Pleased checking my all answers. Thank you.

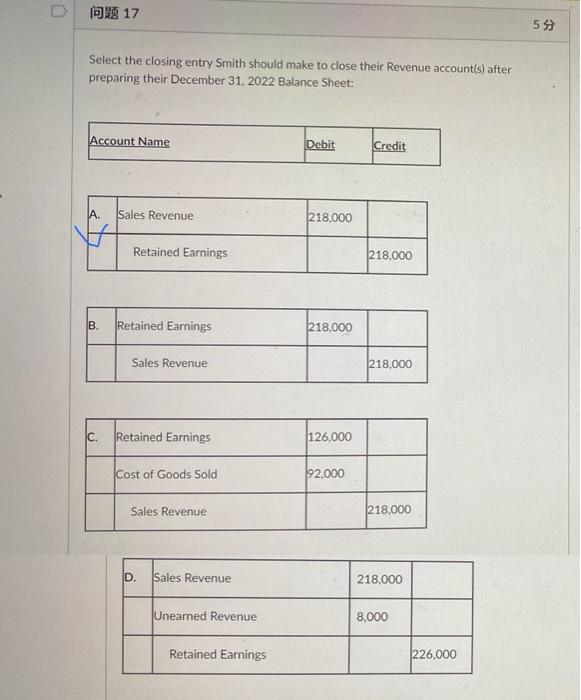

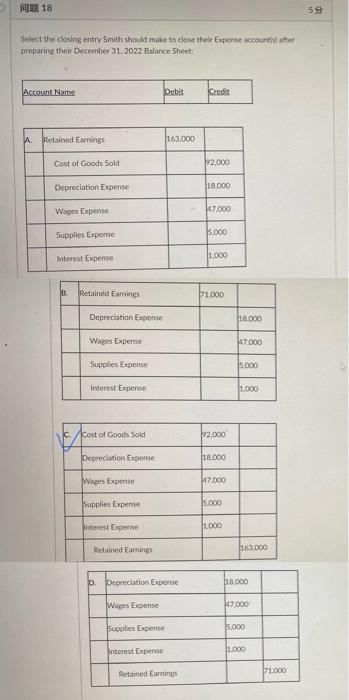

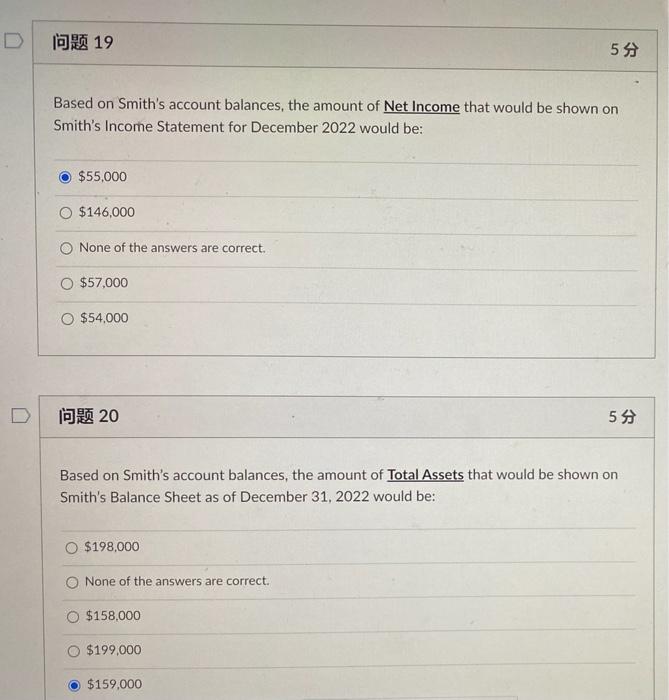

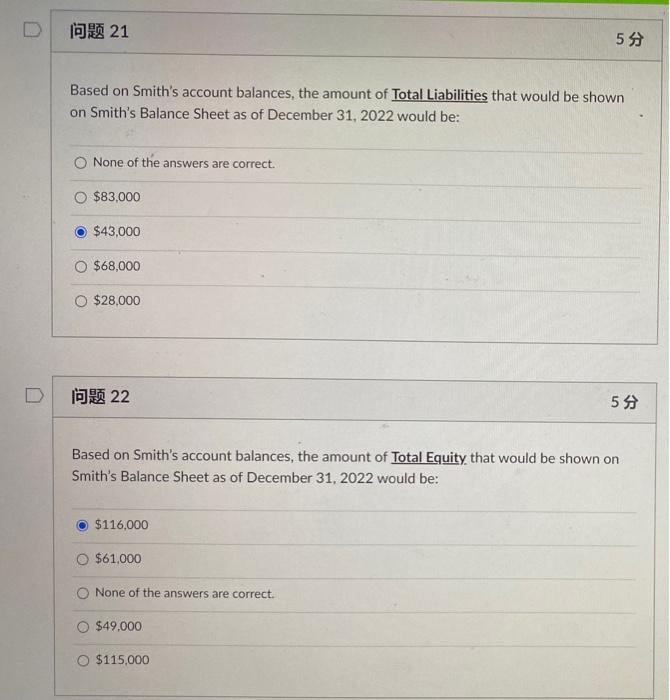

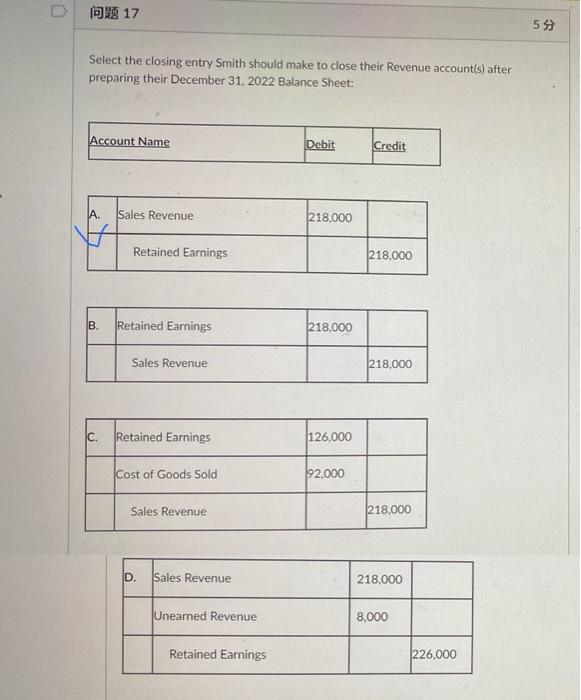

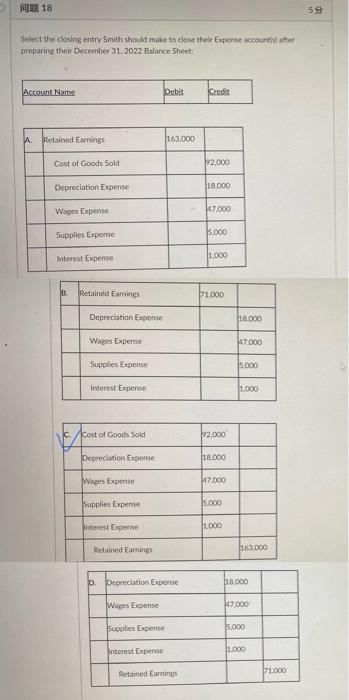

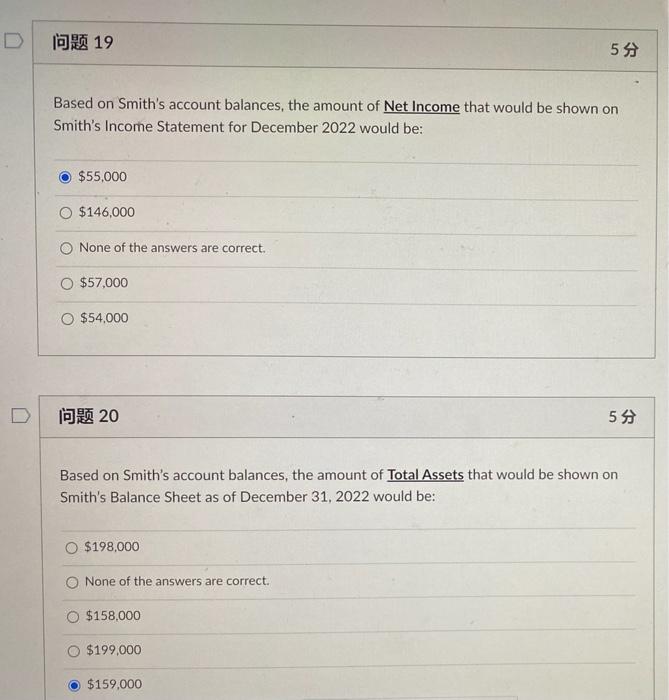

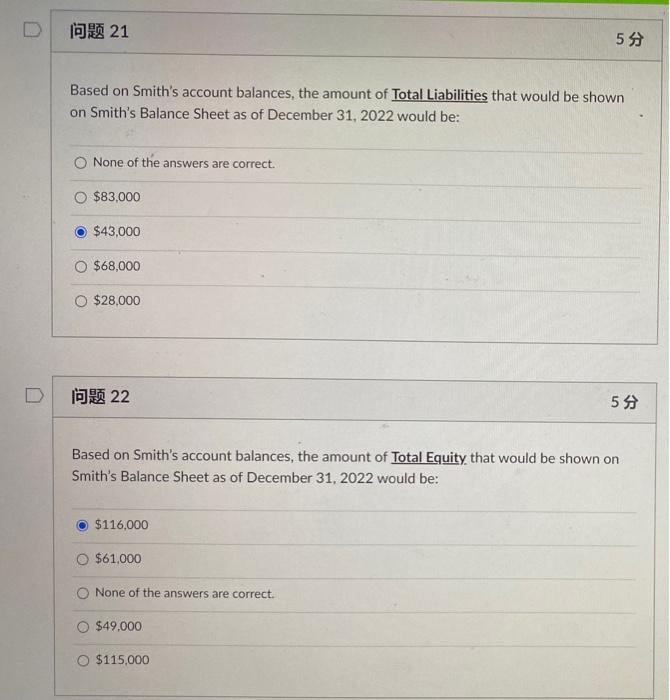

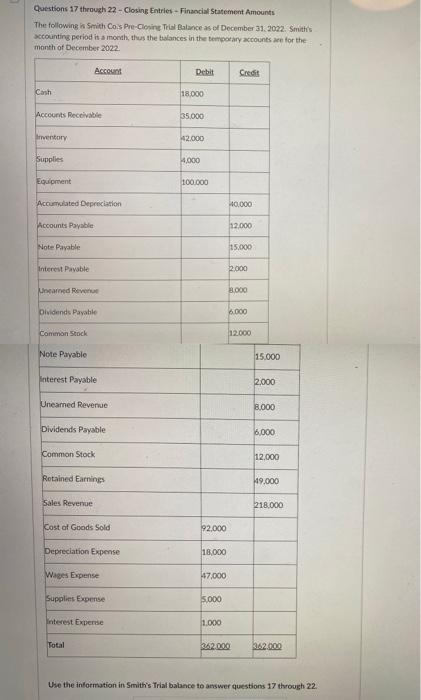

17 59 Select the closing entry Smith should make to close their Revenue account(s) after preparing their December 31, 2022 Balance Sheet: Account Name Debit Credit A. 218,000 218,000 218,000 218,000 126,000 92,000 B. C. Sales Revenue Retained Earnings Retained Earnings Sales Revenue Retained Earnings Cost of Goods Sold Sales Revenue D. Sales Revenue Unearned Revenue Retained Earnings 218,000 218,000 8.000 226,000 D 18 599 Select the closing entry Smith should make to close their Expense accounts) after preparing their December 31, 2022 Balance Sheet: Account Name Debit Kredit A Retained Earnings 163,000 92,000 18.000 47.000 5.000 1,000 Cost of Goods Sold Depreciation Expense Wages Expense Supplies Expense Interest Expense B. Retained Earnings K Depreciation Expense Wages Expense Supplies Expense Interest Expense Cost of Goods Sold Depreciation Expense Wages Expense Supplies Expense Interest Expense Retained Earnings D. Depreciation Expense Wages Expense Supplies Expense Interest Expense Retained Earnings 71.000 92,000 18,000 47.000 5,000 1.000 18.000 47,000 5.000 1.000 163.000 18.000 47,000 $5,000 1.000 71.000 D 19 5 Based on Smith's account balances, the amount of Net Income that would be shown on Smith's Income Statement for December 2022 would be: $55,000 O $146,000 O None of the answers are correct. O $57,000 O $54,000 20 5 Based on Smith's account balances, the amount of Total Assets that would be shown on Smith's Balance Sheet as of December 31, 2022 would be: $198,000 None of the answers are correct. $158,000 $199,000 $159,000 D 21 5 Based on Smith's account balances, the amount of Total Liabilities that would be shown on Smith's Balance Sheet as of December 31, 2022 would be: None of the answers are correct. $83,000 $43,000 $68,000 $28,000 22 5 Based on Smith's account balances, the amount of Total Equity that would be shown on Smith's Balance Sheet as of December 31, 2022 would be: $116,000 $61,000 O None of the answers are correct. O $49.000 $115,000 Questions 17 through 22 - Closing Entries - Financial Statement Amounts The following is Smith Co's Pre-Closing Trial Balance as of December 31, 2022. Smith's accounting period is a month, thus the balances in the temporary accounts are for the month of December 2022. Account Debit Credit Cash Accounts Receivable Inventory Supplies Equipment Accumulated Depreciation Accounts Payable Note Payable Interest Payable Unearned Revenue Dividends Payable Common Stock Note Payable Interest Payable Unearned Revenue Dividends Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold 92,000 Depreciation Expense 18,000 Wages Expense 47,000 Supplies Expense 5,000 Interest Expense 1.000 Total 362.000 362.000 Use the information in Smith's Trial balance to answer questions 17 through 22. 18,000 35,000 42.000 4,000 100.000 40,000 12,000 15,000 2,000 8,000 6.000 12.000 15,000 2,000 8.000 6,000 12.000 49.000 218,000