Please write clear answer for e and f only and I have uploaded the answer for a, b, c, d in case you need it

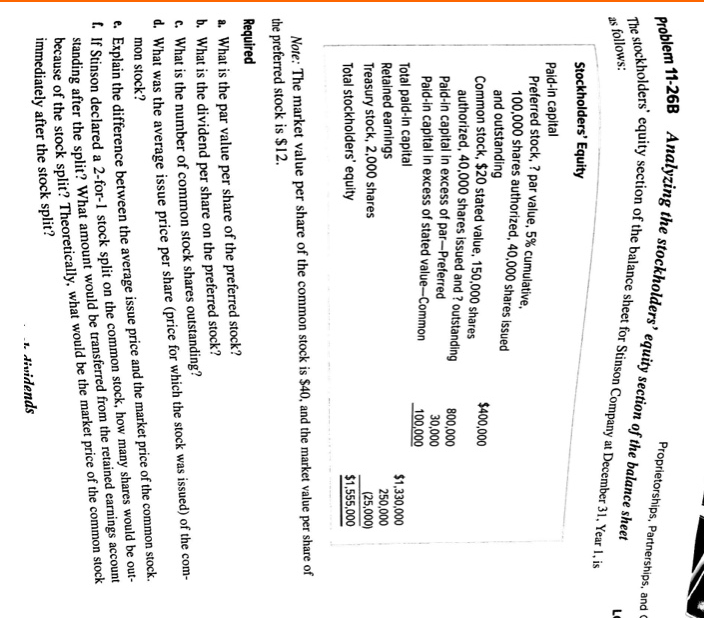

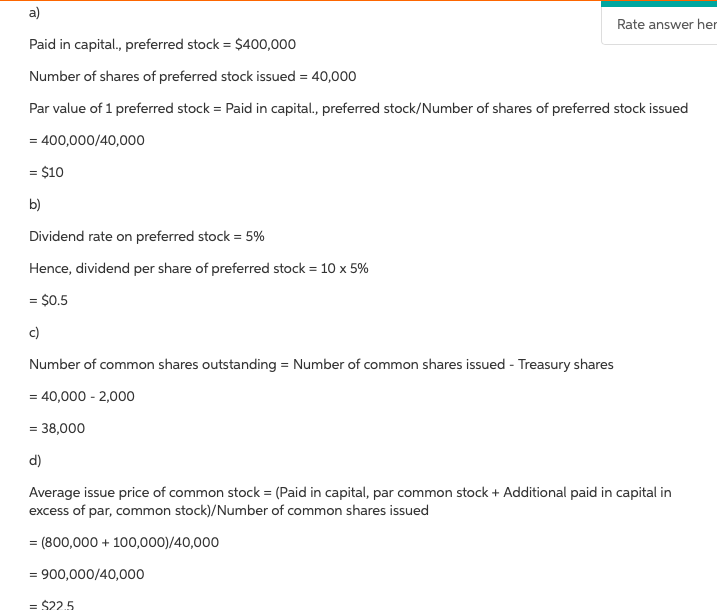

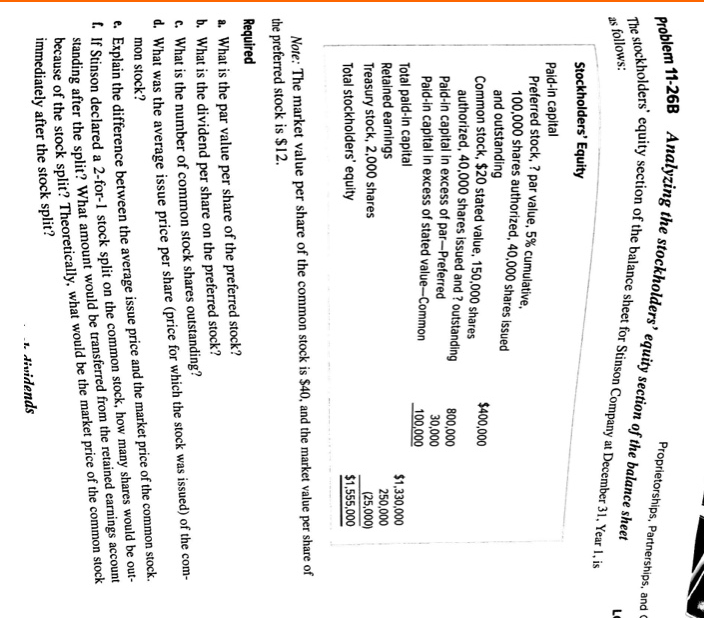

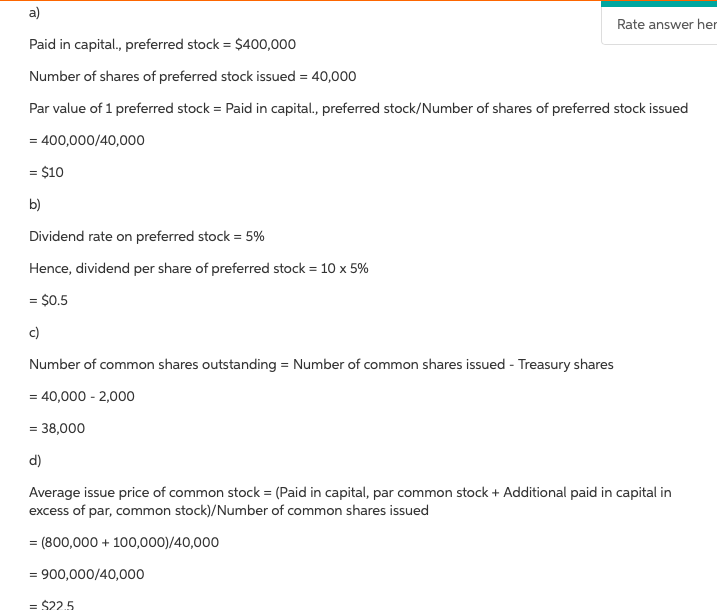

11-26B Analyzing the stockho kholders' equity section of the balance sheet for Stinson Co Proprietorships, Partnerships, and lders' equity section of the balance sheet as follows r Stinson Company at December 31, Year , is Stockholders' Equity Paid-in capital Preferred stock. ? par value, 5% cumulative 100,000 shares authorized, 40,000 shares issued and outstanding Common stock, $20 stated value, 150,000 shares 400,000 authorized, 40,000 shares issued and ? outstanding 800,000 0,000 Paid-in capital in excess of par-Preferred Paid-in capital in excess of stated val Total paid-in capital Retained earnings Treasury stock, 2,000 shares Total stockholders' equity mon 1,330,000 250,000 (25,000) $1,555,000 Note: The market value per share of the common stock is S40, and the market value per share of the preferred stock is $12 Required a. What is the par value per share of the preferred stock? b. What is the dividend per share on the preferred stock? c. What is the number of common stock shares outstanding? d. What was th e average issue price per share (price for which the stock was issued) of the com- xplain the difference between the average issue price and the market price of the common stock. r Stinson declared a 2-for-I stock split on the common stock, how many shares would be out standing after the split? What amount would be transferred from the retained earnings account mon stock? e. E [. I ause of the stock split? Theoretically, what would be the market price of the common stock immediately after the stock split? L. lividends a) Paid in capital., preferred stock $400,000 Number of shares of preferred stock issued 40,000 Par value of 1 preferred stock Paid in capital, preferred stock/Number of shares of preferred stock issued Rate answer her 400,000/40,000 = $10 b) Dividend rate on preferred stock = 5% Hence, dividend per share of preferred stock-10 x 5% $0.5 Number of common shares outstanding Number of common shares issued-Treasury shares = 40,000-2,000 38,000 d) Average issue price of common stock (Paid in capital, par common stock +Additional paid in capital in excess of par, common stock)/Number of common shares issued (800,000+100,000)/40,000 900,000/40,000 $22.5