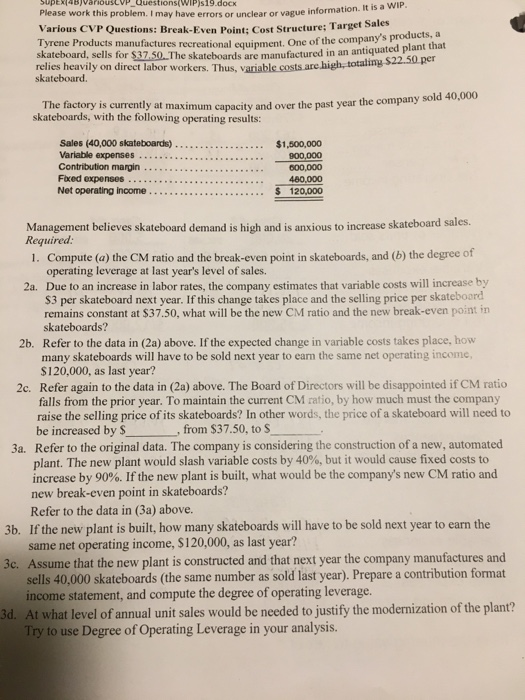

Please work this problem. I may have errors or unclear or vague information. Various CVP Questions: Break-Even Point; Cost Structure; Target Sa Tyrene Products manufactures recreational equipment. On e of the company's products, a plant that skateboard, sells for $37.50. The skateboards are manufactured in an antiquated P relies heavily on direct labor workers. Thus, variable costs are high, totaiing skateboard. ing S22.50 per The factory is currently at maxi skateboards, with the following operating results mum capacity and over the past year the company sold 40,000 Variable expenses Contribution margin. Foxed expenses Net operating income 900,000 600,000 480,000 120,000 Management believes skateboard demand is high and is anxious to increase skateboard sales Required: 1. Compute (a) the CM ratio and the break-even point in skateboards, and (b) the degree of operating leverage at last year's level of sales. 2a. Due to an increase in labor rates, the company estimates that variable costs will increase by S3 per skateboard next year. If this change takes place and the selling price per skateboord remains constant at $37.50, what will be the new CM ratio and the new break-even poin skateboards? 2b. Refer to the data in (2a) above. If the expected change in variable costs takes place, how many skateboards will have to be sold next year to earn the same net operating i $120,000, as last year? 2c. Refer again to the data in (2a) above. The Board of Directors will be disappointed if CM ratio falls from the prior year. To maintain the current CM ratio, by how much must the company raise the selling price of its skateboards? In other words, the price of a skateboard will need to be increased by Refer to the original data. The company is considering the construction of a new, automated plant. The new plant would slash variable costs by 40%, but it would cause fixed costs to increase by 90%. If the new plant is built, what would be the company's new CM ratio and new break-even point in skateboards? Refer to the data in (3a) above. , from $37.50, to S 3a. 3b. If the new plant is built, how many skateboards will have to be sold next year to earn the year? same net operating income, $120,000, as last 3c. Assume that the new plant is constructed and that next year the company manufactures and sells 40,000 skateboards (the same number as sold last year). Prepare a contribution format income statement, and compute the degree of operating leverage. At what level of annual unit sales would be needed to justify the modernization of the plant? use Degree of Operating Leverage in your analysis