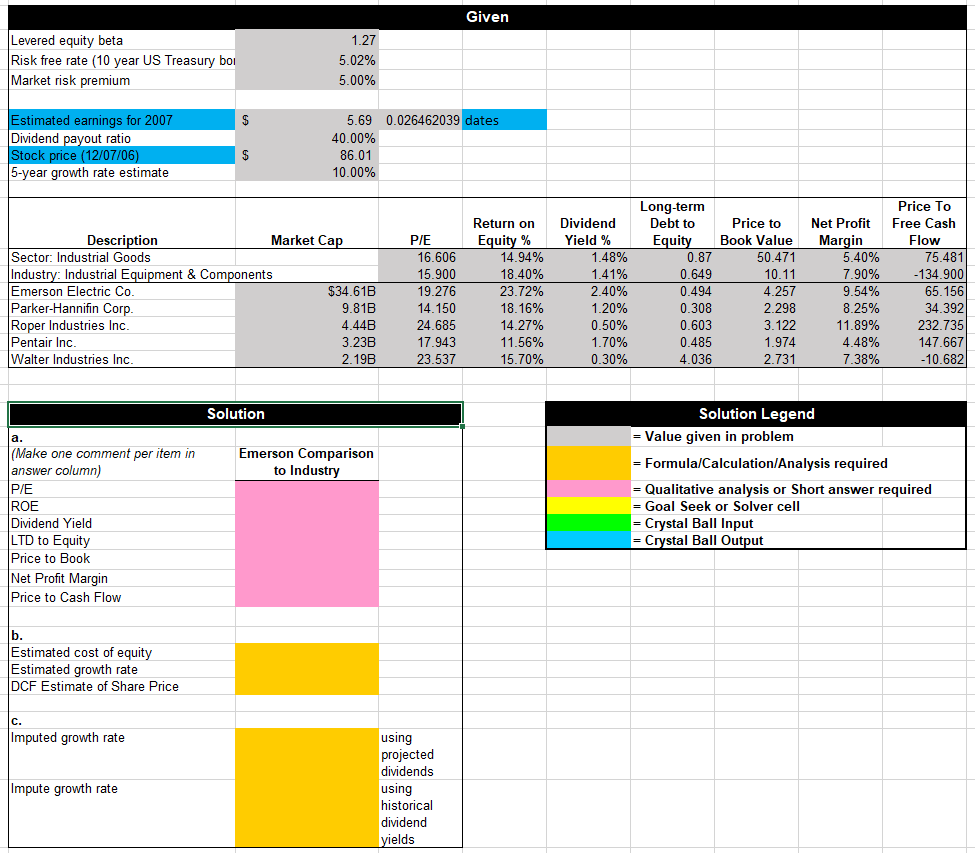

Given 1.27 Levered equity beta Risk free rate (10 year US Treasury boi Market risk premium 5.02% 5.00% $ 0.026462039 dates Estimated earnings for 2007 Dividend payout ratio Stock price (12/07/06) 5-year growth rate estimate 5.69 40.00% 86.01 10.00% $ Return on Price to Description Market Cap Sector: Industrial Goods Industry: Industrial Equipment & Components Emerson Electric Co. $34.61B Parker-Hannifin Corp. 9.81B Roper Industries Inc 4.44B Pentair Inc. 3.23B Walter Industries Inc. 2.19B PIE 16.606 15.900 19.276 14.150 24.685 17.943 23.537 Equity % 14.94% 18.40% 23.72% 18.16% 14.27% 11.56% 15.70% Dividend Yield % 1.48% 1.41% 2.40% 1.20% 0.50% 1.70% 0.30% Long-term Debt to Equity 0.87 0.649 0.494 0.308 0.603 0.485 4.036 Book Value 50.471 10.11 4.257 2.298 3.122 1.974 2.731 Net Profit Margin 5.40% 7.90% 9.54% 8.25% 11.89% 4.48% 7.38% Price To Free Cash Flow 75.481 -134.900 65.156 34.392 232.735 147.667 -10.682 Solution Emerson Comparison to Industry (Make one comment per item in answer column) PIE ROE Dividend Yield LTD to Equity Price to Book Net Profit Margin Price to Cash Flow Solution Legend Value given in problem = Formula/Calculation Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell = Crystal Ball Input Crystal Ball Output b. Estimated cost of equity Estimated growth rate DCF Estimate of Share Price c. Imputed growth rate Impute growth rate using projected dividends using historical dividend yields 8-8 VALUING THE EQUITY OF A STABLE-GROWTH FIRM The Emerson Electric Company (EMR) was founded in 1890 and is located in St. Louis, Missouri. The firm provides product technologies and engineering services for industrial, commercial, and con- sumer markets worldwide. The firm operates in five business segments: process man- agement, industrial automation, network power, climate technologies, and appliance and tools. The company has a lengthy history of dividend payments and steady growth. In recent years, the firm's dividend payout has averaged 40% of earnings. For 2007, firm earnings were estimated to be $5.69 a share, and on December 7, 2006, Emerson's shares were trading for $86.01, and has a price-earnings ratio of 19.26. Data for the industry, sector, Emerson, and four competitor firms are shown on page 300. a. Is Emerson's current stock price reasonable in light of its sector, industry, and com- parison firms? b. Emerson's beta coefficient is 1.27. Assuming a risk-free rate of 5.02% and a mar- ket risk premium of 5%, what is your estimate of the required rate of return for Emerson's stock using the capital asset pricing model (CAPM)? What rate of growth in earnings is consistent with Emerson's policy of paying out 40% of earn- ings in dividends and the firm's historical return on equity? Using your estimated growth rate, what is the value of Emerson's shares using the Gordon (single-stage) growth model? Analyze the reasonableness of your estimated value per share using the Gordon model. c. Based on your analysis in Problem 8-8(b), what growth rate is consistent with Emerson's current share price of $86.01