Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please, with the following information help me to prepare the Cash Flow for the current year under the indirect and direct method. All the information

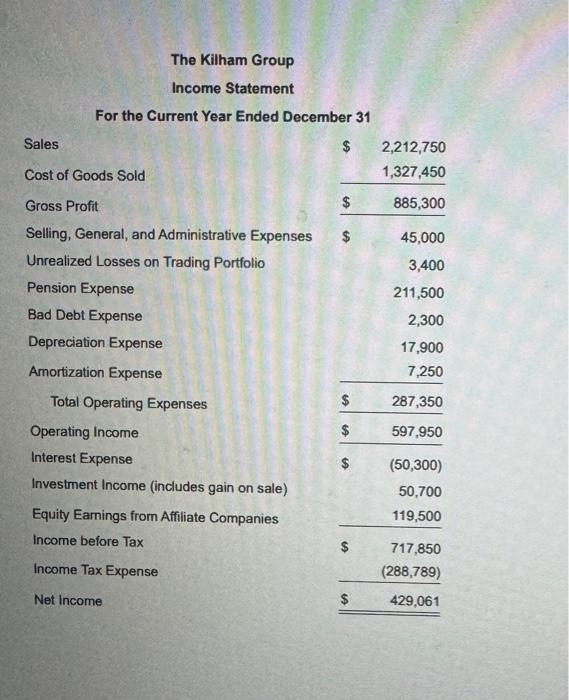

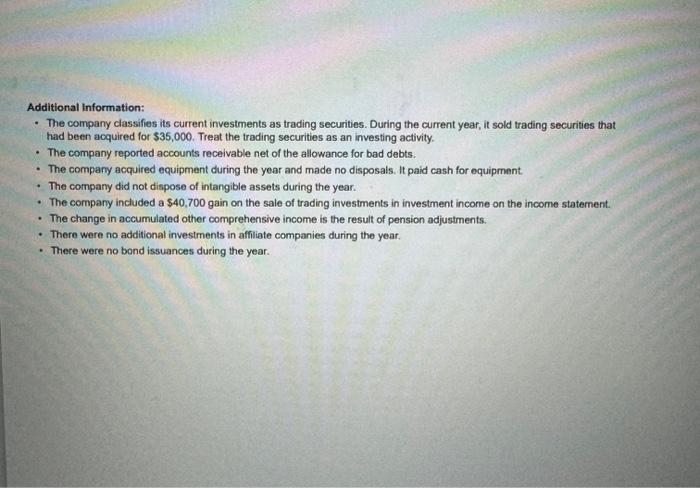

please, with the following information help me to prepare the Cash Flow for the current year under the indirect and direct method. All the information is disclosure below:

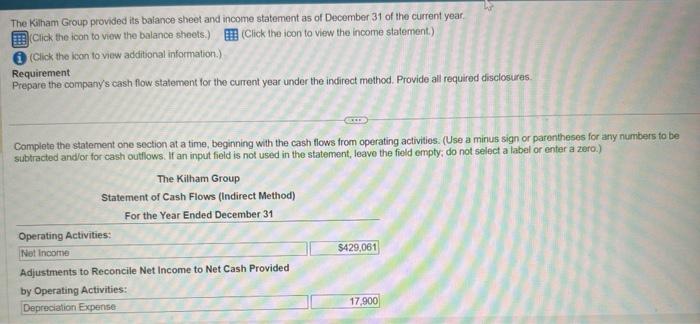

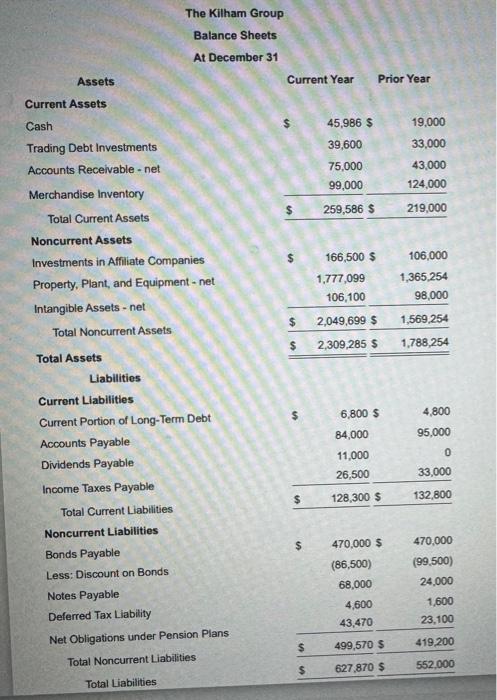

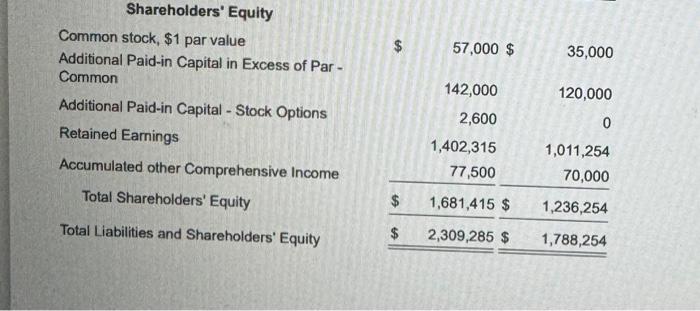

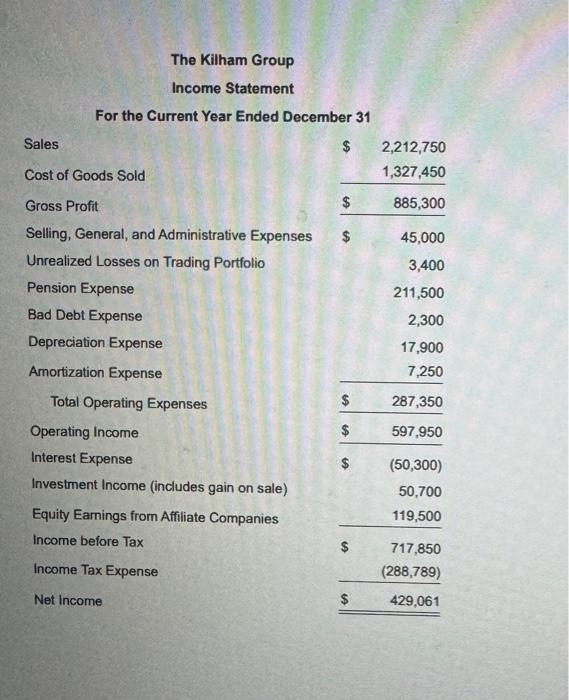

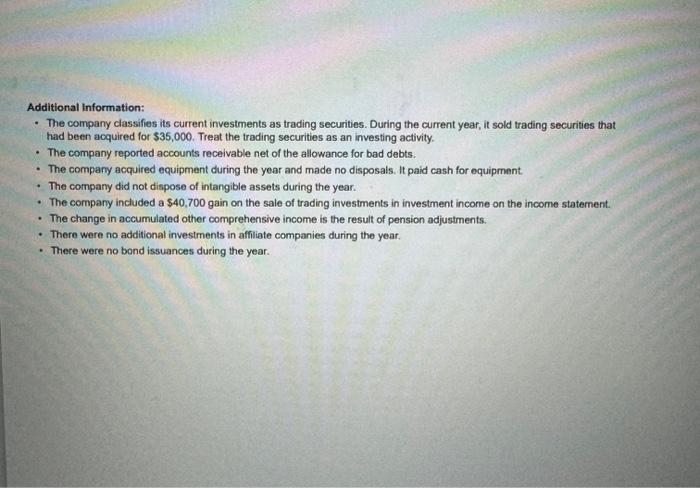

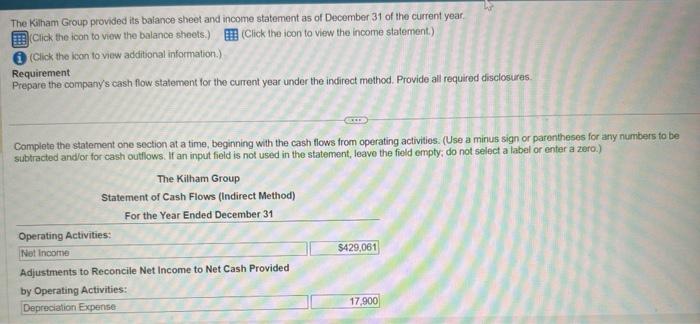

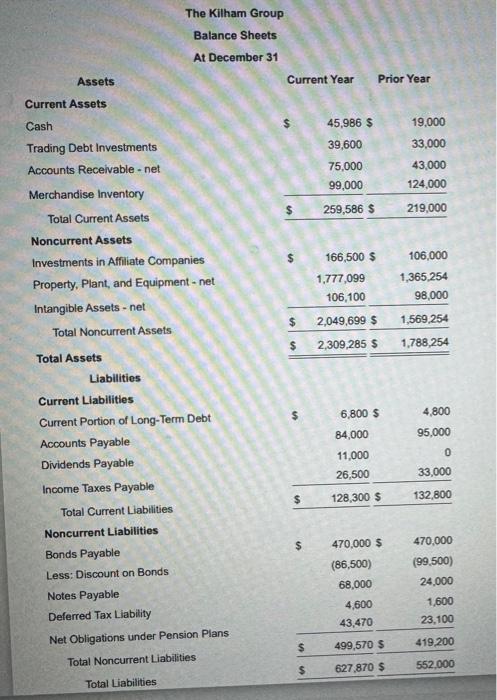

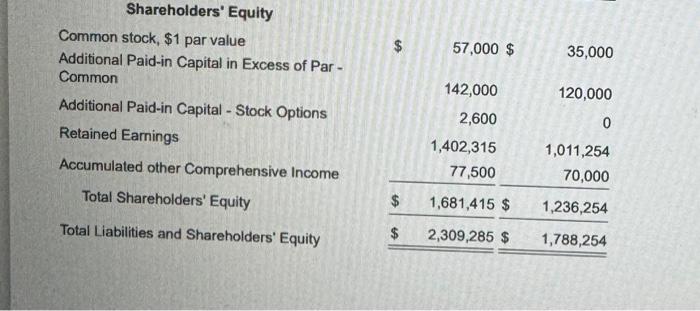

The Kiham Group provided its baiance sheet and income statement as of December 31 of the current year. (Click the icon to view the balance sheels.) (Click the icon to view the income statement.) (Click the kxon lo view additional information.) Requirement Prepare the company's cash flow statement for the current year under the indirect method. Provide all required disclosuras Complete the statement one section at a time, beginning with the cash flows from operating activities: (Use a minus sign or parentheses for any numbers to be subtracted andlor for cash outflows. If an input field is not used in the statement, leavo the field empty; do not select a label or enter a zero.) The Kilham Group Income Statement Additional Information: - The company classifies its current investments as trading securities. During the current year, it sold trading securities that had been acquired for $35,000. Treat the trading securities as an investing activity. - The company reported accounts receivable net of the allowance for bad debts. - The company acquired equipment during the year and made no disposals, It paid cash for equipment. - The company did not dispose of intangible assets during the year. - The company included a $40,700 gain on the sale of trading investments in investment income on the income staternent. - The change in accumulated other comprehensive income is the result of pension adjustments. - There were no additional investments in affiliate companies during the year. - There were no bond issuances during the year. Shareholders' Equity Common stock, $1 par value Additional Paid-in Capital in Excess of Par Common Additional Paid-in Capital - Stock Options Retained Earnings Accumulated other Comprehensive Income Total Shareholders' Equity Total Liabilities and Shareholders' Equity The Kilham Group Balance Sheets At December 31 Assets Current Year Prior Year Current Assets Cash Trading Debt Investments Accounts Receivable - net Merchandise Inventory Total Current Assets \begin{tabular}{ccc} $ & 45,986$ & 19,000 \\ & 39,600 & 33,000 \\ & 75,000 & 43,000 \\ & 99,000 & 124,000 \\ \hline \$ & 259,586 \$ & 219,000 \\ \hline \end{tabular} Noncurrent Assets Investments in Affiliate Companies Property, Plant, and Equipment - net Intangible Assets - net Total Noncurrent Assets Total Assets \begin{tabular}{|c|c|c|} \hline & 166,500$ & 106,000 \\ \hline & 1,777,099 & 1,365,254 \\ \hline & 106,100 & 98,000 \\ \hline & 2,049,699$ & 1,569,254 \\ \hline & 2,309,285s & 1,788,254 \\ \hline \end{tabular} Liabilities Current Liabilities Current Portion of Long-Term Debt Accounts Payable Dividends Payable Income Taxes Payable Total Current Liabilities Noncurrent Liabilities Bonds Payable Less: Discount on Bonds Notes Payable \$ \begin{tabular}{rrr} $ & 6,800$ & 4,800 \\ & 84,000 & 95,000 \\ 11,000 & 0 \\ & 26,500 & 33,000 \\ \hline$ & 128,300$ & 132,800 \\ \hline \end{tabular} Deferred Tax Liability Net Obligations under Pension Plans Total Noncurrent Liabilities Total Liabilities \begin{tabular}{ccr} $ & 470,000$ & 470,000 \\ & (86,500) & (99,500) \\ & 68,000 & 24,000 \\ & 4,600 & 1,600 \\ & 43,470 & 23,100 \\ \hline$ & 499,570 & 419,200 \\ \hline$ & 627,870 & $ \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started