Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the solver tool in excel. Show all steps, formulas and solver parameters used. A company is considering investing up to 1.5 million dollars

Please use the solver tool in excel. Show all steps, formulas and solver parameters used.

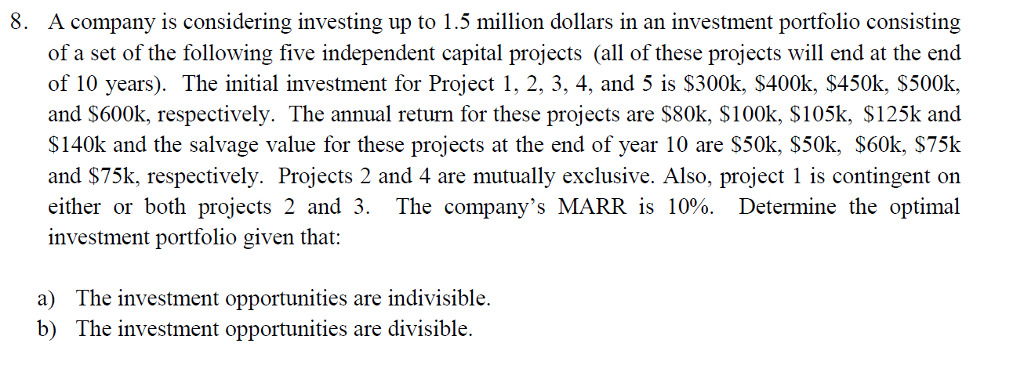

A company is considering investing up to 1.5 million dollars in an investment portfolio consisting of a set of the following five independent capital projects (all of these projects will end at the end of 10 years). The initial investment for Project 1, 2, 3, 4, and 5 is exist300k, exist400k, exist450k. exist500k, and exist600k, respectively. The annual return for these projects are exist80k, exist100k, exist105k, exist125k and exist140k and the salvage value for these projects at the end of year 10 are exist50k, exist50k, exist60k, S75k and exist75k, respectively. Projects 2 and 4 are mutually exclusive. Also, project 1 is contingent on either or both projects 2 and 3. The company's MARR is 10%. Determine the optimal investment portfolio given that: a) The investment opportunities are indivisible. b) The investment opportunities are divisibleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started