Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please zoom your screen to see tables using the keyboard, Ctrl + Please answer the questions -- I have already done the Statement of Cash

Please zoom your screen to see tables using the keyboard, "Ctrl +"

Please zoom your screen to see tables using the keyboard, "Ctrl +"

Please answer the questions -- I have already done the Statement of Cash Flows using Indirect Method after the Balance Sheet.

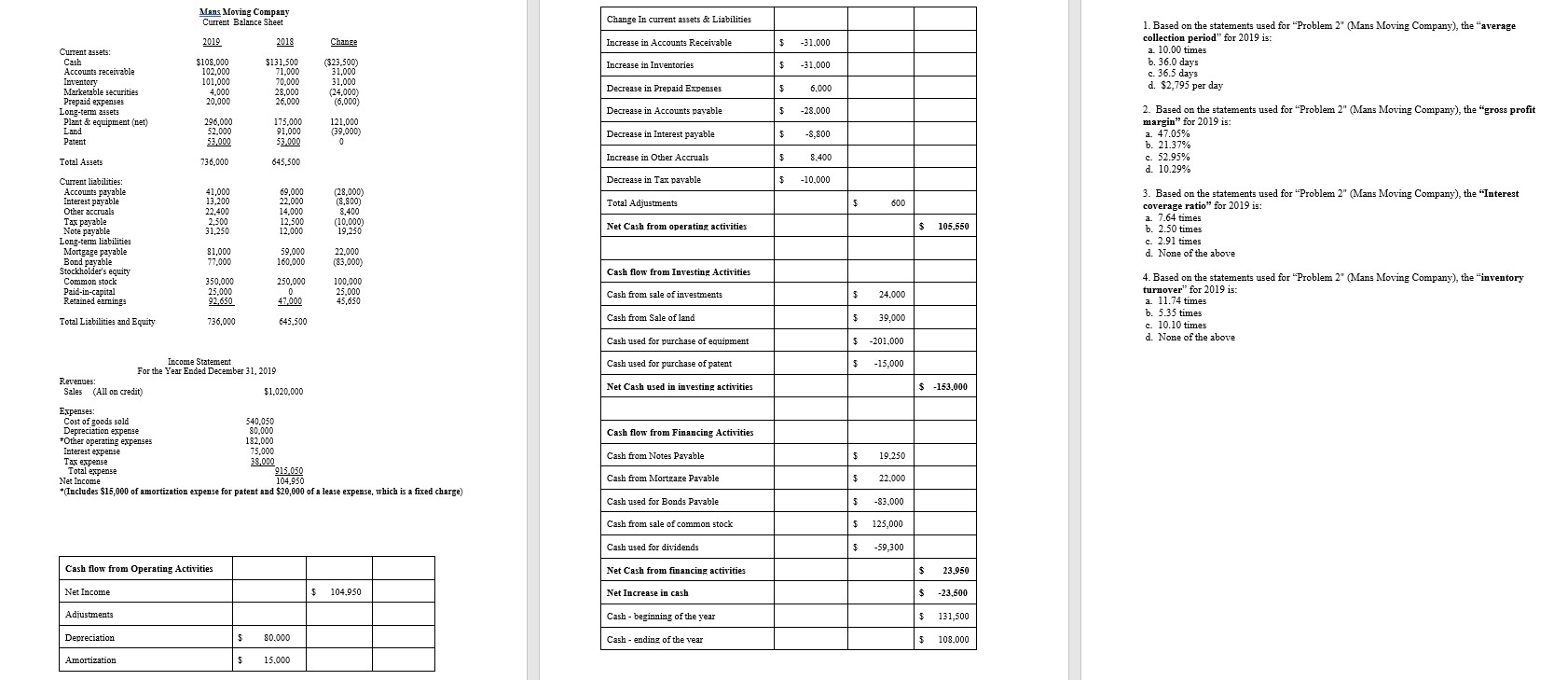

Change In current assets & Liabilities Mans Moving Company Current Balance Sheet 2019 2018 Change Increase in Accounts Receivable $ -31,000 1. Based on the statements used for "Problem 2" (Mans Moving Company), the "average collection period" for 2019 is: a. 10.00 times b. 36.0 days c. 36.5 days d. $2,795 per day Increase in Inventories $ -31,000 $108.000 102,000 101,000 4.000 20,000 $131,500 71.000 70.000 28,000 26.000 Current assets: Cash Accounts receivable Inventory Marketable securities Prepaid expenses Long-term assets Plant & equipment (net) Land Patent ($23,500) 31,000 31,000 (24.000) (6.000) Decrease in Prepaid Expenses 5 6.000 Decrease in Accounts payable $ -28.000 296,000 52.000 53,000 175,000 91,000 53,000 121,000 (39,000) 0 Decrease in Interest payable -8,800 2. Based on the statements used for "Problem 2" (Mans Moving Company), the "gross profit margin" for 2019 is: a. 47.05% b. 21.37% c. 52.95% d. 10.29% Total Assets 736.000 645,500 8.400 Increase in Other Accruals $ Decrease in Tax payable $ -10,000 Total Adjustments $ 600 41,000 13,200 22,400 2,500 31.250 69,000 22,000 14,000 12,500 12.000 (28.000) (8.800) 8,400 (10,000) ( 19,250 Net Cash from operating activities $ 105,550 Current liabilities: Accounts payable Interest payable Other accruals Tax payable Note payable Long-term liabilities Mortgage payable Bond payable Stockholder's equity Common stock Paid-in-capital Retained eamings 3. Based on the statements used for "Problem 2" (Mans Moving Company), the "Interest coverage ratio" for 2019 is: a. 7.64 times b. 2.50 times c. 2.91 times d. None of the above 81,000 77,000 59,000 160.000 22,000 (83.000) Cash flow from Investing Activities 350,000 25,000 92.650 250,000 0 47.000 100,000 25,000 45,650 Cash from sale of investments $ 24.000 4. Based on the statements used for "Problem 2" (Mans Moving Company), the "inventory turnover" for 2019 is: a. 11.74 times b. 5.35 times c. 10.10 times d. None of the above Total Liabilities and Equity $ 736,000 645,500 Cash from Sale of land 39,000 Cash used for purchase of equipment $ 201,000 $ - 15,000 Income Statement For the Year Ended December 31, 2019 Revenues: Sales (All on credit) $1,020,000 Cash used for purchase of patent Net Cash used in investing activities $ -153.000 Cash flow from Financing Activities Expenses: Cost of goods sold 540.050 Depreciation expense 80,000 *Other operating expenses 182,000 Interest expense 75,000 Tax expense 38,000 Total expense 915.050 Net Income 104.950 *Includes $15,000 of amortization expense for patent and $20,000 of a lease expense, which is a fixed charge) Cash from Notes Payable $ 19.250 Cash from Mortgage Payable $ 22.000 Cash used for Bonds Payable $ -83,000 Cash from sale of common stock $ 125,000 Cash used for dividends $ -59,300 Cash flow from Operating Activities Net Cash from financing activities $ 23,950 Net Income $ 104,950 Net Increase in cash $ -23,500 Adjustments Cash - beginning of the year $ 131,500 Depreciation $ 80.000 Cash-ending of the vear 108,000 Amortization $ 15.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started