Answered step by step

Verified Expert Solution

Question

1 Approved Answer

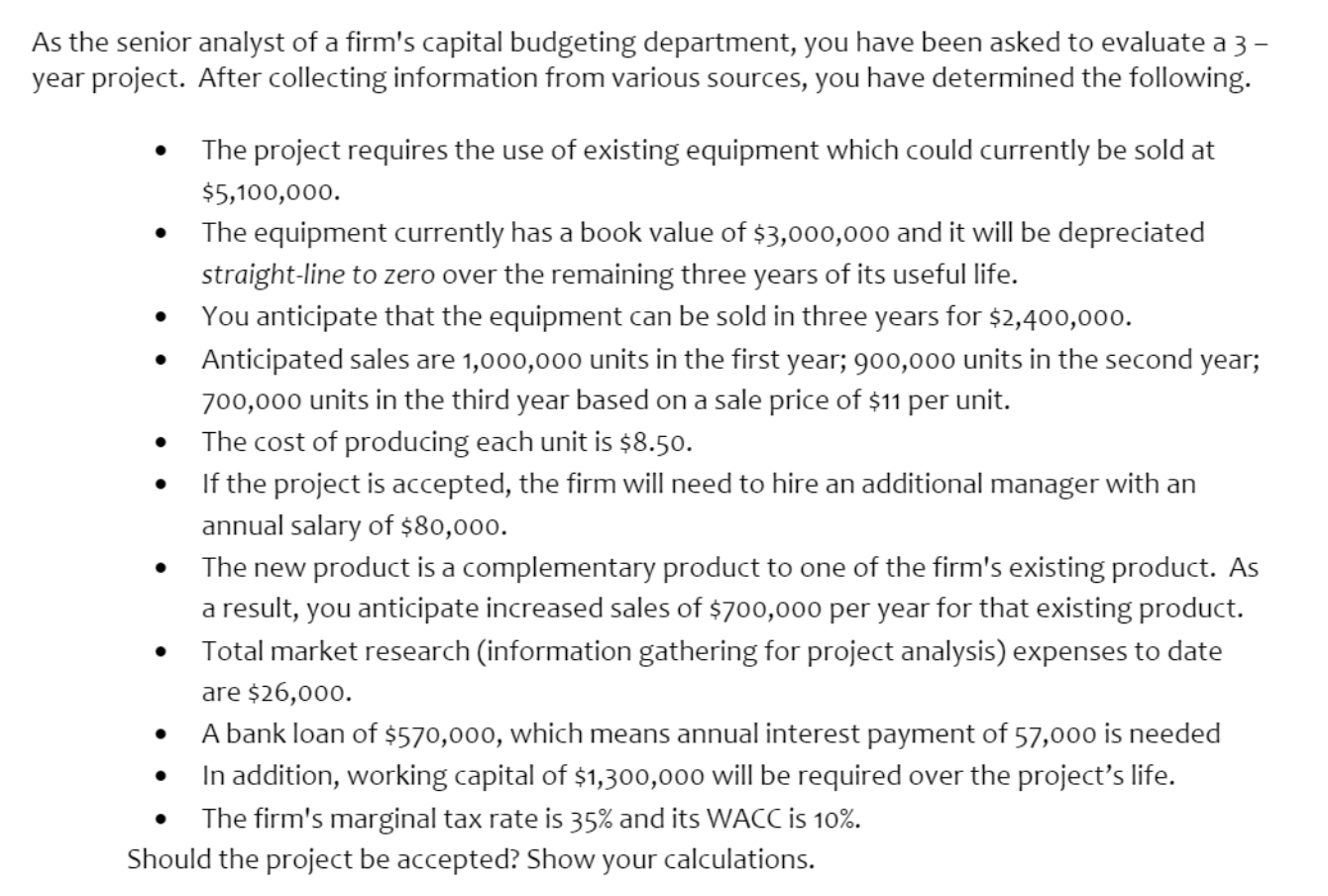

Please write down the complete formula As the senior analyst of a firm's capital budgeting department, you have been asked to evaluate a 3- year

Please write down the complete formulaAs the senior analyst of a firm's capital budgeting department, you have been asked to evaluate a 3- year project. After collecting information from various sources, you have determined the following. . . . . . The project requires the use of existing equipment which could currently be sold at $5,100,000. The equipment currently has a book value of $3,000,000 and it will be depreciated straight-line to zero over the remaining three years of its useful life. You anticipate that the equipment can be sold in three years for $2,400,000. Anticipated sales are 1,000,000 units in the first year; 900,000 units in the second year; 700,000 units in the third year based on a sale price of $11 per unit. The cost of producing each unit is $8.50. If the project is accepted, the firm will need to hire an additional manager with an annual salary of $80,000. The new product is a complementary product to one of the firm's existing product. As a result, you anticipate increased sales of $700,000 per year for that existing product. Total market research (information gathering for project analysis) expenses to date are $26,000. A bank loan of $570,000, which means annual interest payment of 57,000 is needed In addition, working capital of $1,300,000 will be required over the project's life. The firm's marginal tax rate is 35% and its WACC is 10%. Should the project be accepted? Show your calculations. . a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started