Pleasee do correctly.

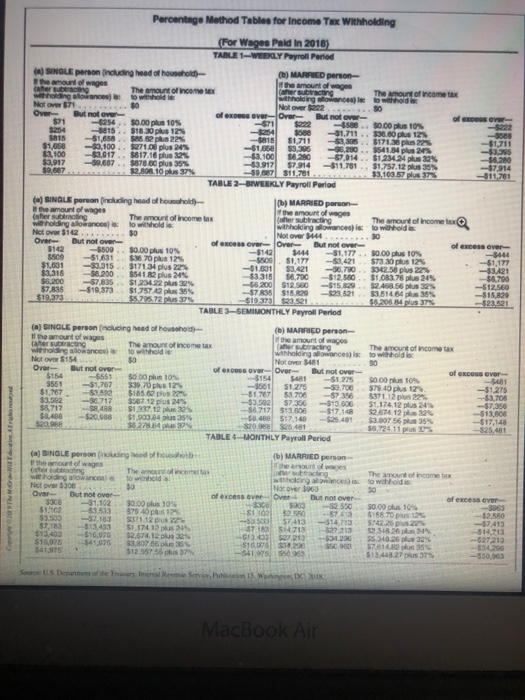

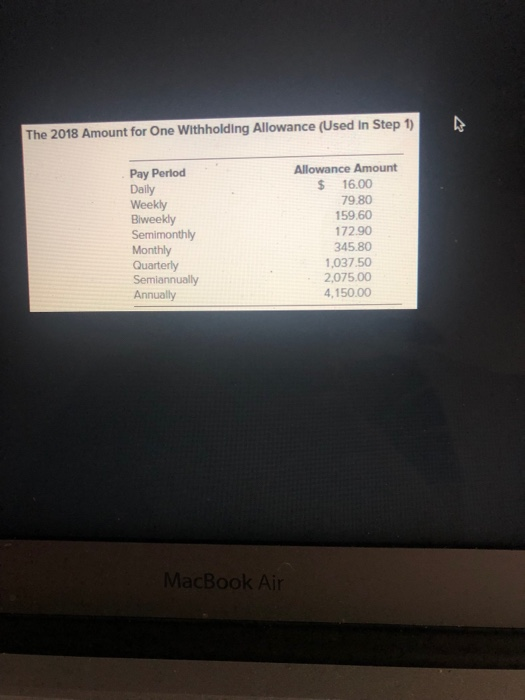

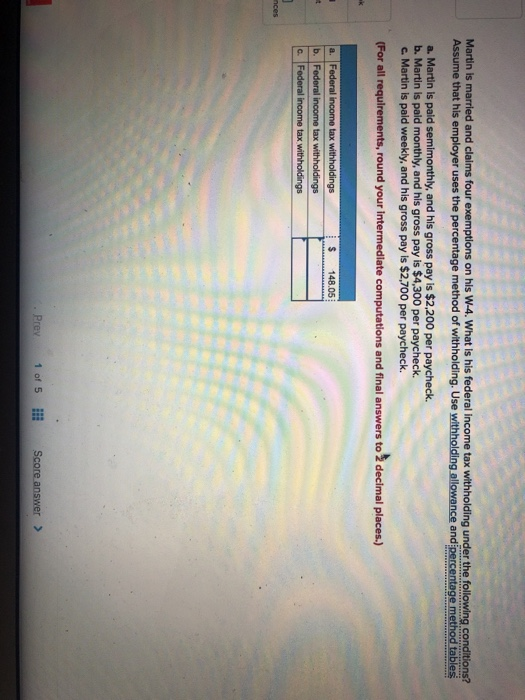

b. Martin is paid monthly, and his gross pay is $4,300 per paycheck. c. Martin is paid weekly, and his gross pay is $2,700 per paycheck. For all e computations and final answers to 2 decimal places.) S 148.05 Percentage Method Tablee for Income Tax Withholding For Weges Pald In 2018) TABLE 1-WEEKLY Payroll Pariod SINGLE pereon nluding heed of housahold- b) MARRIED person- the amount drThe amount of income tax The amount of Inceme 80 $0.00 plus 10% OveBut not ovr.. of expess over- But not over.. $71 -254 5815-$1,658 17 62p $271 oi plus 24% S817 16plus 32% 22% $1.Me- 100, s3.395-4.200, S641 plus 20% -43 91 71 s7.914-$11.761 . S1757 12 p s 35% $3.103 seans 311.761 TABLE 2-BIWEEKLY Payroll Parlad )SINGLE perean (inoluding head of housahold) b)MARRIED parson the amount of wages withholding alaeto withhold is Over The amourt of income tax 80 $0. Opus 10% wthholding allowances) is Not over 3444 to withhold is S0 Dut not over. of excess over- Over But not over. -4509 $444 $3,42 $15,829 1,001 -aas. s17134 plus 22% $54182 plus 24% $1,23422 pu12% $1,757A2phs 36% $1831 $3.421 70$342.58 plus 22 s -se200 6,200 57,835 $7.835-$19373 TABLE 3 -SEMIMONTHLY Payroll Period (a) GINGLE person finclucing head of housahold)- If the amount of wag (b) MARRIED person- The amount of income tax The amcunt of income tax Not over $481 S0 But not over- of expess ovar-Over But not over of excess over- 8481 -4551 S000 plus 10% -4154 $481-61 275 soorte 10% $561$1.275$3,708$7940 plus 12% -61767| $3.706-67 356 5371 12pun 20% -$3.582 $7.336$13.606 51.174 12 plus 24% -s6 7171 s13806-517, 48 S2.67412 plays 3551 . -51,767 $3970 plus12 1,767$3.592 $185.62 plus 229 $8717 sa488-420ss8 s.saas4 phas as% -$17,148 TABLE 4 -MONTHLY Payroll Period b) MARRIED persan The amont of ince tak Nct ovar $300 Over But not over-- 30 of excess ever-OverBut not over excess over. 102-$3.533570 46 plu 12 $2,'83 -$13,433 S,174 1,pus 24 -$14,713 213-54.200 , ss24426 32% $12 55756pt's 37 550.983 $ 1 3,448.27 pus 37 The 2018 Amount for One Withholding Allowance (Used In Step 1) Pay Perlod Daily Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Allowance Amount $ 16.00 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00