Question: Please write it from the case i send it until 2013 The fall case in the photos Written Strategic Audit for (Tesla) I. Current Situation

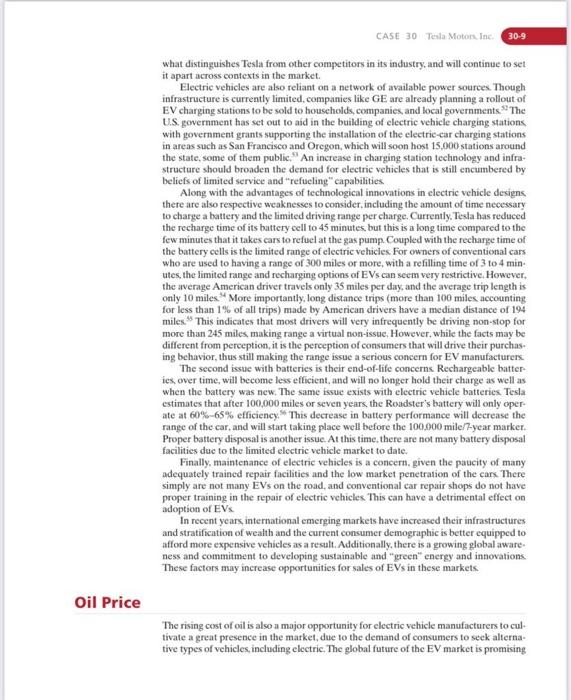

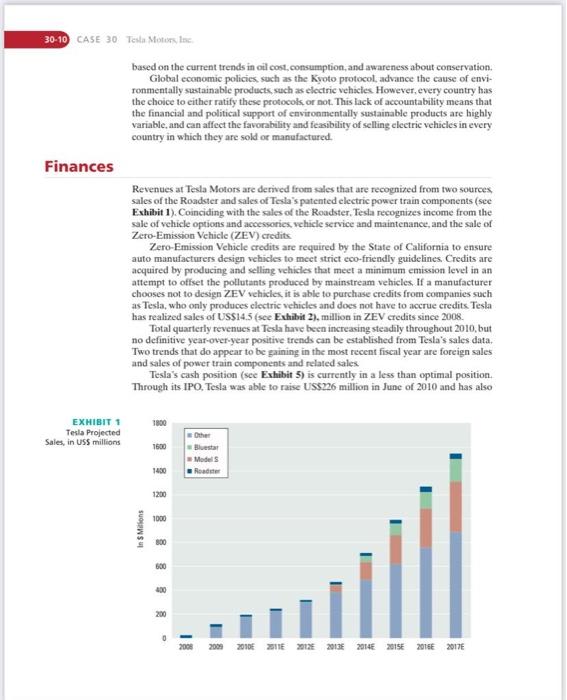

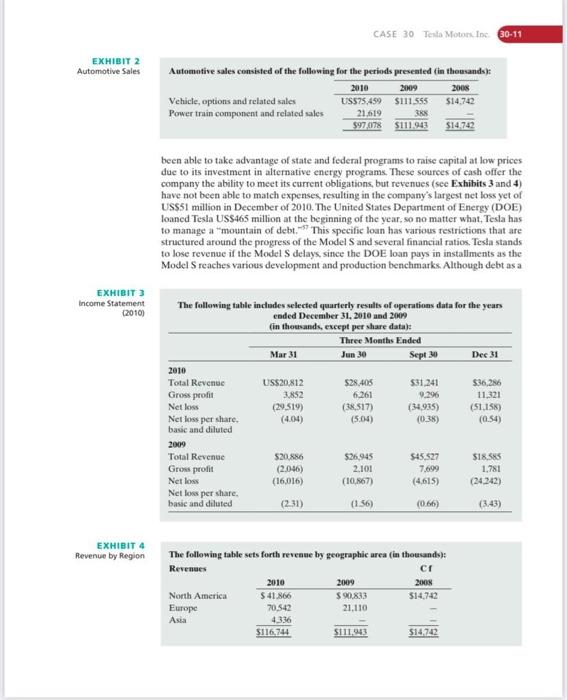

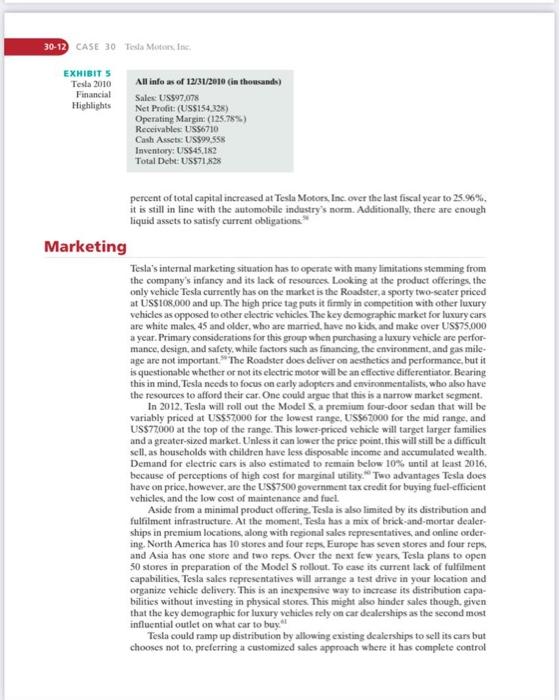

- sla Motors, Inc. is in the business of developing, manufacturing, and selling technology for high-performance electric automotives and power train components. Hoping to develop a greater worldwide acceptance of electric vehicles as an alternative to the traditional internal combustion, petroleum-based vehicles that dominate the market, Tesla is the first company that commercially produced a federally compliant electric vehicle with the design styling and performance characteristics of a high-end performance automobile. Tesla currently offers one vehicle, the Roadster. for sale, as well as supplying electric power train components to Daimler for use in its Smart EV automobile. Additionally, Tesla has a partnership with Toyota Motors to develop and supply an electric power train for Toyota's Rav4 SUV. Background Tesla Motors was founded in Silicon Valley in 2003 by Martin Eberhard and Mare Tarpenning to create efficient electric cars for driving aficionados. The founders acquired their first round of financing from PayPal and SpaceX founder Elon Musk who subsequently took over as CEO in 2008 . The company unveiled its first car, a two-seat sports car named the Roadster, in 2006 after raising $150 million and going through four years of technological and internal struggles. 1 Powered by a three-phase, four-pole AC induction motor, the Roadster has a top speed of 130mph and accelerates from 0 to 60mph in under four seconds, all completely silent. 2 Production of the Roadster began in March of 2008 with a first-year production run of 600 vehicles 3 In June 2008 . Tesla announced that it would be building a four-door, five-passenger sedan called the Model S to be This teaching case was compiled from pablished sources. The author would like to thank Linday Pacheco. Patrick Toomey. Ned Coffec. William Gormly, and Will Hoffman for their rescarch Please address all cor. respobdence to Dr. Alan N. Hottman, Dept. of Management, Bentley Univeruty. 175 Fotest Street, Waltham. MA 02452; ahoffmanG bentley, edu. Printed by permission of Dr. Alan N. Hoftiman. 30-2 CASE 30 lesla Notors inc built in California and be available for sale in 201224 The Model S is slated to retail for approximately $57400 and be offered with battery options for 160 -, 230)-, or 300 -mile ranges per charge. The company went public in June 2010 with an initial public offering at $17 a share, raising about $226.1 million in the first stock debut of a car maker since the Ford Motor Company beld its initial public offering in 1956. Tesla has also tised its innovative technology to partner with traditional automobile manufacturers on their electric vehicle offerings. In 2009, Tesla signed a deal to provide Daimier with the battery technology to power 1000 clectric Sinart city cars. "Tesla will supply battery packs and clectric power trains to Daimler and in return it will receive auto manufacturing and design expertise in areas including safety requirements and mass production of vehicles. . ater in that same year, Daimler announced that it had acquired a "nearly 10 percent" stake in Tesla." On October 6, 2010, Tesla entered into a Phase 1 Contract Services Agreement with Toyota Motor Corporation for the development of a validated power train system, including a battery. power electronics module. motor, gearbox, and associated soft ware, which will be integrated into an electric vehicle version of the RAV4 for which Tesla received USS60 million." In May 2010, Tesla purchased the former NUMMI factory in Frcmont, Califoraia, one of the largest, most advanced and cleanest automotive production plants in the world, where it will build the Model S sedan and future Tesla vehicles. to Additionally. Toyota invested USS50 million in Tesla and together the two companies will cooperate on the development of electric vehicles, parts, and production system and engineering support., Strategic Direction Tesla desires to develop alternative energy electric vehcles for people who love to drive. While most car companies are developing small, compact electric cars. Tesla has focused on a high-priced, high-performance electric vehicle that competes against traditional performance cars such as those offered by BMW and Porschc. The company has also devoted many resources to rescarch and development in an effort to produce an clectric power train that has both long mileage between recharges and the high performance that car enthusiast's desire. Tesla's main objectives are to achieve both growth in sales and profits provide tech. nological leadership in the field of electric vehicles, and foster sustainability and social responsibility. The company desires for growth are served with its-development and sale of the Model $ vehicle that is expected to retail for almost half of the Roadster price and thus create higher demand and revenue. The company further strives for growth through its strategic partnerships with Toyota and Daimler to supply electric power trains to those companies for use in their electric vehicle dediens. The company's objectives of sastainability and social responsibility are shown through its desire to develop automobiles that are not powered by petroletrm products and produce very little carbon emissions. The company won the Globe Sustainability Innovation Award 2009 . Tesla's Competition Tesla's products participate in the automotive market based on its power train tech. nology. It currently competes with a number of vehicles in the non-petrolcum powered (alternative fuel) automobile seement from companies such as Mitsubishi, Nissan. General Motors (Chevy). Toyota, BMW, and Honda to name a few. Within this market segment, there are four primary means of power train propulsion which differentiate the various competitors in this market: = Electric Vehicles (EV) are vehicles powered completely by a single on-board energy storage system (battery pack or fucl cell) which is refucled directly from an electricity source. Both the Tesla Roadster and the Model S are examples of electric vehicles. = Phig-in Hybrid Vehicles (PHEV) are vehicles powered by both a battery pack with an electric motor and an internal combustion engine that can be refueled both with traditional petroleum fuels for the engine and electricity for the battery pack. The internal combustion engine can either work in parallel with the electric motor to power the wheels, such as in a parallel plug-in hybrid vehicle, or be used only to recharge the battery, such as in a series plug-in hybrid vehicle like the Chevrolet Volt. - Hybrid Electric Vehicles (HEV) are vehicles powered by both a battery pack with an electric motor and an internal combustion engine but which can only be refueled with traditional petroleum fuels as the batiery pack is charged via regenerative braking, such as used in a hybrid electric vehicle like the Toyota Prius 12 = Hydrogen Vehicles are vehicles powered by liquefied hydrogen fuel cells. The power plants of such vehicles convert the chemical energy of hydrogen to mechanical energy either by burning hydrogen in an internal combustion engine, or by reacting hydrogen with oxygen in a fucl cell to run electric motors 11 These vehicles are required to refuel their hydrogen fuel cells at special refueling stations Examples of these types of vehicles are the BMW Hydrogen 7 and the Honda Clarity. i-MiEV Established in Japan in 1970, Mitsubishi Motors Corporation is a member of the Mitsubishi conglomerate of 25 distinct companies. Mitsubishi Motors is headquartered in Tokyo, Japan, and employs roughly 31,000 employees. The company sells automobiles in 160 countries worldwide and in 2010 sold 960,000 units H Within the United States, the company had a meager 0.5% of the market share in 2010 with 55,683 units sold 15 Along with traditional gasoline engine automobiles, the company has long been involved in the R\&D of electric vehicles Mitsubishi has been involved in electric vehicle research and development since the 1960 k with a partnership with the Tokyo Electric Power Company (TEPCO)." Since 1966 to the present, the company has dabbled in electric vehicle and battery research and development with numerous prototype vehicles produced. In 2009. Mitsubishi released its newest EV car called the i-MiEV (Mitsubishi Innovative Electric Car). The i-MiEV is a small, four-passenger, all-electric car with a top speed of approximately 80 MPH and a quoted range of 75 miles on a single charge based on US driving habits and terrain. 17 The car is based on lithium-ion battery technology. In October 2010 , the company announced that it had reached the 5000 production unit mark for the car. 18 Currently the i-MiEV is being sold in Japan, other Asian countries Costa Rica, and 14 countries in Europe. The Japanese price of the i-MiEV was originally US550,500 but was reduced to USS 42.690 in mid-2010 due to competition from other car companies Mitsubishi plans on introducing the i-MiEV to the U.S. market in the fall of 2011 The Nissan Motor Company, formed in 1933, is headquartered in Yokohama, Japan and employs over 158,000 workers. Currently, it builds automobiles in 20 countries and offers products and services in 160 countries around the world. 17 In 2010 , it sold globally over 3 miltion vehicles in its first three fiscal quarters (April 2010-December 2010) with over 700,000 of those being sold in the United States 20 The company operates two brands. Nissan and Infinity, which design and sell both passenger vehicles and luxury passenger vehicles. On December 3, 2010, Nissan introduced the LEAF, which it billed as the world's first 100% electric, zero-emission car designed for the mass market. 21 The LEAF is a five-passenger electric car with a top speed of 90mph and a quoted range of 100 miles on a single charge using lithium-Ion battery technology. The current 2011 price in the United States for the LEAF is approximately US $33,000, which is also eligible for the US $7500 electric vehicle tax credit. It is reported that Nissan had sold 3657 LEAFs by the end of February 2011 with 173 of the sales within the United States and the rest in Japan. 2 Chevrolet Motor Company was formed in 1911 and joined the General Motors Corporation in 1918.2. GM has its global headquarters in Detroit, Michigan, and employs 209,000 people in every major region of the world and does business in more than 120 countries 4 In 2010 , Chevrolet sold 4.26 million vehicles worldwide and 1.57 million in the United States 23 In mid-December 2010. Chevy began delivery of a four-passenger, plug-in bybrid electric vehicle called the Volt. The Volt operates by using an electric engine until the batteries are discharged and then a gasoline engine kicks in for what Chevy calls "extended-range" driving. The car is quoted as having a range of 35 miles in electric mode and an additional 340 miles of extended driving using the gasoline engine.. It is reported that Chevy had sold 928 Volts by the end of February 2011: all within the United States D The current 2011 price in the United States for the Volt is approximately US\$42.000, which is also cligible for the US\$7500 electric vehicle tax credit. The Toyota Motor Company was established in 1937 and is headquartered in Toyota City, Japan. It employs over 320,000 employees worldwide with 51 overseas manufacturing companies in 26 countries and regions 25 Toyota's vehicles are sold in more than 170 countries and regions. For fiscal year 2010 . Toyota sold over 72 million vehicles worldwide, of which 1.76 million were sold in the United States 34 In 1997, Toyota introduced a five-passenger, gasoline-electric hybrid automobile called the Prius The Prius has both a gasoline engine and an electric motor, which is used under lighter load conditions to maximize the car's fuel economy. The electric batteries are recharged via the gasoline eneine only. On April 5, 2011. Toyota announced that it had sold its 1 millionth Prius in the United States and had surpassed 2 million global sales 6 months earlier in October 2010,,6 Currently, Toyota offers four versions of the Prius in the United States with prices ranging from US 23,000 to USS28,000, The company has announced a plug-in version of the Prius, which is slated for sale in 2012. ogen 7 Bayerische Motoren Werke (BMW) was established in 1916 in Bavaria, Germany. Originally, the company started manufacturing airplane engines, but after World War I,Germany was not allowed to manufacture any airplane components as part of the terms of the armistice." The company turned its focus to motorcycle engine development and subsequently, in 1928, developed its first automobile. Presently, the company is headquartered in Munich, Germany, and employs approximately 95,000 workers. In 2010, BMW sold approximately 1.2 million vehicles.' In 2006, BMW introduced the four-passenger Hydrogen 7 automobile that was the world's first hydrogen-drive luxury performance automobile." The car is a dual-fucl vehicle capable of running on cither liquid hydrogen or gasoline with just the press of a button on the stecring wheel. 34 The combined range for the car is approximately 425 miles with the bydrogen tank contributing 125 miles and the gasoline providing the rest. To date. BMW has only produced 100 units of the vehicle, which have been leased/ loaned to public figures The car has not been made available for purchase to the general public and no sale price has been quoted. Honda Clarity The Honda Motor Company was established in the 1940s in Japan originally as a manufacturer of engines for motorcycles. 88 Honda produced its first production automobile in 1963 and has been a global supplier since then. In 2010 . Honda sold 3.4 million autobegan production of its four-passenger FCX Clarity, the world's first hydrogen-powered fuel-cell vehicle intended for mass production. " The FCX Clarity FCEV is basically an electric car because the foel cell combines hydrogen with oxygen to make electricity which powers an electric motor, which in turn propels the vehicle." The car can drive 240 miles on a tank, almost as far as a gasoline car, and also gets higher fuel efficiency than a gasoline car or hybrid, the equivalent of 74 miles per gallon of gas 19 The company planned to ship 200 of the Clarity to customers in Southern California who can lease it for three years at USS600 a moath. Barriers to Entry and Imitation The barriers to entry into the non-petroleum-powered automobile market segment are high. The hybrid technology for vehicles such as the Prits is well understood by the major automobile companies and many of them have developed and marketed their own version of electrichasoline hybrid vehicles. The all-electric and hydrogen fuel-cell automobiles are unique technologies that require resources to develop. In this segment. the energy storage and motor technologies are barriers to new competitors. Rechargeable battery systems and fuel cells are newer technologies that require large investments in research and development. A competitor would need to develop its own technologies or partner with another company to acquire these resources. Proprietary Technology As electric vehicles are a newer technology. Tesla's innovation has led it to have some unique resoures in technology and intellectual property over its competitors Tesia's proprietary technology includes cooling systems, salety systems, charge balancing sys. tems, battery enginecring for vibration and environmental durability, customized motor design and the soltware and electronics management systems necessary to manage battery and vehicle performance under demanding real-life driving conditionx. These technology innovations have resalted in an extensive intellectual property portfolio-as of February 3, 2011, the company had 35 isued patents and apptoximately 280 pending: patent applications with the United States Patent and Trademark Office and internationally in a broad range of areas 10 These potents and innovations are not casily duplicated by competitors. A second unique resource that a company developing electric vehicles would require would be its battery cell design. Tesla's current battery strategy incorporates proprietary packaging using cells from multiple battery supplicrs. "This allows the company to limit the power of its battery supply chain. The company also has announced a partnership with Panasonic to jointly collaborate on next-generation battery development. Inherent to the requirements for an electric automobile company is the knowledge and skills of the workforce. Tesla believes that its roots in Silicon Valley have enabled it to recruit enginecrs with strone skills in clectrical engincerine, power electronics, and software enginecring to aid it in development of its electric vehicles and components. 4 Being one of the first to market with a high-performance EV also gives the company a first-mover advantage in experience and branding. Tesla has an agreement with the automobile manufacture Lotus for the supply of its Roadster vehicle bodies. The company entered into a supply agrecment in 2005 with Lotus that requires Tesla to purchase a certain number of vehicle chassis and any additional chassis will requare a new contract of redesign to a nes supplier. Ul This places a large dependence on Lotus to both fulfil the existing contract and also gives them significant power in the event that Tesla requires additional Roadster units. Tesla is dependent on its single battery cell supplier. The company designed the Roadster to be able to use cells produced by various vendors but to date there has only been one supplier for the cells fully qualificd. The same is also true for the battery cells used for battery packs that Tesla supplies to other OEMs. " Any distuption in the supply of battery cells from its vendors could disrupt production of the Roadster or future vehicles and the battery packs produced for other automobile manufacturers. Es nal Opportunities and Threats Electric vehicle companies may be able to take advantage of many of the opportunities with the continuous shift toward green energy Presadent Barack Obama has publicly committed to funding "green" or altermative energy initiatives through various vehicles. A In his 2011 State of the Union Address, the President set a goal of getting one million electric cars on the road by 2015 , Within the United States, various federal and state governmental agencies are currently supporting loan programs through the likes of the Department of Enerzy and the Califormia Zcro-Erission Vehicle (ZEV) proeram. The tragic Louisiana BP oil spill that took place from. April to May 2010 intensified the focus on decreasing U.S. dependence on petrolcum products. It also highlighted the fact that while alternative energy is currently more expensive to produce than conventional energy, there are hidden environmental and human costs that must be taken into consideration when making this comparison. This increased focus on alternative energy has been beneficial for the EV industry, benefiting both Tesla and its competitors. Due in part to this increase in funding. Tesla is competing in an industry that is expanding, making its absolute market share less relevant than how fast it is growing its market share. Despite the new dawn of interest and pledges for funding alternative encrgy, many plans for funding will never come to fruition. Currently in the United States, there is a massive budget deficit. and members of the Republican Party have focused their demands for budget cuts in the "discretionary spending" arena, which is where alternative energy funding falls. Notably, some of the cuts proposed would seriously affect programs funding energy efficiency, renewable energy, and the DOE Loan Guarantee Authority. 4k The EV industry has very few lobbyists compared to the traditional car and petroleum industry, and so is more vulnerable to being targeted in budget cuts. These cuts represent a serious threat to the continued development of the alternative energy and electric car industry. For EVs to come into widespread use, the United States must develop an EV-charging infrastructure, and this will need the support of both state and federal government in the form of both funding and regulation. Not only is the federal government facing budget cuts, but the state of California is also dealing with massive shortfalls and reductions in services and funding. This is especially important to Tesia since it operates its manufacturing in California, and one of its largest target markets is California, due to the strict emissions regulation and traditional green focus of Californians. There are also many regulations to which companies developing electric vehicles are subjected. A topic of current interest is the upcoming change in how the range of electric vehicles is calculated-a regulation determined by the EPA. It is thought that the new calculation will result in a lower advertised range for all the electric vehicles, which may make their superiority over traditional petroleum-based vehicles less prevalent. There are also numerous safety requirements that EVs must adhere to, governed by the National Highway Traffic Safety Administration. Companies that produce less than 5000 cars for sale and have three product lines or less can qualify for a gradual phase-in regulation for advanced airbag systems and other safety requirements. Similarly, in Europe, smaller companies are currently exempt from many of the safety testing regulations, and are currently allowed to operate under the "Small Series Whole Vehicle Type Approval." Additionally, battery safety and testing is regulated by the Pipeline and Hazardous Materials Safety Administration, which is based on UN guidelines regarding the safe transport of hazardous materiak. These guidelines ensure that the batteries will perform or travel safely when undergoing changes in altitude, temperature, vibrations, shocks, external short circuiting, and overcharging. Other regulatory issues include automobile manufacturer and dealer regulations. which are set on a state-by-state basis. In some United States states, such as Texas it is not legal for the dealer and manufacturer to be owned by the same company. Therefore. these regulations would impact the market penetration levels that a company wishing to utilize a distribution model based on being able to both manufacture and sell its cars through its own wholly owned dealerships would be able to reach in certain states. An interesting. though potentially costly, new regulation is the minimum noise requirements, mandated by the Pedestrian Safety Enhancement Act of 2010 signed in January 2011. There have been concerns that since electric cars are so much quicter than their combustion-engine counterparts that their design must be somehow altered to increase the amount of noise they generate in order to make them easier to hear by people with impaired vision. These regulations are likely to take cffect by 2013 and could alter clectric vehicle designs The macrocconomic conditions of 2011 and the outlook for the near future is slow but continued growth, in contrast to the past several years of economic retraction. In recent years American buyers, and indeed buyers in most parts of the world, have cut back on discretionary purchases in light of high unemployment and general economic uncertainty. The economic recovery has created more demand for higher-priced luxury vehicles. The largest component of what makes an electric vehicle attractive from a financial standpoint is the savings in traditional fuel costs. There is a huge difference between the cost of electricity to recharge an clectric vehicle versus the cost of gas to fuel a conventional vehicle. Hence, as oil pnices increase, the financial incentive to purchase an electric 30. Tesla Motors, Inc. vehicle increases as well. Additionally, the variability of oil prices means that owners of conventionally powered vehicles cannot predict what their fuel costs for the year will be with any confidence. Thux, the much more stable costs of electricity make an electric vehicle more desirable. It is not likely that the cost of oil will ever see a sustained and significant drop in price, nor is it likely that the cost of oil will ever be as stable as the cost of electricity, creating a sustained advantage over traditionally powered vehicles. Electric vehicle manufacturers are currently riding the wave of environmental consciousness that began in the 1960 , and has been slowly gaining momentum since. The "Green movement" encourages people to make choices that lessen their negative impact on the environment, and to tse resources that are renewable. Aliernative fucl products fit this description, by both reducing consumer demand for oil and elininating harmful emissions during use. For the time being electric vehicles still leave a noticeable "footprint," though one not nearly as large as a conventional car. ges to Adoption of Electric Cars: 1er Perceptions Consumer perceptions of electric vehicles are a huge challenge to adoption. Many people think of electric vehicles as being underpowered, clunky looking, hard to charge. quirky, and undependable. Public experience with traditional vehicles and their concerns about the newness of alierative fucl vehicles must be overcome. Additionally, the absence of a public infrastructure for rechareing electric vehicle batteries introduces a. "Which came first - the chicken or the egg?" paradox: There is no infrastructure because there are not enough clectric vehicles, and part of the reason why there are not many electric vehicles is because there is no infrastructure to support them. For the time being, consumers must charge their vehicles cither at home, or possibly at their place of work. This limits the electric vehicle driving range, which has a negative impact on the image of electric wehicles with consumers. Another concern that consumers have whea considering an alternative energy vehicle is the cost. Electric vehucles, as well as most alternative fuel velicles, cost significantly more than traditional vehicles of similar style and performance. This is due both to the cost of the research and development and the high cost of materiak. particularly for the battery cells. Additionally, the production of low environmental impact products is in most cases more expensive than their conventionally produced counterparts. So long as there are areas of the world willing to sactifice the environment (natural resources. air, water, waste production) to create low-cost products, this dynamic will continue. The EV industry is hampered by the public view of the limited runge of vehicles in comparison to traditional gasoline cars. In recent years there has been much advancement in the ways of sustainable encrgy. High gas prices along with increased awareness on environmental impacts have becoene the catalysas for new research into sastainability. There has been an increase in new battery technology that is an opportunity for the electric vehicle industry, Currently, the most viable battery for an electric vehicle, that abo provides performance, is the lithium-ion batiery (is the same type found in your laptop), Companies like Planar Encrgy are now coming out with "solid state, ceramiclike" batteries that could potentially provide more energy for a lower cost. S1 With these new advances, there is a distinct opportunity for electric car companies to create a better performing and less expensive vehicle. Eloctric vehicle companies that can develop battery architectures that cross this limited mileage chasm will have positive implications in the public view. Tesla is credited to have one of the industry's best batteries, and it is on the cutting edge of innovative technology. This type of innovative technology is what distinguishes Tesla from other competitors in its industry, and will continue to set it apart across contexts in the market. Electric vehicles are also reliant on a network of available power sources. Though infrastructure is currently limited, companies like GE are already planning a rollout of EV charging stations to be sold to households, companies and local governments 2 The U.S. government has set out to aid in the building of electric vehicle charging stations with government grants supporting the installation of the electric-ear charging stations in areas such as San Francisco and Oregon, which will soon host 15,000 stations around the state, some of them public." An increase in charging station technology and infrastructure should broaden the demand for electric vehicles that is still encumbered by beliefs of limited service and "refucling" capabilities. Along with the advantages of technological innovations in electric vehicle designs, there are also respective weaknesses to consider, including the amount of time necessary to charge a battery and the limited driving range per charge. Currently. Teala has reduced the recharge time of its battery cell to 45 minutes, but this is a long time compared to the few minutes that it takes cars to refuel at the gas pump. Coupled with the recharge time of the battery cells is the limited range of electric vehicles. For owners of conventional cars who are used to having a range of 300 miles or more, with a refilling time of 3 to 4min. utes, the limited range and recharging options of EVs can seem very restrictive. However, the average American driver travels only 35 miles per day, and the average trip length is only 10 miles 4 More importantly, long distance trips (more than 100 miles accounting for less than 1% of all trips) made by American drivers have a median distance of 194 miles. .\$ This indicates that most drivers will very infrequently be driving non-stop for more than 245 miles making range a virtual non-issuc. However, while the facts may be different from perception, it is the perception of consumers that will drive their purchasing behavior, thus still making the range issue a serious concern for EV manufacturers. The second issue with batteries is their end-of-life concerns. Rechargeable batteries, over time, will become less eflicient, and will no longer hold their charge as well as when the battery was new. The same issuc exists with electric vehicle batteries Tesla estimates that after 100,000 miles or seven years, the Roadster's battery will only operate at 60%65% efficiency. . This decrease in battery performance will decrease the range of the car, and will start taking place well before the 100,000 mile/7year marker. Proper battery disposal is another issue. At this time, there are not many battery disposal facilities duc to the limited electric vehicle market to date. Finally, maintenance of electric vehicles is a concern. given the paucity of many adequately trained repair facilities and the low market penetration of the cars. There simply are not many EVs on the road, and conventional car repair shops do not have proper training in the repair of electric vehicles. This can have a detrimental effect on adoption of EVs. In recent years international emerging markets have increased their infrastructures and stratification of wealth and the current consumer demographic is better equipped to afford more expensive vehicles as a result. Additionally, there is a growing global awareness and commitment to developing sustainable and "green" energy and innovations. These factors may increase opportunities for sales of EVs in these markets. The rising cost of oil is also a major opportunity for electric vehicle manufacturers to cultivate a great presence in the market, due to the demand of consumers to seck alternative types of vehicles, including electric. The global future of the EV market is promising based on the current trends in oil cost, consumption, and awareness about conservation. Giobal economic policies, such as the Kyoto protocol, advance the cause of environmentally sustainable products, such as electric vehicles. However, every country has the choice to either ratify these protocols or not. This lack of accountability means that the financial and political support of environmentally sustainable products are bighly variable, and can affect the favorability and feasibility of selling electric vehicles in every country in which they are sold or manufactured. Revenues at Tesla Motors are derived from sales that are recognized from two sources, sales of the Roadster and sales of Tesla's patented electric power train components (see Exhibit 1). Coinciding with the sales of the Roadster. Tesla recognixes income from the sale of vehicle options and aceessories, vehicle service and maintenance, and the sale of Zero-Emission Vehicle (ZEV) credits Zero-Emission Vehicle credits are required by the State of California to ensure auto manufacturers design vchicles to meet strict eco-friendly guidelines. Credits are acquired by producing and selling vehicles that meet a minimum emsission level in an aftempt to offset the pollutants ptoduced by mainstream vehicles. If a manufacturer chooses not to design ZEV vehicles, it is able to purchase credits from companies such as Tesla, who only produces electric vehicles and does not have to accrue credits. Tesla has realired sales of USS14.5 (see Exhibit 2), million in ZEV credits since 2008. Total quarterly revenues at Tesla have been increasing steadily throughout 2010 , but no definitive yeaf-over-year positive trends can be established from Tesla's sales data. Two trends that do appear to be gaining in the most recent fiscal year are foreign sales and sales of power train components and related sales. Tesla's cash position (see Exhibit 5) is currently in a less than optimal position. Through its IPO. Tesla was able to raise US\$226 million in June of 2010 and has also Automotive Sales Automntive sales consisfed of the following for the periods preseated (in theosands): been able to take advantage of state and federal programs to raise capital at low prices due to its investment in alternative encrgy programs. These sourees of cash offer the company the ability to meet its current obligations, but revenues (see Exhibits 3 and 4 ) have not been able to match expenses, resulting in the company's largest net loss yet of USS51 million in December of 2010. The United States Department of Energy (DOE) loancd Tesla USS465 million at the beginning of the year, $0 no matter what, Tesla has to manage a "mountain of debt. - " This specific loan has various restrictions that are structured around the progress of the Model S and several financial ratios. Testa stands to lose revenue if the Model S delays, since the DOE loan pays in installments as the Model S reaches various development and production benchmarks. Although debt as a ExHIEIT 3 income Statement The following table includes selected quarterly results of operations data for the years esded December 31,2010 and 2009 (in thensands, except per share data): EXHIBIT 4 Revenue by Region The following table sets forth reveane by geographic area (in thousands): Revenaes CI A infe as of 1231/2010 (in thonssndv) Salee-US597.078 Net Prodit (US\$154.328) Operating Margin: (125.7896) Receivables US 67710 Cash Assete US\$99 568 Iaventory: USS45,18? Total Dehe: US\$71,k2s percent of total capital increased at Tesla Motors. Inc. over the last fiscal year to 25.96%. it is still in line with the automobile industry's norm. Additionally, there are enough liquid assets to satisfy current obligations. Tesla's internal markcting situation has to operate with many limitations stemming from the company's infancy and its lack of resources. Looking at the product offerings the only vehicle Iesia currently has on the market is the Roadster, a sporty two-seater priced at USS108 000 and up. The hish price tag pets it firmly in competition with other luxury vehicles as opposed to other electne vehicles The key denographic market for luxury cars are white males 45 and oldcr, who are married, have no kids, and make over US575,000 a year. Primary conciderations for this group when purchasing a luxury vehicle are performance, design, and safety, while factors such as financing, the environenent, and gais mile. age are not important." The Roadster does deliver on aesthetics and performance, but it is questionable whether or not its electric motor will be an effective differentiator. Bearing this in mind, Tesla needs to focus on eafly adopters and cavironmentalists, who also have the resources to afford their car. One could argae that this is a narrow aarket scgment. In 2012. Tesla will roll out the Model S. a premium four-door sedan that will be variably priced at US\$57000 for the lowest range, US\$67000 for the mid range, and USS72000 at the top of the range. This lower-priced vehicle will target larjer families and a greater-sined market. Unless it can lower the price point, this will still be a difficult sell, as households with children have less disposable income and accumulated wealth. Demand for electric cars is also estimated to remain below 10% until at leist 2016 . because of perceptions of high cost for marginal utility. io Two advantages Tesla does have an price, however, are the US\$7500 goverrimeat tax credit for buying fuel-efficient vehicles, and the low cost of maintenance and fact. Aside from a minimal product offering. Tesla is also limited by its distribution and fulfilment infrastructure. At the moment. Tesla has a mix of brick-and-mortar dealershps in premium locations, along with repional sales representatives, and online ordering. North America has 10 stores and fouir reps. Europe has scven stores and four reps. and Asia has one store and two reps. Over the next few years. Tesla plans to open $0 stores in preparation of the Model S rollout. To case its current lack of fulfilment capabilities. Tesla sales representatives will arrange a test drive in your location and otganize vehicle delivery. This is an inespensive way to increase its distribution capabilities without investing in physical stores. This might also hinder sales though, given that the key demographic for luxury vchicles rely on car dealerships as the second ment influential outlet on what car to buy. it Tesla could ramp up distribution by allowing existing dealerships to sell its cars but chooses not to preferring a customized sales approach where it has complete control over its message. To compliment direct sales the company has avoided traditional advertising in lieu of product placement, Internet ads and event marketing. It is adept at fuming current customers into vocal brand ambassador. The company website is littered with quotes from owners and industry revicwers singing its praises. This promotion strategy is a clear strength for Tesla, especially considering that recommendations from friends and relatives as well as general word of mouth, are the most influential factors for a lusuryisports car's key demographic. The Tesla brand is also inherently tied to the environmental/green movement. Because of this, it has been able to generate a lot of free media publicity. Tesla is headquartered in Palo Alto, California, where it also manufactures its power trains, battery packs, motors, and gearbox. The body and chassis for the Roadster are manufactured by Lotus in Hethel, England, and then are fully assembled in Menlo Park, Califormia, for US. buyers, or Wymondham, England, for European and Asian customcrs. For the upcoming launch of the Model S. Tesla is building a new factory in Fremont. California, that will have a capacity of 20,000 cars per year. Tesla's main operating strength lies in its intellectual property and its patents. Currently. Tesla has 35 issued patents with another 280 pending. Proprietary components include power train technology, salety systems, charge balancing, battery enginecring for vibration and environmental dumability, motor design, and the electricity management system. The company also owns the proprictary software systems that are used to manage efficiency, safety, and controk. Tesla's software is designed to be updatable. and many aspects of the vehicle architecture have been designed so it can be used on multiple future models To boost operational know-how and supplement the revenue Tesla gets from sales of the Roadster, it also sells Zero-Emission Vehicle credits, and supplies power train and battery pack components to original equipment manufacturers Currently. Tesla has strategic partnerships with Daimler and Toyota, and is providing their electric vehicle expertise in the development of Daimler's Smart Car and Toyota's new RAV4. These partnerships are an opportunity for Tesla to diversify its revenue streams and network and access greater supply chains As previously mentioned. Tesla has decided to distribute through its own network of stores and regional sales staff as opposed to selling through established dealer networks. Despite fulfilment implications, Teda considers owning its own distribution channel as a competitive advantage. Channel ownership not only allows for greater operating efficiency through inventory control, but also gives Tesla control over its sales message. warranty, price, brand image, and user feedback. The drawbacks to this strategy include the high capital costs of buying real estate and constructing showrooms and the cost of additional sales staff Currently, over 2000 parts are sourced from 150 suppliers. One major issue with the current supply structure is that many vendors are the single source. This leaves Tesla vulnerable to delays and increased coste. Due to limited economies of scale, (as of December 31,2010 only 1500 Roadsters were sold) production costs also run high. The first Roadster was sold in early 2008 , but revenues didn't exceed the costs of production until the second quarter of 2009 . Tesla is still struggling to bring the costs of the Model S down so it can be profitably sold at US 557000 . Servicing vehicles presents another challenge for Tesla. Given the complex and proprictary components of their cars, the average mechanic won't be able to diagnose 30-14 CASE 30 Teila Motors tas and fix issues. Lacking the appropriate physical infrastructure. Tesla sends maintenance technicians (which it refers to as Rangers) to wherever the car owner lives. The cars themselves also have advanced diagnostic systems that link up to a server at Tesla's headquarters. Issues can be determined prior to sending Rangers out to fix the car. which saves time and resources. Overall though, this system isn't as convenient as having a worldwide infrastructure of third-party repair shops. This Ranger service system may work for the time being. with only 1500 cars on the road, but with the anticipated sales of the Model S and subsequent vehicles, the services infrastructure will have to be greatly expanded. Two ideas that Tesla bopes will come to fruition are an increase in fast charge stations, and the creation of a battery replacement network. The latter harkens back to the days where cowboys would exchange tired horses for fresh steeds. In anticipation of this, the Model S will incorporate removable battery packs. Human Resources Tesla Motors operates more like a software company than a car company, and innovation is top priority. CEO Elon Musk is a serial entreprencur who has stocked his executive team with half-techie, half-basiness hybrid employees who are former industry leaders. Taking a cue from Google, the environment is fast paced and culturally unstructured. Employees are encouraged to challenge norms, think outside the box, and commit time to innovation. In order to boost teamwork and eliminate departmental silos, most staff work in an open room with no walk. Tesla prides itself on solutions created through an integration of all departments working side by side. An explanation for this corporate culture can be found in the hiring of Human Resources director. Arnnon Geshuri, who was the former director of staffing and operations at Google. Because of the emphasis on technology and innovation. the majority of manufacturing is done in California, as opposed to areas with lower labor costs, due to the abundance of top-quality engineers. Due to the extreme importance of Tesla's intellectual capital. it is imperative to have happy employees. Aside from being able to get in on the ground floor of an innovative new company, cmployees are also given competitive salaries, bencfits, an aesthetically pleasing office space, and "meaningful equity." Currently. Tesla has about 900 employees, including 212 in the power train and R.ED department, 170 in vehicle design and engineering, 121 in sales and marketing. 79 in the service department, and 213 in the manufacturing department. Tesla is currently looking to hire more graduating engineering students and sales staff, especially those who have had some hands-on experience. Recruiting and retaining the best talent is a paramount goal, because of difficulties arising from Tesla's capacity to design, test, manufacture, and sell at the same time. Tesla's Future: Success or Bust? In a nutshell, Tesla has limited sales in a limited market, and is making low margins due to high product costs and the lack of economies of scale. However. if oil prices continue to climb toward US 200 a barrel and new electric cars, such as the Chevy Volt and Nissan Leaf, catch on with consumers, the upside for Tesla could be enormous. Can Tesla reach the tipping point? Or will it become just a footnote in automotive history? Time will tell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts