Please write a one page SUMMARY and YOUR OPINION on the following article (if you have difficulty seeing, please open in seperate tab and use the settings to zoom in, thank you) :

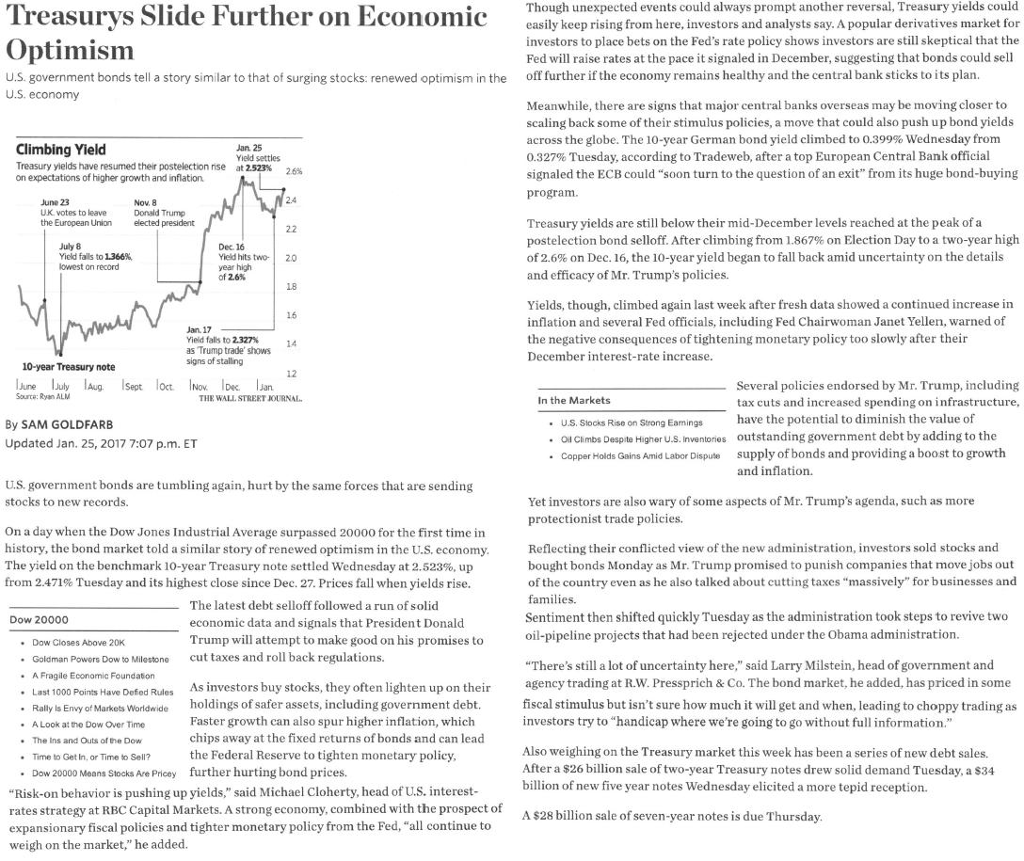

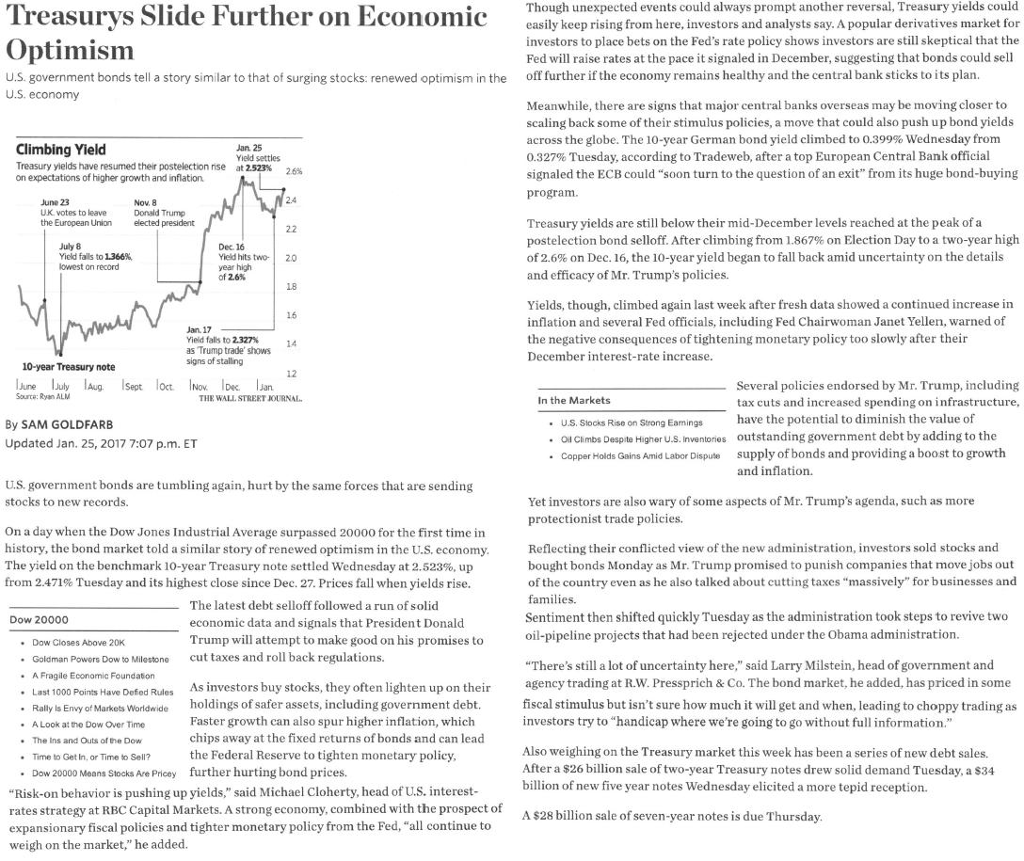

Treasurys Slide Further on Economic Optimism U.S government bonds tell a story similar to that of surging stocks: renewed optimism in the U.S. economy Climbing Yield Jan 25 Yield settles Treasury yields have resumed their postelection nse at 2523% on expectations of higher growth and inflation June 23 Nov, 8 UK votes to leave the European Union elected president July 8 Dec 16 Yield fails to1366% Yield hits two- 20 lowest on record year high of 2.6% Jan.17 Yield falls to 2.327% as Trump trade' shows signs of stalling 10-year Treasury note Source: Ryan ALM THE WALL STREET JOURNAL By SAM GOLDFARB Updated Jan. 25, 2017 7:07 p.m. ET US government bonds are tumbling again, hurt by the same forces that are sending stocks to new records On a day when the Dow Jones Industrial Average surpassed 2000o for the first time in history, the bond market told a similar story of renewed optimism in the U.S. economy The yield on the benchmark 10-year Treasury note se ed Wednesday at 2.523%, up from 2.471% Tuesday and its highest close since Dec. 27. Prices fall when yields rise. The latest debt sellofffollowed a run of solid Dow 20000 economic data and signals that President Donald Trump w attempt to make good on his promises to Dow Closes Above 20K cut taxes and roll back regulations Goldman Powers Dow to Milestone A Fragile Economic Foundation As investors buy stocks, they often lighten up on their Last 1000 Points Have Defed Rules holdings of afer assets, including government debt Rally Envy of Markets Worldwide Faster growth can also spur higher inflation, which A Look at the Dow Over Time chips away at the fixed returns ofbonds and can lead The Ins and Outs ofthe Dow the Federal Reserve to tighten monetary policy, Time to Getlin, or Time to Sell? Dow 20000 Means stocks Are Pricey further hurting bond prices. "Risk-on behavior is pushing up yields," said Michael Cloherty,head of U.S. interest rates strategy at RBC Capital Markets. A stron economy, combined with the prospect of expansionary fiscal policies and tighter monetary policy from the Fed,"a continue to weigh on the market," he added. Though unexpected events could always prompt another reversal, Treasury yields could easily keep rising from here, investors and analysts say. A popular derivatives market for skeptical that the investors to place bets on the Fed's rate policy shows investors are st Fed will raise rates t the pace it signaled in December, suggesting that bonds could sell off further if the economy remains healthy and the central bank sticks to its plan Meanwhile, there are signs at major central banks overseas may be moving closer to scaling back some of their stimulus policies, a move that could also push up bond yields across the globe. The lo-year German bond yield climbed to 0.399% Wednesday from o.327% Tuesday, according to Tradeweb, after a top European Central Bank official signaled the ECB could "soon turn to the question of an exit" from its huge bond-buying program. Treasury yields are still below their mid-December levels reached at the peak of a postelection bond selloff. After climbing from 1.867% on Election Day to a two-year high of 2.69 on Dec. 16, the 10-year yield began to fall backamid uncertainty on the details and efficacy of Mr. Trump's policies. Yields, though, climbed again last week after fresh data showed a continued increase in nflation and several Fed officials, including Fed Chairwoman Janet Yellen, warned o he negative consequences of tightening monetary policy too slowly after their December interest-rate increase Several policies endorsed by Mr. Trump, including n the Markets tax cuts and increased spending on infrastructure have the potential to diminish the value of US. Stocks Rise on Strong Eamings outstanding government debt by adding to the ON Climbs Desporte Higher U.S. Inventories supply of bonds and providing a boost to growth Copper Holds Gains Amid Labor Dispute and inflation. Yet investors are also wary of some aspects of Mr. Trump's agenda, such as more protectionist trade policies. Reflecting their conflicted view of the new administration nvestors sold stocks and bought bonds Monday as Mr. Trump promised to punish companies that movejobs out ng taxes "massively" for businesses and of the country even as he also talked about cut fam es. Sentiment then shifted quickly Tuesday as the administration took steps to revive two oil-pipeline projects that had been rejected under the Obama administration said Larry Milstein, head of government and "There's still a lot of uncertainty here agency trading at RW. Pressprich &Co. The bond market, he added, has priced in some fiscal stimulus but isn't sure how much it will get and when, leading to choppy trading as investors try to "handicap where we're going to go without full information Also weighing on the Treasury market this week has been a series of new debt sales. After a $26 billion sale of two-year Treasury notes drew solid demand Tuesday, a s34 billion of new five year notes Wednesday elicited a more tepid reception. A$28 billion sale of seven-year notes is due Thursday