Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please with solutions thanks Question 2: Mr. A - Annual Salary $120,000, Vacation pay 10%, Pay period frequency: Monthly. Number of hours required to work

please with solutions thanks

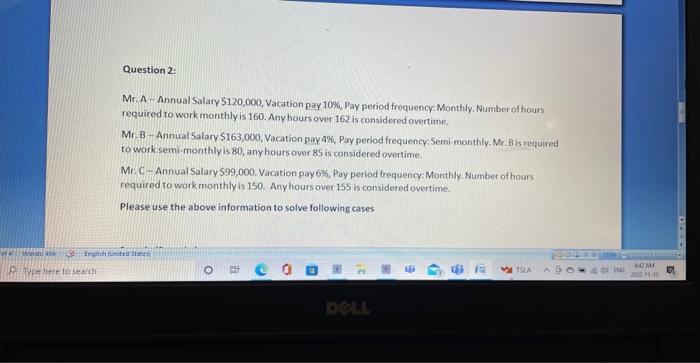

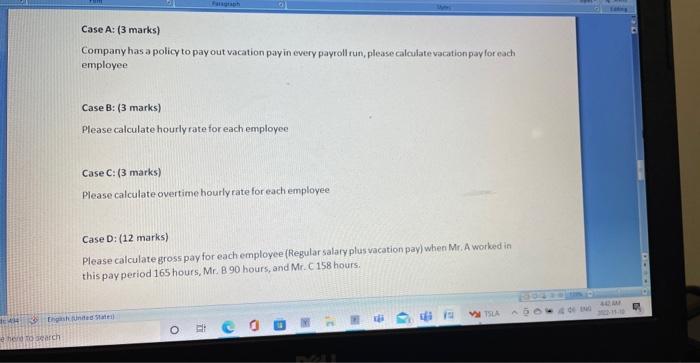

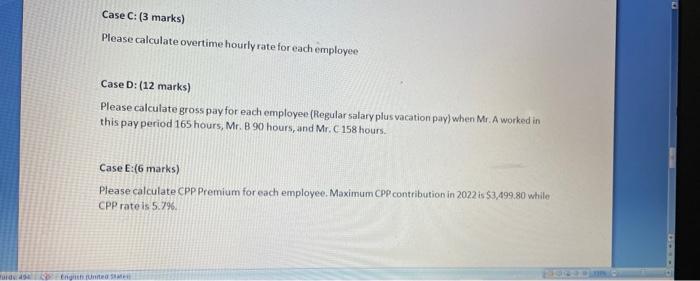

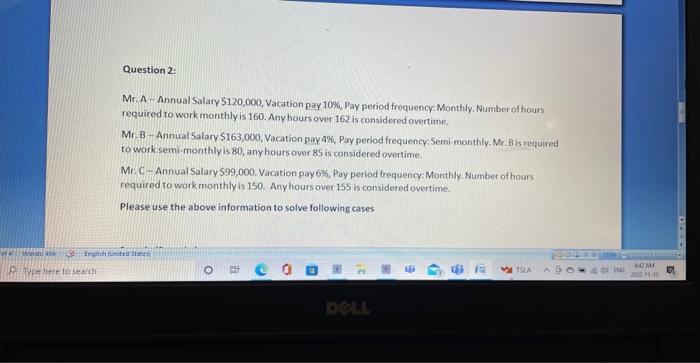

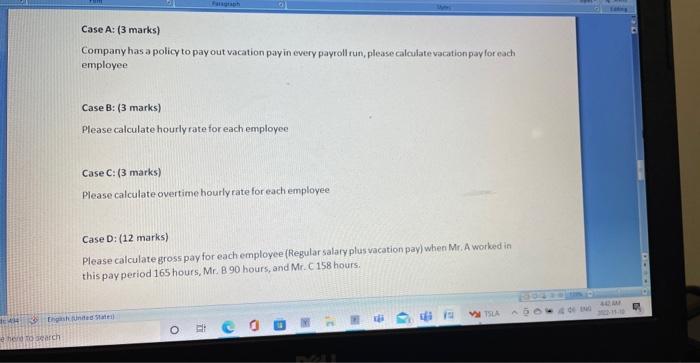

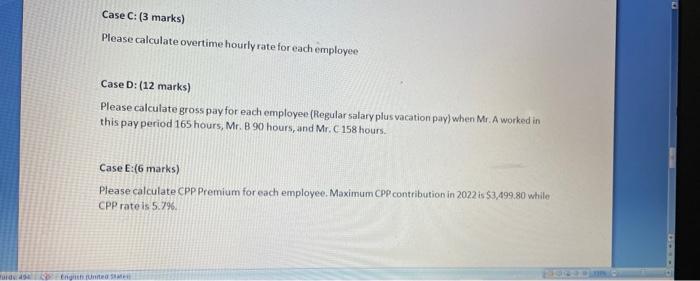

Question 2: Mr. A - Annual Salary $120,000, Vacation pay 10%, Pay period frequency: Monthly. Number of hours required to work monthly is 160 . Any hours over 162 is considered overtime. Mr. B - Annual Salary $163,000, Vacation pay 4%, Pay period frequency: Semi-monthly. Mr. B is required to work semi-monthly is 80 , any hours over 85 is considered overtime. Mr. C - Annual Salary $99,000. Vacation pay 6\%, Pay period frequency: Monthly. Number of hours required to work monthly is 150 . Any hours over 155 is considered overtime. Please use the above information to solve following cases Case A: (3 marks) Company has a policy to pay out vacation pay in every payroll run, please calculate vacation pay for each employee Case 8: ( 3 marks) Please calculate hourly rate for each employee Case C:(3 marks) Please calculate overtime hourly rate for each employee Case D: ( 12 marks) Please calculate gross pay for each employee (Regular salary plus yacation pay) when Mr. A worked in this pay period 165 hours, Mr. B 90 hours, and Mr. C 158 hours. Case C: (3 marks) Please calculate overtime hourly rate for each employee Case D: (12 marks) Please calculate gross pay for each employee (Regular salary plus vacation pay) when Mr. A worked in this pay period 165 hours, Mr. B 90 hours, and Mr. C.158 hours. Case E:(6 marks) Please calculate CPP Premium for cach employee. Maximum CPP contribution in 2022 is $3,499,80 while CPP rate is 5.796. Question 2: Mr. A - Annual Salary $120,000, Vacation pay 10%, Pay period frequency: Monthly. Number of hours required to work monthly is 160 . Any hours over 162 is considered overtime. Mr. B - Annual Salary $163,000, Vacation pay 4%, Pay period frequency: Semi-monthly. Mr. B is required to work semi-monthly is 80 , any hours over 85 is considered overtime. Mr. C - Annual Salary $99,000. Vacation pay 6\%, Pay period frequency: Monthly. Number of hours required to work monthly is 150 . Any hours over 155 is considered overtime. Please use the above information to solve following cases Case A: (3 marks) Company has a policy to pay out vacation pay in every payroll run, please calculate vacation pay for each employee Case 8: ( 3 marks) Please calculate hourly rate for each employee Case C:(3 marks) Please calculate overtime hourly rate for each employee Case D: ( 12 marks) Please calculate gross pay for each employee (Regular salary plus yacation pay) when Mr. A worked in this pay period 165 hours, Mr. B 90 hours, and Mr. C 158 hours. Case C: (3 marks) Please calculate overtime hourly rate for each employee Case D: (12 marks) Please calculate gross pay for each employee (Regular salary plus vacation pay) when Mr. A worked in this pay period 165 hours, Mr. B 90 hours, and Mr. C.158 hours. Case E:(6 marks) Please calculate CPP Premium for cach employee. Maximum CPP contribution in 2022 is $3,499,80 while CPP rate is 5.796

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started