Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please work on this ASAP the assignment is timed it's not as long as it looks C11-1 (Algo) Financial Reporting of Depreciation, Write-off, Bond Issuance

please work on this ASAP the assignment is timed it's not as long as it looks

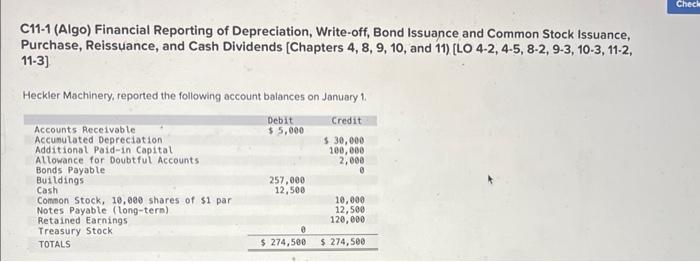

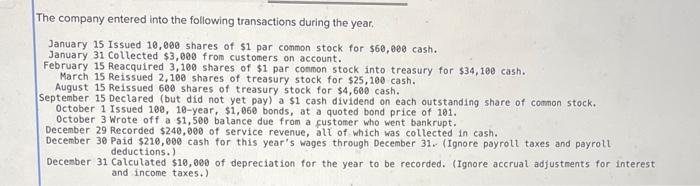

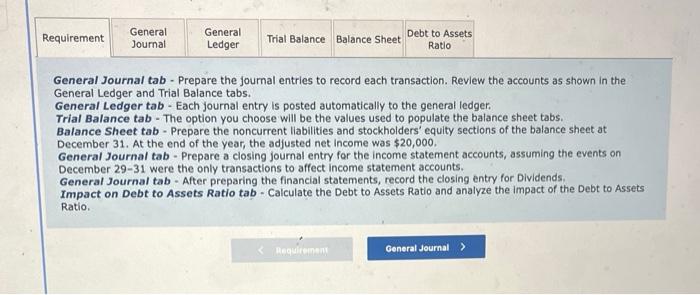

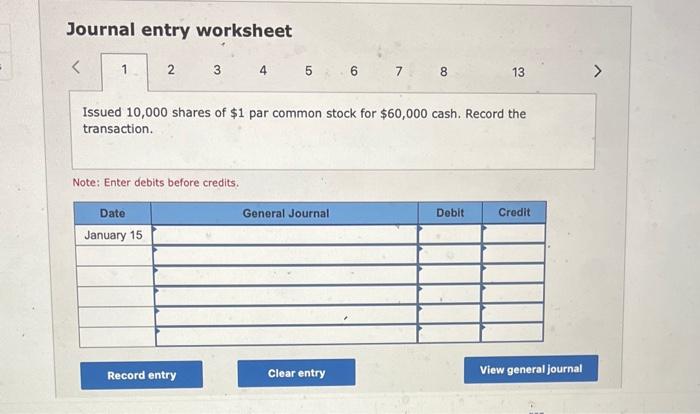

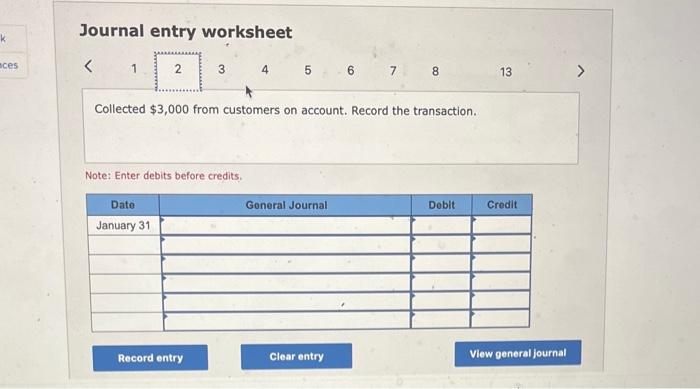

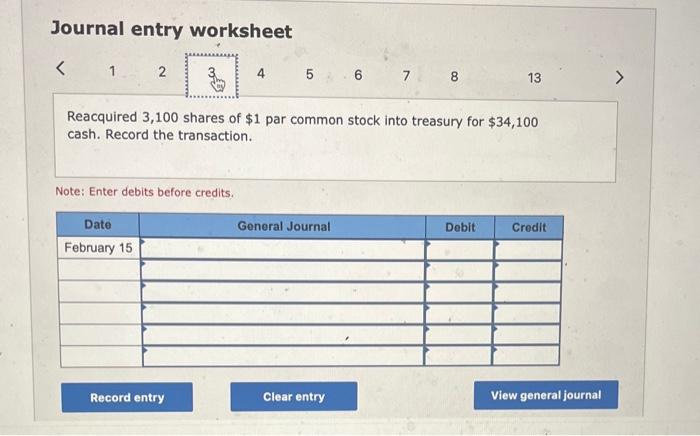

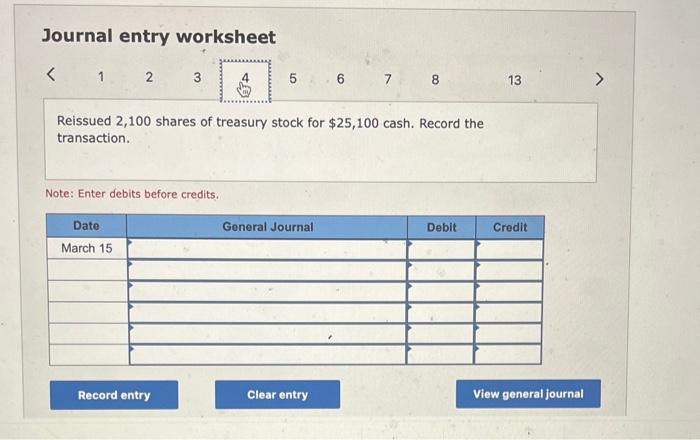

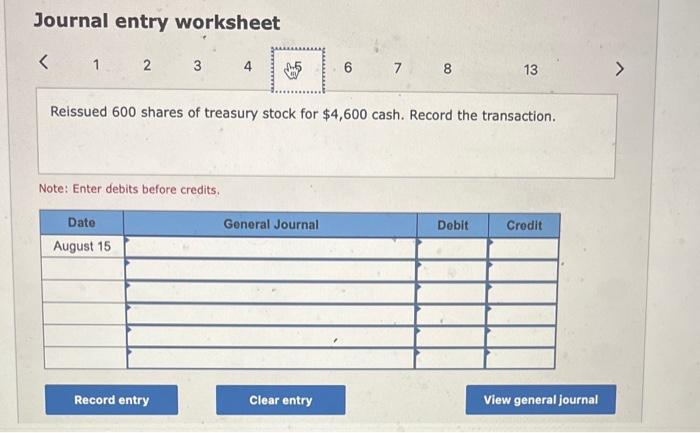

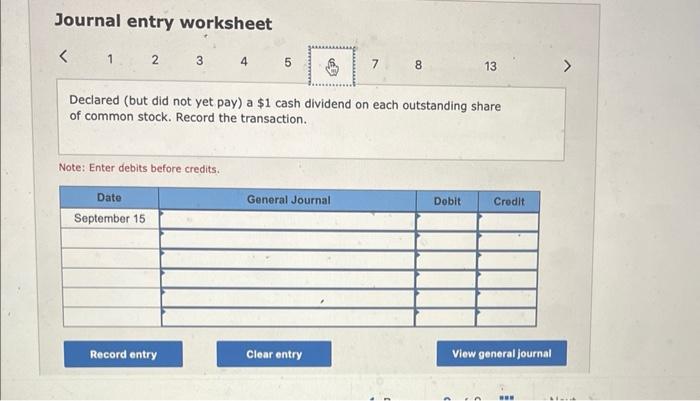

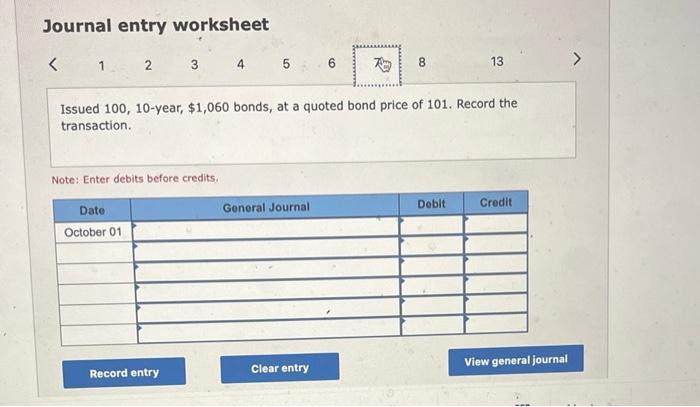

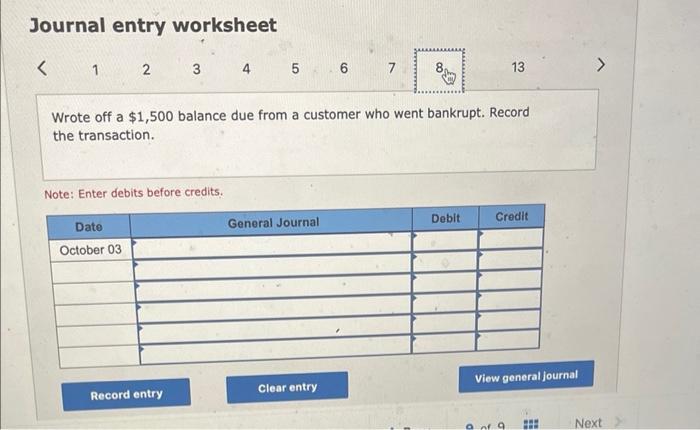

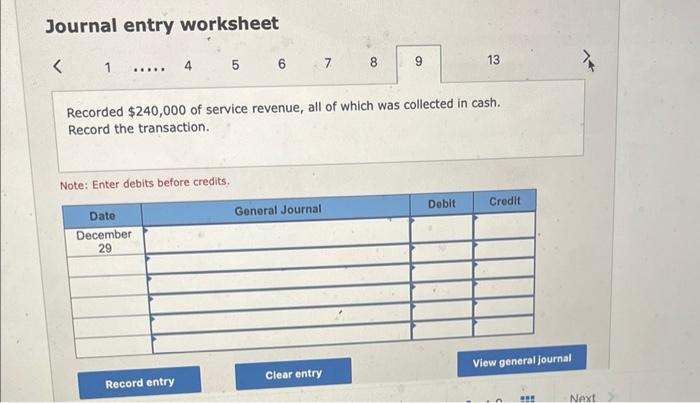

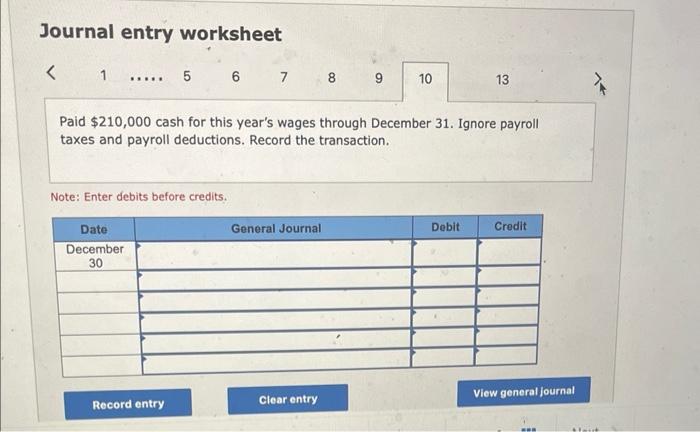

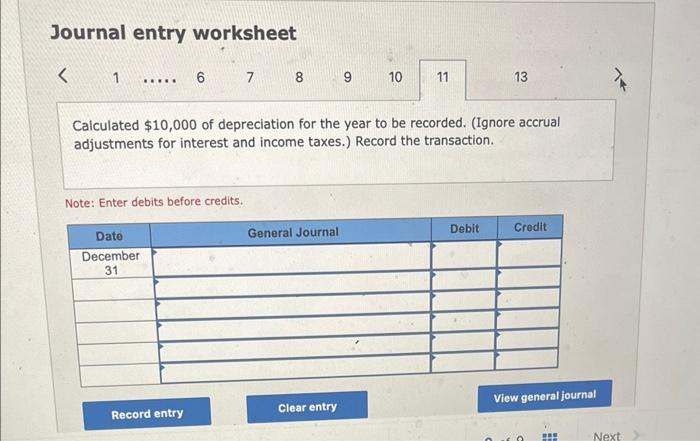

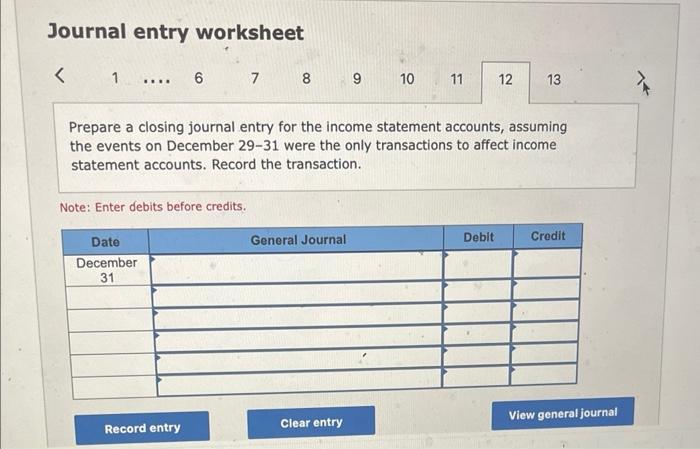

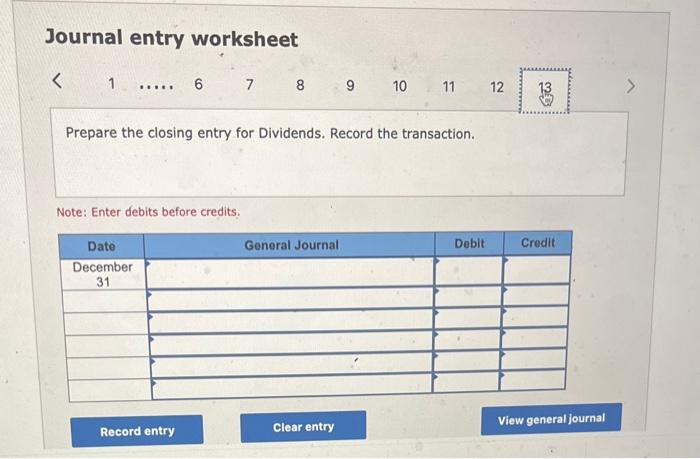

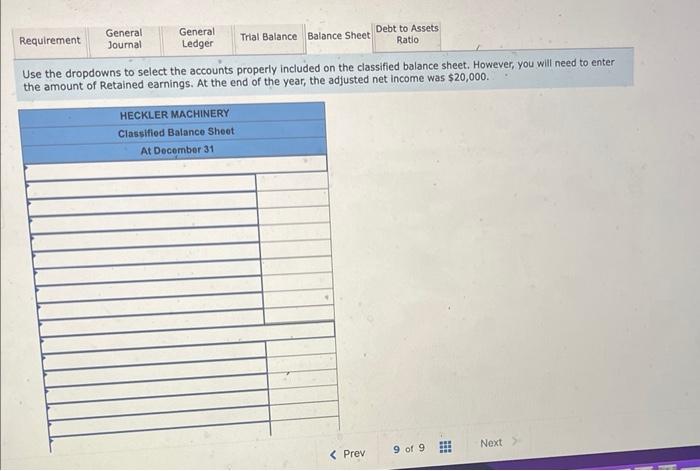

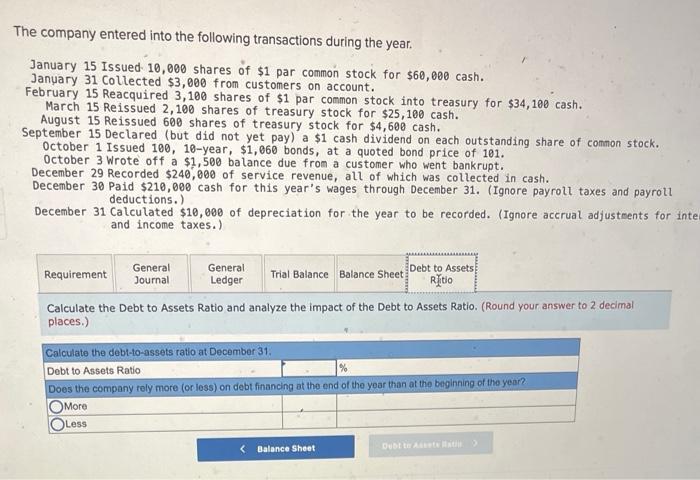

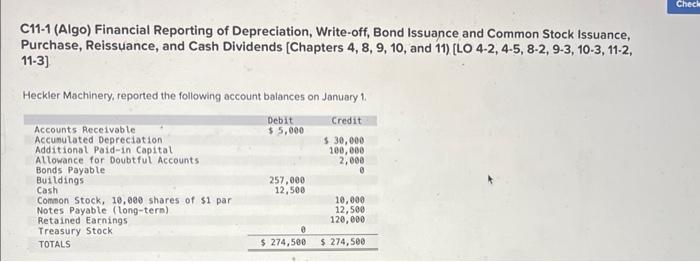

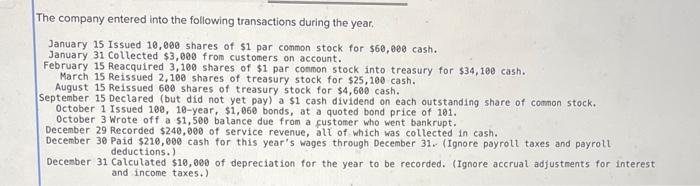

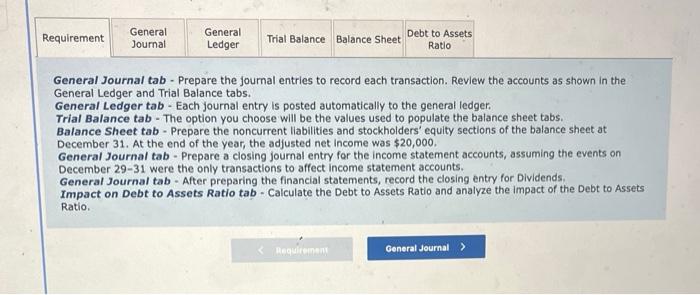

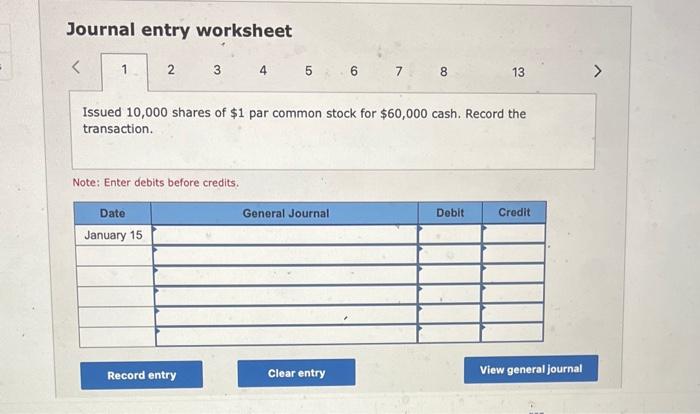

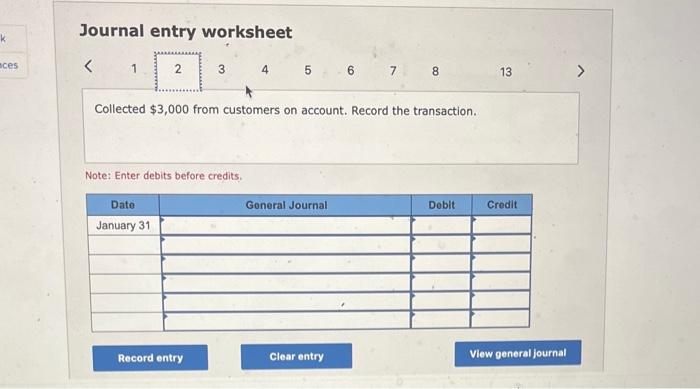

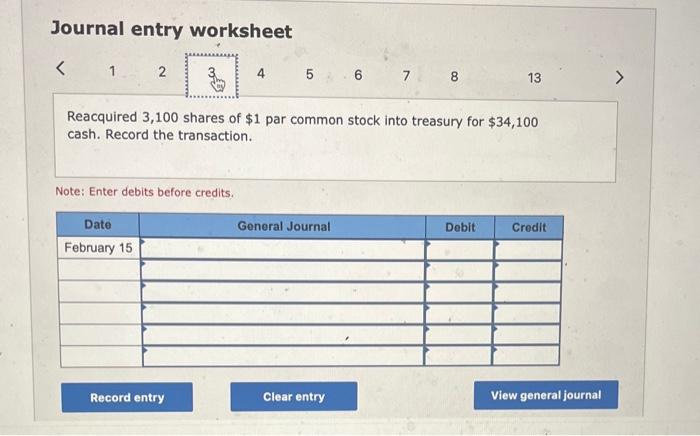

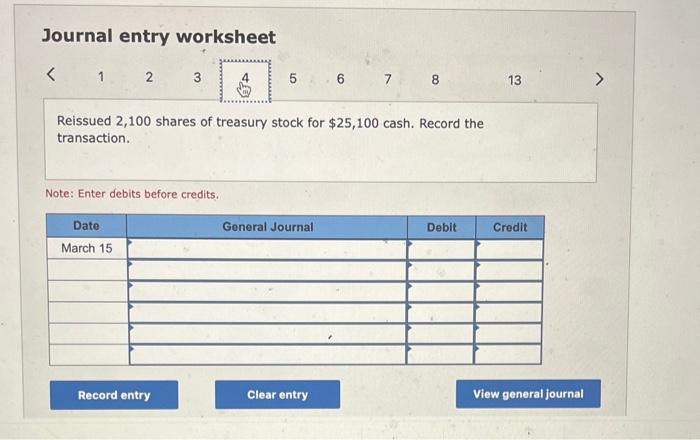

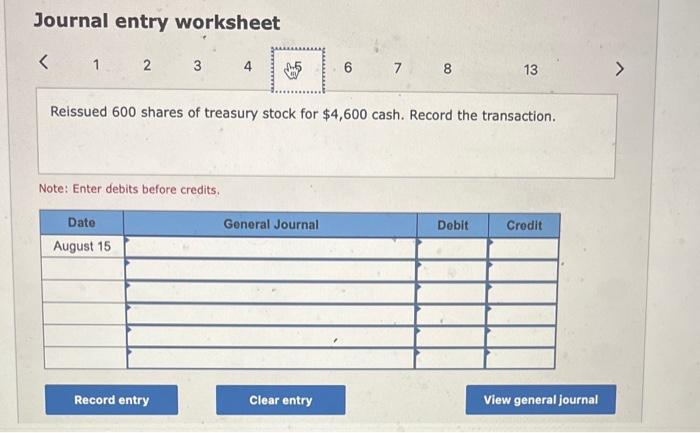

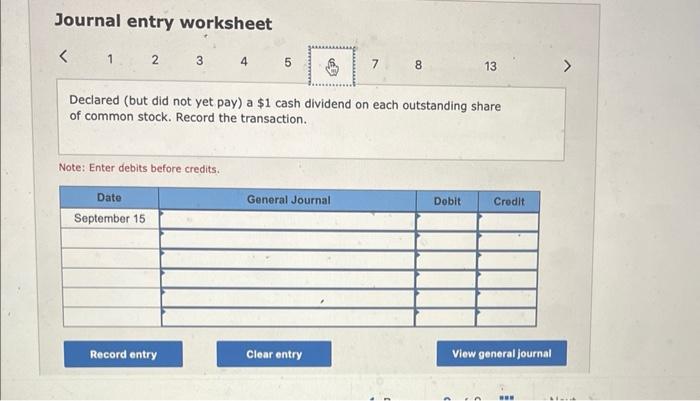

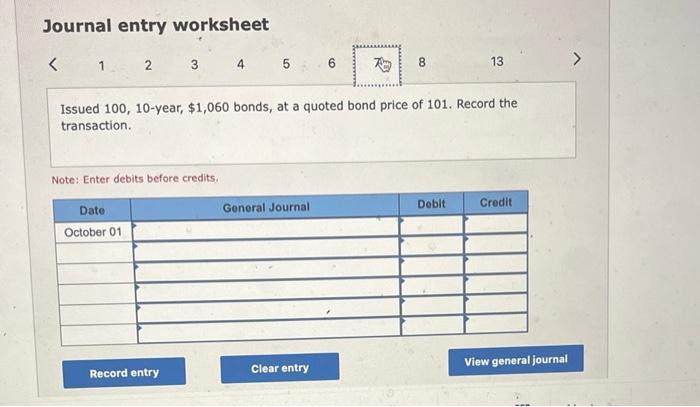

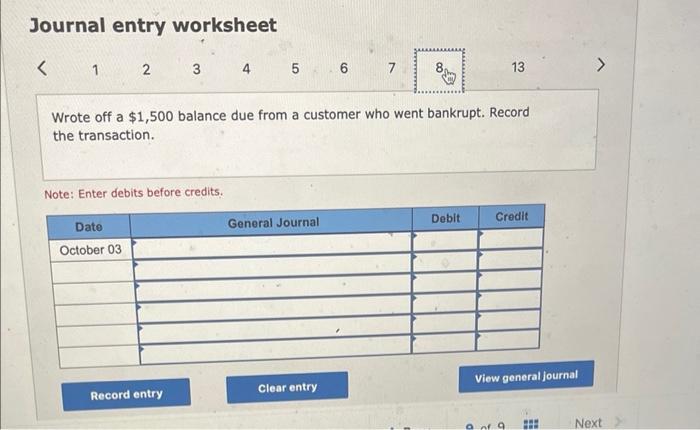

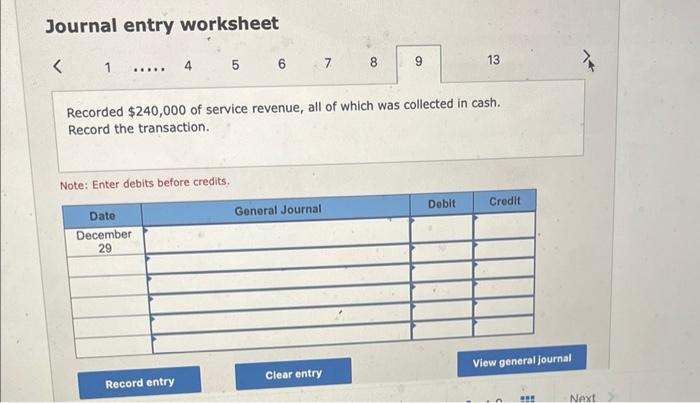

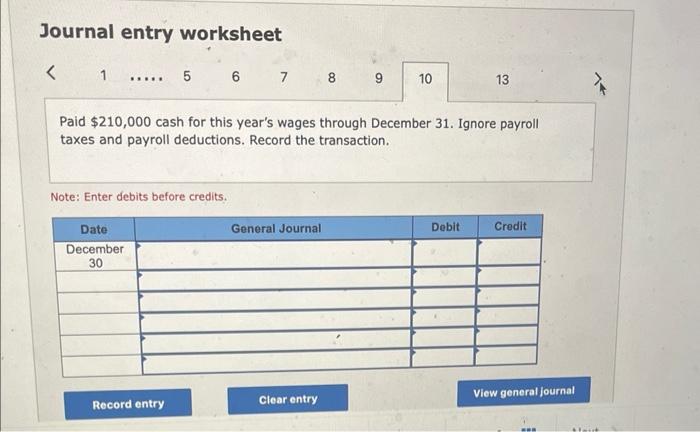

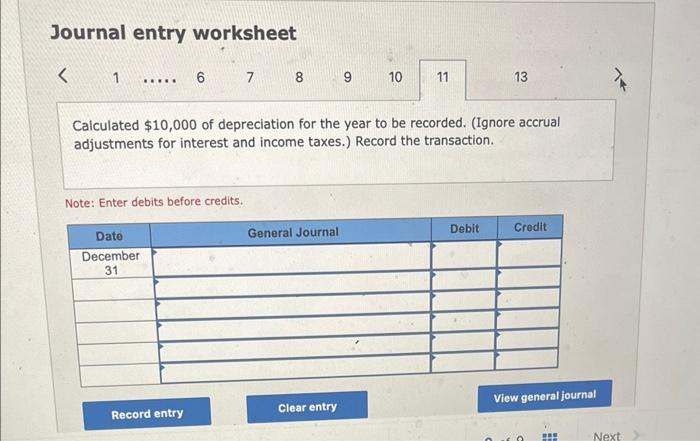

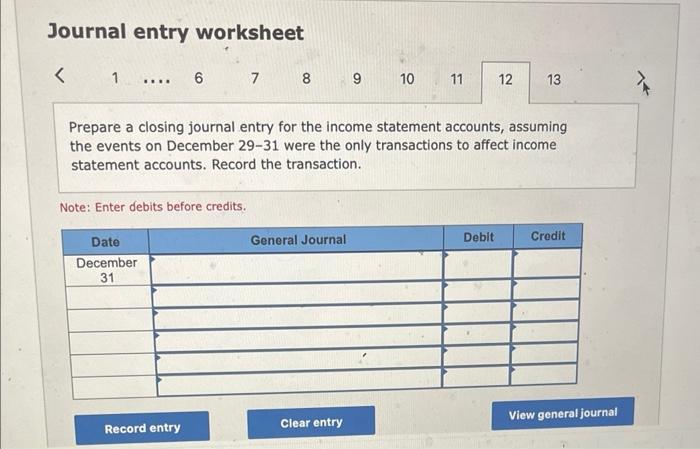

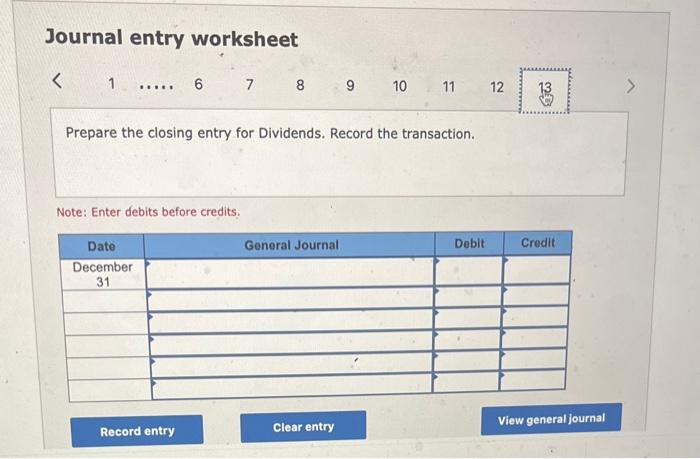

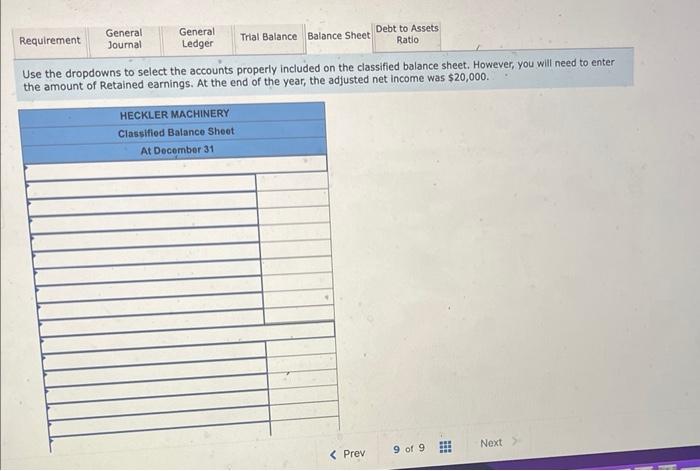

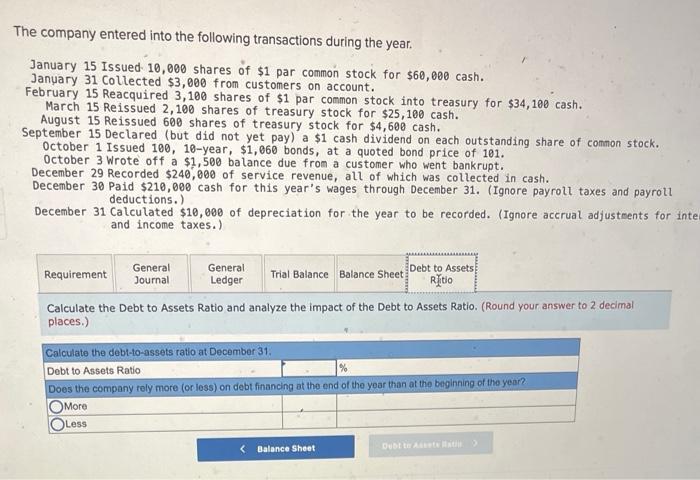

C11-1 (Algo) Financial Reporting of Depreciation, Write-off, Bond Issuance and Common Stock Issuance, Purchase, Reissuance, and Cash Dividends [Chapters 4, 8, 9, 10, and 11) [ LO 42,45,82,93,103,112, 11-3] Heckler Machinery, reported the following account balances on January 1. The company entered into the following transactions during the year. January 15 Issued 10,000 shares of $1 par conmon stock for $60,000 cash. January 31 Collected $3,000 from customers on account. February 15 Reacquired 3,100 shares of $1 par conmon stock into treasury for $34,100 cash. March 15 Reissued 2, 100 shares of treasury stock for $25,100 cash. August 15 Reissued 600 shares of treasury stock for $4,600 cash. September 15 Declared (but did not yet pay) a $1 cash dividend on each outstanding share of connon stock. October 1 Issued 100, 10-year, \$1,06e bonds, at a quoted bond price of 101. October 3 Wrote off a $1,500 balance due from a customer who went bankrupt. December 29 Recorded $240,000 of service revenue, alt of which was collected in cash. December 30 Paid $210,000 cash for this year's wages through December 31. (Ignore payroll taxes and payrotl deductions.) Decenber 31 Calculated $10,000 of depreciation for the year to be recorded. (Ignore accrual adjustnents for interest and income taxes+) General Journal tab - Prepare the journal entries to record each transaction. Review the accounts as shown in the General Ledger and Trial Balance tabs. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab - The option you choose will be the values used to populate the balance sheet tabs. Balance Sheet tab - Prepare the noncurrent liabilities and stockholders' equity sections of the balance sheet at December 31 . At the end of the year, the adjusted net income was $20,000. General Journal tab - Prepare a closing journal entry for the income statement accounts, assuming the events on December 29-31 were the only transactions to affect income statement accounts. General Journal tab - After preparing the financial statements, record the closing entry for Dividends. Impact on Debt to Assets Ratio tab - Calculate the Debt to Assets Ratio and analyze the impact of the Debt to Assets Ratio. Journal entry worksheet 245678 13 Issued 10,000 shares of $1 par common stock for $60,000 cash. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Collected $3,000 from customers on account. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 5678 Reacquired 3,100 shares of $1 par common stock into treasury for $34,100 cash. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 567 Reissued 2,100 shares of treasury stock for $25,100 cash. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 123 7 13 Reissued 600 shares of treasury stock for $4,600 cash. Record the transaction. Note: Enter debits before credits. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started