Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please work BE 7-6 please. Also please provide details on how the aging method is done for (b), (b) is the part I am having

Please work BE 7-6 please. Also please provide details on how the aging method is done for (b), (b) is the part I am having a lot of difficulites with . Thanks.

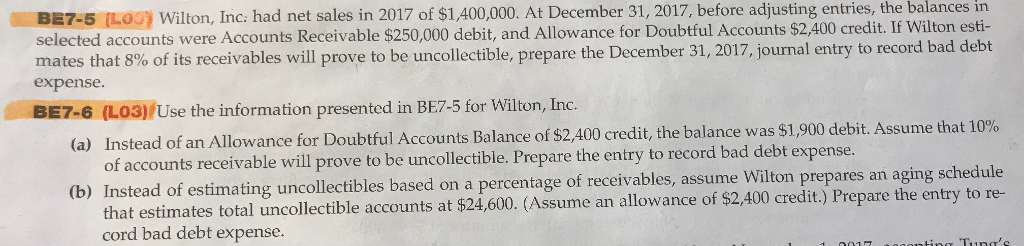

BE7-5 ILo Wilton, Inc: had net sales in 2017 of $1,400,000. At December 31, 2017, before adjusting entries, the balances in selected accounts were Accounts Receivable $250,000 debit, and Allowance for Doubtful Accounts $2,400 credit. If Wilton esti- mates that 8% of its receivables will prove to be uncollectible, prepare the December 31, 2017, journal entry to record bad debt expense BE7-6 (LO3)/Use the information presented in BE7-5 for Wilton, Inc. (a) Instead of an Allowance for Doubtful Accounts Balance of $2400 credit,the balance was $1,900 debit. Assume tha of accounts receivable will prove to be uncollectible. Prepare the b) Instead of estimating uncollectibles based on entry to record bad debt expense a percentage of receivables, assume Wilton prepares an aging schedule estimates total uncollectible accounts at $24,600. (Assume an allowance of $2,400 credit.) Prepare the entry to re- cord bad debt expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started