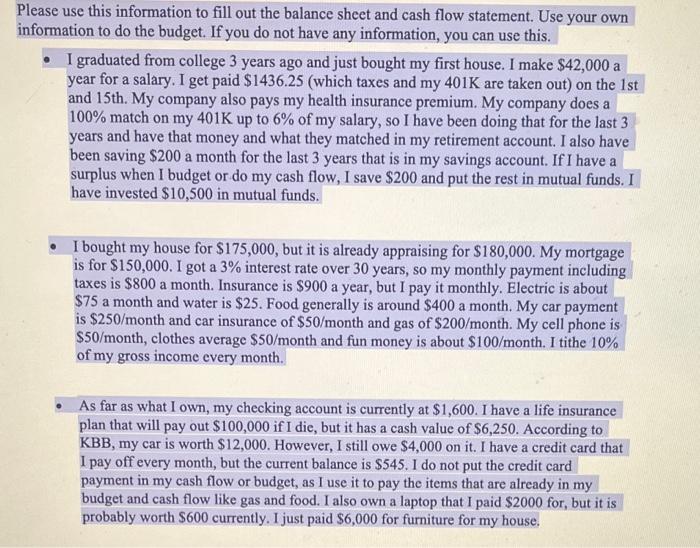

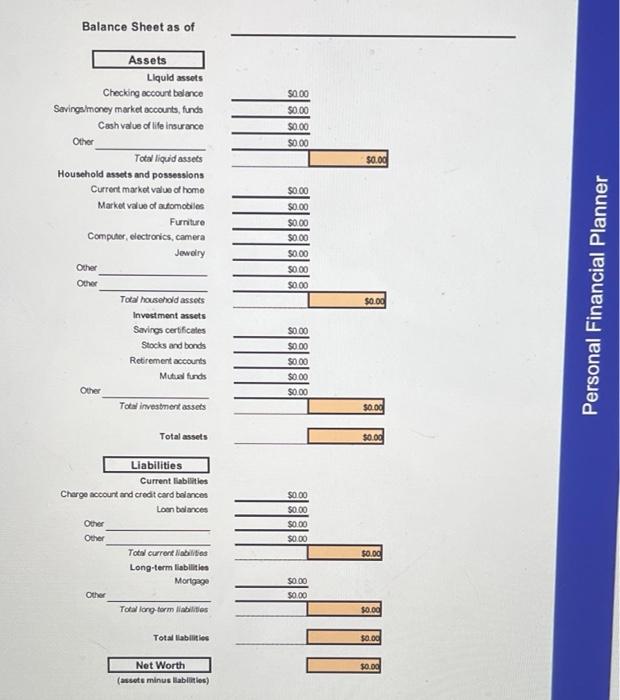

Please use this information to fill out the balance sheet and cash flow statement. Use your own information to do the budget. If you do not have any information, you can use this. - I graduated from college 3 years ago and just bought my first house. I make $42,000 a year for a salary. I get paid \$1436.25 (which taxes and my 401K are taken out) on the 1st and 15 th. My company also pays my health insurance premium. My company does a 100% match on my 401K up to 6% of my salary, so I have been doing that for the last 3 years and have that money and what they matched in my retirement account. I also have been saving $200 a month for the last 3 years that is in my savings account. If I have a surplus when I budget or do my cash flow, I save $200 and put the rest in mutual funds. I have invested $10,500 in mutual funds. - I bought my house for $175,000, but it is already appraising for $180,000. My mortgage is for $150,000. I got a 3% interest rate over 30 years, so my monthly payment including taxes is $800 a month. Insurance is $900 a year, but I pay it monthly. Electric is about $75 a month and water is $25. Food generally is around $400 a month. My car payment is $250/ month and car insurance of $50/ month and gas of $200 /month. My cell phone is $50 /month, clothes average $50 /month and fun money is about $100/ month. I tithe 10% of my gross income every month. - As far as what I own, my checking account is currently at $1,600. I have a life insurance plan that will pay out $100,000 if I die, but it has a cash value of $6,250. According to KBB, my car is worth $12,000. However, I still owe $4,000 on it. I have a credit card that I pay off every month, but the current balance is $545. I do not put the credit card payment in my cash flow or budget, as I use it to pay the items that are already in my budget and cash flow like gas and food. I also own a laptop that I paid $2000 for, but it is probably worth $600 currently. I just paid $6,000 for furniture for my house. Balance Sheet as of Household assets and possessions Current labilities Charge sccourt and creat card bel incos Oover Other Loen balances Long-term liablilities Cher Morigare \begin{tabular}{rr} \hline \multicolumn{1}{r}{5000} \\ \hline 5000 \\ \hline & 8000 \\ \hline \end{tabular} Totallabilitios Narne: Personal Cash Flow Statement Purpose: To maintain a wecord of cash infows and ouificm for a montsi tor thee notitsil. Instructiona: Frecort infows and outfowt of cash for a one-for hive-j ment petod. Suggentied wabeltes: Whin thet mpledollarceen Supgeated app: Ensensig. Pitam Pry giliv. Frny Dorlar For month ending Cash inflows Total intome Cash Outflows Fixed expenses Varlable expenate 10.00 Teal Duetows 50.00 Surplus (Deficit) Allocation of surplus Emargancy tos tavingr Finsneial gouls sevinge Ohersavingt. Whato Neat bor your Persinal Financial Plan? - Decide which aren of spending neee ro be arvised