Answered step by step

Verified Expert Solution

Question

1 Approved Answer

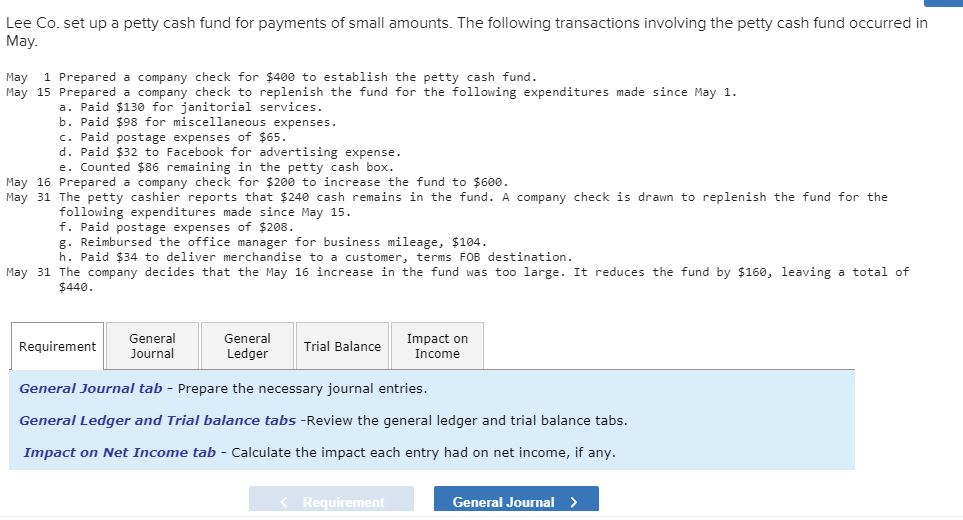

Please write all 5 journal entries with a little description. Lee Co. set up a petty cash fund for payments of small amounts. The following

Please write all 5 journal entries with a little description.

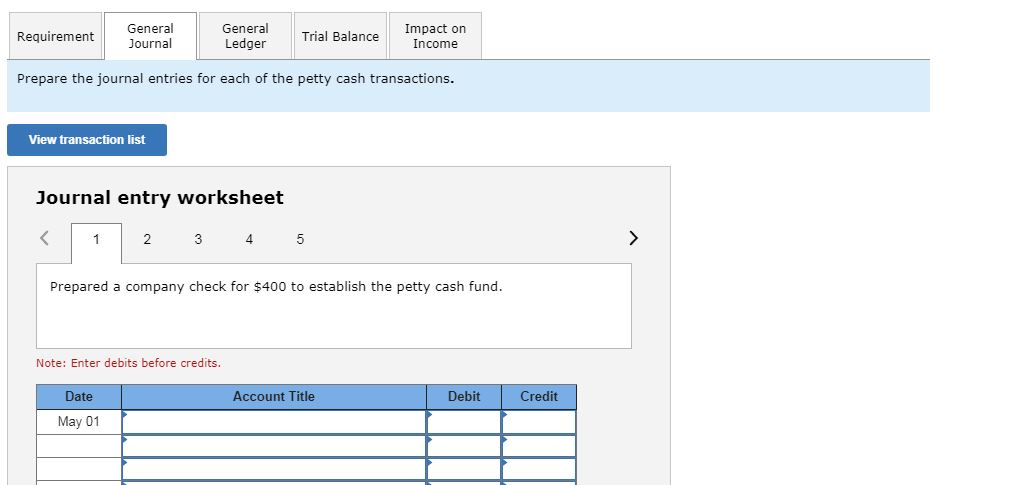

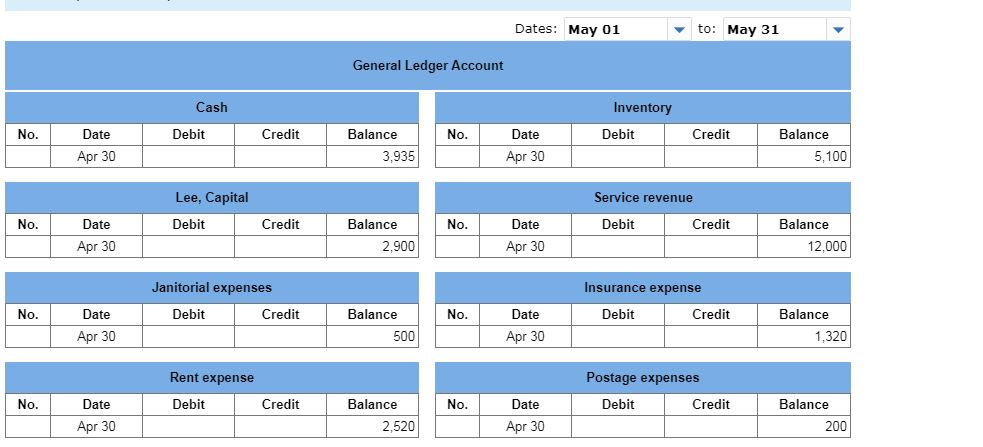

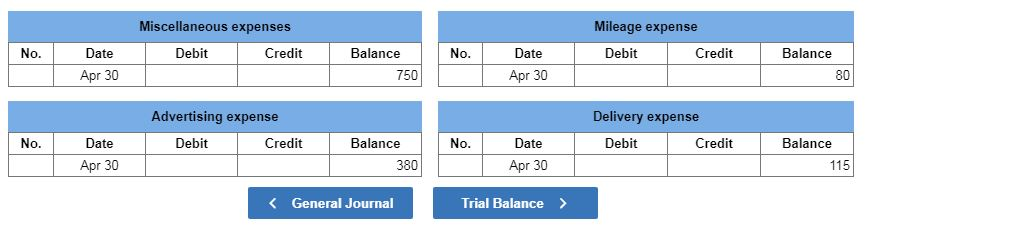

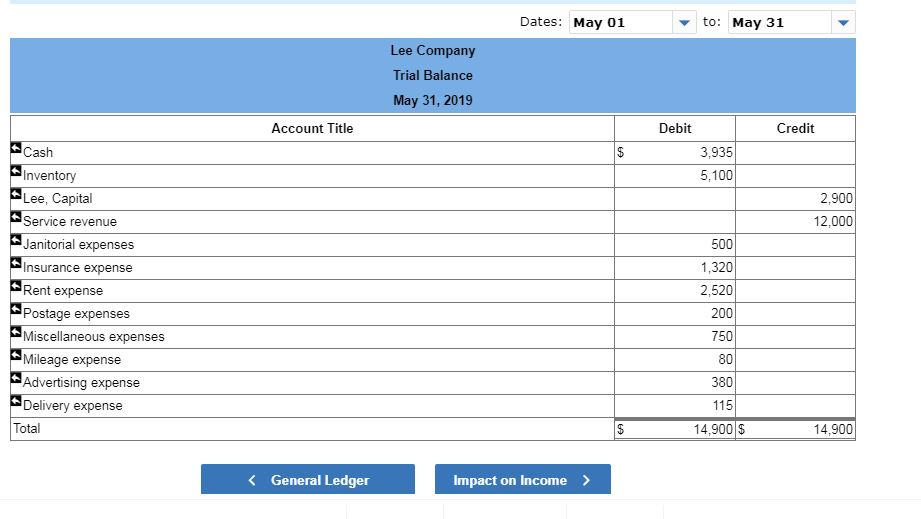

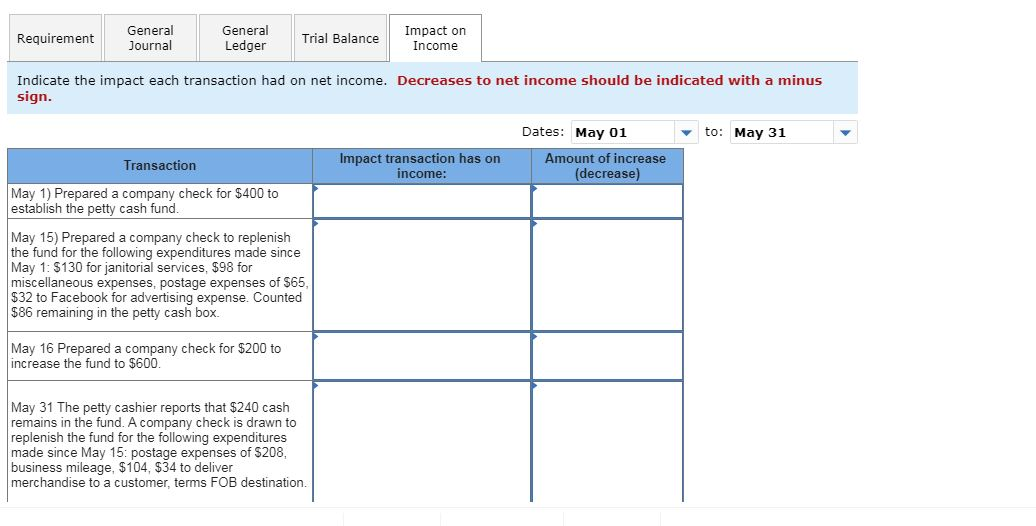

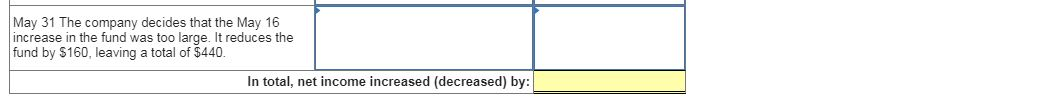

Lee Co. set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May. 1 Prepared a company check for $400 to establish the petty cash fund May May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1 a. Paid $130 for janitorial services b. Paid $98 for miscellaneous expenses c. Paid postage expenses d. Paid $32 to Facebook for advertising expense e. Counted $86 remaining in the petty cash box $65 May 16 Prepared a company check for $200 to increase the fund to $600. May 31 The petty cashier reports that $240 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15 f. Paid postage expenses of $208 g. Reimbursed the office manager for business mileage, $104 h. Paid $34 to deliver merchandise to a customer, terms FOB destination May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $160, leaving a total of $440 General Impact on General Trial Balance Requirement Journal Ledger Income General Journal tab Prepare the necessary journal entries. General Ledqer and Trial balance tabs-Review the general ledger and trial balance tabs. Impact on Net Income tab Calculate the impact each entry had on net income, if any. General Journal> Requirement General Journal General Impact on Requirement Trial Balance Ledger Income Prepare the journal entries for each of the petty cash transactions. View transaction list Journal entry worksheet 1 2 4 5 Prepared a company check for $400 to establish the petty cash fund. Note: Enter debits before credits Date Account Title Debit Credit May 01 Dates: May 01 to: May 31 General Ledger Account Cash Inventory Credit Credit No. Date Debit Balance No. Date Debit Balance Apr 30 3,935 Apr 30 5,100 Lee, Capital Service revenue Credit Balance Balance No. Date Debit No. Date Debit Credit Apr 30 2,900 Apr 30 12,000 Janitorial expenses Insurance expense No. Date Debit Credit Balance No. Date Debit Credit Balance 1,320 Apr 30 Apr 30 500 Rent expense Postage expenses No. Date Debit Credit Balance No. Date Debit Credit Balance Apr 30 2,520 Apr 30 200 Miscellaneous expenses Mileage expense No. Date Debit Credit Balance No. Date Debit Credit Balance Apr 30 Apr 30 750 80 Advertising expense Delivery expense Debit No. Date Credit Balance No. Date Debit Credit Balance Apr 30 Apr 30 380 115 General Journal Trial Balance > Dates: May 01 to: May 31 Lee Company Trial Balance May 31, 2019 Credit Account Title Debit Cash 3,935 Inventory Lee, Capital Service revenue 5,100 2,900 12,000 Janitorial expenses 500 Insurance expense 1,320 Rent expense 2,520 Postage expenses 200 Miscellaneous expenses 750 Mileage expense Advertising expense Delivery expense Total 80 380 115 14,900 14,900 S $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started