Answered step by step

Verified Expert Solution

Question

1 Approved Answer

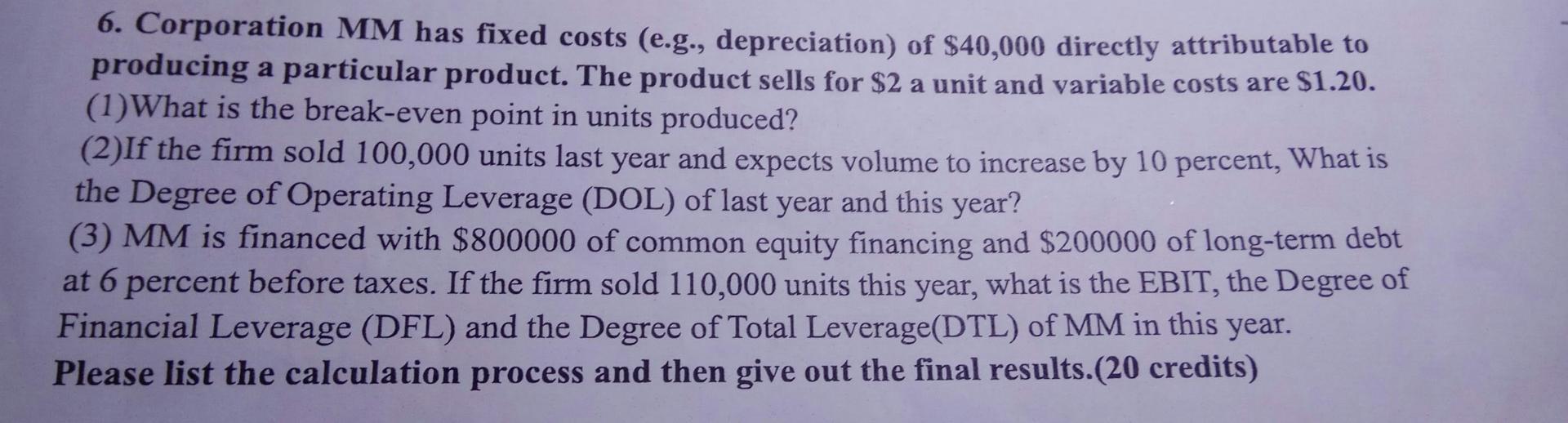

please write in details by Finance expert 6. Corporation MM has fixed costs (e.g., depreciation) of $40,000 directly attributable to producing a particular product. The

please write in details by Finance expert

6. Corporation MM has fixed costs (e.g., depreciation) of $40,000 directly attributable to producing a particular product. The product sells for $2 a unit and variable costs are $1.20. (1) What is the break-even point in units produced? (2)If the firm sold 100,000 units last year and expects volume to increase by 10 percent, What is the Degree of Operating Leverage (DOL) of last year and this year? (3) MM is financed with $800000 of common equity financing and $200000 of long-term debt at 6 percent before taxes. If the firm sold 110,000 units this year, what is the EBIT, the Degree of Financial Leverage (DFL) and the Degree of Total Leverage(DTL) of MM in this year. Please list the calculation process and then give out the final results.(20 credits)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started