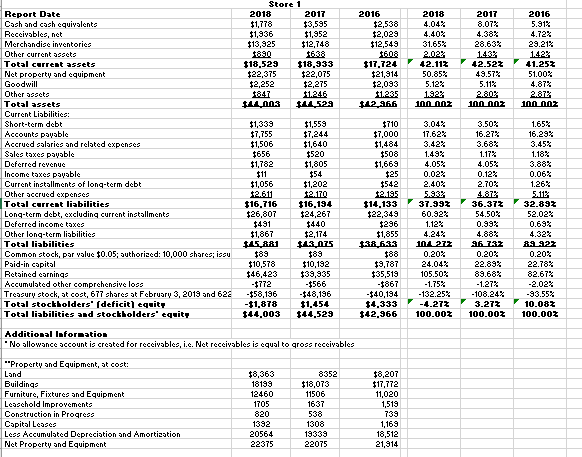

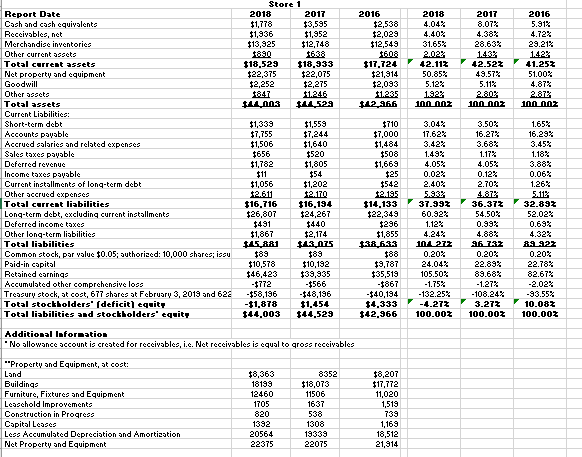

Please Verify if %s of Common Balance Sheet is Correct

Help with doing %s for additional information

Store 1 2018 2017 $1,778 $3,595 $1,936 $1,952 $13,925 $12,748 1890 612 $18.529 $18.933 $22,375 $22,075 $2,252 $2,275 11.246 11.003 14.523 2016 $2,538 $2,029 $12,549 600 $17.724 $21.914 $2,093 1.245 $12.966 2018 4.04% 4.40% 31.65% 2.023 42.112 50.85% 5.12% 1927 100 naz 2017 8.07% 4.38% 28.63% 143 42.522 49.57% 5.11% 2.803 100 002 2016 5.91% 4.72% 29.21% 1423 41.252 51.00% 4.87% 2.875 100002 Report Date Cash and cash equivalents Receivables, not Merchandise inventorics Other current assets Total current assets Net property and cquipment Goodwill Other Dosets Total assets Current Liabilities: Short-term debt Accounts payable Accrued salaries and related expenses Sales taxes payable Deferred revenue Income taxes payable Current installments of long-term debt Other accrued expenses Total current liabilities Long-term debt, excluding current installments Deferred income taxes Other long-term liabilities Total liabilities Common stock, par value $0.05; authorized: 10,000 shares; issu Paid-in capital Retained earningo Accumulated other comprehensive loss Treasury stock, at cost, 677 shares at February 3, 2013 and 622 Total stockholders' (deficit equity Total liabilities and stockholders' equity $1,339 $7,755 $1,506 $656 $1,782 $11 $1,056 12.611 $16.716 $26,807 $491 $1,867 115.181 $89 $10,576 $46,423 -$772 -$58,186 -$1,878 $44,003 $1,559 $7,244 $1,640 $520 $1,805 $54 $1,202 12.10 $16.194 $24,267 1440 $2,174 $13,025 $89 $10,192 $39,935 -1566 -$48,136 1.454 $44,529 $710 $7,000 $1,484 $508 $1,669 $25 $542 2.195 $14,133 $22,349 $296 $1,855 138 133 3.04% 17.62% 3.42% 1.49% 4.05% 0.022 2.40% 5.985 37.992 60.92% 1.12% 4.243 1071 272 0.20% 24.04% 105.50% -1.75% -132.25% -4.272 100.002 3.50% 16.272 3.68% 1.17% 4.05% 0.12% 2.70% 4.872 36.372 54.50% 0.99% 4.88% 96 7:32 0.20% 22.89% 89.68% -1.272 -108.24% 3.272 100.002 1.65% 16.29% 3.45% 1.18% 3.88% 0.06% 1.26% 5.113 32.892 52.02% 0.69% 4.32% 82 222 0.20% 22.78% 82.67% -2.02% -93.55% 10.082 100.00% 188 9,787 $35,519 -$667 -$40,194 $4,333 $42,966 Additional Information "No allowance account is created for receivables, i.c. Net receivables is equal to gross receivables ""Property and Equipment, ut cost: Land Buildings Furniture, Fixtures and Equipment Leasehold Improvements Construction in Progress Capital Leases Less Accumulated Depreciation and Amortization Net Property and Equipment $8,363 18199 12460 1705 820 1392 20564 22375 8352 $18,073 11506 1637 538 1308 19339 22075 $8,207 $17,772 11,020 1,519 739 1,169 18,512 21,914