Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE WORK OUT PROBLEM BY HAND PLEASE DO NOT USE EXCEL FORMULA'S (IRR) Year end prices of Copard Co's shares are as shown below. Year

PLEASE WORK OUT PROBLEM BY HAND

PLEASE DO NOT USE EXCEL FORMULA'S (IRR)

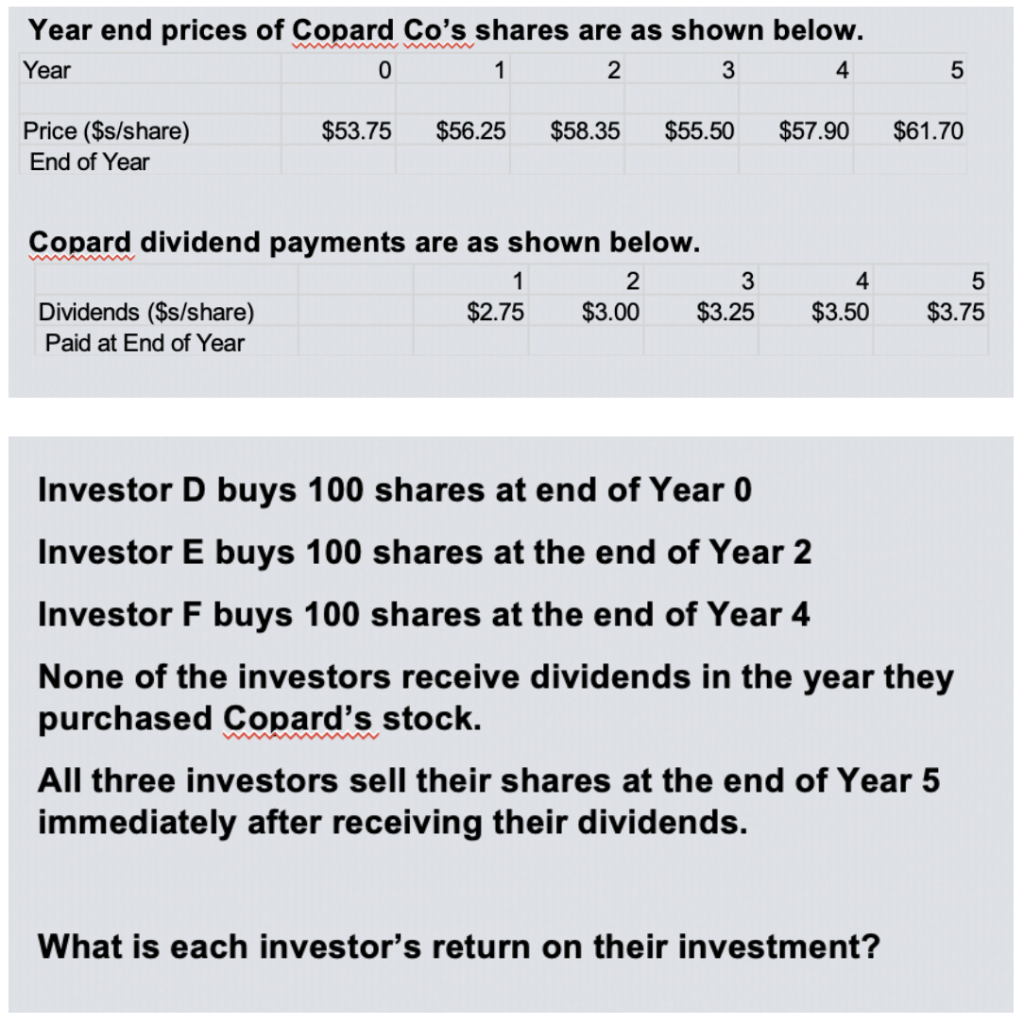

Year end prices of Copard Co's shares are as shown below. Year 0 1 2 3 4 5 $53.75 $56.25 $58.35 $55.50 $57.90 $61.70 Price ($s/share) End of Year Copard dividend payments are as shown below. 1 2 3 Dividends ($s/share) $2.75 $3.00 $3.25 Paid at End of Year 4 $3.50 5 $3.75 Investor D buys 100 shares at end of Year 0 Investor E buys 100 shares at the end of Year 2 Investor F buys 100 shares at the end of Year 4 None of the investors receive dividends in the year they purchased Copard's stock. All three investors sell their shares at the end of Year 5 immediately after receiving their dividends. What is each investor's return on their investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started