Please zoom in if you can't see it

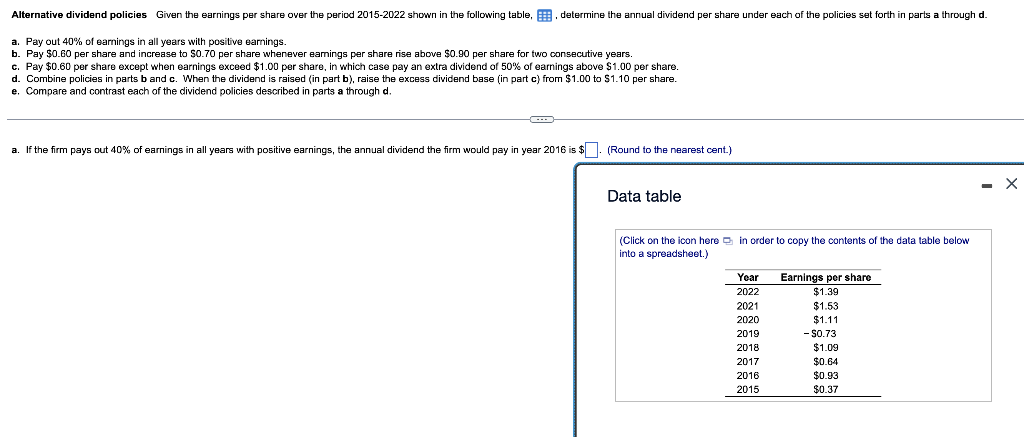

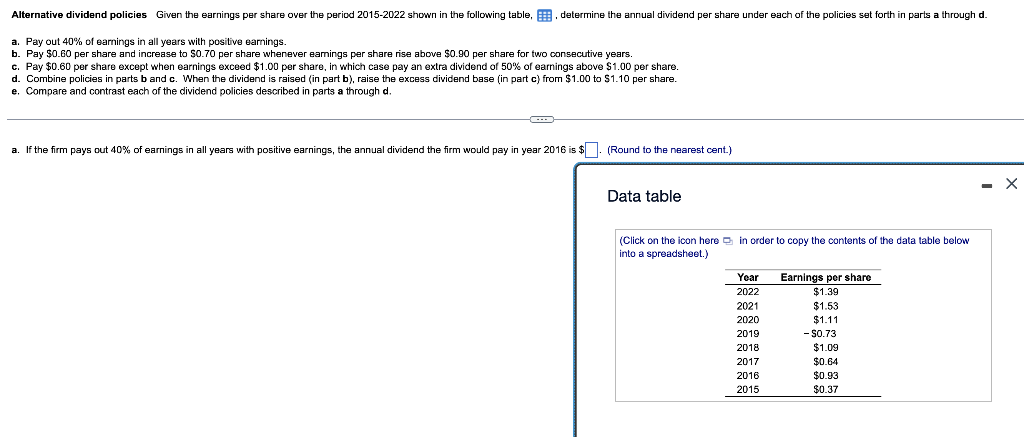

Alternative dividend policies Given the earnings per share over the period 2015-2022 shown in the following table, B. determine the annual dividend per share under each of the policies set forth in parts a through d. a. Pay out 40% of earnings in all years with positive earnings. b. Pay $0.60 per share and increase to $0.70 per share whenever earnings per share rise above $0.90 per share for two consecutive years. C. Pay $0.60 per share except when earnings exceed $1.00 per share, in which case pay an extra dividend of 50% of earnings above $1.00 per share. d. Combine policies in parts b and c. When the dividend is raised (in part b), raise the excess dividend base (in part c) from $1.00 to $1.10 per share. e. Compare and contrast each of the dividend policies described in parts a through d. a. If the firm pays out 40% of earnings in all years with positive earnings, the annual dividend the firm would pay in year 2016 is $. (Round to the nearest cent.) Data table (Click on the icon here in order to copy the contents of the dala table below into a spreadsheet.) Year 2022 2021 2020 2019 2018 2017 2016 2015 Earnings per share $1.39 $1.53 $1.11 -S0.73 $1.09 $0.64 $0.93 $0.37 Alternative dividend policies Given the earnings per share over the period 2015-2022 shown in the following table, B. determine the annual dividend per share under each of the policies set forth in parts a through d. a. Pay out 40% of earnings in all years with positive earnings. b. Pay $0.60 per share and increase to $0.70 per share whenever earnings per share rise above $0.90 per share for two consecutive years. C. Pay $0.60 per share except when earnings exceed $1.00 per share, in which case pay an extra dividend of 50% of earnings above $1.00 per share. d. Combine policies in parts b and c. When the dividend is raised (in part b), raise the excess dividend base (in part c) from $1.00 to $1.10 per share. e. Compare and contrast each of the dividend policies described in parts a through d. a. If the firm pays out 40% of earnings in all years with positive earnings, the annual dividend the firm would pay in year 2016 is $. (Round to the nearest cent.) Data table (Click on the icon here in order to copy the contents of the dala table below into a spreadsheet.) Year 2022 2021 2020 2019 2018 2017 2016 2015 Earnings per share $1.39 $1.53 $1.11 -S0.73 $1.09 $0.64 $0.93 $0.37