Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please write brief and in detail and appropriate answer with references Topic is ADIB Bank UAE Q1. Give a brief overview of ADIB bank, including

please write brief and in detail and appropriate answer with references

Topic is ADIB Bank UAE

Q1. Give a brief overview of ADIB bank, including its strategic goals, quality mission, and its quality guidelines.

Q2

here is the example for Q2 but its for some other topic just to show how to write its answer in brief

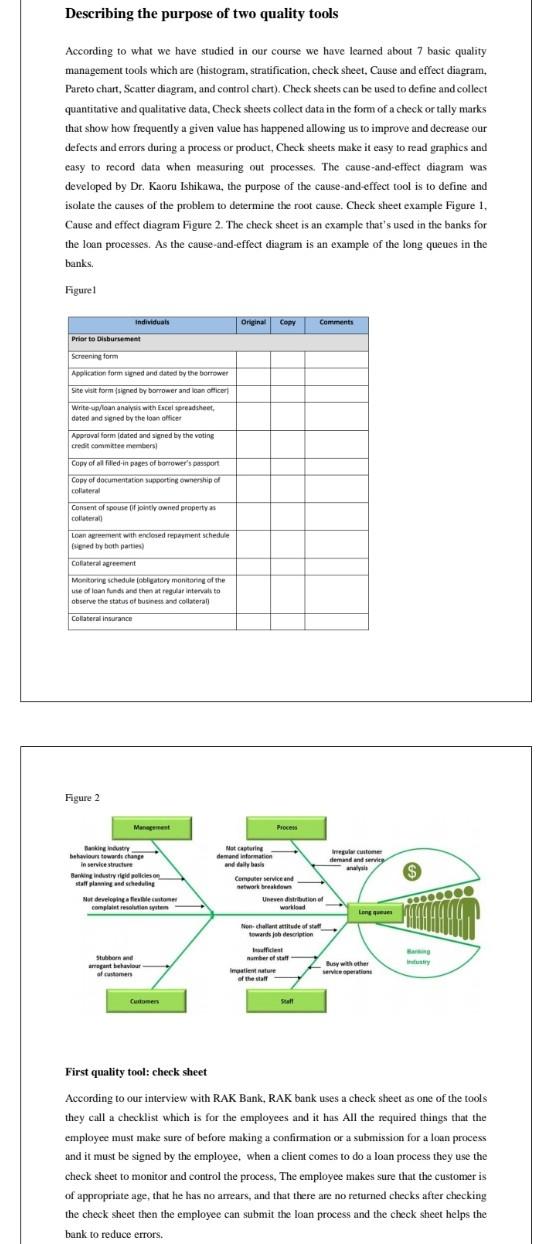

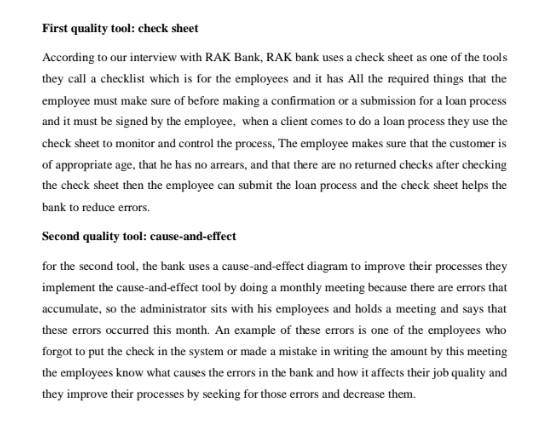

Investigate and describe the purpose of at least TWO quality tools the organization currently uses to control, monitor and or continuously improve its processes. Please ensure to provide actual examples of the tools used i.e., graphs, control charts, cause and effect diagrams etc. Describing the purpose of two quality tools According to what we have studied in our course we have learned about 7 basic quality management tools which are (histogram, stratification, check sheet, Cause and effect diagram, Pareto chart, Scatter diagram, and control chart). Check sheets can be used to define and collect quantitative and qualitative data, Check sheets collect data in the form of a check or tally marks that show how frequently a given value has happened allowing us to improve and decrease our defects and errors during a process or product, Check sheets make it easy to read graphics and easy to record data when measuring out processes. The cause-and-effect diagram was developed by Dr. Kaoru Ishikawa, the purpose of the cause-and-effect tool is to define and isolate the causes of the problem to determine the root cause. Check sheet example Figure 1 . Cause and effect diagram Figure 2. The check sheet is an example that's used in the banks for the loan processes. As the cause-and-effect diagram is an example of the long queues in the banks. Figurel First quality tool: check sheet According to our interview with RAK Bank, RAK bank uses a check sheet as one of the rools they call a checklist which is for the employees and it has All the required things that the employee must make sure of before making a confirmation or a submission for a loan process and it must be signed by the employee, when a client comes to do a loan process they use the check sheet to monitor and control the process, The employee makes sure that the customer is of appropriate age, that he has no arrears, and that there are no returned checks after checking the check sheet then the employee can submit the loan process and the check sheet helps the bank to reduce errors. First quality tool: check sheet According to our interview with RAK Bank, RAK bank uses a check sheet as one of the tools they call a checklist which is for the employees and it has All the required things that the employee must make sure of before making a confirmation or a submission for a loan process and it must be signed by the employee, when a client comes to do a loan process they use the check sheet to monitor and control the process, The employee makes sure that the customer is of appropriate age, that he has no arrears, and that there are no returned checks after checking the check sheet then the employee can submit the loan process and the check sheet helps the bank to reduce errors. Second quality tool: cause-and-effect for the second tool, the bank uses a cause-and-effect diagram to improve their processes they implement the cause-and-effect tool by doing a monthly meeting because there are errors that accumulate, so the administrator sits with his employees and holds a meeting and says that these errors occurred this month. An example of these errors is one of the employees who forgot to put the check in the system or made a mistake in writing the amount by this meeting the employees know what causes the errors in the bank and how it affects their job quality and they improve their processes by seeking for those errors and decrease them. Additional quality tools Based on our interview with Ms. Maryam Alfalahi, we found out that RAK Bank is currently implementing two quality management tools that are: a check sheet as well as cause-and-effect diagram in order to solve the problems that the bank might face. We recommend that RAK Bank applies the Pareto chant, scatter diagrums, and flowcharts as quality management tools. Pareto chart A Pareto chart is a beneficial tool that helps an organization to focus on separating the serious important problems from the trivial ones, the concept behind this tool is that eighty percent of the problems happen because of twenty percent of the reasons. Using Pareto charts to solve problems helps the organization concentrate its limited resources in the right way. Moreover. RAK Bank can use this tool to distinguish between major problems and small problems for example: long waiting time, bad customer service, complex procedures, errors in transactions. bad facility layout, poot locations, and bad working conditions. We believe that if RAK Bank implemented this tool, it would enhance the performance of all departments as they will be able to identify the most critical problems. Applying the Pareto chart will also allow RAK Bank to save money and time due to utilizing their limited resources in solving serious matters instead of wasting them trying to solve problems that are not significant. Seatter diagram The second quality management tool that we suggest is the scatter diagram because it is known to be the simplest tool among the seven other tools. Scatter diagrams are used to demonstrate how two variables are related. There are three types of correlations: positive (strong/weak). negative (strong/weak), and no correlation. In case RAK Bank executed this tool, they can for example determine the relationship between the working hours and the quality of service provided, if there were long working hours, eventually, the quality of the service provided will be poor because employees are most likely to be tired and vice versa. Or else, they can use them to detemine the correlation between the customer satisfaction rate and the behaviour of the employees or service providers. Flowchart The Flowchart is the last tool that we advise RAK Bank to use. A flowchart is a diagram that is used for the graph inputs, steps, and outputs of a specific process. There are basic symbols that are used when charting flowcharts, including Start/End to illustrate the beginning and end of a process, Decision Making which is a checkpoint that has branches to it, Arrows to show the path, and Steps. The additional symbols of flowcharts are documentation, Input/Output, Wait, and Measure, RAK Bank can benefit from Flowcharts in many ways, for instance: to understand how a process is done, to plan for improvements or projects, and to document processes. In addition to that, banks like RAK Bank can use Flowcharts to make a depositing system and withdrawing system just like the process we used in the project which is the loaning system in RAK Bank In the end, we suppose that RAK Bank should consider executing these previous tools that we mentioned because we guarantee that they will take the performance to the next level and allow the bank to continuously improve which are both the purpose of using these tools in any quality setting. Continual improvement method Furthermore, RAKBANK can work on different improvement methods. However, we recommend RAKBANK use the lean six sigma method. Lean six sigma is a method used to improve an organization continually by eliminating of reducing waste and defects systematically. RAKBANK a broad range of financial services like loans, retail banking, and money transmission. RAKBANK needs to implement lean six sigma in all departments. To do that the company needs to follow a series of steps to identify the areas of improvement. First, the company needs to get management support by communicating the need of implementing lean six sigma in RAKBANK to gain their support. Second, raise awareness in the company to ensure that the employees are trained to implement lean six sigma successfully. For example. the company can offer the employees courses to get the yellow belt, green belt, and black belt. The company needs to have the necessary resources to implement it. Third, establish ownership by assigning people to be responsible for implementing the strategy. As this would create a sense of responsibility and engagement. Fourth, creating value. This is done by identifying what creates value for the customers. Fifth, prioritize the tasks by working on the most important tasks first and then working on the other tasks. So, organizing the task from the most important to the least important tasks. Sixth, gathering data to identify the causes of the problems and identify the solutions. For example, RAKBANK can use value stream mapping to identify the root causes of the firm's problems. Seventh, sustain improvements by committing to continuously improve. This would help the company establish an environment where employees can leam continuously. The implementation of lean six sigma will have several benefits for RAKBANK. For instance, in the loan department, the company will be able to reduce the time to process a loan application. Also, it would reduce the error in the account opening process, money transfers, and the bank's environment. As it will reduce the delivery time. And improve accuracy, timeliness, and customer communication. While in the company it will improve RAKBANK's working environment. In addition, there are different types of waste that the lean six sigma strategy could reduce in the bank. Such as overprocessing which means that there are so many steps. The production is about a high amount of information like printing a high amount of customer application forms. The motion is about the poor layout of the RAKBANK branches, Waiting is another type of waste and it's about the time that the internal and extermal customers need to wait. Inventory could be a type of waste because if the bank had a high inventory it could lead to waste. Such as plastic cards and printed customer forms. Transportation is about the transpont of documents and staff movement for meetings. Reworking or rechecking is about not getting things right the first time which could waste effort and time. While in the company it will improve RAKBANK's working environment. Conclusion In conclusion, in our interview, we knew that RAK bank uses two kinds of quality management tools which are check sheets and cause and effect. we've created a flow chart that describes a loan process, and we improved it we saw that the loan process takes a lot of time RAK bank should facilitate the loan process by decreasing the number of steps in it. Our recommendations to RAK bank are to use the Pareto chart because it's a beneficial tool that helps separate serious important problems from ordinary problems. And we suggest the yse a scatter diagram. RAK bank should consider executing those tools that we suggested to take their performance to a next level and to continuously improve their work quality

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started