Please use the same format to answer the question so that it is easy to follow!

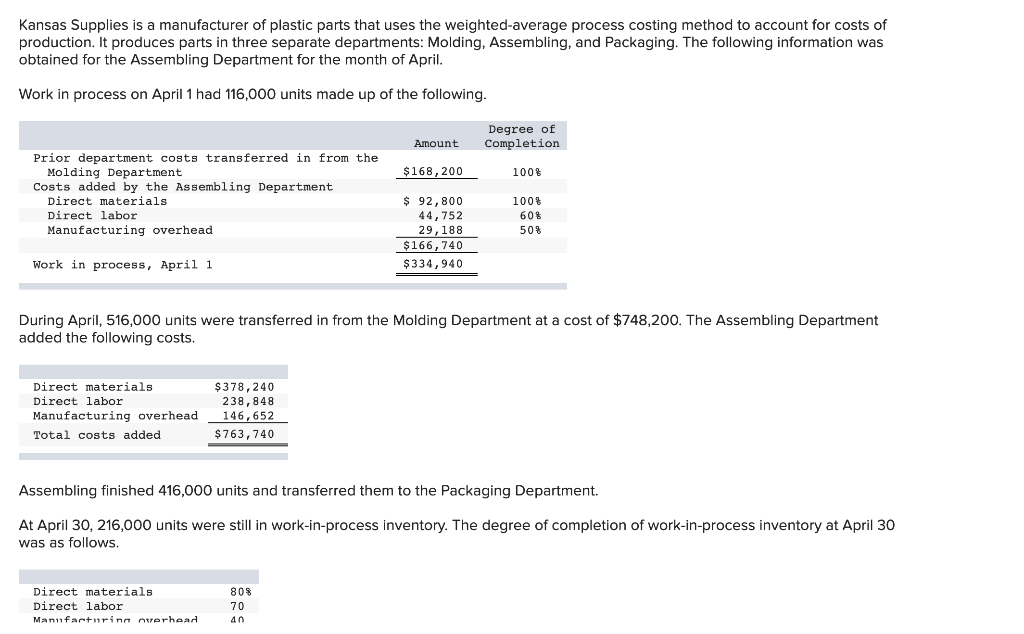

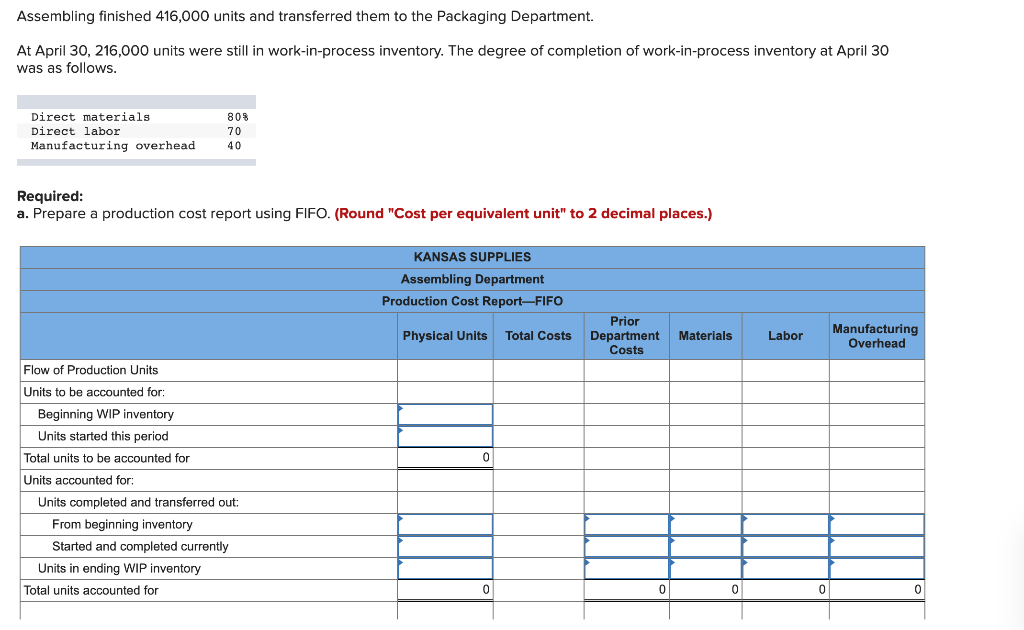

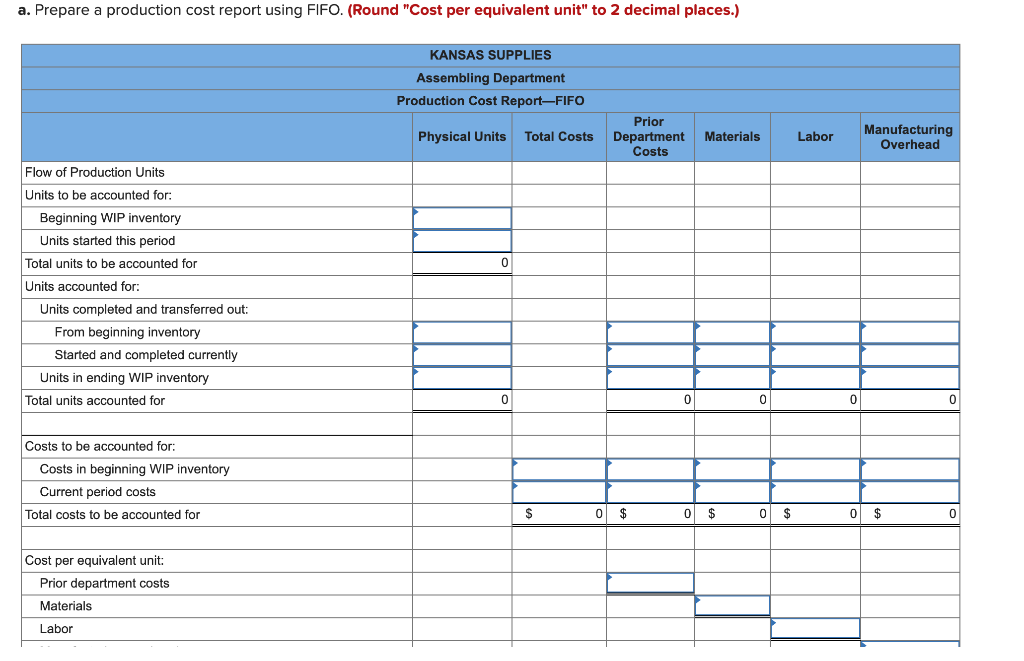

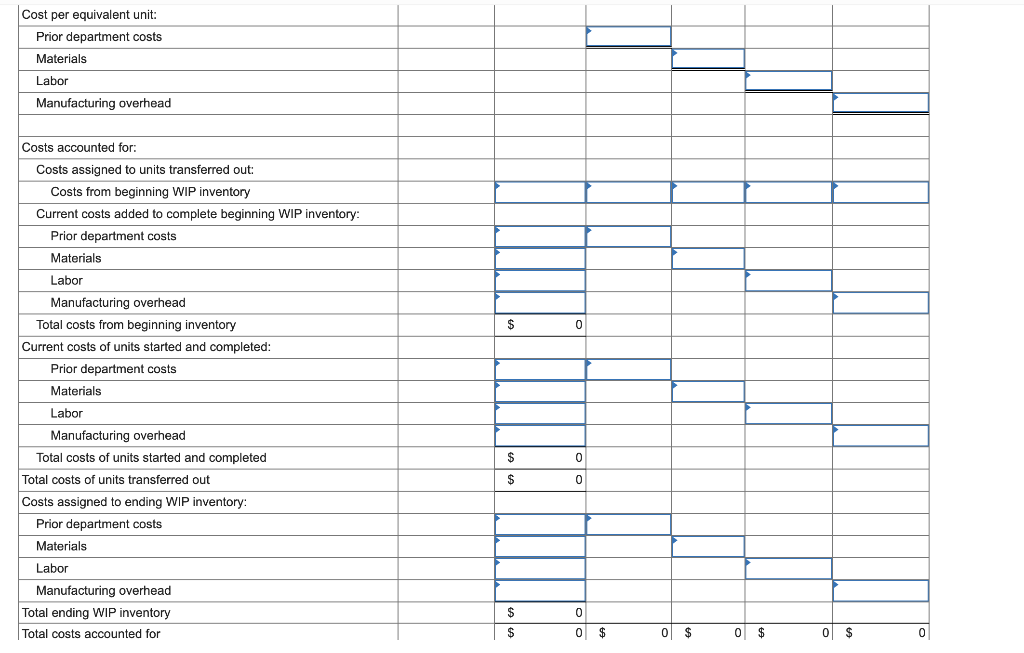

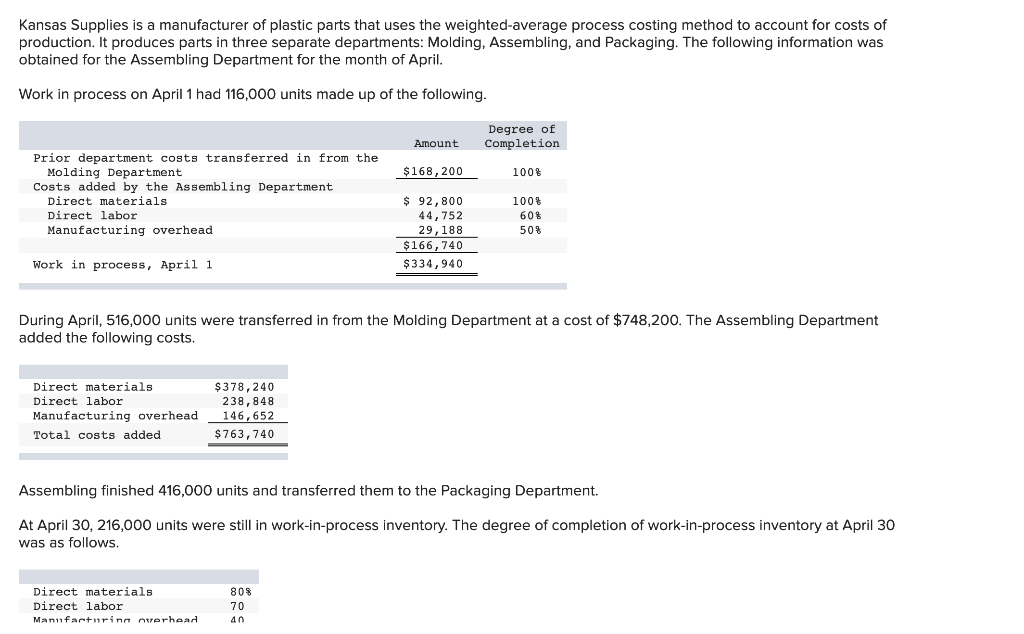

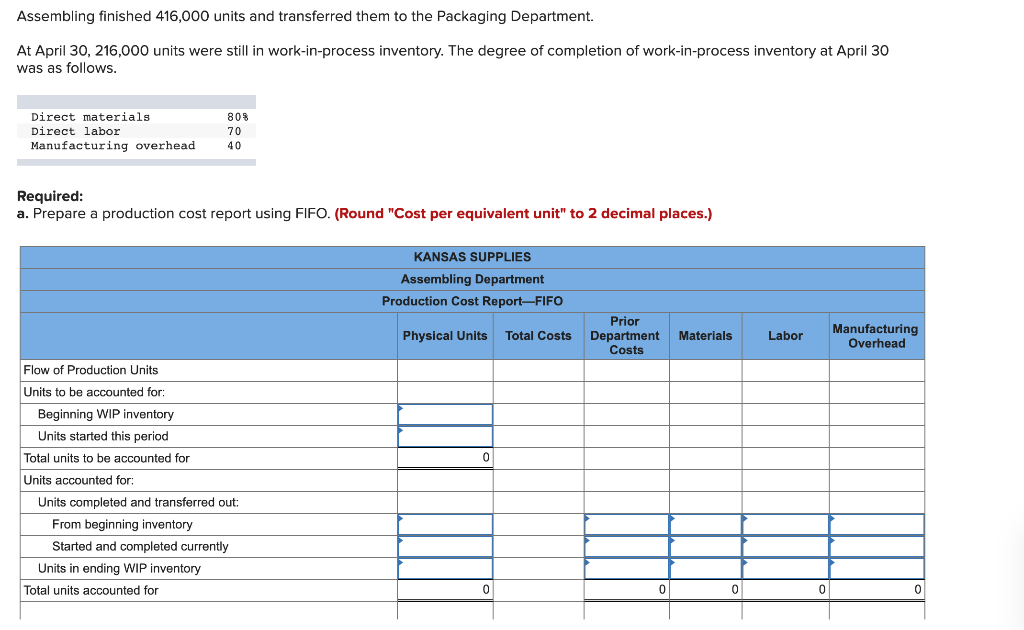

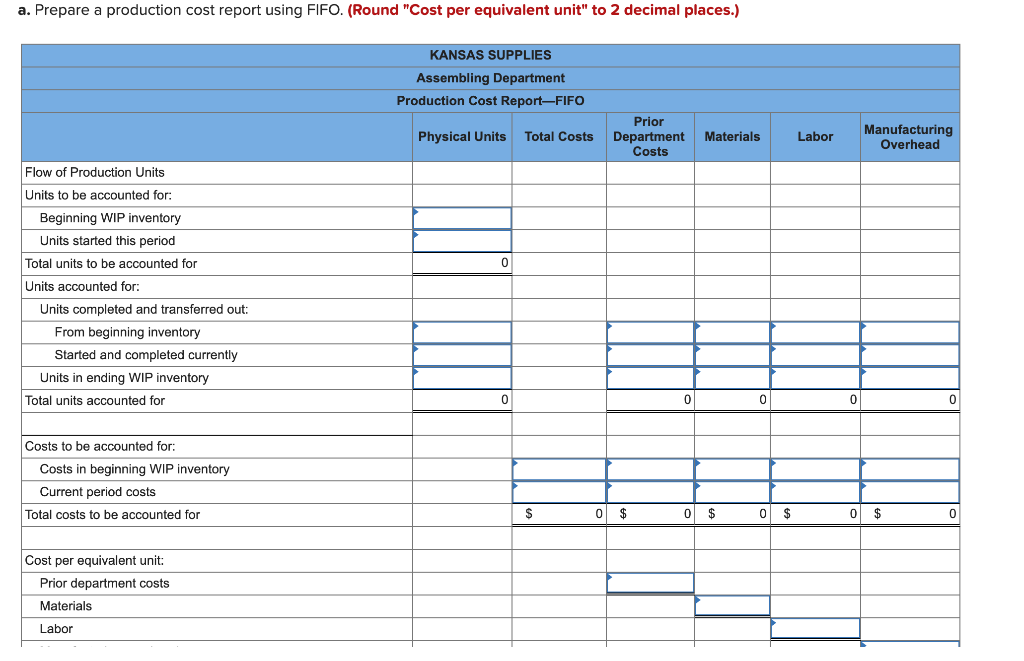

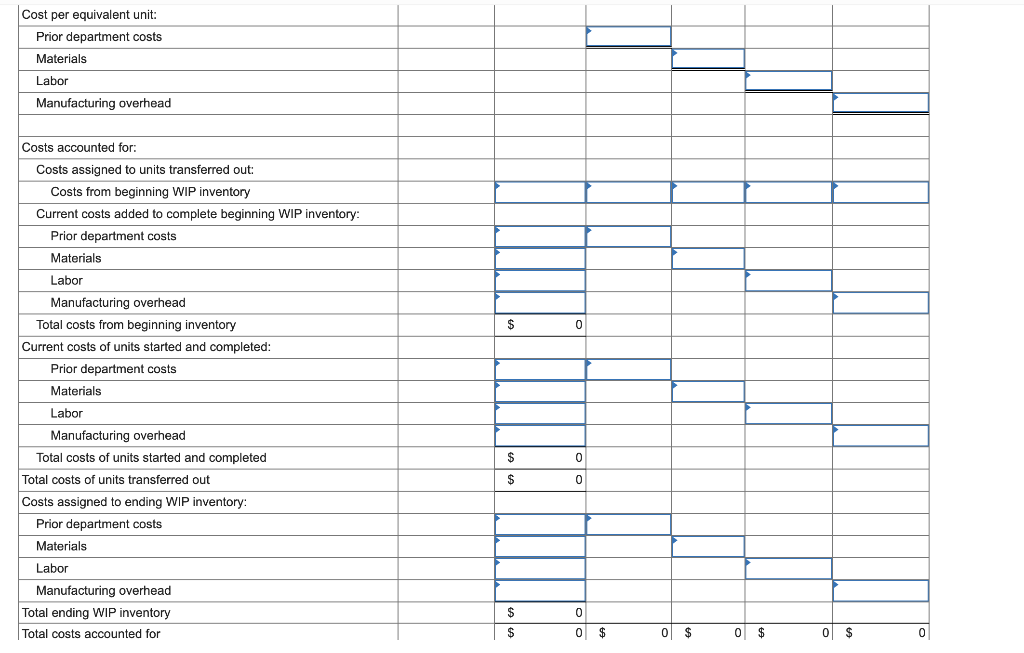

Kansas Supplies is a manufacturer of plastic parts that uses the weighted-average process costing method to account for costs of production. It produces parts in three separate departments: Molding, Assembling, and Packaging. The following information was obtained for the Assembling Department for the month of April. Work in process on April 1 had 116,000 units made up of the following. Amount Degree of Completion $168,200 100% Prior department costs transferred in from the Molding Department Costs added by the Assembling Department Direct materials Direct labor Manufacturing overhead $ 92,800 44,752 29,188 $166, 740 $334, 940 100% 60% 50% Work in process, April 1 During April, 516,000 units were transferred in from the Molding Department at a cost of $748,200. The Assembling Department added the following costs. Direct materials Direct labor Manufacturing overhead Total costs added $378,240 238,848 146,652 $763, 740 Assembling finished 416,000 units and transferred them to the Packaging Department. At April 30, 216,000 units were still in work-in-process inventory. The degree of completion of work-in-process inventory at April 30 was as follows. Direct materials Direct labor Manufacturing overhead 80% 70 40 Assembling finished 416,000 units and transferred them to the Packaging Department. At April 30, 216,000 units were still in work-in-process inventory. The degree of completion of work-in-process inventory at April 30 was as follows. Direct materials Direct labor Manufacturing overhead 808 70 40 Required: a. Prepare a production cost report using FIFO. (Round "Cost per equivalent unit" to 2 decimal places.) KANSAS SUPPLIES Assembling Department Production Cost ReportFIFO Physical Units Total Costs Prior Department Costs Materials Labor Manufacturing Overhead 0 Flow of Production Units Units to be accounted for: Beginning WIP inventory Units started this period Total units to be accounted for Units accounted for: Units completed and transferred out: From beginning inventory Started and completed currently Units in ending WIP inventory Total units accounted for 0 0 0 0 0 a. Prepare a production cost report using FIFO. (Round "Cost per equivalent unit" to 2 decimal places.) KANSAS SUPPLIES Assembling Department Production Cost Report-FIFO Physical Units Total Costs Prior Department Costs Materials Labor Manufacturing Overhead 0 Flow of Production Units Units to be accounted for: Beginning WIP inventory Units started this period Total units to be accounted for Units accounted for: Units completed and transferred out: From beginning inventory Started and completed currently Units in ending WIP inventory Total units accounted for 0 0 0 Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for $ o $ 0 $ 0 $ 0 $ 0 Cost per equivalent unit: Prior department costs Materials Labor Cost per equivalent unit: Prior department costs Materials Labor Manufacturing overhead Costs accounted for: Costs assigned to units transferred out: Costs from beginning WIP inventory Current costs added to complete beginning WIP inventory: Prior department costs Materials Labor $ 0 $ 0 Manufacturing overhead Total costs from beginning inventory Current costs of units started and completed: Prior department costs Materials Labor Manufacturing overhead Total costs of units started and completed Total costs of units transferred out Costs assigned to ending WIP inventory: Prior department costs Materials Labor Manufacturing overhead Total ending WIP inventory Total costs accounted for $ 0 $ 0 0 $ $ 0 $ 0 $ 0 $ 0