Answered step by step

Verified Expert Solution

Question

1 Approved Answer

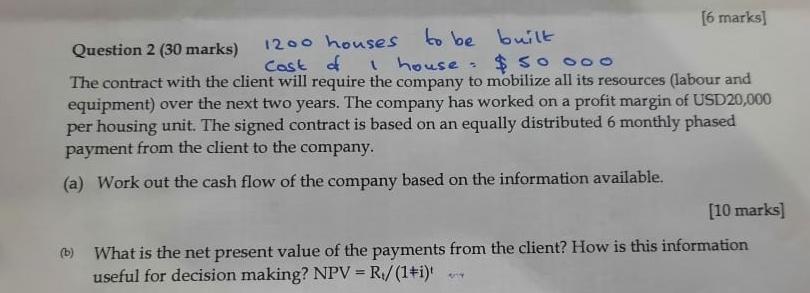

please work PART (b) assume discount rate = 6% 1200 houses to be built at $50 000 per house. [6 marks] Question 2 (30 marks)

please work PART (b)

assume discount rate = 6%

1200 houses to be built at $50 000 per house.

[6 marks] Question 2 (30 marks) 1200 houses to be built ost of I house $ Soooo The contract with the client will require the company to mobilize all its resources (labour and equipment) over the next two years. The company has worked on a profit margin of USD 20,000 per housing unit. The signed contract is based on an equally distributed 6 monthly phased payment from the client to the company. (a) Work out the cash flow of the company based on the information available. [10 marks] (b) What is the net present value of the payments from the client? How is this information useful for decision making? NPV =Rs/(1+i)' [6 marks] Question 2 (30 marks) 1200 houses to be built ost of I house $ Soooo The contract with the client will require the company to mobilize all its resources (labour and equipment) over the next two years. The company has worked on a profit margin of USD 20,000 per housing unit. The signed contract is based on an equally distributed 6 monthly phased payment from the client to the company. (a) Work out the cash flow of the company based on the information available. [10 marks] (b) What is the net present value of the payments from the client? How is this information useful for decision making? NPV =Rs/(1+i)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started