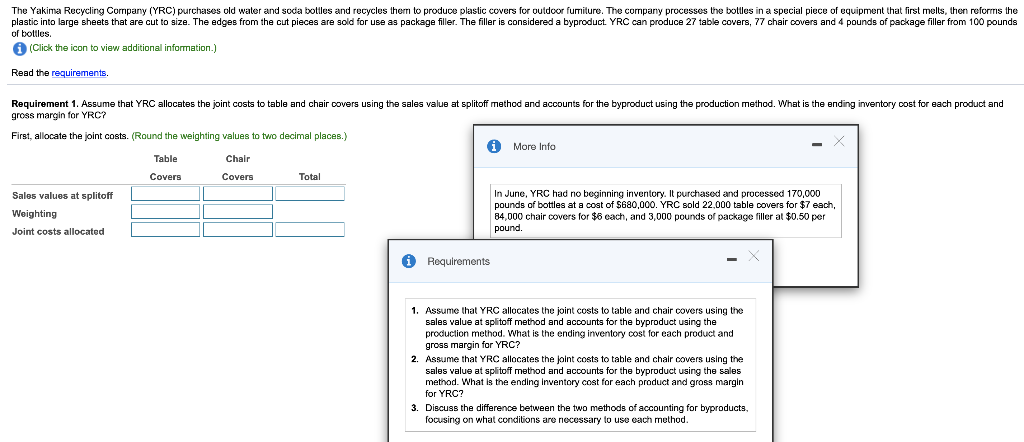

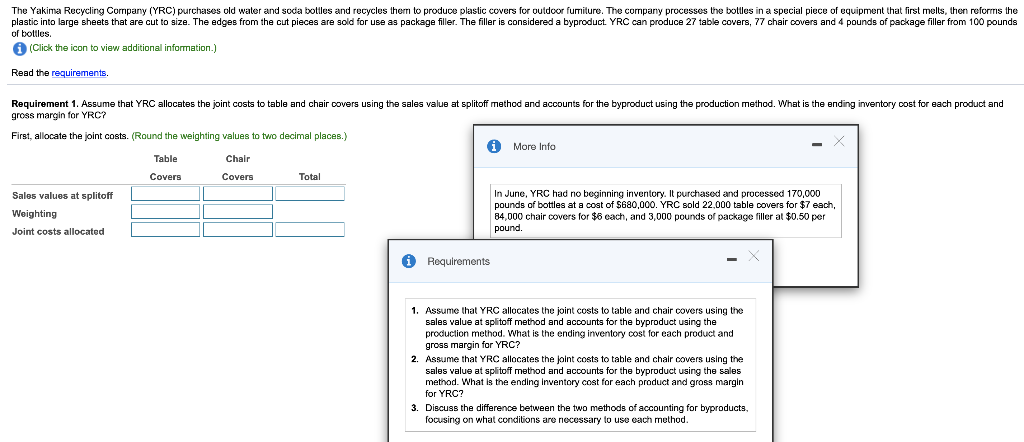

please use this information to do requirements 1,2, 3. (the first picture)

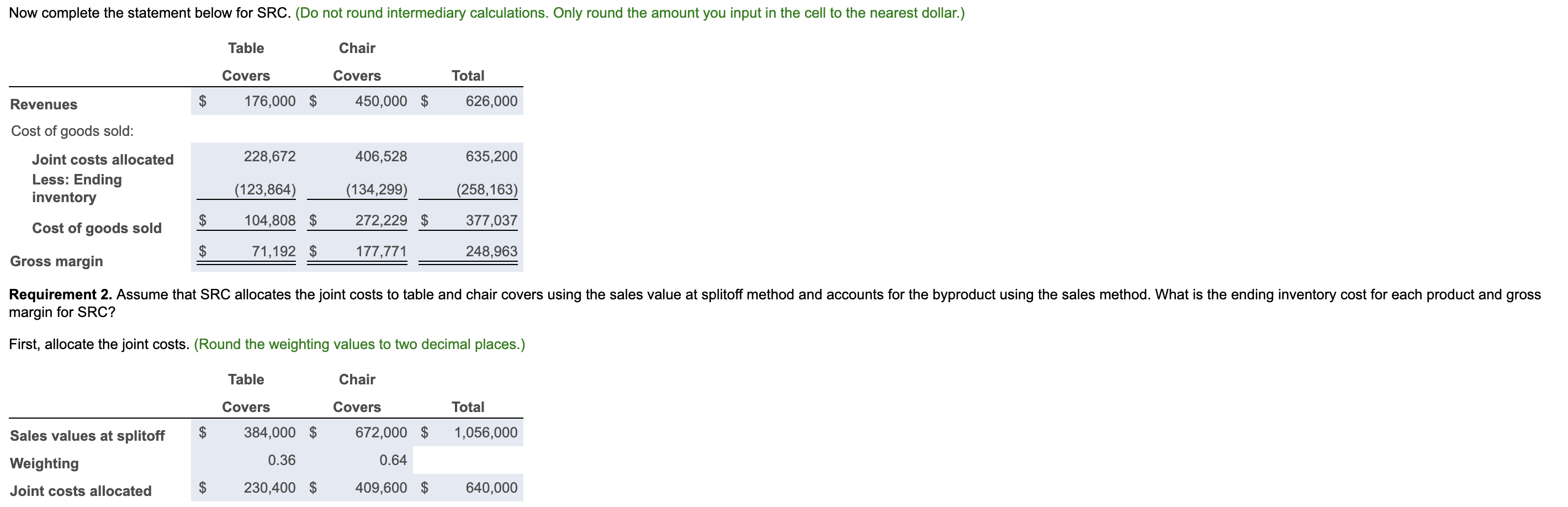

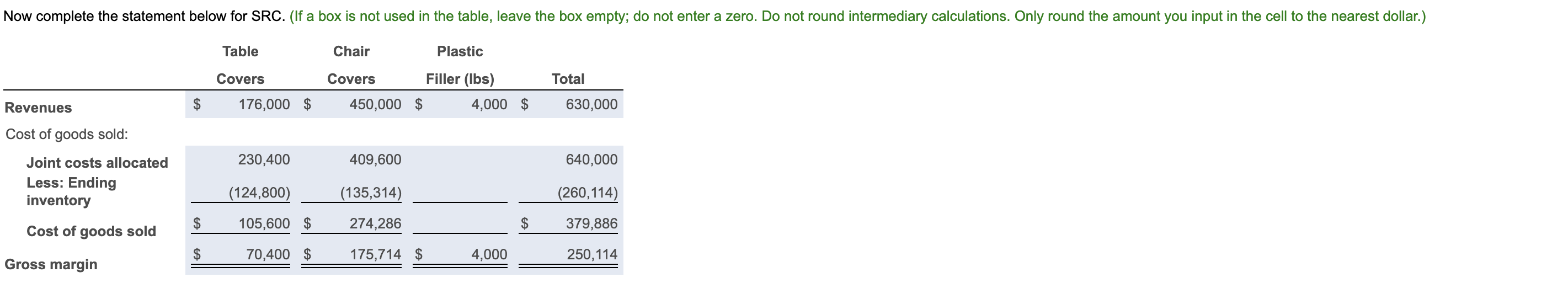

The second and the third picture are the sample of the blankthose answers not for my questions.

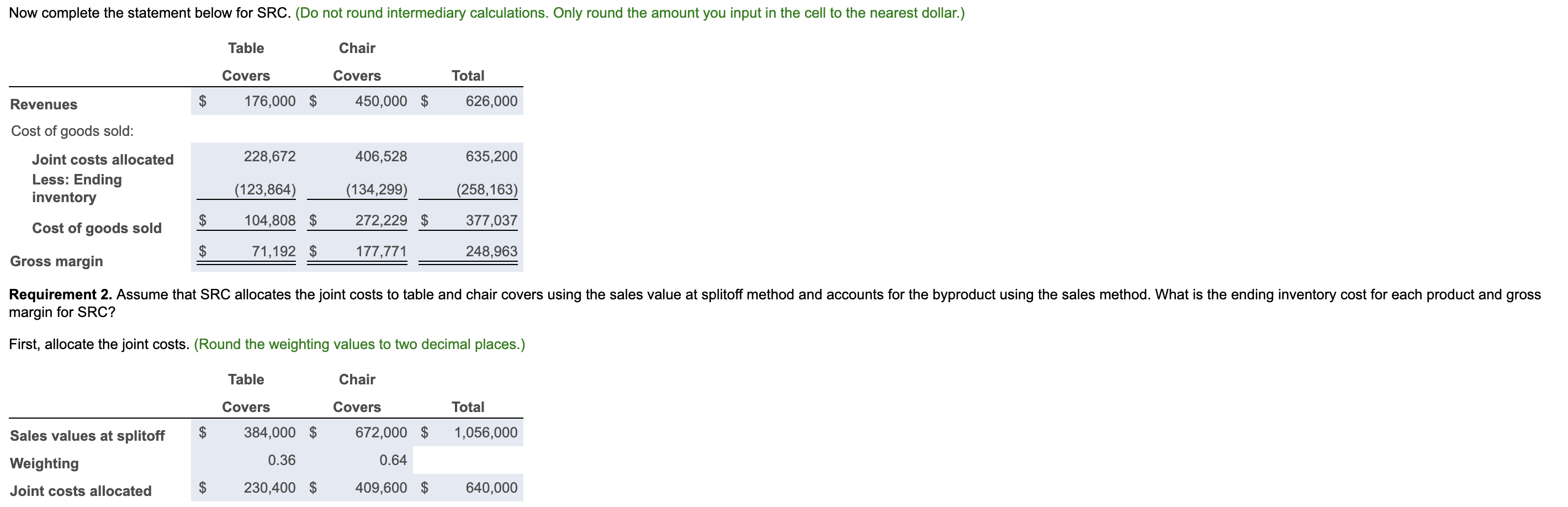

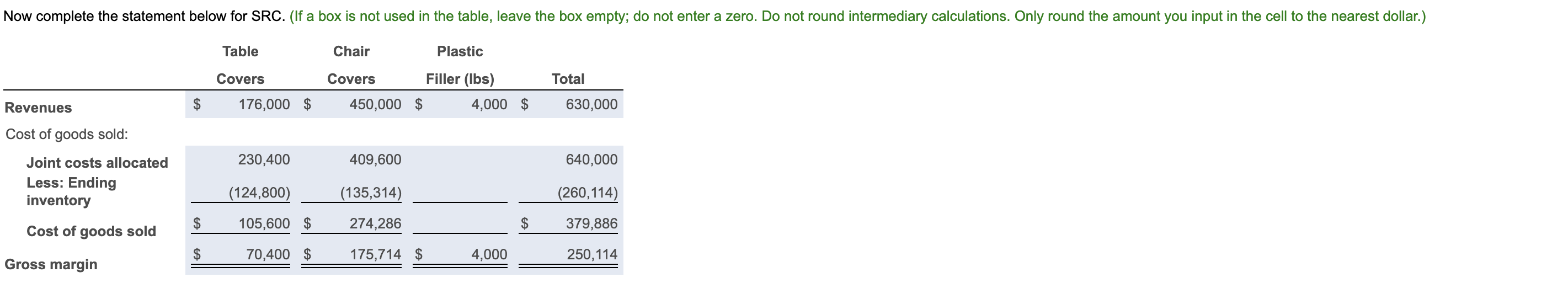

The Yakima Recycling Company (YRC) purchases old water and soda bottles and recycles them to produce plastic covers for outdoor furniture. The company processes the bottles in a special piece of equipment that first melts, then reforms the plastic into large sheets that are cut to size. The edges from the cut pieces are sold for use as package filler. The filler is considered a byproduct. YRC can produce 27 table covers, 77 chair covers and 4 pounds of package filler from 100 pounds of bottles. (Click the icon to view additional information.) Read the requirements. Requirement 1. Assume that YRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the production method. What is the ending inventory cost for each product and gross margin for YRC? i More Info First, allocate the joint costs. (Round the weighting values to two decimal places.) Table Chair Covers Covers Total Sales values at splitoff Weighting Joint costs allocated In June, YRC had no beginning inventory. It purchased and processed 170,000 pounds of bottles at a cost of $680,000. YRC sold 22,000 table covers for $7 each, 84,000 chair covers for $6 cach, and 3,000 pounds of package filler at $0.50 per pound. Requirements 1. Assume that YRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the production method. What is the ending inventory cost for each product and gross margin for YRC? 2. Assume that YRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the sales method. What is the ending Inventory cost for each product and gross margin for YRC? 3. Discuss the difference between the two methods of accounting for byproducts, focusing on what conditions are necessary to use each method. Now complete the statement below for SRC. (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar.) Table Chair Covers Total Covers 176,000 $ Revenues 450,000 $ 626,000 Cost of goods sold: Joint costs allocated Less: Ending inventory 228,672 406,528 635,200 (123,864) (134,299) (258,163) $ 104,808 $ 272,229 $ 377,037 Cost of goods sold $ 71,192 $ 177,771 248,963 Gross margin Requirement 2. Assume that SRC allocates the joint costs to table and chair covers using the sales value at splitoff method and accounts for the byproduct using the sales method. What is the ending inventory cost for each product and gross margin for SRC? First, allocate the joint costs. (Round the weighting values to two decimal places.) Table Chair Covers Covers Total Sales values at splitoff $ 384,000 $ 672,000 $ 1,056,000 0.36 0.64 Weighting Joint costs allocated $ 230,400 $ 409,600 $ 640,000 Now complete the statement below for SRC. (If a box is not used in the table, leave the box empty; do not enter a zero. Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar.) Table Chair Plastic Covers Total Covers Filler (lbs) 450,000 $ 4,000 $ Revenues 176,000 $ 630,000 230,400 409,600 640,000 Cost of goods sold: Joint costs allocated Less: Ending inventory (124,800) (135,314) (260,114) $ 105,600 $ 274,286 $ 379,886 Cost of goods sold $ 70,400 $ 175,714 $ 4,000 250,114 Gross margin