Please use the same format for the table

Has been updated

I m sorry.The app will compress the image, which I have tried to do best.

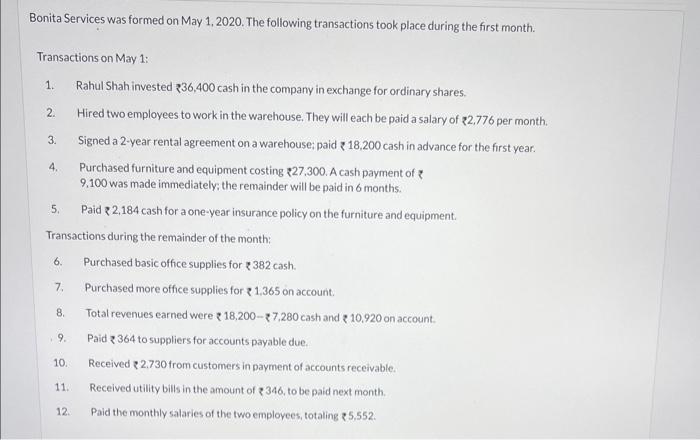

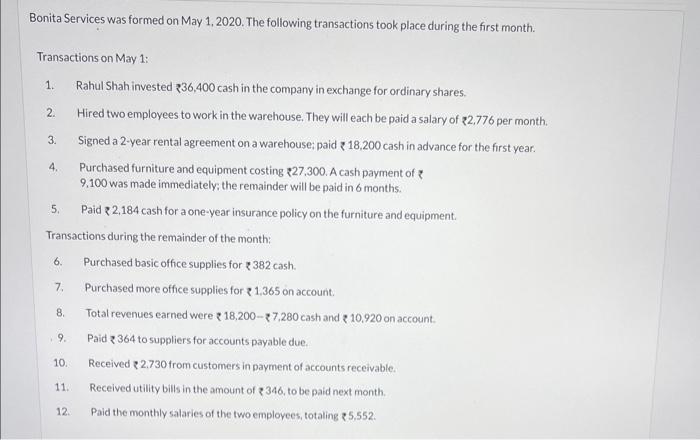

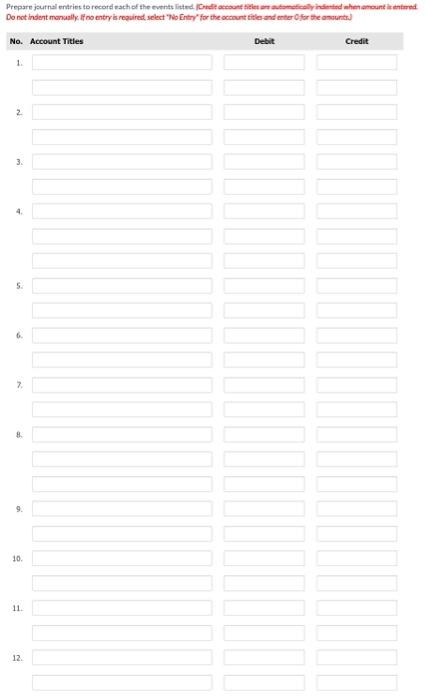

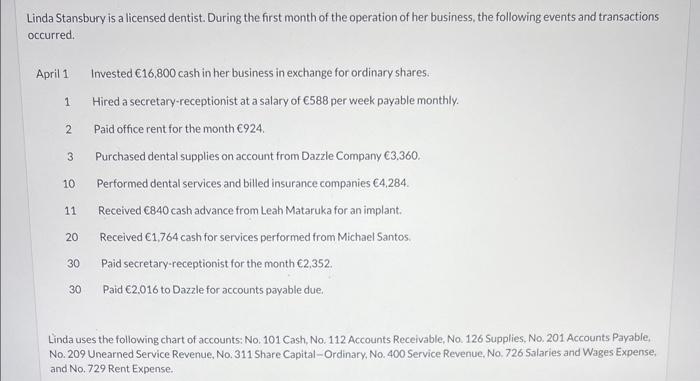

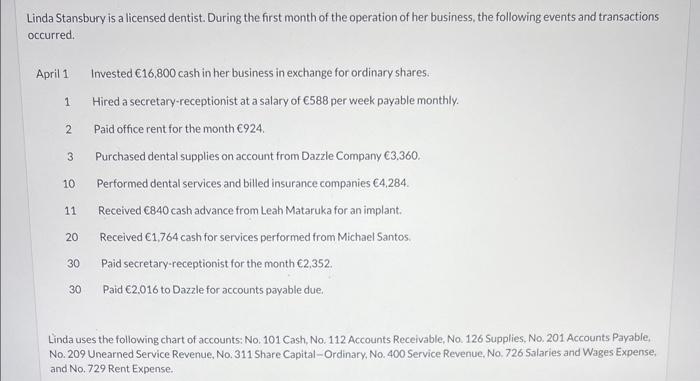

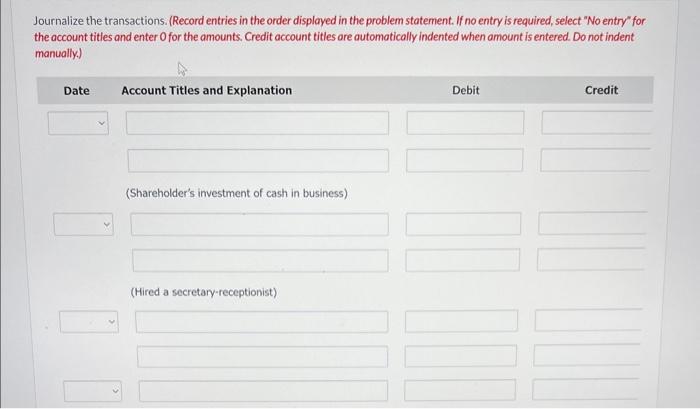

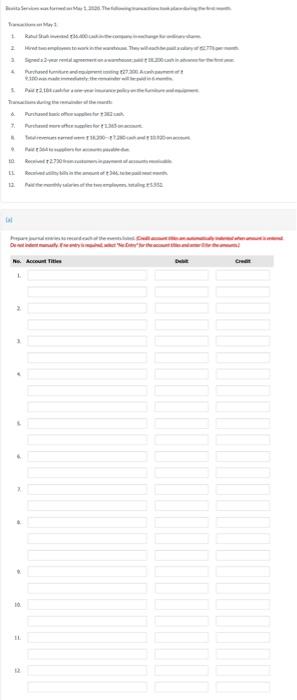

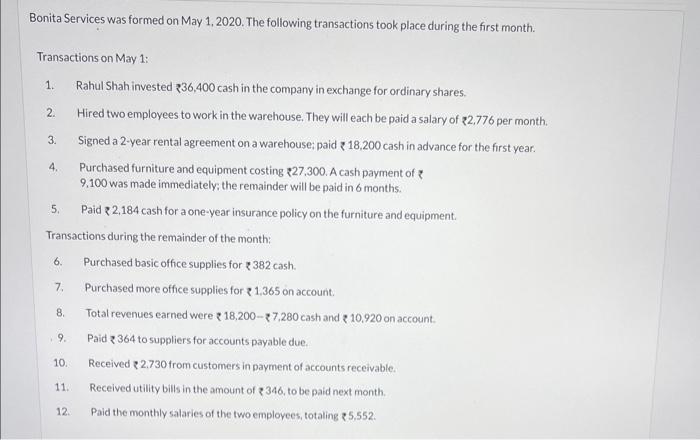

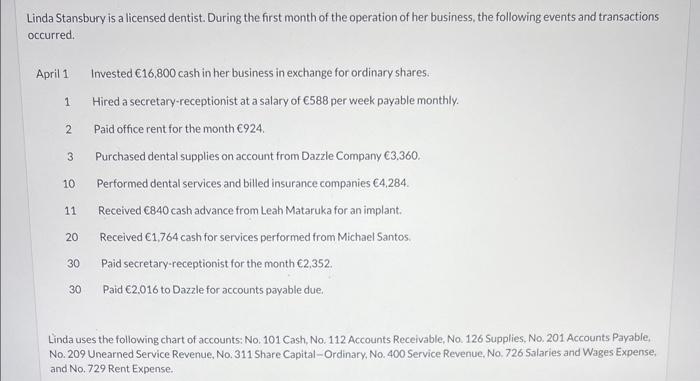

at Bonita Services was formed on May 1,2020. The following transactions took place during the first month. Transactions on May 1: 1. Rahul Shah invested 36,400 cash in the company in exchange for ordinary shares. 2. Hired two employees to work in the warehouse. They will each be paid a salary of 22,776 per month. 3. Signed a 2-year rental agreement on a warehouse: paid 18,200 cash in advance for the first year. 4. Purchased furniture and equipment costing 27,300. A cash payment of 9,100 was made immediately; the remainder will be paid in 6 months. 5. Paid 2,184 cash for a one-year insurance policy on the furniture and equipment. Transactions during the remainder of the month: 6. Purchased basic office supplies for 382 cash. 7. Purchased more office supplies for 1,365 on account. 8. Total revenues earned were 18,2007,280 cash and 10,920 on account. 9. Paid 364 to suppliers for accounts payable due. 10. Received 2.730 from customers in payment of accounts receivable. 11. Received utility bills in the amount of 346, to be paid next month. 12. Paid the monthly salaries of the two employees, totaling 5,552. No. Account nitles Linda Stansbury is a licensed dentist. During the first month of the operation of her business, the following events and transactions occurred. April 1 Invested 16,800 cash in her business in exchange for ordinary shares. 1 Hired a secretary-receptionist at a salary of 588 per week payable monthly. 2 Paid office rent for the month 924. 3 Purchased dental supplies on account from Dazzle Company 3.360. 10 Performed dental services and billed insurance companies 4,284. 11 Received 6840 cash advance from Leah Mataruka for an implant. 20 Received 1,764 cash for services performed from Michael Santos. 30 Paid secretary-receptionist for the month 2,352. 30 Paid 2.016 to Dazzle for accounts payable due. Linda uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 209 Unearned Service Revenue, No.311 Share Capital-Ordinary. No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Journalize the transactions. (Record entries in the order displayed in the problem statement. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent m