Please write down each step. I'll thumb up. Thanks!

Please write down each step. I'll thumb up. Thanks!

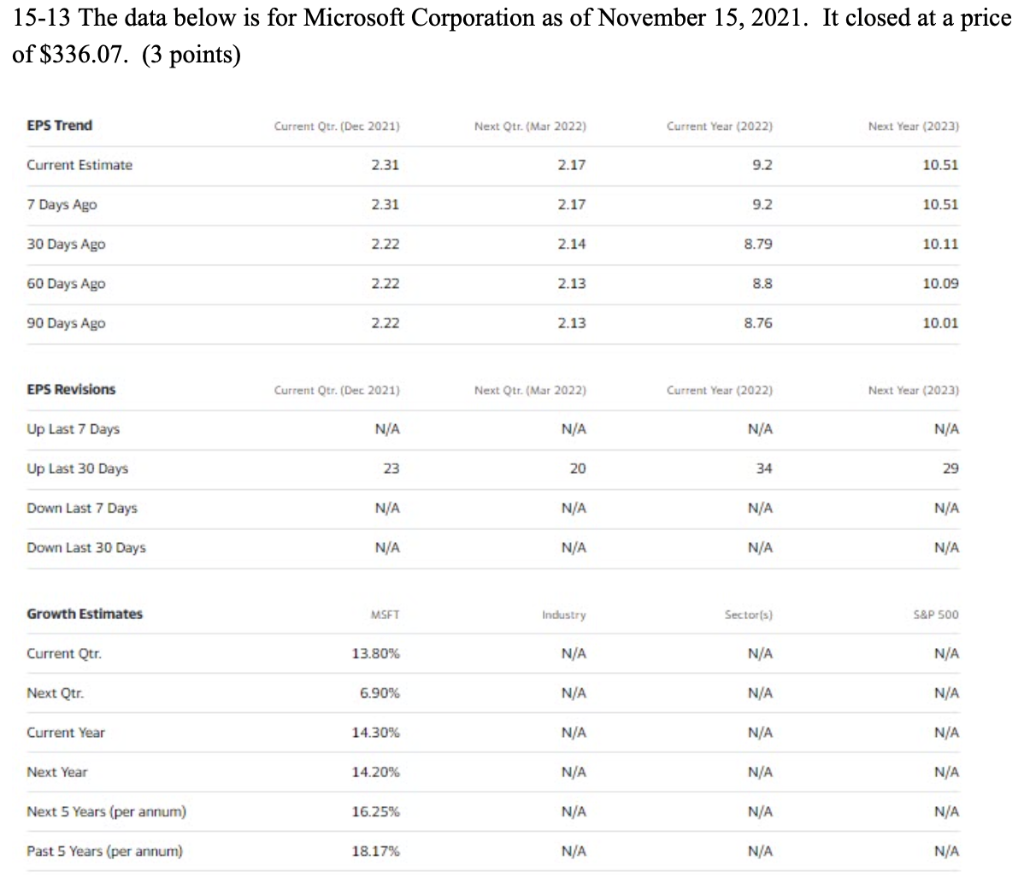

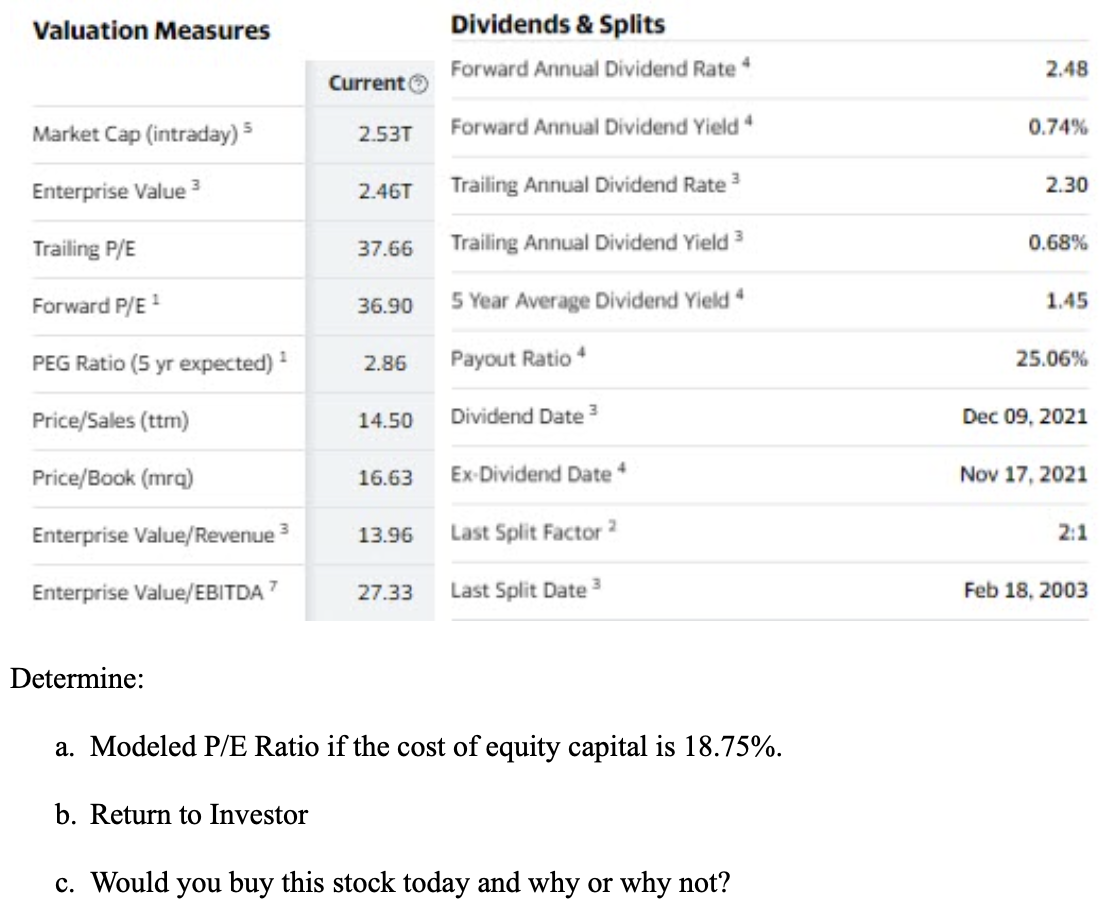

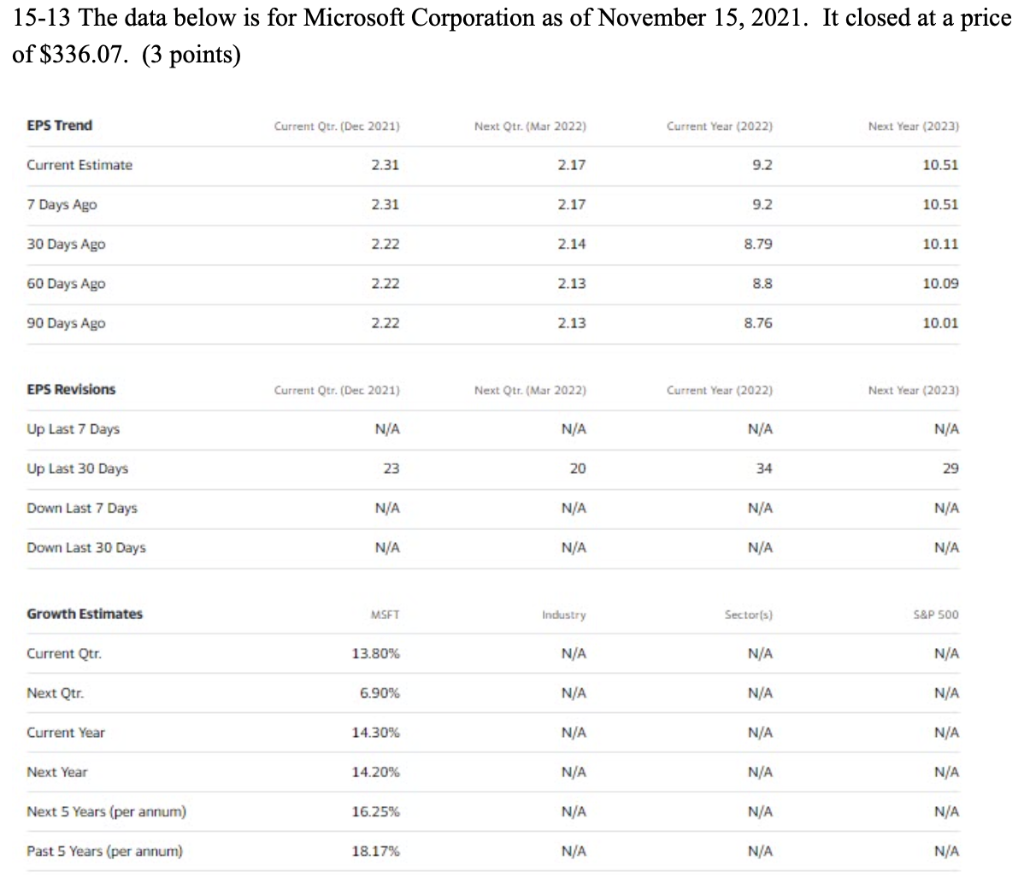

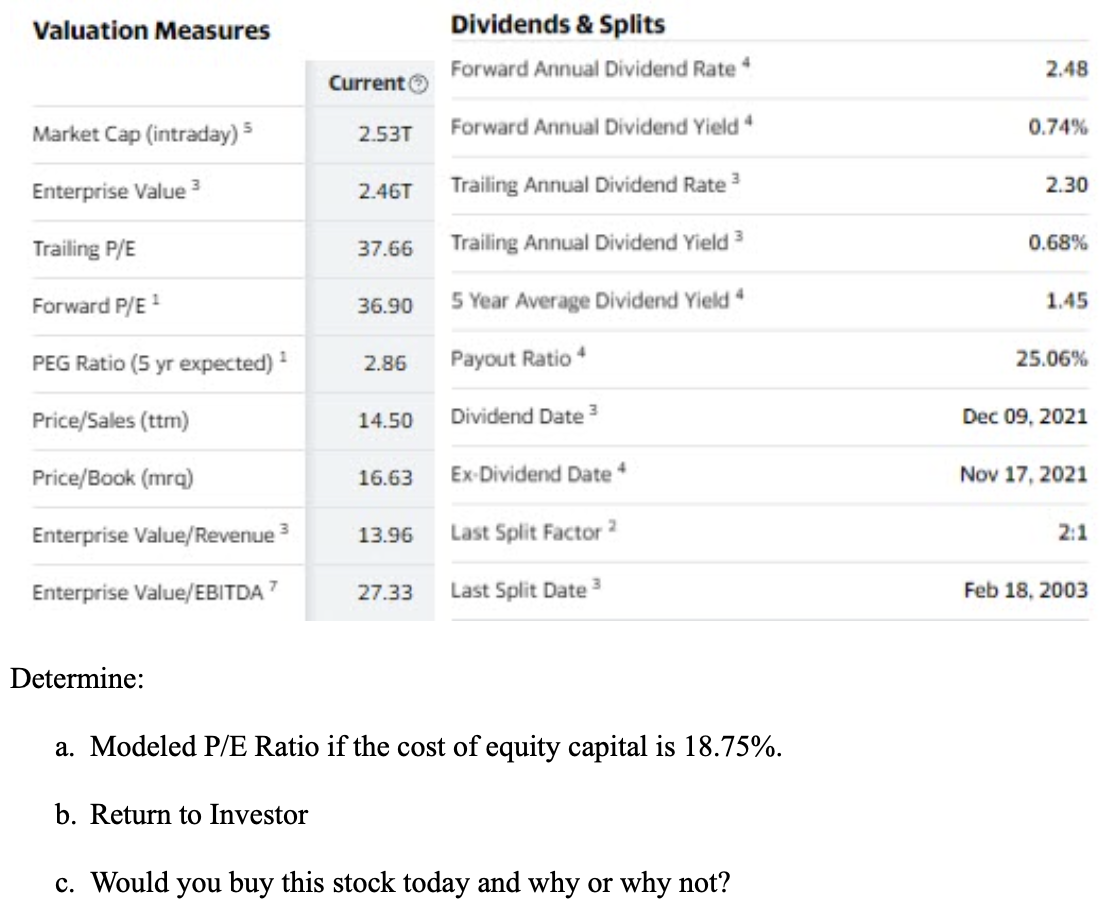

15-13 The data below is for Microsoft Corporation as of November 15, 2021. It closed at a price of $336.07. (3 points) EPS Trend Current Otr. (Dec 2021) Next Otr. (Mar 2022) Current Year (2022) Next Year (2023) Current Estimate 2.31 2.17 9.2 10.51 7 Days Ago 2.31 2.17 9.2 10.51 30 Days Ago 2.22 2.14 8.79 10.11 60 Days Ago 2.22 2.13 8.8 10.09 90 Days Ago 2.22 2.13 8.76 10.01 EPS Revisions Current Otr. (Dec 2021) Next Otr. (Mar 2022) Current Year (2022) Next Year (2023) Up Last 7 Days N/A N/A N/A N/A Up Last 30 Days 23 20 34 29 Down Last 7 Days N/A N/A N/A N/A Down Last 30 Days N/A N/A N/A N/A Growth Estimates MSFT Industry Sector(s) S&P 500 Current Qtr. 13.80% N/A N/A N/A Next Qtr. 6.90% N/A N/A N/A Current Year 14.30% N/A N/A N/A Next Year 14.20% N/A N/A N/A Next 5 Years (per annum) 16.25% N/A N/A N/A Past 5 Years (per annum) 18.17% N/A N/A N/A Valuation Measures Dividends & Splits Forward Annual Dividend Rate * 2.48 Current Market Cap (intraday) 2.53T 0.74% Forward Annual Dividend Yield Trailing Annual Dividend Rate? 2.46T 2.30 Enterprise Value Trailing P/E Forward P/E 1 37.66 Trailing Annual Dividend Yield 0.68% 36.90 5 Year Average Dividend Yield 1.45 1 PEG Ratio (5 yr expected) 2.86 25.06% Payout Ratio Dividend Date Price/Sales (ttrn) 14.50 Dec 09, 2021 Price/Book (mra) 16.63 Ex Dividend Date Nov 17, 2021 Enterprise Value/Revenue 3 13.96 2:1 Last Split Factor? Last Split Date Enterprise Value/EBITDA 27.33 Feb 18, 2003 Determine: a. Modeled P/E Ratio if the cost of equity capital is 18.75%. b. Return to Investor c. Would you buy this stock today and why or why not? 15-13 The data below is for Microsoft Corporation as of November 15, 2021. It closed at a price of $336.07. (3 points) EPS Trend Current Otr. (Dec 2021) Next Otr. (Mar 2022) Current Year (2022) Next Year (2023) Current Estimate 2.31 2.17 9.2 10.51 7 Days Ago 2.31 2.17 9.2 10.51 30 Days Ago 2.22 2.14 8.79 10.11 60 Days Ago 2.22 2.13 8.8 10.09 90 Days Ago 2.22 2.13 8.76 10.01 EPS Revisions Current Otr. (Dec 2021) Next Otr. (Mar 2022) Current Year (2022) Next Year (2023) Up Last 7 Days N/A N/A N/A N/A Up Last 30 Days 23 20 34 29 Down Last 7 Days N/A N/A N/A N/A Down Last 30 Days N/A N/A N/A N/A Growth Estimates MSFT Industry Sector(s) S&P 500 Current Qtr. 13.80% N/A N/A N/A Next Qtr. 6.90% N/A N/A N/A Current Year 14.30% N/A N/A N/A Next Year 14.20% N/A N/A N/A Next 5 Years (per annum) 16.25% N/A N/A N/A Past 5 Years (per annum) 18.17% N/A N/A N/A Valuation Measures Dividends & Splits Forward Annual Dividend Rate * 2.48 Current Market Cap (intraday) 2.53T 0.74% Forward Annual Dividend Yield Trailing Annual Dividend Rate? 2.46T 2.30 Enterprise Value Trailing P/E Forward P/E 1 37.66 Trailing Annual Dividend Yield 0.68% 36.90 5 Year Average Dividend Yield 1.45 1 PEG Ratio (5 yr expected) 2.86 25.06% Payout Ratio Dividend Date Price/Sales (ttrn) 14.50 Dec 09, 2021 Price/Book (mra) 16.63 Ex Dividend Date Nov 17, 2021 Enterprise Value/Revenue 3 13.96 2:1 Last Split Factor? Last Split Date Enterprise Value/EBITDA 27.33 Feb 18, 2003 Determine: a. Modeled P/E Ratio if the cost of equity capital is 18.75%. b. Return to Investor c. Would you buy this stock today and why or why not

Please write down each step. I'll thumb up. Thanks!

Please write down each step. I'll thumb up. Thanks!