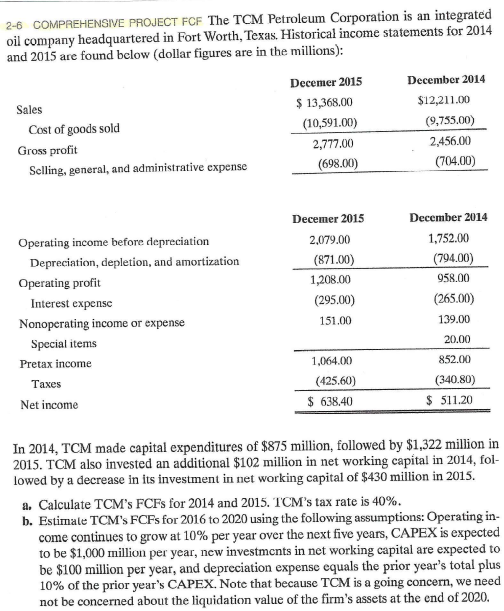

2-6 COMPREHENSIVE PROJECT FCF The TCM Petroleum Corporation is an integrated oil company headquartered in Fort Worth, Texas. Historical income statements for 2014 and

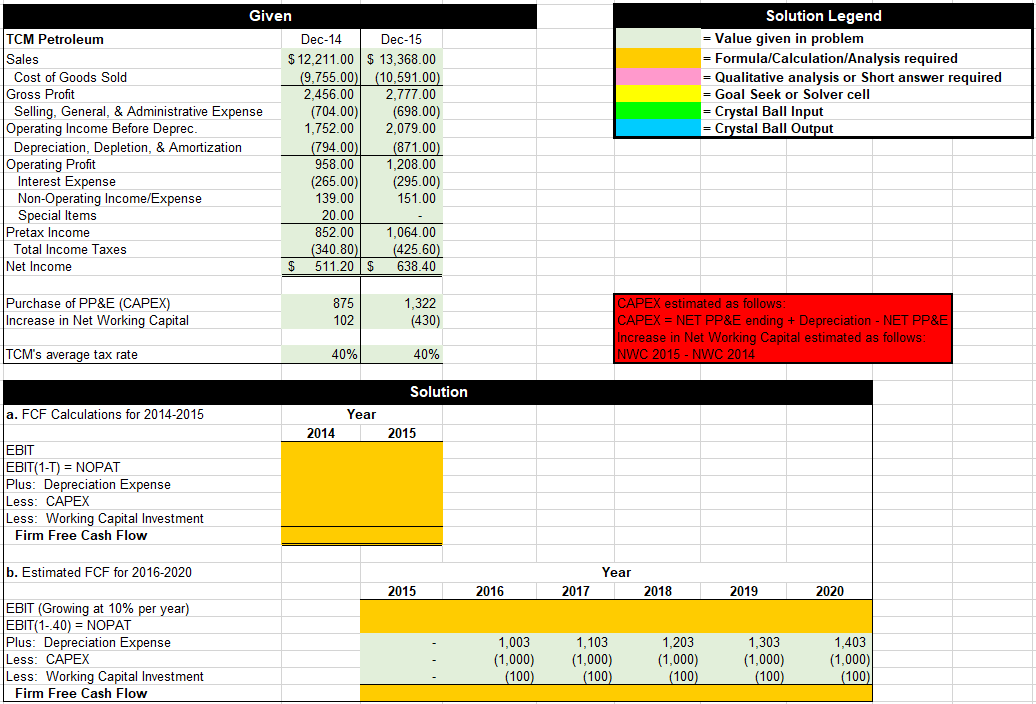

2-6 COMPREHENSIVE PROJECT FCF The TCM Petroleum Corporation is an integrated oil company headquartered in Fort Worth, Texas. Historical income statements for 2014 and 2015 are found below (dollar figures are in the millions): Sales Cost of goods sold Gross profit Selling, general, and administrative expense December 2015 December 2014 $ 13,368.00 $12,211.00 (10,591.00) (9,755.00) 2,777.00 2,456.00 (698.00) (704.00) Decemer 2015 December 2014 Operating income before depreciation 2,079.00 1,752.00 Depreciation, depletion, and amortization (871.00) (794.00) Operating profit 1,208.00 958.00 Interest expense (295.00) (265.00) Nonoperating income or expense 151.00 139.00 Special items 20.00 Pretax income 1,064.00 852.00 Taxes (425.60) (340.80) Net income $ 638.40 $ 511.20 In 2014, TCM made capital expenditures of $875 million, followed by $1,322 million in 2015. TCM also invested an additional $102 million in net working capital in 2014, fol- lowed by a decrease in its investment in net working capital of $430 million in 2015. a. Calculate TCM's FCFS for 2014 and 2015. TCM's tax rate is 40%. b. Estimate TCM's FCFs for 2016 to 2020 using the following assumptions: Operating in- come continues to grow at 10% per year over the next five years, CAPEX is expected to be $1,000 million per year, new investments in net working capital are expected to be $100 million per year, and depreciation expense equals the prior year's total plus 10% of the prior year's CAPEX. Note that because TCM is a going concern, we need not be concerned about the liquidation value of the firm's assets at the end of 2020. Given Dec-14 Dec-15 $ 12,211.00 $ 13,368.00 (10,591.00) (698.00) Solution Legend - Value given in problem = Formula/Calculation/Analysis required = Qualitative analysis or Short answer required - Goal Seek or Solver cell Crystal Ball Input = Crystal Ball Output TCM Petroleum Sales Cost of Goods Sold (9,755.00) Gross Profit 2,456.00 2,777.00 Selling, General, & Administrative Expense (704.00) Operating Income Before Deprec. 1,752.00 2,079.00 Depreciation, Depletion, & Amortization (794.00) (871.00) Operating Profit 958.00 1,208.00 Interest Expense Special Items Pretax Income Total Income Taxes Net Income (265.00) (295.00) Non-Operating Income/Expense 139.00 20.00 151.00 852.00 1,064.00 (340.80) (425.60) $ 511.20 $ 638.40 Purchase of PP&E (CAPEX) 875 1,322 Increase in Net Working Capital 102 (430) TCM's average tax rate 40% 40% Solution a. FCF Calculations for 2014-2015 Year 2014 2015 EBIT = EBIT(1-T) NOPAT Plus: Depreciation Expense Less: CAPEX Less: Working Capital Investment Firm Free Cash Flow b. Estimated FCF for 2016-2020 EBIT (Growing at 10% per year) EBIT(1-.40) = NOPAT Plus: Depreciation Expense Less: CAPEX Less: Working Capital Investment Firm Free Cash Flow CAPEX estimated as follows: | CAPEX = NET PP&E ending + Depreciation - NET PP&E Increase in Net Working Capital estimated as follows: NWC 2015 - NWC 2014 Year 2015 2016 2017 2018 2019 2020 1,003 1,103 1,203 1,303 1,403 (1,000) (1,000) (1,000) (1,000) (1,000) (100) (100) (100) (100) (100)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Free Cash Flow FCF for TCM Petroleum Corporation follow these steps a FCF Calculati...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started