please verify if correct. answer with formular.

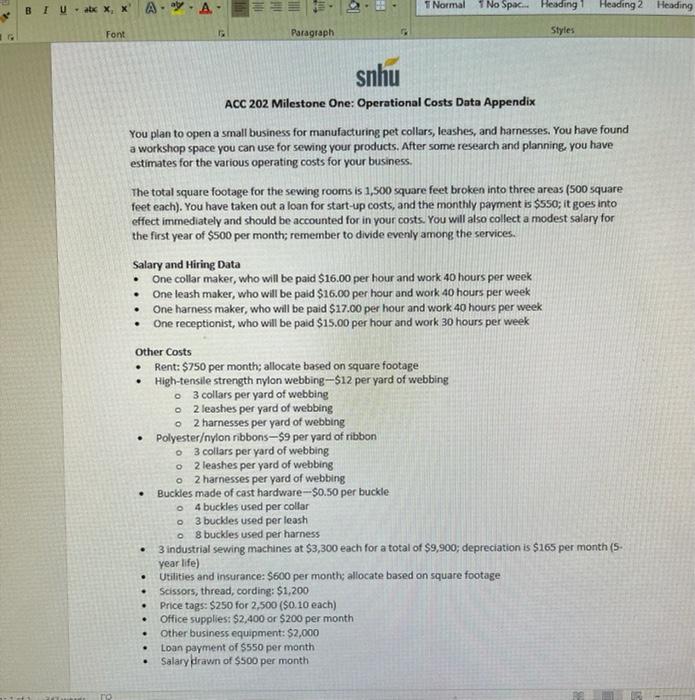

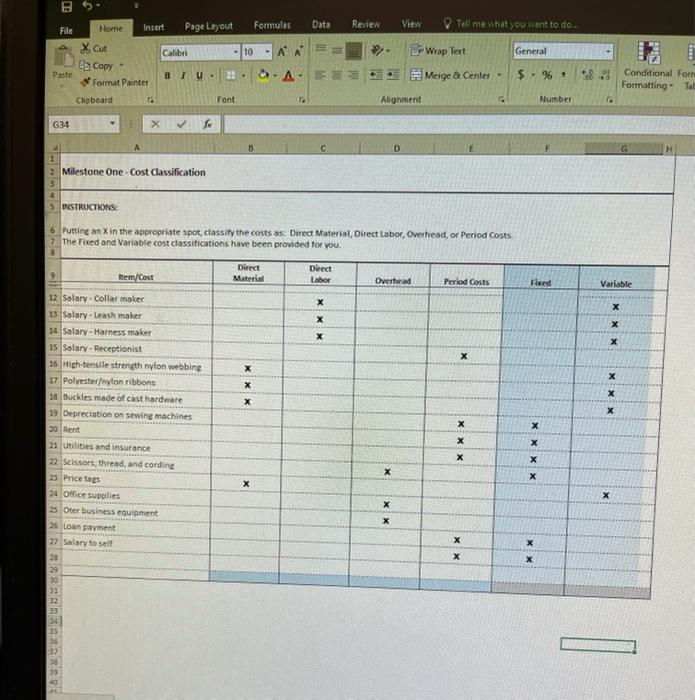

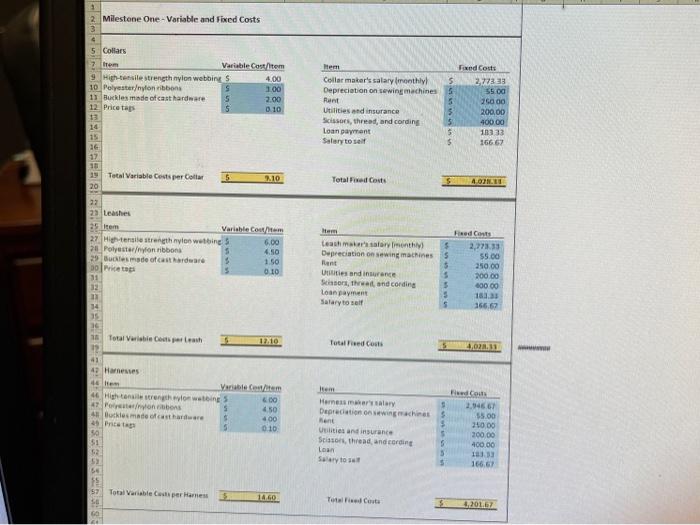

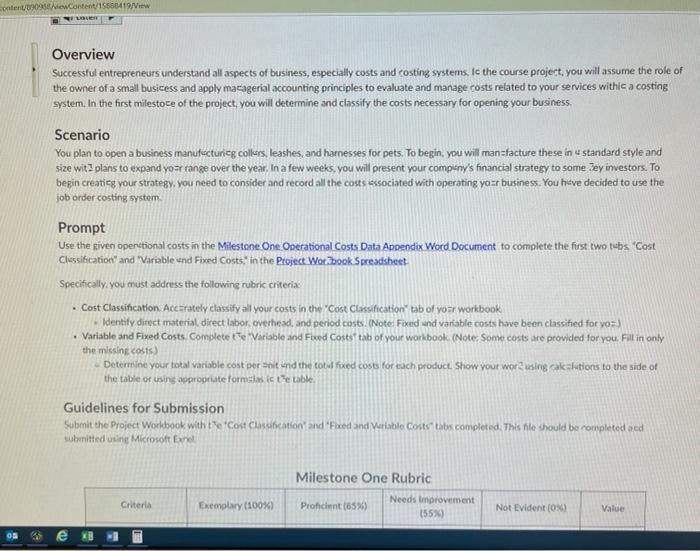

contentcontent/15653419/ UN Overview Successful entrepreneurs understand all aspects of business, especially costs and costing systems. ic the course project, you will assume the role of the owner of a small busicess and apply macagerial accounting principles to evaluate and manage costs related to your services withic a costing system. In the first milestote of the project, you will determine and classify the costs necessary for opening your business Scenario You plan to open a business manufacturieg collers, leashes, and harnesses for pets. To begin, you will man=facture these in standard style and size wit plans to expand yo=r range over the year. In a few weeks, you will present your company's financial strategy to some Jey investors. To begin creatieg your strategy, you need to consider and record all the costs essociated with operating your business. You have decided to use the job order costing system Prompt Use the given operational costs in the Milestone One Operational Costs Data Appendix Word Document to complete the first two tubs "Cost Classification" and "Variable and Fixed Costs in the Project Wot Book Spreadsheet Specifically, you must address the following rubric criteria Cost Classification. Accurately classify all your costs in the "Cost Classification" tb of your workbook - Identify direct material direct labor, overhead, and period costs. (Note: Fixed and variable costs have been classified for yor) Variable and Fixed Costs. Complete the "Variable and Fixed Costs tab of your workbook (Note: Some costs are provided for you. Fil in only the missing costs) Determine your total variable cost per sit and the total fixed costs for each product. Show your wor using cakslutions to the side of the table or using appropriate formclasic the table Guidelines for Submission Submit the Project Workbook with te 'Cost Cention and Fixed and Variable costs tots completed. This he should be completed aed submitted using Microsoft Milestone One Rubric Needs Improvement Procent (050) (55) Criteris Exemplary (100%) Not Evident (O) Value BIU.ak x * A. A lili HO * Normal * No Space Heading Heading 2 Heading Font Paragraph Styles snhu ACC 202 Milestone One: Operational Costs Data Appendix You plan to open a small business for manufacturing pet collars, leashes, and harnesses. You have found a workshop space you can use for sewing your products. After some research and planning you have estimates for the various operating costs for your business The total square footage for the sewing rooms is 1,500 square feet broken into three areas (500 square feet each). You have taken out a loan for start-up costs, and the monthly payment is $550; it goes into effect immediately and should be accounted for in your costs. You will also collect a modest salary for the first year of $500 per month, remember to divide evenly among the services. Salary and Hiring Data One collar maker, who will be paid $16.00 per hour and work 40 hours per week One leash maker, who will be paid $16.00 per hour and work 40 hours per week One harness maker, who will be paid $17.00 per hour and work 40 hours per week One receptionist, who will be paid $15.00 per hour and work 30 hours per week Other Costs Rent: $750 per month; allocate based on square footage High-tensile strength nylon webbing-$12 per yard of webbing o 3 collars per yard of webbing o 2 leashes per yard of webbing o 2 harnesses per yard of webbing Polyesterylon ribbons-$9 per yard of ribbon o 3 collars per yard of webbing o 2 leashes per yard of webbing 2 harnesses per yard of webbing Buckles made of cast hardware ---$0.50 per buckle o 4 buckles used per collar o 3 buckles used per leash o 8 buckles used per harness 3 industrial sewing machines at $3,300 each for a total of $9,900; depreciation is $165 per month (5- year life) Utilities and insurance: $600 per month allocate based on square footage Scissors, thread, cording: $1,200 Price tags: $250 for 2,500 (50.10 each) Office supplies: $2,400 or $200 per month Other business equipment: $2,000 Loan payment of $550 per month Salary prawn of $500 per month . . . . . . E Data Review BS File Horne Insert Page Layout Formulas Xcut Calibri - 10 -AA e Copy Paste 81U- BE Format Painter Chobeard Font . View Tell me what you want to do Wrap Text General Merge a Center $. % his a A. 48 Conditional Forre Formatting Ta Alignment Number G34 D 1 2 Milestone One Cost Classification 4 5 INSTRUCTIONS: 6 itting an X in the appropriate spot, classify the costs as: Direct Material, Direct Labor, Overhead, or Period Costs 7 The Fixed and Variable cost classifications have been provided for you. 8 Direct Direct Item/Cost Material Labor Overhead Period Costs Ford Variable XXX X xxx X 12 Salary - Collar maker 13 Salary-Leash maker 14 Salary - Harness maker 15 Salary - Receptionist 16 High-tensile strength nylon webbing 17 Polyesterylon ribbons 18 Buckles made of cast hardware 19 Depreciation on sewing machines 20 Rent 21 Utilities and insurance 22 Scissors, thread, and cording 23 Price tags 24 Office Supplies Oter business equipment 26 loan payment 27 Salary to sell X X X X X X X x XIX X X 28 29 30 31 1888 2 Milestone One - Variable and Fixed Costs 3 Fixed Costs 5 Collars -7 tem Variable Cost/item 9 High-tensile strength nylon webbins 4.00 10 Polyesterylon ribbon S 1.00 11 Buckles made of cast hardware 5 2.00 12 Price tap 0.10 13 14 15 16 Hem Collar makar's salary monthly Depreciation on sewing machines Runt Utilities and insurance Scissors, thread, and cording Loan payment Salary to sell 3 15 $ 5 5 $ 2,77333 55 00 25000 200,00 400.00 1023 166 67 15 Total Variable Costs per Collar 5 2.10 Total Costs 4.0 20 22 2 Leashes 25 ltem VariableCom 27. Highenie strength to watings 20. Polyesterylon ribbons 4.50 29 made of cast hardware 1.50 Do Price tag 0.10 31 32 Hem Leathmasalary month Depreciation on sewing machines Rant Untities and insurance Son, that and cording Loan payment Salary to self $ $ $ 5 3 5 Fred Cont 2,773.33 55.00 250.00 200.00 40000 183.33 166,67 13 Total Variable Cats per la 12.10 Total costs 21.02.11 41 4 Harnesses Vetem 46 High to strength won wings 6.00 47 Porto 4.50 4 Buckles made of casthardware 400 45 Price 010 so Si 52 5 64 TE 57 Total Variable Couper Hares 14.60 SE Item FC Maresmeralary 2.94661 Depreciation has 5 $5.00 Bent 2100 ilities and insurance 200.00 So, thread, and condit 5 400.00 Loan 3 1 Salary to 5 166.6 Total Corte 4, 2017 contentcontent/15653419/ UN Overview Successful entrepreneurs understand all aspects of business, especially costs and costing systems. ic the course project, you will assume the role of the owner of a small busicess and apply macagerial accounting principles to evaluate and manage costs related to your services withic a costing system. In the first milestote of the project, you will determine and classify the costs necessary for opening your business Scenario You plan to open a business manufacturieg collers, leashes, and harnesses for pets. To begin, you will man=facture these in standard style and size wit plans to expand yo=r range over the year. In a few weeks, you will present your company's financial strategy to some Jey investors. To begin creatieg your strategy, you need to consider and record all the costs essociated with operating your business. You have decided to use the job order costing system Prompt Use the given operational costs in the Milestone One Operational Costs Data Appendix Word Document to complete the first two tubs "Cost Classification" and "Variable and Fixed Costs in the Project Wot Book Spreadsheet Specifically, you must address the following rubric criteria Cost Classification. Accurately classify all your costs in the "Cost Classification" tb of your workbook - Identify direct material direct labor, overhead, and period costs. (Note: Fixed and variable costs have been classified for yor) Variable and Fixed Costs. Complete the "Variable and Fixed Costs tab of your workbook (Note: Some costs are provided for you. Fil in only the missing costs) Determine your total variable cost per sit and the total fixed costs for each product. Show your wor using cakslutions to the side of the table or using appropriate formclasic the table Guidelines for Submission Submit the Project Workbook with te 'Cost Cention and Fixed and Variable costs tots completed. This he should be completed aed submitted using Microsoft Milestone One Rubric Needs Improvement Procent (050) (55) Criteris Exemplary (100%) Not Evident (O) Value BIU.ak x * A. A lili HO * Normal * No Space Heading Heading 2 Heading Font Paragraph Styles snhu ACC 202 Milestone One: Operational Costs Data Appendix You plan to open a small business for manufacturing pet collars, leashes, and harnesses. You have found a workshop space you can use for sewing your products. After some research and planning you have estimates for the various operating costs for your business The total square footage for the sewing rooms is 1,500 square feet broken into three areas (500 square feet each). You have taken out a loan for start-up costs, and the monthly payment is $550; it goes into effect immediately and should be accounted for in your costs. You will also collect a modest salary for the first year of $500 per month, remember to divide evenly among the services. Salary and Hiring Data One collar maker, who will be paid $16.00 per hour and work 40 hours per week One leash maker, who will be paid $16.00 per hour and work 40 hours per week One harness maker, who will be paid $17.00 per hour and work 40 hours per week One receptionist, who will be paid $15.00 per hour and work 30 hours per week Other Costs Rent: $750 per month; allocate based on square footage High-tensile strength nylon webbing-$12 per yard of webbing o 3 collars per yard of webbing o 2 leashes per yard of webbing o 2 harnesses per yard of webbing Polyesterylon ribbons-$9 per yard of ribbon o 3 collars per yard of webbing o 2 leashes per yard of webbing 2 harnesses per yard of webbing Buckles made of cast hardware ---$0.50 per buckle o 4 buckles used per collar o 3 buckles used per leash o 8 buckles used per harness 3 industrial sewing machines at $3,300 each for a total of $9,900; depreciation is $165 per month (5- year life) Utilities and insurance: $600 per month allocate based on square footage Scissors, thread, cording: $1,200 Price tags: $250 for 2,500 (50.10 each) Office supplies: $2,400 or $200 per month Other business equipment: $2,000 Loan payment of $550 per month Salary prawn of $500 per month . . . . . . E Data Review BS File Horne Insert Page Layout Formulas Xcut Calibri - 10 -AA e Copy Paste 81U- BE Format Painter Chobeard Font . View Tell me what you want to do Wrap Text General Merge a Center $. % his a A. 48 Conditional Forre Formatting Ta Alignment Number G34 D 1 2 Milestone One Cost Classification 4 5 INSTRUCTIONS: 6 itting an X in the appropriate spot, classify the costs as: Direct Material, Direct Labor, Overhead, or Period Costs 7 The Fixed and Variable cost classifications have been provided for you. 8 Direct Direct Item/Cost Material Labor Overhead Period Costs Ford Variable XXX X xxx X 12 Salary - Collar maker 13 Salary-Leash maker 14 Salary - Harness maker 15 Salary - Receptionist 16 High-tensile strength nylon webbing 17 Polyesterylon ribbons 18 Buckles made of cast hardware 19 Depreciation on sewing machines 20 Rent 21 Utilities and insurance 22 Scissors, thread, and cording 23 Price tags 24 Office Supplies Oter business equipment 26 loan payment 27 Salary to sell X X X X X X X x XIX X X 28 29 30 31 1888 2 Milestone One - Variable and Fixed Costs 3 Fixed Costs 5 Collars -7 tem Variable Cost/item 9 High-tensile strength nylon webbins 4.00 10 Polyesterylon ribbon S 1.00 11 Buckles made of cast hardware 5 2.00 12 Price tap 0.10 13 14 15 16 Hem Collar makar's salary monthly Depreciation on sewing machines Runt Utilities and insurance Scissors, thread, and cording Loan payment Salary to sell 3 15 $ 5 5 $ 2,77333 55 00 25000 200,00 400.00 1023 166 67 15 Total Variable Costs per Collar 5 2.10 Total Costs 4.0 20 22 2 Leashes 25 ltem VariableCom 27. Highenie strength to watings 20. Polyesterylon ribbons 4.50 29 made of cast hardware 1.50 Do Price tag 0.10 31 32 Hem Leathmasalary month Depreciation on sewing machines Rant Untities and insurance Son, that and cording Loan payment Salary to self $ $ $ 5 3 5 Fred Cont 2,773.33 55.00 250.00 200.00 40000 183.33 166,67 13 Total Variable Cats per la 12.10 Total costs 21.02.11 41 4 Harnesses Vetem 46 High to strength won wings 6.00 47 Porto 4.50 4 Buckles made of casthardware 400 45 Price 010 so Si 52 5 64 TE 57 Total Variable Couper Hares 14.60 SE Item FC Maresmeralary 2.94661 Depreciation has 5 $5.00 Bent 2100 ilities and insurance 200.00 So, thread, and condit 5 400.00 Loan 3 1 Salary to 5 166.6 Total Corte 4, 2017