Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please work this out like it's meant for a 10 year old. thanks QUESTION TWO (20 marks) i. Distinguish between prime costs and indirect costs

please work this out like it's meant for a 10 year old. thanks

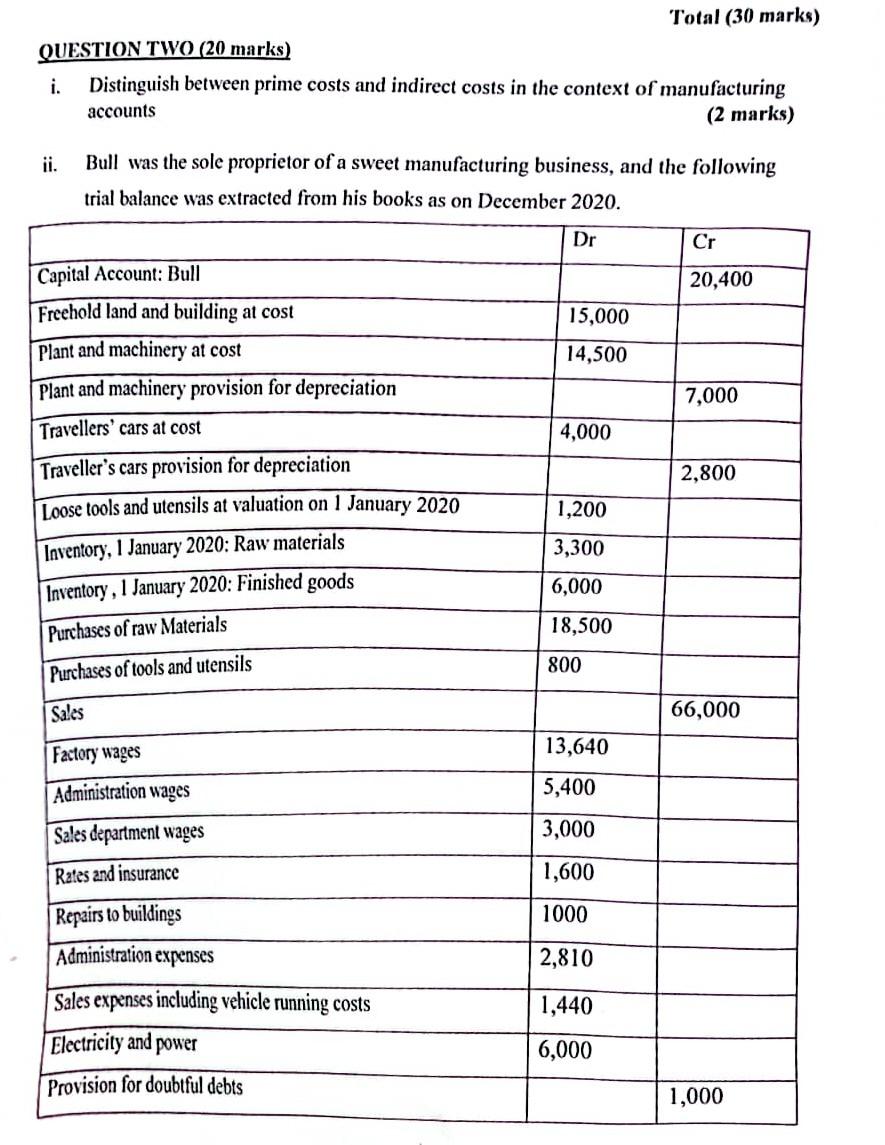

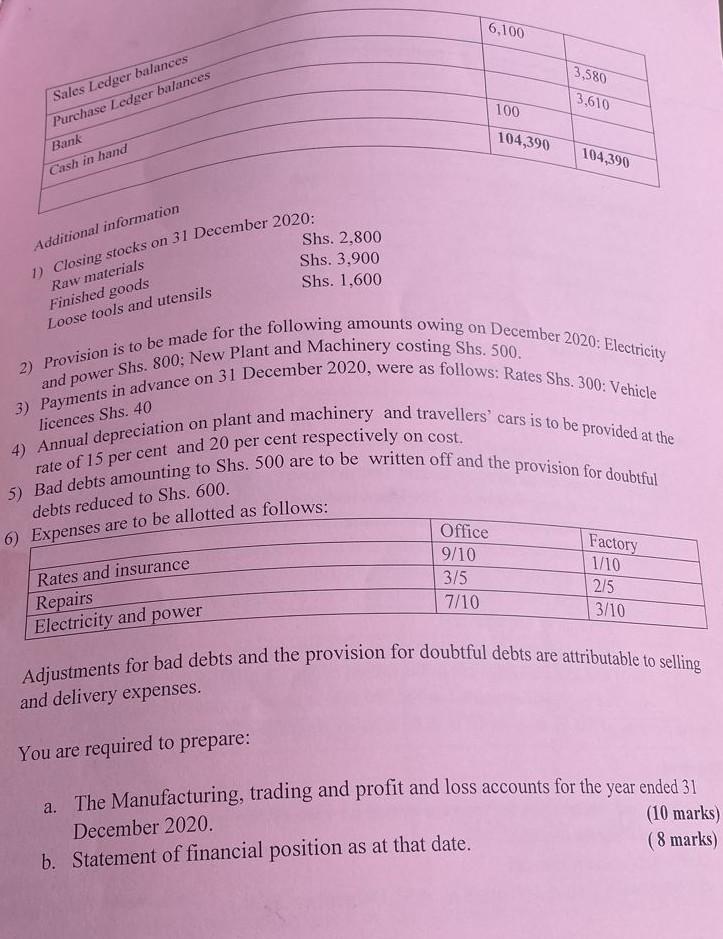

QUESTION TWO (20 marks) i. Distinguish between prime costs and indirect costs in the context of manufacturing accounts ( 2 marks) ii. Bull was the sole proprietor of a sweet manufacturing business, and the following on 31 December 2020: 1) Closing stocks on Shs. 2,800 Raw materials Shs. 3,900 Finished goods Shs. 1,600 Loose tools and utensils 2) Provision is to be made for the following amounts owing on December 2020: Electricity and power Shs. 800, New Plant and Machinery costing Shs. 500. licences Shs. 40 4) Annual depreciation on plant and machinery and travellers' cars is to be provided at the rate of 15 per cent and 20 per cent respectively on cost. 5) Bad debts amounting to Shs. 500 are to be written off and the provision for doubtful dehts reduced to Shs. 600 . Adjustments for bad debts and the provision for doubtful debts are attributable to selling and delivery expenses. You are required to prepare: a. The Manufacturing, trading and profit and loss accounts for the year ended 31 December 2020. (10 marks) b. Statement of financial position as at that date. ( 8 marks) QUESTION TWO (20 marks) i. Distinguish between prime costs and indirect costs in the context of manufacturing accounts ( 2 marks) ii. Bull was the sole proprietor of a sweet manufacturing business, and the following on 31 December 2020: 1) Closing stocks on Shs. 2,800 Raw materials Shs. 3,900 Finished goods Shs. 1,600 Loose tools and utensils 2) Provision is to be made for the following amounts owing on December 2020: Electricity and power Shs. 800, New Plant and Machinery costing Shs. 500. licences Shs. 40 4) Annual depreciation on plant and machinery and travellers' cars is to be provided at the rate of 15 per cent and 20 per cent respectively on cost. 5) Bad debts amounting to Shs. 500 are to be written off and the provision for doubtful dehts reduced to Shs. 600 . Adjustments for bad debts and the provision for doubtful debts are attributable to selling and delivery expenses. You are required to prepare: a. The Manufacturing, trading and profit and loss accounts for the year ended 31 December 2020. (10 marks) b. Statement of financial position as at that date. ( 8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started