Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please with detailed answers. 1. How much would you need to give Trine (one payment) to fund a $10,000 scholarship for the next 10 years

please with detailed answers.

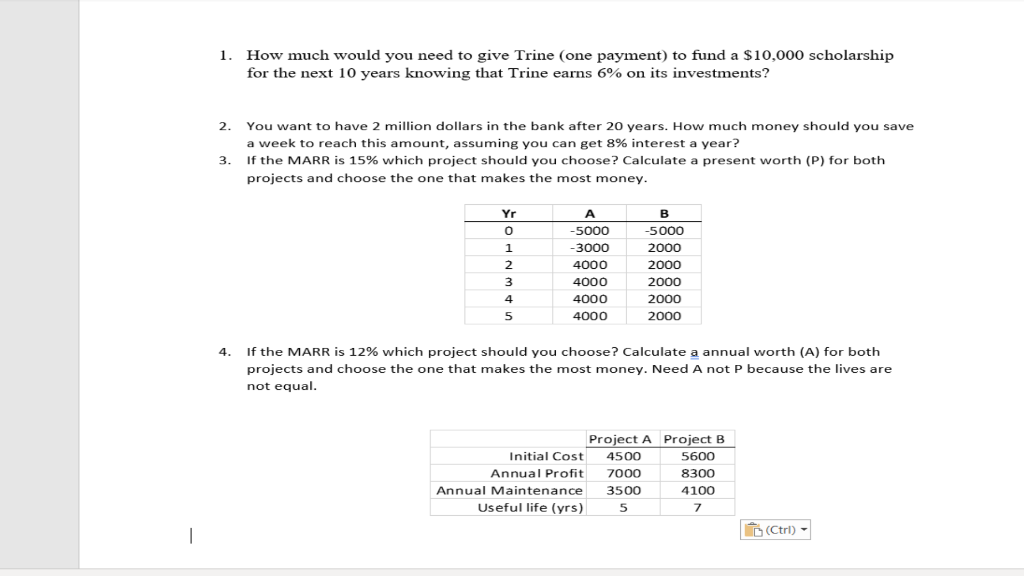

1. How much would you need to give Trine (one payment) to fund a $10,000 scholarship for the next 10 years knowing that Trine earns 6% on its investments? 2. You want to have 2 million dollars in the bank after 20 years. How much money should you save a week to reach this amount, assuming you can get 8% interest a year? 3. If the MARR is 15% which project should you choose? Calculate a present worth (P) for both projects and choose the one that makes the most money. O nM+in A -5000 -3000 4000 4000 4000 4000 B -5000 2000 2000 2000 2000 2000 4. If the MARR is 12% which project should you choose? Calculate a annual worth (A) for both projects and choose the one that makes the most money. Need A not P because the lives are not equal. Project A Project B Initial Cost 4500 5600 Annual Profit 7000 8300 Annual Maintenance 3500 4100 Useful life (yrs) 5 (Ctrl)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started